Crypto Digest — 22 January 2026

📢 Read the daily digest for 2026-01-22: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Wayfinder (PROMPT) — 22 January 2026

New weekly coin research for Wayfinder (PROMPT). — Score: 7.00/10 TL;DR: An AI-driven omni-chain protocol enabling users to automate blockchain interactions via natural language AI agents

US Senate Agriculture Committee to release updated market structure bill

The US Senate Agriculture Committee plans to release its version of the Digital Asset Markets Clarity Act by close of business Wednesday, with a markup hearing next week. Lawmakers are weighing additional DeFi restrictions after delays in the banking committee and Coinbase’s withdrawn support.

Bitcoin Dips Below $90,000 Amid Broad Market Selloff

Bitcoin slid below $90,000 for the first time since January 9, tracking a global selloff in equities, bonds and risk assets amid rising geopolitical tensions and tariff fears. The drop to a one-week low followed a 4% decline on Tuesday, as long-dated Treasuries and Japanese bonds surged, prompting de-risking across markets.

Bitcoin Drops Below $90K as $708M of Liquidations Sweep Market

Bitcoin fell below $90,000 on January 21 after forced unwind of leveraged long positions drove over $708 million in liquidations, with longs accounting for approximately $649 million. The 12-hour RSI plunged to -33.7, signaling weak momentum amid a sudden deleveraging event.

NYSE developing 24/7 trading platform for tokenized securities

The New York Stock Exchange plans a separate blockchain-based venue for tokenized equities and ETFs, operating 24/7 with instant on-chain settlement and stablecoin funding. The platform would remain aligned with existing market structure rules and require regulatory approval. ICE is collaborating with Citigroup, BNY Mellon and other clearing members to support tokenized deposits across its global clearinghouses.

US crypto regulation stalls as lawmakers warn of falling behind global competitors for years

The Senate Banking Committee canceled its crypto bill markup on January 15, 2026, delaying long-awaited legislation establishing marketplace rules for digital assets. Industry leaders, including Coinbase CEO Brian Armstrong, criticized the draft as worse than no regulation, while Sen. Cynthia Lummis lamented the setback. Lawmakers warn the US risks ceding leadership to foreign markets without a clear regulatory framework.

Bitcoin has a 30% chance of falling below $80,000 by late June, options data suggests

Options market indicators show a roughly 30% probability of Bitcoin dropping below $80,000 by late June. Data from decentralized venues highlight a pronounced put skew and elevated open interest in put options around $75,000–$80,000 strikes. Geopolitical tensions and tariff concerns have exacerbated downside risk in the weeks following Bitcoin’s early-year rally.

NYSE Develops Tokenized Securities Platform to Enable 24/7 Trading

The New York Stock Exchange announced plans to build a platform for trading and on-chain settlement of tokenized U.S. equities and ETFs, pending regulatory approval. The system will support round-the-clock trading, fractional shares, dollar-denominated orders, and instant settlement via tokenized capital and stablecoin funding, leveraging NYSE’s Pillar engine with blockchain post-trade infrastructure.

Crypto Markets Shed Over $100 Billion as Major Altcoins Plunge by Double Digits

Geopolitical tensions and renewed U.S.–EU tariff threats triggered a sharp sell-off on January 19, leading to a $100 billion decline in total crypto market capitalization. Bitcoin fell below $92,000 while large-cap altcoins such as SUI, APT and ARB saw losses exceeding 10 percent. The downturn followed a quiet weekend but was amplified by weekend trade war headlines and liquidation pressures.

Paradex Pricing Glitch Briefly Values Bitcoin at Zero, Causing Mass Liquidations and Chain Rollback

A technical error during scheduled maintenance on the Starknet-based DEX Paradex caused Bitcoin’s price to flash at $0, triggering widespread liquidations. The platform rolled back its chain state to a known good block, force-cancelling open orders and restoring pre-maintenance account balances. Recovery modes and withdrawal restrictions remained in place while the team continued assessment.

Coinbase Accused of “Rug Pull” as White House Weighs Killing CLARITY Act

CryptoSlate reported that Coinbase CEO Brian Armstrong denied claims of a White House conflict but confirmed a ‘rug pull’ criticism after withdrawing support for the CLARITY Act. The Senate Banking Committee postponed its January 15 markup as bipartisan talks continue. The dispute centers on stablecoin reward provisions and the balance of power between banks, exchanges and regulators.

