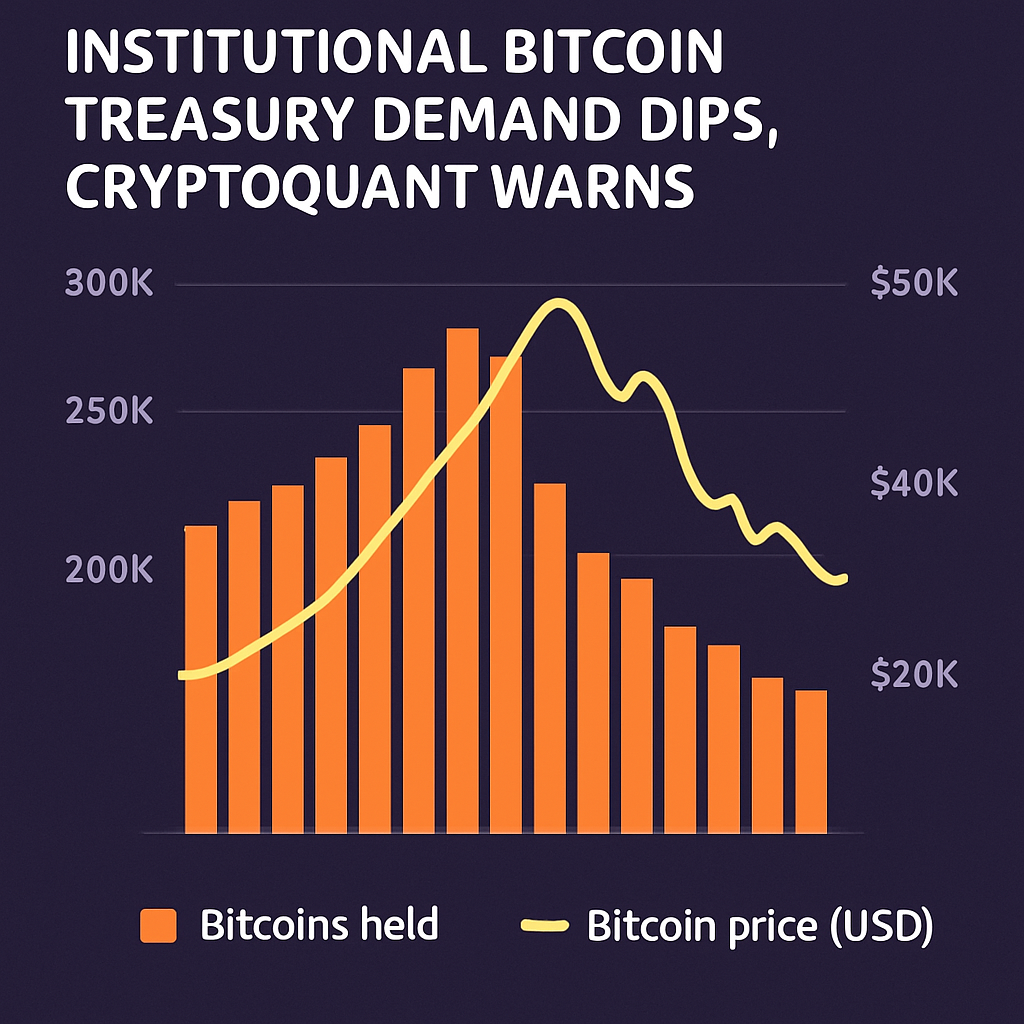

Data from CryptoQuant reveals that average Bitcoin (BTC) purchase sizes by corporate treasury firms plummeted 86% from peak levels in early 2025, even as aggregate holdings climbed to a record 840,000 BTC. Strategy, one of the largest treasury companies, reduced its per‐transaction size from an average of 14,000 BTC at peak to just 1,200 BTC in August. Other firms saw average purchases decline from 66,000 BTC to 343 BTC over the same period. These trends indicate a notable shift toward smaller, more cautious accumulation strategies, driven by liquidity constraints and heightened market uncertainty.

Record Holdings Amid Cautious Accumulation

Despite the contraction in deal sizes, treasury activity remained robust. CryptoQuant data recorded 53 transactions in June and 46 in August, underscoring continued demand but at reduced intensities. This fragmentation of buying interest suggests an environment of tighter liquidity and a preference for scaled entries to minimize market impact. With treasuries absorbing more BTC than newly mined supply—over 3,100 BTC versus 450 BTC per day during peak accumulation—these dynamics raise questions about the sustainability of price support.

Asia Emerges as Growth Frontier

Amid subdued average deal sizes, Asia has surfaced as a key region for new treasury initiatives. Taiwan-based Sora Ventures announced a $1 billion Bitcoin fund, committing an initial $200 million to seed emerging corporate treasuries. The fund aims to pool institutional capital and provide coordinated buying strategies, potentially offsetting declines in average individual purchases. This regional focus reflects a broader shift in institutional flows toward Asia’s growing crypto infrastructure landscape.

Market Implications and Outlook

The reduction in average purchase sizes signals a more nuanced approach to treasury accumulation, balancing risk management with strategic entry points. However, smaller deal sizes may weaken the collective buying pressure that drove Bitcoin’s mid-year rally. Observers will monitor whether Asia’s new funds can aggregate sufficient capital to maintain the demand-supply imbalance that has underpinned BTC’s trading range near $110,000–$113,000.

Strategic Considerations for Investors

Investors should assess on-chain metrics and treasury purchase patterns to gauge institutional conviction. Key indicators include deal frequency, average transaction size, and fund launches. Continued vigilance is warranted, as a further decline in average purchase sizes could presage volatility if demand fails to match supply. Conversely, coordinated fund deployments like Sora Ventures’ initiative may reinvigorate accumulation momentum.

In conclusion, the evolving landscape of Bitcoin corporate treasuries highlights the interplay between liquidity, risk management, and strategic capital deployment. While record holdings demonstrate enduring institutional interest, the marked shift toward smaller purchases underscores a cautious market stance. Asia’s burgeoning treasury funds may play a pivotal role in sustaining long-term support for Bitcoin price stability and growth.

Comments (0)