Bitcoin Drops Below $90K as $708M of Liquidations Sweep Market

Bitcoin fell below $90,000 on January 21 after forced unwind of leveraged long positions drove over $708 million in liquidations, with longs accounting for approximately $649 million. The 12-hour RSI plunged to -33.7, signaling weak momentum amid a sudden deleveraging event.

Bitcoin has a 30% chance of falling below $80,000 by late June, options data suggests

Options market indicators show a roughly 30% probability of Bitcoin dropping below $80,000 by late June. Data from decentralized venues highlight a pronounced put skew and elevated open interest in put options around $75,000–$80,000 strikes. Geopolitical tensions and tariff concerns have exacerbated downside risk in the weeks following Bitcoin’s early-year rally.

$1.2B Bitcoin ETF Inflows Signal Renewed Institutional Bullish Bets

$1.2 billion net inflows into U.S. spot Bitcoin ETFs over the past two days indicate a shift from arbitrage strategies to directional bullish positions. Institutional investors and hedge funds are increasing long exposure while reducing short positions, signaling confidence in further market upside. Data from ETFs and CME futures highlight a growing appetite for leveraged Bitcoin exposure and a potential inflection point in institutional demand.

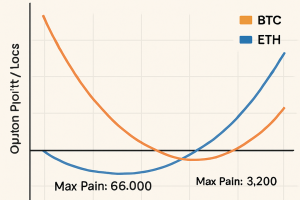

BTC and ETH Pinned at Max Pain as $2.2B Options Expire

More than $2.2 billion of Bitcoin and Ethereum options are set to expire at Deribit’s max pain levels, constraining price action around $90,000 and $3,100. Dealer hedging has compressed volatility ahead of U.S. jobs data and a Supreme Court tariff ruling expected later today.

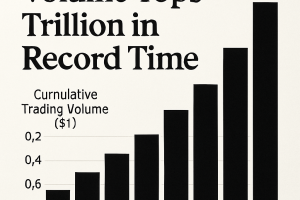

Spot Crypto ETF Volume Tops $2 Trillion in Record Time

Cumulative trading volume for U.S. spot Bitcoin and Ethereum ETFs surpassed $2 trillion, doubling the prior milestone in half the time. Combined net inflows reached $645.6 million on January 2, signaling robust institutional demand at the start of 2026.

Bitcoin set for first yearly loss since 2022 as macro trends weigh on crypto

Bitcoin is on track to post its first annual loss since 2022, ending 2025 over 6% lower after a mid-year rally peaked in October. The decline follows market liquidations exceeding $19 billion triggered by U.S. tariff announcements and growing correlation with stock market trends.

Coinbase Predicts Three Sectors to Dominate Crypto Market by 2026

Coinbase Institutional forecasts three sectors will lead crypto markets in 2026: perpetual futures to drive volume, prediction markets evolving into core infrastructure, and stablecoins expanding real-world payments. A structural reset is expected as leverage declines.

Record $27B Bitcoin and Ethereum Options Expiry Looms on Deribit

Crypto markets face a historic year-end event as over $27 billion in options on Bitcoin ($23.6 billion) and Ethereum ($3.8 billion) expire on Deribit today, accounting for 50% of open interest. Call options outnumber puts nearly 3:1, signaling institutional bullish sentiment, while ‘max pain’ levels near $95 000 (BTC) and $3 000 (ETH) may anchor short-term price action.

Crypto Derivatives Trading Hits $86 Trillion in 2025, Binance Commands Nearly 30%

Crypto derivatives trading surged to a record $86 trillion in 2025, averaging $265 billion per day. Binance led with nearly 30% market share, followed by OKX and Bybit. The growth reflects deeper institutional participation and evolving risk profiles.

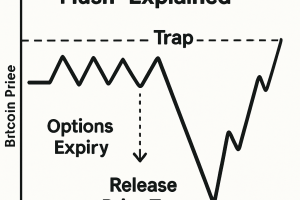

Bitcoin Gamma Flush Explained: $24B Options Expiry to Release Price Trap on Dec 26

A major gamma flush is set for December 26 as $23.7 billion in Bitcoin options expire, termed the “boss level” of this week’s expiries. The associated trading dynamics could break the current $85K–$90K price trap by removing dealer hedging pressures, freeing Bitcoin price to respond to fundamental supply and demand. Anticipated key levels include support at $85K–$88K, a flip zone at $90,616, and a long-term target near $118K.

