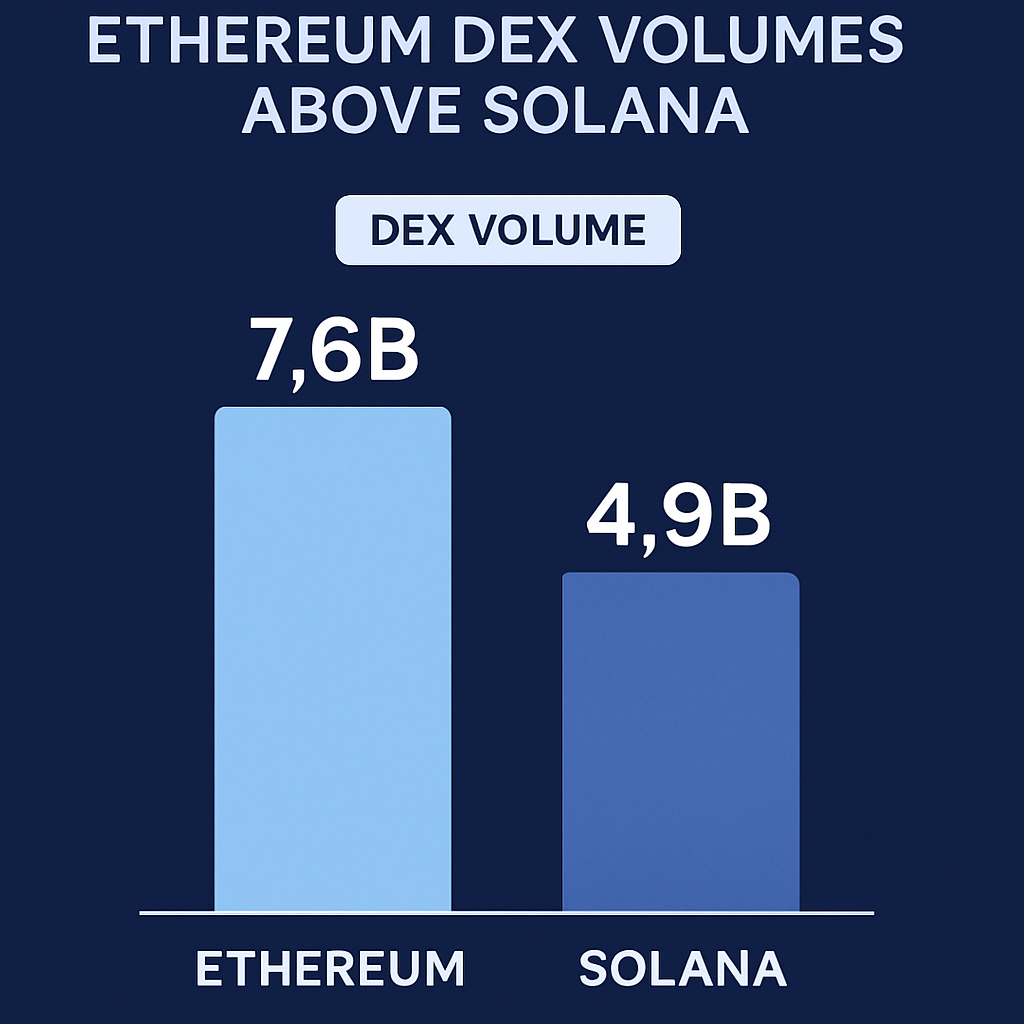

For the first time since April, decentralized exchange (DEX) volumes on Ethereum have outpaced those on Solana, driven by a wave of institutional asset allocation and record spot ETF inflows. DefiLlama data shows $24.5 billion in Ethereum DEX trading over the past 48 hours compared to $10 billion on Solana. This shift marks a reversal from earlier in the year when memecoin activity on Solana dominated decentralized trading.

Uniswap retained its position as the leading platform, facilitating $8.6 billion in swaps during the period. Trading desks reported heavy order flow from asset managers and corporate treasuries seeking exposure to Ether ahead of anticipated Federal Reserve rate cuts. Staking derivatives also saw strong performance: liquid staking tokens like Lido’s LDO rallied over 65% as regulators clarified the status of staking services under SEC rules.

Institutional instruments played a key role. Spot Ether ETF products recorded cumulative inflows exceeding $1.5 billion this week, with BlackRock’s IBIT alone attracting $800 million. ETF participants funneled capital into on-chain liquidity pools, boosting swap volumes and tightening market depth on centralized venues. The increased liquidity on DEXs contributed to deeper order books and narrower spreads, enhancing on-chain trading conditions.

Meanwhile, Solana-based DEXs experienced a pullback following developer audits and memecoin volatility. The recent failure of the TRUMP memecoin eroded confidence in Solana’s speculative ecosystem, prompting a rotation toward Ethereum’s more established DeFi infrastructure. Traders noted that Ethereum’s smart contract security audits and institutional compliance frameworks offered a more stable environment for large-ticket transactions.

Market analysts anticipate that if institutional channels continue to expand on Ethereum, DEX volumes could sustain above $20 billion levels, supporting long-term growth for layer-1 applications. Solana is expected to regain momentum as new token launches and developer grants unfold, but the current data highlights the prevailing influence of institutional demand in shaping decentralized trading landscapes.

The outcome underscores Ethereum’s position as the dominant venue for institutional DeFi activity. As regulatory clarity improves and network upgrades advance, Ethereum DEXs are poised to capitalize on deeper integration with traditional finance, potentially cementing their role as primary liquidity hubs for large-scale digital asset trading.

Comments (0)