Bitcoin Dips Below $90,000 Amid Broad Market Selloff

Bitcoin slid below $90,000 for the first time since January 9, tracking a global selloff in equities, bonds and risk assets amid rising geopolitical tensions and tariff fears. The drop to a one-week low followed a 4% decline on Tuesday, as long-dated Treasuries and Japanese bonds surged, prompting de-risking across markets.

Crypto Markets Shed Over $100 Billion as Major Altcoins Plunge by Double Digits

Geopolitical tensions and renewed U.S.–EU tariff threats triggered a sharp sell-off on January 19, leading to a $100 billion decline in total crypto market capitalization. Bitcoin fell below $92,000 while large-cap altcoins such as SUI, APT and ARB saw losses exceeding 10 percent. The downturn followed a quiet weekend but was amplified by weekend trade war headlines and liquidation pressures.

Crypto Market Erases $100B in Single Day During Sharp Correction

The total cryptocurrency market capitalization plunged by approximately $100 billion over a 12-hour span ending January 19, 2026, falling from around $3.20 trillion to near $3.09 trillion before a partial rebound. Bitcoin, Ether and XRP each declined by 3–4 percent as macro risk-off sentiment intensified amid thin liquidity. On-chain data indicate derivatives-driven positioning amplified the downturn.

Bitcoin ETFs Rebound with $1.8bn Inflows as BTC Steadies Near $95k

Bitcoin spot ETFs recorded $1.81 billion in net inflows over the past week, reversing previous outflows and signaling renewed institutional engagement. ETF flows were broad-based across issuers, cushioning downside risk and supporting price consolidation in the mid-$90,000 range.

Crypto Data Platform CoinGecko Weighs Sale for Around $500 Million

CoinGecko is exploring a potential sale that could value the crypto market data provider at approximately $500 million. Investment bank Moelis has been engaged to oversee the process, which commenced late last year during a record M&A environment.

Crypto markets edge higher despite US-Venezuela tensions; Bitcoin near $93,000

Crypto markets remained resilient despite U.S.–Venezuela tensions, with Bitcoin near $93,000 and Ethereum above $3,000. Bullish technical setups, stablecoin inflows, and institutional interest underpinned gains, while major altcoins and memecoins posted notable advances.

Crypto Unrealized Losses Reach $350B as Bitcoin Buyers Step In

Unrealized losses across the crypto ecosystem hit $350 billion amid sustained outflows. Institutional investors and ETFs are accumulating Bitcoin, with Digital Asset Treasuries adding 24 000 BTC daily and U.S. spot Bitcoin ETFs recording net inflows.

Bitcoin Crashes $3K in Minutes as Liquidations Explode on Friday

Bitcoin plunged over USD 3,000 within minutes, dropping below USD 90,000 following a brief stabilization around USD 92,300. The sell-off triggered more than USD 415 million in liquidations, with Ethereum and other major altcoins also suffering steep declines in volatile trading.

Fed slashes interest rates but issues mixed forward guidance

The U.S. Federal Reserve cut interest rates by 25 basis points to a new 3.50–3.75% range, marking the third reduction of 2025. Chair Jerome Powell’s mixed remarks signal uncertainty over further cuts, dampening prospects for a Bitcoin rally.

Bitcoin Whipsawed by $1.39 Billion Whale Dump Triggering Mass Liquidations

A coordinated whale sell-off discharged 15,565 BTC worth $1.39 billion in one hour, plunging price from $89,700 to $87,700 before a swift rebound. Liquidations exceeded $171 million in longs and $14 million in shorts, spotlighting low weekend liquidity risks.

Bitcoin battles $50K price target as Fed adds $13.5B overnight liquidity

Federal Reserve halted quantitative tightening with a $13.5 billion repo injection, marking second-largest overnight liquidity boost since 2020. Bitcoin price briefly tested the $50,000 level amid renewed macro bull signals.

Bitcoin drops over 5% amid renewed risk aversion

Bitcoin fell more than 5% to $86,461 on Monday, marking its steepest daily decline in a month as renewed risk aversion weighed on investors. Record outflows from US spot Bitcoin ETFs and Tether’s downgrade added further pressure.

