US Senate Agriculture Committee to release updated market structure bill

The US Senate Agriculture Committee plans to release its version of the Digital Asset Markets Clarity Act by close of business Wednesday, with a markup hearing next week. Lawmakers are weighing additional DeFi restrictions after delays in the banking committee and Coinbase’s withdrawn support.

US crypto regulation stalls as lawmakers warn of falling behind global competitors for years

The Senate Banking Committee canceled its crypto bill markup on January 15, 2026, delaying long-awaited legislation establishing marketplace rules for digital assets. Industry leaders, including Coinbase CEO Brian Armstrong, criticized the draft as worse than no regulation, while Sen. Cynthia Lummis lamented the setback. Lawmakers warn the US risks ceding leadership to foreign markets without a clear regulatory framework.

Coinbase Accused of “Rug Pull” as White House Weighs Killing CLARITY Act

CryptoSlate reported that Coinbase CEO Brian Armstrong denied claims of a White House conflict but confirmed a ‘rug pull’ criticism after withdrawing support for the CLARITY Act. The Senate Banking Committee postponed its January 15 markup as bipartisan talks continue. The dispute centers on stablecoin reward provisions and the balance of power between banks, exchanges and regulators.

US Senate committee delays crypto market structure bill after Coinbase opposition

US Senate Banking Committee postponed debate on a landmark crypto market structure bill after Coinbase CEO withdrew support, citing concerns over regulator roles and stablecoin provisions. Bipartisan talks continue to refine legislation. The bill would define token classifications and allocate oversight between SEC and CFTC.

Crypto Leaders Split Over Clarity Act Amendments Ahead of Senate Markup

Coinbase withdrew support for the Clarity Act due to unfavorable amendments, while Ripple Labs and Coin Center endorsed the bill ahead of the January 15 Senate markup. Banking lobby influence has sparked debate over the bill’s impact on software developers, non-custodial platforms, and traditional finance interests.

Dubai Tightens Crypto Rules on Privacy While Expanding Institutional Access

Dubai’s DIFC barred privacy tokens and devices under a new DFSA framework, requiring licensed firms to assess token suitability. Rule changes effective January 12, 2026, also remove restrictions on institutional crypto investments in the free zone. Move aligns with global AML standards.

South Korea’s FSC to Lift Nine-Year Ban on Corporate Crypto Investment

South Korea’s Financial Services Commission is set to allow listed companies and professional investors to allocate up to 5% of equity capital into the top 20 cryptocurrencies, ending a 2017 restriction. Final guidelines expected in January or February will permit transactions for investment and financial purposes on five major regulated exchanges. Stablecoin inclusion and risk-mitigation measures remain under discussion.

U.S. Senate committee schedules Clarity Act vote Jan 15

The U.S. Senate Banking Committee will vote on the CLARITY Act on Jan 15, aiming to define digital asset trading, custody, and stablecoin oversight. Backers expect reduced market manipulation and stronger institutional engagement. Passage would set precedents for U.S. crypto regulation.

Colombia Orders Crypto Exchanges to Report User Data in Tax Crackdown

Colombia’s DIAN enacted Resolution 000240 on December 24, 2025, mandating local and foreign crypto service providers to submit detailed user and transaction data—including identities, volumes, asset values, and net balances—for all transactions in 2026. Non-compliance carries fines up to 1% of unreported transaction value.

SEC now fully Republican, set for pro-crypto rulemaking in 2026

Departure of SEC Commissioner Caroline Crenshaw leaves commission fully Republican, clearing path for pro-crypto rulemaking in 2026. Regulatory procedures still mandate public notice and comment, but major policy shifts are anticipated.

Morgan Stanley files S-1s for Bitcoin and Solana ETFs

Morgan Stanley filed S-1 registration statements with the SEC on Jan. 6, 2026, to launch spot Bitcoin and Solana ETFs. The proposed trusts will hold underlying tokens directly and aim for passive exposure via public exchange listings.