2025 Bitcoin Volatility Fuels Rise in Private Litigation

Bitcoin’s 2025 price surge to $126,000 and subsequent 30% correction have generated regulatory gaps filled by private lawsuits. Reduced SEC enforcement under Trump has led to class actions and arbitration over token misrepresentations and marketing practices.

Bitcoin LTH Selling Fears Overstated by Exchange Transfers

Apparent spikes in long-term holder selling were inflated by Coinbase transferring UTXOs, distorting on-chain sell metrics. When excluding these transfers, LTH sell rates align with historical norms, while on-chain signals such as the NVT Golden Cross and RSI suggest accumulation and market maturation.

Fidelity Director Warns of Potential Year-Long Crypto Winter

Fidelity’s global macro director suggested that Bitcoin’s October peak around $125,000 may have signaled the end of the current four-year cycle, forecasting a potential bottom near $65,000–$75,000 in 2026 despite a longer-term bullish stance on digital assets.

Investors Pivot to Active Strategies After Crypto Crash

Following a steep crypto market downturn, investors are increasingly adopting actively managed and hedged strategies to mitigate risk. Traditional vehicles such as ETFs, derivatives, and equity in crypto-affiliated firms have expanded, while treasury companies and mining stocks have underperformed. Data centres backed by AI demand present a new growth avenue for mining firms. Institutional backing for Bitcoin remains strong, with major endowments and sovereign funds increasing exposure.

BTC OGs selling covered calls is the main culprit suppressing price

Long-term Bitcoin holders write covered calls against existing inventory, compelling market makers to hedge by selling spot bitcoin, thereby exerting downward pressure on prices. Fresh demand from ETF investors fails to offset this effect. Options market activity thus steers price action.

Why Is Crypto Down Today? – December 5, 2025

Crypto market capitalization fell 1.1% on Friday morning (UTC), with 90 of the top 100 coins and 9 of the top 10 coins dropping. Bitcoin dipped 1.2% to $92,227 and Ethereum slipped 0.6% to $3,169 amid macro sensitivity and ETF outflows.

Bitcoin Surges 11% on Fed’s $38B Liquidity Injection

Bitcoin rallied 11% from $83,823 to over $93,000 after the Federal Reserve ended quantitative tightening and injected $38.5 billion via repo operations. Vanguard’s opening to crypto ETFs added demand, and CME FedWatch odds for a December rate cut rose above 80%.

Strategy’s Yield Hunt Boosts Short-Seller Opportunities

Strategy’s exploration of crypto lending exposes its 650,000 BTC reserve to re-hypothecation and funds short-seller inventory. Market makers and hedge funds may exploit lower borrowing costs, increasing counterparty risk and compressing Strategy’s stock premium.

Bitcoin falls again after weak November as bearish sentiment goes on

Bitcoin slumped 6% to $85,788 following its largest monthly drop since mid-2021. Record $18,000 November decline and rising crypto liquidations totalling nearly $1 billion reinforced bearish sentiment. Strategy cut its earnings forecast.

Crypto Market Mood Lifted as Amazon Pours $50B Into AI Infrastructure

Bitcoin rebounded above $87,000 and crypto mining stocks surged after Amazon announced a $50 billion investment in AI and high-performance computing infrastructure. Market sentiment improved as expectations rose for increased data-center demand.

ETF Outflows and Stablecoin Declines Signal Capital Flight in Crypto Market

Spot Bitcoin ETFs have recorded persistent outflows totaling $3.55 billion in November, marking the highest monthly withdrawal since launch. Stablecoin supply has contracted for the first time in months as algorithmic tokens lose nearly half their circulating supply. Corporate digital asset treasuries have reversed share premiums into discounts, indicating reduced demand for crypto assets.

Cryptocurrencies Whipped by Flight from Risk

Bitcoin and ether fell over 2% to multi-month lows as investors fled risk assets, with bitcoin sliding to $85,350.75 and ether to $2,777.39 amid tech stock declines. Both tokens faced weekly losses around 8%, marking a broader shift in market sentiment and erasing roughly $1.2 trillion from crypto market value over six weeks.

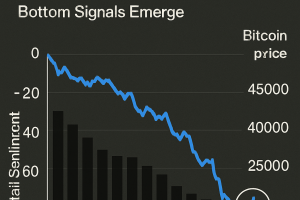

Retail Mood Sours Amid Crypto Selloff, Bottom Signals Emerge

Social sentiment around major tokens turned negative as prices declined, yet on-chain metrics hint at short-term bottom formation. Bitcoin’s Net Unrealized Profit ratio reached levels historically preceding rebounds. Institutions plan increased exposure ahead of regulatory changes.