Bitcoin ETFs Become Top Revenue Source for BlackRock

BlackRock’s US-listed spot bitcoin ETF reached $70 billion in net assets 341 days after launch and has generated an estimated $245 million in annual fees. Allocations have approached $100 billion in assets under management and now represent over 3% of total bitcoin supply.

Bitcoin ETFs Smash Trading Volume Records During BTC’s Wild Friday Swings

US spot Bitcoin ETFs traded a combined $11.5 billion on Friday, marking a new single-day volume high. BlackRock’s IBIT accounted for $8 billion but saw $122 million in net outflows. ETFs still net positive by $238.4 million overall.

Bitcoin ETFs Have Bled a Record $3.79B in November

U.S.-listed spot BTC ETFs recorded record outflows of $3.79 billion in November, exceeding the prior peak of $3.56 billion. BlackRock's IBIT fund saw over $2 billion redeemed, while ether ETFs lost $1.79 billion. Solana and XRP ETFs saw net inflows amid the sell-off.

Bitcoin Slips Below $93K as Crypto Weakness Worsens, Local Bottom Could Be Near

Bitcoin fell to a fresh six-month low below $93,000, erasing year-to-date gains amid deteriorating market sentiment. Strong U.S. economic data reduced expectations for near-term Federal Reserve rate cuts. Bitfinex analysts noted that capitulation by short-term holders may signal a local bottom soon.

Bitcoin Nears 2025 Break-Even as Price Falls Below $95K

Bitcoin plunged below $95,000, erasing 2025 gains as investors withdrew $900 million from funds amid risk aversion. The largest cryptocurrency dropped 4.7% to $94,147 following deep liquidations and ETF outflows totaling $870 million. Market sentiment nears ‘extreme fear’ as liquidity thins and macro uncertainty intensifies.

ZEC up +43.96%, BTC -1.23%, Zcash is The Coin of The Day

Total cryptocurrency market capitalization fell by 1.56% to $3.23 trillion over 24 hours, with trading volume down by 25.58%. Bitcoin price declined 0.15% to $95,693, while Bitcoin dominance edged down to 58.92%. Zcash led gainers with a 43.96% advance.

Crypto Markets Today: Bitcoin Breaches $98K as Liquidations Top $1.1B

A sharp liquidity crunch triggered over $1.1 billion in crypto derivatives liquidations, pushing bitcoin below $98,000. Roughly half of the liquidations involved BTC positions, while ether and altcoins also suffered double-digit losses. Market response remained measured.

Bitcoin Crumbles Below $100K as Liquidity Crunch Hits

BTC fell below $100K during U.S. trading, reversing overnight gains above $104K. Market equities including miners dropped sharply amid easing rate-cut expectations. Government shutdown-related liquidity drain weighed on risk assets but fiscal flows may soon reverse.

Solana Slides 5% to $145 After Key Support Breach

SOL slid from $153 to $145 over 24 hours after breaking below $150 support. Trading volume jumped 13% above weekly averages as institutional sellers dominated. Spot Solana ETFs maintained inflows despite price pressures.

Bitcoin Holds Above $105K as Traders Eye Shutdown Deal, Liquidity Boost

Bitcoin price recovered above $105,000 after an early session drop, sustaining near $106,000 into late afternoon. Traders anticipate a $150 billion Treasury liquidity injection following potential U.S. shutdown resolution. Altcoin performance varied amid ETF and policy developments.

Bitcoin Plunges Below $100K for First Time Since June as Crypto Correction Worsens

Bitcoin fell below $100 000 for the first time since June amid a broad crypto correction, marking a 20% decline from October highs above $126 000. Analysts cite faded ETF demand and macro pressures, while some spot buyers emerged on dips.

Ether’s 20% Freefall Triggers $1B Liquidation Cascade as Crypto Losses Accelerate

Ether plunged over 20% in two days, triggering nearly $1 billion in liquidations across leveraged ETH markets. Analyst warns risk of further slides toward $2,700–$2,800 as ETF flows collapse and retail interest wanes.

NYSE Lists Solana, Hedera, Litecoin Spot Crypto ETFs for Trading

The NYSE posted listing notices for four new spot crypto ETFs tied to Solana, Litecoin, Hedera and a Grayscale Solana Trust. Listings proceed under generic standards during a U.S. government shutdown, bypassing individual SEC approvals.