Crypto Market Erases $100B in Single Day During Sharp Correction

The total cryptocurrency market capitalization plunged by approximately $100 billion over a 12-hour span ending January 19, 2026, falling from around $3.20 trillion to near $3.09 trillion before a partial rebound. Bitcoin, Ether and XRP each declined by 3–4 percent as macro risk-off sentiment intensified amid thin liquidity. On-chain data indicate derivatives-driven positioning amplified the downturn.

$1.2B Bitcoin ETF Inflows Signal Renewed Institutional Bullish Bets

$1.2 billion net inflows into U.S. spot Bitcoin ETFs over the past two days indicate a shift from arbitrage strategies to directional bullish positions. Institutional investors and hedge funds are increasing long exposure while reducing short positions, signaling confidence in further market upside. Data from ETFs and CME futures highlight a growing appetite for leveraged Bitcoin exposure and a potential inflection point in institutional demand.

DeadLock Ransomware Exploits Polygon Smart Contracts to Evade Takedowns

Cybersecurity firm Group-IB warns that the DeadLock ransomware is leveraging Polygon smart contracts to rotate proxy server addresses, making its command-and-control infrastructure highly resilient. The on-chain technique allows attackers to update their proxy endpoints without centralized servers, complicating disruption efforts.

Jefferies Analyst Warns Quantum Computing Could Compromise Bitcoin Cryptography

Jefferies global head of equity strategy removed bitcoin from his long-term model portfolio, citing the existential risk posed by cryptographically relevant quantum computers. A ChainCode Labs report warns that a sufficiently powerful quantum machine could derive private keys from public keys in days, threatening up to 50% of circulating BTC.

Bitcoin ETFs Rebound with $1.8bn Inflows as BTC Steadies Near $95k

Bitcoin spot ETFs recorded $1.81 billion in net inflows over the past week, reversing previous outflows and signaling renewed institutional engagement. ETF flows were broad-based across issuers, cushioning downside risk and supporting price consolidation in the mid-$90,000 range.

Crypto.com reports $30 million breach in Bitcoin and Ethereum hack

Crypto.com disclosed a security breach resulting in unauthorized withdrawals totaling 4,836 ETH and 443.93 BTC, worth over $30 million, after attackers bypassed two-factor authentication. The exchange has reimbursed affected users and enhanced wallet security measures.

US Senate committee delays crypto market structure bill after Coinbase opposition

US Senate Banking Committee postponed debate on a landmark crypto market structure bill after Coinbase CEO withdrew support, citing concerns over regulator roles and stablecoin provisions. Bipartisan talks continue to refine legislation. The bill would define token classifications and allocate oversight between SEC and CFTC.

Crypto Leaders Split Over Clarity Act Amendments Ahead of Senate Markup

Coinbase withdrew support for the Clarity Act due to unfavorable amendments, while Ripple Labs and Coin Center endorsed the bill ahead of the January 15 Senate markup. Banking lobby influence has sparked debate over the bill’s impact on software developers, non-custodial platforms, and traditional finance interests.

Crypto Digest — 21 January 2026

📢 Read the daily digest for 2026-01-21: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Immunefi (IMU) — 21 January 2026

New weekly coin research for Immunefi (IMU). — Score: 7.00/10 TL;DR: IMU powers Immunefi’s Security OS, creating a self-reinforcing flywheel aligning incentives for protocols, security researchers, and community to secure Web3 in

Crypto Digest — 20 January 2026

📢 Read the daily digest for 2026-01-20: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Sport.Fun (FUN) — 20 January 2026

New weekly coin research for Sport.Fun (FUN). — Score: 6.00/10 TL;DR: Onchain multi-sport fantasy prediction economy with tokenized athlete shares and revenue-driven buybacks on Base L2.

Crypto Digest — 19 January 2026

📢 Read the daily digest for 2026-01-19: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — PAAL AI (PAAL) — 19 January 2026

New weekly coin research for PAAL AI (PAAL). — Score: 7.00/10 TL;DR: PAAL AI is an Ethereum-based, Web3-native AI infrastructure platform providing multimodal on-chain analytics and AI services via its PaaLLM language models.