Since Trump's election, crypto has experienced a wild year-long policy ride

Crypto industry saw a sweeping reversal from restrictive enforcement to pro-innovation rulemaking after the 2025 presidential election. Executive orders fast-tracked stablecoin regulation and a bitcoin reserve, while legislative efforts stalled amid a record government shutdown. The sector gained significant policy wins under an administration reshaping U.S. digital asset strategy.

XRP Outperforms Bitcoin as ETF Filings Near Final Window

XRP surged above resistance as ETF momentum and network growth drove renewed institutional interest. Volume spiked nearly double the daily average during the breakout, lifting XRP to its strongest close in over a week. New wallet creations also rose significantly.

Bitcoin ‘money vessel’ amasses $8B but recovery lacks ETF inflows

On-chain data shows Bitcoin’s realized capitalization rose by $8 billion in the past week, driven by treasury firms and miners. Price recovery remains muted without renewed ETF and institutional purchases.

Bitcoin Price Could Collapse to $70K or Lower as Bull Market Is Over: Elliott Wave Expert

Elliott Wave analyst Jon Glover projected that the bitcoin bull market is complete and a sustained bear market could drive prices below $70K, a potential 35% drop from current levels. The forecast follows bitcoin’s recent fall from $126K to $104K and aligns with historical bearish cycles post-halving events.

Trade wars trigger Bitcoin drawdown amid U.S.–China tensions

U.S.–China trade frictions spurred a rapid correction in Bitcoin, with prices plunging over 13% after new tariffs and export controls triggered $19 billion in liquidations. Market resilience tested as risk assets sold off on geopolitical headlines.

Crypto-Native Traders Drive $12B Bitcoin Deleveraging Event

Roughly $12 billion in Bitcoin futures positions were liquidated in a single day, marking the largest intra-day open interest drop on record. Data indicates that crypto-native venues led the sell-off, while institutional platforms remained largely stable. This event may signal a market inflection point.

After record crypto crash, rush to hedge against further freefall

Options investors purchased hedges after a record $19B crypto liquidation on Oct 10–11, with bitcoin down 14% and ether off 12.2%. The sell-off was triggered by Trump’s 100% tariff on Chinese imports, and despite a partial rebound, volatility remains high.

Q4 Crypto Surge? Historical Trends, Fed Shift and ETF Demand Align

Q4 historically delivers average gains of 79% for bitcoin since 2013, driven by institutional treasury accumulations and ETF inflows. With the Fed’s latest rate cut and $18 billion in BTC and ETH ETF inflows in Q3, CoinDesk Indices projects continued market momentum into year-end.

Altcoins Cratered in Oct. 10 Crypto Flash Crash as Bitcoin Held Up, Wiston Capital Says

Wiston Capital founder Charlie Erith reported that altcoins plunged about 33% in roughly 25 minutes on Oct. 10, erasing $18.7 billion in liquidations, while bitcoin fell less severely. Erith plans to track bitcoin’s 365-day EMA, market breadth and volatility metrics before re-leveraging.

Bitcoin’s On-Chain Strength Sets Stage for Fourth-Quarter Gains, Says ARK Invest

ARK Invest research highlights Bitcoin’s sustained on-chain metrics, including rising active addresses and declining exchange reserves, as bullish indicators for Q4 performance. Institutional inflows via ETFs and increasing network security support the projection of renewed upward momentum.

Largest Crypto Liquidation Ever Sees $16B Longs Wiped Out Amid Trade Fears

Trump’s 100% tariff threat on China triggered a risk-off wave that liquidated over $16 billion in crypto longs, marking the largest such event on record. Bitcoin and Ether tumbled 10% and 16% respectively, while stablecoin USDe saw minor peg deviations during the turmoil.

BTC, ETH, XRP and SOL Enter Slow Bottoming Process After $16B Liquidations

A $16 billion liquidation event forced leveraged positions across Bitcoin, Ether, XRP and Solana, triggering a major sell-off. Weekend liquidity constraints and cautious market maker behavior are expected to prolong a gradual, multi-phase bottoming process.

Bitcoin Implied Volatility Hits 2.5-Month High

Bitcoin’s 30-day implied volatility index climbed above 42%, marking its highest level in 2.5 months. Historical data indicate similar October spikes, with average late-month gains near 6% and November returns exceeding 45%. Traders view elevated volatility as a bullish seasonal signal.