Bitcoin Holds $112K as Fed Rate-Cut Odds Top 98%

Bitcoin surged through the $112,000 resistance into the weekly close, driven by expectations of Federal Reserve rate cuts. Traders eyed a break above $113,000 as inflation data cooled and CME FedWatch signaled over 98% odds of easing next week. Week ahead holds key FOMC decision.

Bitcoin and Ethereum Slip Below Key Support as Crypto Market Cap Falls

Bitcoin and Ethereum declined through established support thresholds, dragging the overall cryptocurrency market valuation under $3.8 trillion. The drop occurred amid a risk-off environment driven by U.S. banking sector concerns and ongoing trade tensions. Technical indicators signaled bearish momentum across major digital assets.

MARA Holdings adds 400 BTC to reserves in $46 M purchase

MARA Holdings purchased 400 BTC valued at approximately $46.31 million via institutional platform FalconX, boosting its total Bitcoin holdings to 52 850 BTC. The transaction, executed two hours prior to reporting, underscores continued institutional commitment amid broader market volatility. MARA’s reserves now approximate $6.12 billion in Bitcoin assets.

Green Shoots on China Lifts Crypto in Sunday Action

Crypto markets rebounded Sunday as China’s Ministry of Commerce clarified rare-earth export controls are limited and President Trump’s conciliatory Truth Social post reassured investors. Bitcoin rose about 3% while ether, solana and dogecoin gained 6-8%, partially reversing Friday’s steep losses.

Tether CEO Paolo Ardoino: ‘Bitcoin and Gold Will Outlast Any Other Currency’

Tether CEO Paolo Ardoino stated that bitcoin and gold will outlast all other currencies, reiterating Tether’s strategy of allocating up to 15% of net profits to bitcoin reserves and expanding gold backing via XAUt. Investors await the next reserve attestation to gauge shifts in asset allocations.

Largest Ever Crypto Liquidation Event Wipes Out 6,300 Wallets on Hyperliquid

A record liquidation event on Hyperliquid erased over $1.23 billion in trader capital and left 6,300 wallets in the red amid a broader $19 billion market sell-off triggered by new U.S. tariffs and geopolitical uncertainty.

Trump Tariff Threat Sparks Crypto Flash Crash, Bitcoin Dips Below $110K

Trump’s threat of 100% tariffs on China sparked a crypto flash crash that drove Bitcoin below $110 000 and liquidated $7 billion in leveraged positions. Ether, XRP and Solana plunged over 15% as forced liquidations amplified volatility.

XRP Plunges 42% to $1.64 Before Partial Recovery to $2.36

XRP plunged 42% to $1.64 amid large-scale liquidations and a fall in futures open interest. The token rebounded to $2.36 as volume spiked 164% above its 30-day average and open interest contracted by $150 million.

Privacy Tokens Surge as Market Rotates to 2018 Narratives

Privacy-focused tokens rallied as Zcash gained over 40% and Railgun jumped 117% in 24 hours. Dash, Monero and other anonymity assets saw double-digit gains amid broader market consolidation. Spot volumes for privacy coins spiked above $1.1 billion across exchanges.

Privacy Tokens Surge as Market Rotates to 2018 Narratives

Privacy-focused tokens rallied as Zcash gained over 40% and Railgun jumped 117% in 24 hours. Dash, Monero and other anonymity assets saw double-digit gains amid broader market consolidation. Spot volumes for privacy coins spiked above $1.1 billion across exchanges.

XRP, DOGE, SOL See Pullback as $2.72B Flows Into Bitcoin ETFs

Bitcoin briefly dipped below $120,000 amid profit-taking, while spot Bitcoin ETFs attracted a record $2.72 billion inflow this week. XRP, Dogecoin and Solana all pulled back 2–3% as traders weighed ETF dynamics. Privacy coins outperformed amid renewed hedging demand.

Filecoin Plunges 7% Amid Intensified Selling Pressure

Filecoin’s FIL token dropped as much as 7% in 24 hours, sliding from $2.39 to $2.23 amid a broader market decline. Trading volume spiked to nearly 6 million tokens, well above the 3.4 million daily average. Technical models signal potential base formation above $2.23 but warn of sustained volatility.

BNB Chain memecoins mint new millionaires in wild trading week

Onchain data reveals traders on BNB Chain generated gains of up to $7.9 million using small-cap memecoins. One investor achieved a 2,260-fold return, while multiple wallets turned modest investments into multi-million dollar profits. Activity reflects renewed speculative capital flow across DeFi ecosystems.

