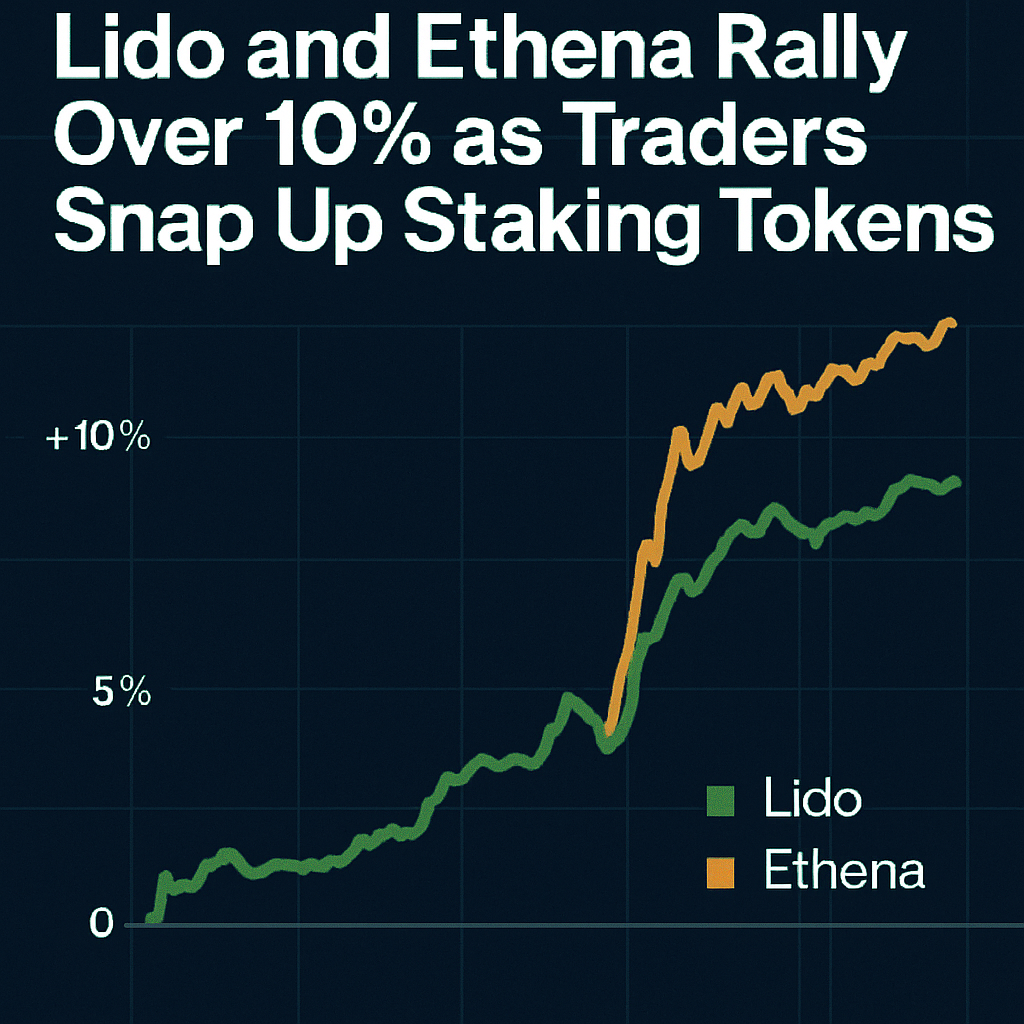

Staking-focused tokens Lido (stETH) and Ethena (ENA) posted gains exceeding 10% in a single session, outpacing most altcoins. The rally reflects increased demand for yield-bearing positions and confidence in Ethereum’s proof-of-stake roadmap.

Yield Dynamics

• Lido’s tokenized staking derivative, stETH, saw volume jumps as traders leveraged its liquidity and composability within DeFi protocols. Higher ETH staking rewards and anticipation of EIP-1559 fee burns supported the move.

• Ethena’s ENA token, which offers synthetic exposure to real-world yields, attracted new entrants seeking diversified income streams beyond on-chain staking. Its unique collateralization mechanism enabled competitive APYs.

Market Impact

DeFi lending platforms reported heightened demand for borrowable stETH and ENA, tightening funding rates for liquidity providers. Protocols offering automated restaking strategies also observed net inflows, illustrating growing sophistication among yield-seeking participants.

Upcoming Catalysts

Analysts point to scheduled protocol upgrades—such as Lido’s governance vote on fee adjustments and Ethena’s upcoming multi-asset collateral integration—as potential catalysts. Both ecosystems aim to enhance capital efficiency and expand cross-chain support, which could sustain bullish sentiment.

On-chain data shows that large whale wallets orchestrated multi-million-dollar accumulations, signaling strategic positioning ahead of anticipated yield cycles. With reduced macro volatility and clearer regulatory guidance on staking, market participants view staking tokens as an attractive hedge in a maturing DeFi landscape.

While yields remain subject to network conditions and protocol governance, Lido and Ethena’s outperformance underscores a broader shift: from spot speculation toward sophisticated yield strategies that blend DeFi innovation with traditional income objectives.

Comments (0)