Rising Open Interest Signals Bullish Bias

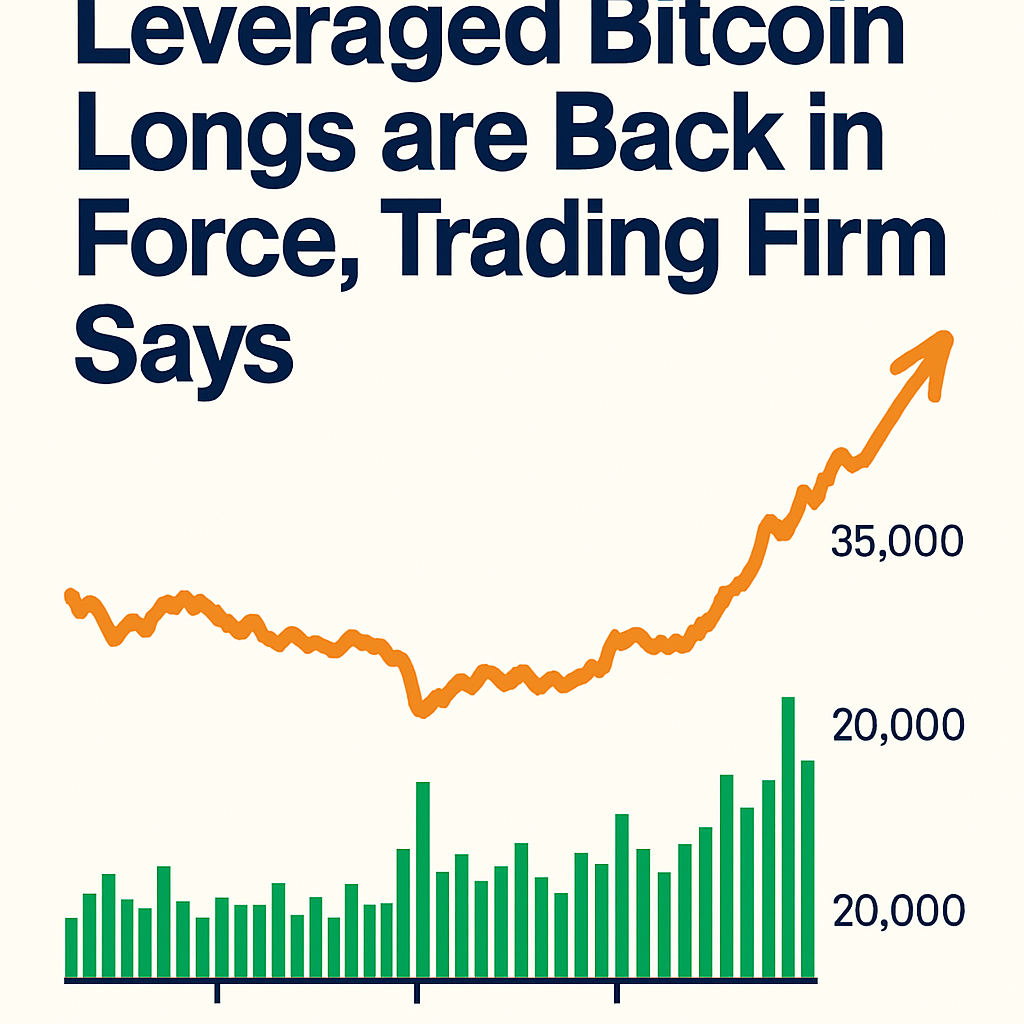

Open interest in Bitcoin perpetual futures has climbed from $42.8 billion to $43.6 billion, a sign that traders are allocating fresh capital into long positions despite recent volatility. This data was highlighted in a market insights update by Singapore-based QCP Capital, which monitors perpetuals funding rates and position biases across centralized and decentralized venues.

Elevated Funding Rates Reflect Growing Conviction

Annualized funding rates on major platforms such as Deribit have surged above 13%, indicating that traders holding long positions are willing to pay premiums to maintain exposure. Such double-digit funding rates have not been sustained since the earlier half of the year and demonstrate traders’ readiness to bear costs in anticipation of further price gains in the historically strong fourth quarter.

Resilience After Recent Liquidations

Last week’s sharp price drop below $109 000 triggered over $700 million in long liquidations—the largest daily figure in six months according to Coinglass. Despite that sell-off, leveraged longs have re-entered forcefully, suggesting that liquidations served to reset positions rather than dampen sentiment. Traders appear confident that the dip offers an attractive entry point for upside capture.

Price Recovery Near $114 000

Bitcoin’s price has rebounded to trade near $114 000 after the volatility-driven sell-off, aligning with the resurgence in perpetual open interest. Market participants view the recent consolidation phase as a healthy prelude to a potential “Uptober” rally, with the reset in leverage providing a cleaner foundation for further upside moves.

Implications for Q4 Outlook

The return of aggressive long positioning underscores growing optimism for Bitcoin’s performance in Q4. With macro uncertainties persisting, traders appear to be positioning for a continuation of the seasonal bullish trend. The sustained willingness to pay elevated funding rates suggests that confidence in higher prices may outweigh short-term risks.

Comments (0)