GraniteShares files leveraged XRP ETF offering 3x long and short exposure

GraniteShares submitted a filing for a new XRP ETF providing 3x long and 3x short leveraged exposure to XRP. The product parallels existing leveraged Bitcoin, Ethereum and Solana ETFs, broadening trading options for aggressive and hedging strategies. Institutional interest in leveraged crypto ETFs continues to expand.

Bitcoin loses $5K and Ethereum falls below $4,500 in 24-hour correction

Bitcoin declined by $5,000 within 24 hours, briefly dipping under $121,000 before recovering slightly. Ethereum fell over 5%, slipping below $4,500 alongside broader altcoin losses. The total crypto market capitalization decreased by approximately 2% to around $4.27 trillion.

Bitcoin ETFs Post Largest Daily Inflow of 2025

US spot Bitcoin ETFs recorded $1.21B in net inflows on Oct. 6, 2025, the largest daily intake of 2025. Total ETF assets reached $169.48B, representing 6.79% of Bitcoin’s market cap. BlackRock’s iShares Bitcoin Trust contributed $969.95M of the inflows.

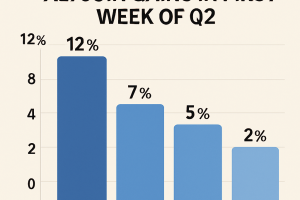

Layer-1 Sector Leads Altcoin Gains in First Week of Q4

Layer-1 blockchains outperformed other segments in the first week of October with a 12.5% gain, led by Solana, Avalanche and BNB. The layer-2 sector followed with 11.3% growth, while meme coins and DeFi tokens recorded modest advances under 5%.

Bitcoin Surges to ATH on Macro Tailwinds; Ether, DOGE and BNB Rally

Bitcoin rose to a new record of $126,223 amid a convergence of macroeconomic factors, including US government shutdown concerns and ETF inflows. Ether reached a three-week high above $4,700, while DOGE and BNB posted gains of around 6% amid broad market strength.

BNB tops $1.2K in 4% rally as chain activity and institutional demand accelerate

BNB surged over 4% to exceed $1,200, driven by spikes in trading volume and increased institutional interest. Active addresses on the BNB Chain rose sharply, with Aster Protocol TVL up 570%. Despite a late retracement, key support held above $1,200.

Bitcoin hits record high against yen as Japan’s new PM plans to revive Abenomics

Bitcoin reached an all-time peak versus the Japanese yen as markets anticipated aggressive fiscal and monetary stimulus under the new prime minister. The yen weakened sharply, and Japanese equities also gained on renewed policy optimism. The move highlights cross-asset demand for alternative stores of value.

Political waves send Nikkei, bitcoin, gold soaring to record highs

Japanese markets rallied sharply after the ruling party elected a new leader poised to revive fiscal stimulus. Gold climbed near $4,000 and bitcoin reached a lifetime peak above $125,000 amid demand for alternative assets. Global equities also gained on renewed risk appetite.

Asia Morning Briefing: Sanctioned Ruble Stablecoin Appears at Token2049

A ruble-backed stablecoin issued by a Russian state bank under U.S. sanctions sponsored Token2049 in Singapore, exploiting Hong Kong-based organizer exemptions. Former White House crypto director Bo Hines praised Tether amid shutdown-driven haven demand that lifted bitcoin above $125,000. The incident highlights compliance risks at global events.

Bitcoin Surges to Record High Above $125K After $3.2B Spot ETF Inflows

Bitcoin rallied above $125,000 on Oct. 5, driven by a record $3.24 billion in net inflows into U.S.-listed spot ETFs for the week ended Oct. 3. The rally extended October gains to 11% and reflected heightened safe-haven demand amid a U.S. government shutdown. Other major tokens including XRP, ETH, SOL and DOGE also rose 1–3% during Asian trading hours.