Bitcoin Implied Volatility Hits 2.5-Month High

Bitcoin’s 30-day implied volatility index climbed above 42%, marking its highest level in 2.5 months. Historical data indicate similar October spikes, with average late-month gains near 6% and November returns exceeding 45%. Traders view elevated volatility as a bullish seasonal signal.

Bitcoin rebounds toward range highs as liquidity data emerges

Bitcoin held above $120,000 after a correction from recent highs, with onchain and market data indicating controlled profit taking and renewed buying momentum. Net taker volume shifted to neutral levels, supporting confidence in sustained demand. Market metrics point to balanced conditions for further upside.

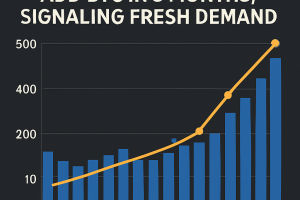

Short-term holders add 559,000 BTC in three months, signaling fresh demand

Short-term Bitcoin holders increased supply by 559,000 BTC over the past quarter, rising from 4.38 million to 4.94 million BTC, indicating new investor participation. On-chain data show the Fund Flow Ratio falling to its lowest level since July 2023. Reduced exchange activity suggests accumulation over selling amid near-peak prices.

VanEck Forecasts Bitcoin to Capture Half of Gold’s Market Cap

VanEck’s Head of Digital Assets Research predicts Bitcoin could attain half of gold’s market capitalization after the April 2028 halving. The forecast reflects shifting preferences among younger investors toward digital store-of-value assets amid record highs for both Bitcoin and gold.

Bitcoin Surges Past $126,000 Amid Institutional Demand

Bitcoin breached $126,100 for the first time on Oct. 6, 2025, driven by record US spot ETF inflows and macro uncertainty. The rally retraced to $123,500, with support at the prior all-time high. Traders await Fed signals later this month.

Dogecoin holds $0.25 support as whales add 30M DOGE amid ascending triangle pattern

Dogecoin found a floor near $0.251 after early volatility, supported by institutional flows and whale accumulation. The token consolidated inside an ascending triangle, with on‐chain data showing mid‐tier wallets adding 30 million DOGE. Traders now eye breakout targets in the $0.27–0.30 range.

XRP rejected above $3, closes lower as sellers dominate

XRP surged toward $3.07 but encountered heavy selling pressure, confirming resistance at that level. The token stabilized near $2.98 after institutional prints drove a high-volume rejection. Market structure suggests continued accumulation on dips despite bearish session control.

Morgan Stanley Recommends ‘Conservative’ Crypto Allocations for Advisors

Morgan Stanley’s October Global Investment Committee report recommends up to 4% cryptocurrency allocations in higher-risk “Opportunistic Growth” portfolios and up to 2% in balanced growth strategies, with zero allocation for wealth-preservation mandates. The guidance underscores growing institutional acceptance and the need for periodic rebalancing amid volatility and macro stress.

The Fed’s Next Move on Oct. 29 Could Derail Crypto and Equities

A partial U.S. government shutdown has delayed key economic data ahead of the Fed’s Oct. 28–29 meeting, leaving markets pricing in a 25 bps cut but facing uncertainty if labor reports remain frozen. Missing data and persistent inflation raise the risk of a surprise pause, which could trigger sharp downward moves in both crypto and U.S. stocks.

Bitcoin corrects from $125K all-time high after record surge

Bitcoin entered a brief retracement phase, falling over $2,000 from its $125,000 record high as traders assessed potential support levels around $118,000–$124,000. Derivative data indicated short sellers were trapped near the peak, driving stop-loss liquidations and heightened volatility. Analysts noted institutions are monitoring price action to gauge continued momentum in the “debasement trade.”

Bitcoin to $200K by End of 2025? This Cycle Indicator Points to Explosive Months Ahead

On-chain demand metrics have increased since July, mirroring previous bull cycles and potentially driving bitcoin beyond $200,000 by year-end. Trader’s Realized Price at $116,000 is identified as a key threshold for bull phase transition. ETF inflows and whale accumulation underpin the bullish outlook.

Accumulation Trends Strengthen as Bitcoin Breaks Through $120K

Aggregate Accumulation Trend Score rose above 0.5 for the first sustained time since August, indicating renewed demand over supply. Mid-size wallets have shifted into accumulation mode while whales continue distribution pressure. Bitcoin gained roughly 8% during U.S. trading hours this week.