Crypto Digest — 18 January 2026

📢 Read the daily digest for 2026-01-18: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Fogo (FOGO) — 18 January 2026

New weekly coin research for Fogo (FOGO). — Score: 8.00/10 TL;DR: A Solana VM–compatible Layer 1 blockchain optimized for ultra-low latency (40 ms blocks) and high throughput (65,000 TPS), targeting institutional-grade on-chai

Crypto Digest — 17 January 2026

📢 Read the daily digest for 2026-01-17: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Midnight Network (NIGHT) — 17 January 2026

New weekly coin research for Midnight Network (NIGHT). — Score: 8.00/10 TL;DR: Midnight is a Cardano partner chain offering programmable privacy via zero-knowledge proofs and a dual-token model separating governance (NIGHT) from transactio

🔎 Coin Research — Fogo (FOGO) — 16 January 2026

New weekly coin research for Fogo (FOGO). — Score: 7.00/10 TL;DR: A high-performance Solana Virtual Machine Layer 1 blockchain optimized for ultra-low latency on-chain trading.

Internet Computer Delivers 39% Surge Driven by MISSION70 Tokenomics Plan

Internet Computer (ICP) surged 39% after DFINITY released the MISSION70 whitepaper targeting a 70% inflation reduction via supply and demand measures. On-chain data shows rising network activity and reduced exchange balances indicating strong holder confidence.

🔎 Coin Research — ByteNova (BYTE) — 15 January 2026

New weekly coin research for ByteNova (BYTE). — Score: 6.00/10 TL;DR: ByteNova is an edge AI platform enabling personal AI companions that run entirely on-device, leveraging containerized architectures and decentralized compute in

Crypto Digest — 14 January 2026

📢 Read the daily digest for 2026-01-14: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Story (IP) — 14 January 2026

New weekly coin research for Story (IP). — Score: 7.00/10 TL;DR: Programmable intellectual property blockchain enabling on-chain licensing and monetization of IP assets.

Polygon Labs to Acquire Coinme and Sequence for Stablecoin Payments

Polygon Labs has signed definitive agreements to acquire Coinme and Sequence for a combined $250 million to integrate regulated fiat rails and wallet infrastructure into its stablecoin payments stack. The deals target US money-transmission licenses and one-click cross-chain capabilities.

Crypto Data Platform CoinGecko Weighs Sale for Around $500 Million

CoinGecko is exploring a potential sale that could value the crypto market data provider at approximately $500 million. Investment bank Moelis has been engaged to oversee the process, which commenced late last year during a record M&A environment.

Tether freezes $182M USDT across five Tron wallets

Tether executed one of its largest single-day enforcement actions by immobilizing approximately $182 million in USDT across five wallet addresses on the Tron blockchain after receiving a formal law enforcement request. The freezes, ranging from $12 million to $50 million per address, underscore Tether’s compliance framework launched in December 2023 and its cooperation with global sanctions regimes.

Crypto Digest — 13 January 2026

📢 Read the daily digest for 2026-01-13: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Monad (MON) — 13 January 2026

New weekly coin research for Monad (MON). — Score: 7.00/10 TL;DR: A high-performance EVM-compatible Layer 1 blockchain achieving 10,000 transactions per second through parallel execution and a custom BFT consensus protocol.

Dubai Tightens Crypto Rules on Privacy While Expanding Institutional Access

Dubai’s DIFC barred privacy tokens and devices under a new DFSA framework, requiring licensed firms to assess token suitability. Rule changes effective January 12, 2026, also remove restrictions on institutional crypto investments in the free zone. Move aligns with global AML standards.

Strategy Acquires 13,627 Bitcoin Following MSCI Inclusion Decision

Strategy announced acquisition of 13,627 Bitcoin for $1.25 billion, raising total holdings to 687,410 BTC. Purchase followed MSCI’s decision not to exclude crypto treasury firms from global indices. Acquisition comes as U.S. lawmakers advance the CLARITY Act.

Vitalik Buterin Unveils Seven-Step ‘Walkaway Test’ for Ethereum

Ethereum co-founder Vitalik Buterin introduced a seven-item checklist designed to ensure the network’s resilience in the absence of its core developers. The plan covers quantum resistance, scalability via ZK-EVM, long-term state architecture, account abstraction, gas scheduling, decentralized PoS, and censorship-resistant block building.

South Korea’s FSC to Lift Nine-Year Ban on Corporate Crypto Investment

South Korea’s Financial Services Commission is set to allow listed companies and professional investors to allocate up to 5% of equity capital into the top 20 cryptocurrencies, ending a 2017 restriction. Final guidelines expected in January or February will permit transactions for investment and financial purposes on five major regulated exchanges. Stablecoin inclusion and risk-mitigation measures remain under discussion.