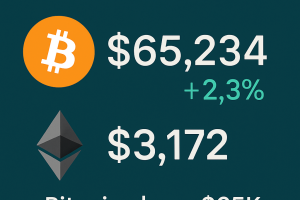

Crypto market snapshot: BTC above $20K, Ether holds $1.3K

The crypto market opened in positive territory, with Bitcoin trading at $20,194 and Ether at $1,355, up 3.07% and 2.09% in the last 24 hours, respectively. Trading volumes for Bitcoin surged over 23%, while Ether volumes increased by 6.5%. Toncoin, LUNA, HNT, and EGLD led deep-value gains, while RSR, CHZ, POLY, and BTRST were the top losers. The fear & greed index rose to 25, remaining in “extreme fear.”

Crypto trader turns $3K into $2M after CZ post sends memecoin soaring

A trader transformed a $3,000 BNB stake into nearly $2 million after Binance co-founder Changpeng Zhao reposted the BNB Chain’s phishing incident post alongside a new “4” memecoin. Blockchain data shows the trader was among the first buyers, achieving a 650× return and retaining $1.88 million in unrealized gains. “Smart money” wallets also accumulated the token following the viral social media mention.

Bitcoin hits all-time high above $125,000

Bitcoin surged to a record peak, climbing 2.7% to $125,245.57 after breaking its previous high set in mid-August. The rally reflects strong institutional demand, inflows into spot bitcoin ETFs, and a broader risk-on environment amid U.S. market gains. The U.S. dollar weakened as investors weighed uncertainty over a potential government shutdown and delayed economic data.

Bitcoin Nears $124K as Total Crypto Market Cap Tops $4.21T

Bitcoin rallied 14% over the past week to near $124,000 amid a US government shutdown and dovish Fed outlook. On-chain data indicated a $1.6B surge in buy volume and a $92 Coinbase premium gap, signaling strong US-led demand.

BNB Breakout Over $1.1K Leaves Bitcoin, Dogecoin Behind, With Ecosystem Tokens in Focus

BNB surged past $1,100, boosting attention to BNB Chain protocols and driving increased network activity. Binance founder endorsements and PancakeSwap trading fees rose, while the total value locked on the chain increased only modestly, suggesting cautious long-term capital allocation.

Bitcoin Hits $120K With Traders Eyeing Bullish October Rally

Bitcoin surged past $120,000 for the first time since August as futures open interest hit a record $32.6 billion amid macro uncertainty from a U.S. government shutdown and renewed ETF hopes.

Dogecoin jumps 9% and Shiba Inu surges 6% amid memecoin momentum

Dogecoin jumped nearly 9% in 24 hours, breaking resistance on heavy trading amid U.S. ETF approval speculation, while Shiba Inu rose 6% as exchange reserves fell to multi-year lows, indicating reduced supply and institutional accumulation.

Memecoins Are No Longer a Joke, Galaxy Digital Says in New Report

Galaxy Digital research concludes that memecoins have matured into a significant market segment, driving liquidity, fees and community engagement. The report highlights the role of platforms like Pump.fun in spawning thousands of tokens, testing infrastructure and reshaping trading habits across chains.

Leveraged Bitcoin Longs are Back in Force, Trading Firm Says

BTC perpetual futures open interest and funding rates have increased, indicating renewed long-position confidence. QCP Capital reports open interest rose from $42.8 billion to $43.6 billion and annualized funding rates jumped above 13%.

Bitcoin, Ethereum, Solana Decline Amid Broad Crypto Market Selloff

Cryptocurrency markets declined on Wednesday following the largest deleveraging event of 2025. Bitcoin fell 0.6% to $112,584, Ethereum dropped 0.8%, and Solana slid 4.4% as investors digested excess leverage and recent Federal Reserve rate cuts. XRP managed a slight gain of 0.2%. Analysts warn that sustained weakness in bitcoin could trigger further panic selling among short-term holders.

Crypto Whales Panic Sell ETH, HYPE & PUMP Amid September Market Chaos

Major whale addresses liquidated positions across Ethereum, Hyperliquid (HYPE), and PUMP tokens, realizing losses of up to $4.19 million on single trades. Liquidations approached $1.7 billion, reflecting peak risk aversion among large holders and heightened market volatility.

Crypto Market Stabilizes After $1.7B Flush as Bitcoin Dominance Surges to 57%

Markets cooled after $1.7 billion in leveraged positions were liquidated, driving traders back into Bitcoin and raising its dominance to 57%. Ethereum remained near $4,100 while institutions continued to buy through the dip. Options markets prepare for major September expiry.