Citi Sees Bitcoin Hitting $181K in 2026 as ETF Flows Drive Crypto Higher

Citi forecasts Bitcoin at $133K by end-2025 and $181K in 12 months, with Ether at $4.5K by year-end. Institutional demand and ETF inflows remain key drivers amid favorable regulation.

Citigroup raises ether year-end outlook and lowers bitcoin forecast

Citigroup raised its 2025 year-end price target for ether to $4,500 while trimming bitcoin to $133,000, citing evolving investor flows and macroeconomic variables. Analysts project further upside driven by ETF inflows and DeFi staking.

When Could Bitcoin Break Out to New Highs? Watch Out for Gold

Bitcoin has traded in a narrow $100 000–$120 000 range for three months while gold surged past record highs. Historical data shows alternating cycles between the two assets, suggesting bitcoin may rally once gold’s momentum eases. Analysts monitor correlation shifts for a breakout signal.

IBIT’s Options Market Fuels Bitcoin ETF Dominance

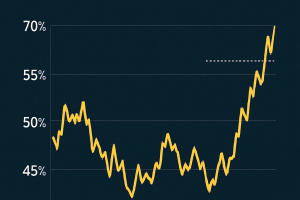

A recent report finds that IBIT now controls 57.5 % of Bitcoin ETF assets under management after ETF options launch in November 2024. Daily options volumes of $4–5 billion have reshaped market flows, eclipsing futures and altering volatility patterns.

Retail Onboarding Shifts from Bitcoin to Altcoins

A CoinGecko survey of 2,549 crypto participants found that only 55% of new investors started with Bitcoin, 37% with altcoins and 10% never bought Bitcoin. Analysts attribute the shift to lower unit costs, community appeal and maturing market access but expect Bitcoin to retain core portfolio relevance.

Crypto Treasury Firms Could Become Long-Term Giants like Berkshire Hathaway

Syncracy Capital’s Ryan Watkins forecasts that digital asset treasury firms holding $105 billion could evolve into enduring financial players by deploying on-chain assets, funding operations and governance. Watkins likens them to profit-driven crypto foundations capable of building businesses within networks. Successful firms will combine disciplined capital allocation with operational expertise.

Crypto Treasury Firms Could Become Long-Term Giants

Analyst Ryan Watkins of Syncracy Capital argues that digital asset treasury firms holding $105 billion could evolve into enduring ecosystem players, deploying capital into operations, governance, and infrastructure akin to Berkshire Hathaway’s model.

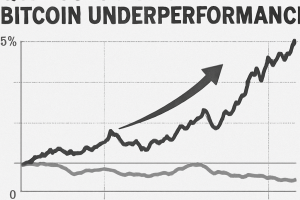

Grayscale Sees ‘Distinct’ Q3 Altcoin Season amid Bitcoin Underperformance

Grayscale reports that Q3 2025 saw a unique altseason characterized by falling Bitcoin dominance and selective altcoin rallies. Performance drivers included sector rotation, DeFi protocols and emerging Layer-2 networks, diverging from previous dominance-driven cycles.

Layer-1 Blockchains Emerge as Crypto’s 2025 Backbone

Layer-1 blockchains are shifting from speculative assets to core infrastructure in 2025, supporting tokenisation, stablecoins and emerging DeFi use cases. Key challenges include scalability, interoperability and user experience enhancements to drive broader adoption.

Near $30M Ether wipeout on Hyperliquid stands out as crypto market sees $1B in liquidations

A $29.1 million ETH-USD long on Hyperliquid triggered the largest individual liquidation in 24 hours amid a $1.19 billion market-wide wipeout. Long positions accounted for nearly 90% of liquidations, with over 260,000 traders affected, highlighting increased risk-taking on decentralized perpetual exchanges.

Ethereum co-founder shifts $6M of ETH as whales buy $1.6B

Ethereum co-founder Jeffrey Wilcke transferred 1,500 ETH (≈$6 M) to Kraken, potentially preparing a future sale. At least 15 large wallets acquired over 406,000 ETH (≈$1.6 B) in the past two days, reflecting substantial institutional accumulation.

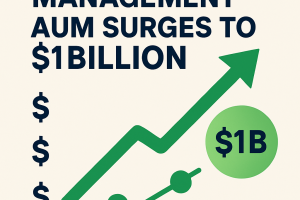

Onchain Asset Management AUM Surges 118% to $35 Billion in 2025

Assets under management onchain doubled this year to $35 billion, led by yield vaults, discretionary strategies and structured products. Report warns of concentration risk as top three protocols capture 31 percent of AUM.