Crypto Digest — 12 January 2026

📢 Read the daily digest for 2026-01-12: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Bittensor (TAO) — 12 January 2026

New weekly coin research for Bittensor (TAO). — Score: 8.00/10 TL;DR: Bittensor is a decentralized blockchain-based AI protocol that creates a peer-to-peer marketplace for machine intelligence, where models and compute resources a

U.S. Senate committee schedules Clarity Act vote Jan 15

The U.S. Senate Banking Committee will vote on the CLARITY Act on Jan 15, aiming to define digital asset trading, custody, and stablecoin oversight. Backers expect reduced market manipulation and stronger institutional engagement. Passage would set precedents for U.S. crypto regulation.

🔎 Coin Research — DeepNode (DN) — 11 January 2026

New weekly coin research for DeepNode (DN). — Score: 7.00/10 TL;DR: DeepNode is a decentralized AI infrastructure network leveraging a novel Proof-of-Work-Relevance consensus to reward contributors based on real-world model perf

Stablecoin Firm Rain Secures $250M Series C at $1.95B Valuation

Stablecoin issuer Rain raised $250 million in a Series C round led by ICONIQ, boosting total funding to over $338 million and valuing the company at $1.95 billion. The round reflects heightened institutional and consumer interest amid regulatory clarity under the Trump administration. Rain plans to deploy capital for market expansion, platform scaling, and strategic acquisitions.

Crypto Digest — 10 January 2026

📢 Read the daily digest for 2026-01-10: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Trusta.AI (TA) — 10 January 2026

New weekly coin research for Trusta.AI (TA). — Score: 7.00/10 TL;DR: Decentralized identity and reputation network for both human users and AI agents, providing verifiable on-chain attestations and Sybil-resistant reputation scor

Colombia Orders Crypto Exchanges to Report User Data in Tax Crackdown

Colombia’s DIAN enacted Resolution 000240 on December 24, 2025, mandating local and foreign crypto service providers to submit detailed user and transaction data—including identities, volumes, asset values, and net balances—for all transactions in 2026. Non-compliance carries fines up to 1% of unreported transaction value.

Truebit Token Crashes 99% After $26M Ethereum Exploit

Truebit reported a smart-contract exploit that drained approximately 8,535 ETH (around $26 million), triggering a 99% collapse in its TRU token price. The team acknowledged the breach, confirmed contact with law enforcement, and warned users to avoid the compromised contract address.

Truebit Token Crashes 99% After $26M Exploit

The Truebit protocol suffered a security breach on January 8, 2026, allowing the attacker to drain 8,535 ETH (≈$26.6 million) via a mispriced mint function. The TRU token price plunged by over 99%, and the team has engaged law enforcement to mitigate losses.

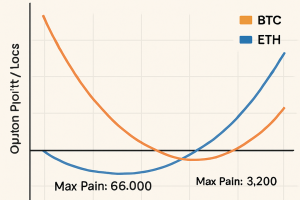

BTC and ETH Pinned at Max Pain as $2.2B Options Expire

More than $2.2 billion of Bitcoin and Ethereum options are set to expire at Deribit’s max pain levels, constraining price action around $90,000 and $3,100. Dealer hedging has compressed volatility ahead of U.S. jobs data and a Supreme Court tariff ruling expected later today.

Crypto Digest — 09 January 2026

📢 Read the daily digest for 2026-01-09: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Depinsim (ESIM) — 09 January 2026

New weekly coin research for Depinsim (ESIM). — Score: 7.00/10 TL;DR: Tokenizing global mobile connectivity via a decentralized eSIM DePIN network.

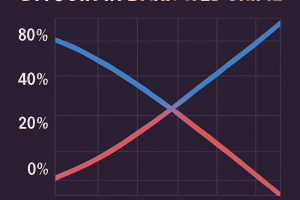

Stablecoins Overtake Bitcoin in Dark Web Crime

Chainalysis data shows stablecoins represented 84% of the $154 billion illicit transaction volume in 2025. The shift displaced Bitcoin in dark web crime and empowered large-scale money laundering and state-sponsored evasion operations.

Ethereum raises blob capacity to 14 with latest BPO fork ahead of Fusaka

Ethereum network increased data blob capacity per block to 14 target and 21 maximum through a Blob Parameters Only fork. The upgrade enhances Layer 2 scaling potential by expanding onchain data availability, aiming to reduce transaction fees and boost throughput.

Crypto Digest — 08 January 2026

📢 Read the daily digest for 2026-01-08: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!