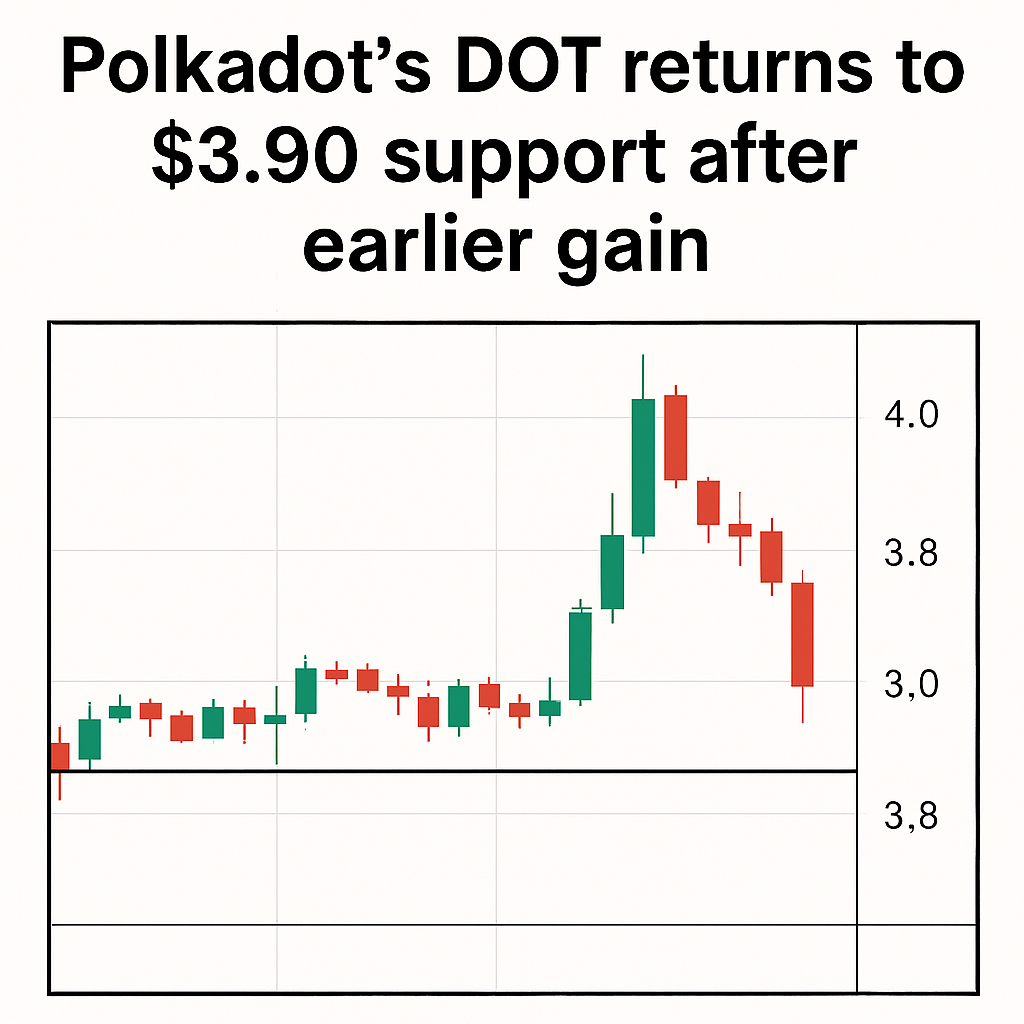

Polkadot’s native token DOT registered a 2% intraday gain on Thursday, briefly testing resistance at $4.02 before correcting back to strong support around $3.90–$3.91. According to CoinDesk Research’s technical model, the uptick was driven by substantial institutional volume, indicating professional accumulation behavior in a market environment often dominated by retail traders.

The technical analysis model highlighted a measured advance from a floor near $3.81 to a peak of $4.02, accompanied by trading volumes exceeding 4.6 million units. Such volume patterns typically signal the involvement of larger market participants hedging positions or repositioning ahead of anticipated catalysts.

Short-term trading range analysis shows a volatility band of roughly 5.2% between the floor and ceiling levels. Volume clusters near support levels suggest that market makers and institutional desks are actively buying during pullbacks and testing higher price thresholds.

Paraguay’s recent $6 million tokenization investment into the Polkadot ecosystem may have contributed to the bullish sentiment, marking one of the first sovereign endorsements of the network for infrastructure development. This event underscores the growing interest from public sector entities in leveraging blockchain for national projects.

Despite the strong volume signals, some analysts caution that failure to breach the $4.02 ceiling could lead to a deeper retracement toward the moving average supports at $3.81. Nevertheless, the prevailing consensus is that institutional accumulation ahead of potential protocol upgrades or governance votes may underpin further upside for DOT in the coming sessions.

Comments (0)