Coinbase exec defends CLARITY Act delay: 'I completely understand'

Coinbase Institutional head John D’Agostino said the US CLARITY Act’s complexity justifies its timeline, contrasting it with the simpler Genius Act. He highlighted global regulatory momentum and warned delays have driven $952 million of outflows from crypto investment products.

Crypto tax data to be collected in 48 countries ahead of CARF 2027

Starting Jan. 1, crypto service providers in 48 jurisdictions must collect detailed wallet transaction data for the OECD’s Crypto-Asset Reporting Framework (CARF), with data exchanges set to begin in 2027. The initiative targets tax evasion and money laundering by mandating centralized and decentralized platforms record user activity. A second group of 27 jurisdictions will follow in 2027, expanding the scope of international transparency efforts.

Senate Banking Panel to Mark Up CLARITY Act on January 15

US senators have scheduled a January 15 markup of the CLARITY Act in the Senate Banking Committee. The bill seeks to define digital commodities, token classifications, and stablecoin regulations. Bipartisan support is required to secure the 60 Senate votes necessary for final passage.

Crypto-Asset Reporting Framework goes live in 48 jurisdictions Jan 1, 2026

The OECD’s Crypto-Asset Reporting Framework (CARF) will begin data collection in 48 jurisdictions on January 1, 2026. Crypto platforms must gather detailed tax-residency data, verify user identities and report balances and transactions annually to domestic tax authorities.

IMF confirms negotiations to sell El Salvador’s state-run Chivo Bitcoin wallet

IMF mission chief confirmed ongoing negotiations for sale of El Salvador’s state-run Chivo Bitcoin wallet under terms of a 2024 funding agreement, indicating potential government divestment. The move follows a deal requiring the halt of new Bitcoin acquisitions.

Trump may authorize crypto bailout in 2026

Analysis predicts President Trump could intervene to rescue digital‐asset holders if a major stablecoin or exchange failure threatens financial stability in 2026. The report cites his administration’s pro‐crypto policies, growing political and financial ties to the sector, and available emergency funding tools as factors supporting potential intervention.

US Lawmakers Propose Stablecoin Tax Exemption and Staking Reward Deferral

A bipartisan draft bill would exempt up to $200 in stablecoin payments from capital gains taxes and allow users to defer staking and mining income for up to five years. The proposal includes anti-abuse measures, wash sale rules for digital assets, and mark-to-market options for traders and dealers.

SEC confirms years-long director bans for former Alameda, FTX executives

The US Securities and Exchange Commission obtained final consent judgments imposing officer-and-director bars on former Alameda Research and FTX executives Caroline Ellison, Gary Wang, and Nishad Singh for eight to ten years following misuse of investor funds. All three are also subject to five-year conduct-based injunctions.

Senate Confirms Selig as CFTC Chair and Hill as FDIC Chair

The US Senate confirmed Michael Selig as CFTC chair and Travis Hill as FDIC chair by a 53–43 vote, installing crypto-friendly leaders at key financial agencies. These appointments are poised to influence the direction of future digital asset regulation and oversight.

US crypto industry cheers 2025 wins, but party may fizzle next year

Trump administration eased crypto oversight in 2025 by rescinding accounting guidance, dismissing SEC lawsuits and approving federal stablecoin rules. A top regulator relaxed bank crypto rules and conditionally approved trust bank licenses. However, stalled market structure legislation and uncertain Senate prospects threaten industry momentum.

UK FCA Launches Wide-Ranging Crypto Consultation

The UK Financial Conduct Authority launched a public consultation on proposed rules for crypto assets, covering listings, trading platform standards, and prudential requirements. The consultation follows a government announcement that formal regulation will commence in October 2027 and seeks feedback by February 12, 2026. The FCA aims to protect consumers, support innovation, and align UK rules more closely with the US regulatory model.

US OCC Grants Initial Approval for Crypto Firms to Launch National Trust Banks

The U.S. Office of the Comptroller of the Currency granted preliminary approval for Ripple and Circle to establish national trust banks. BitGo, Paxos and Fidelity Digital Assets received conditional approvals to convert state charters to national ones. These approvals permit management and settlement of digital assets under federal oversight, excluding deposit taking and lending activities.

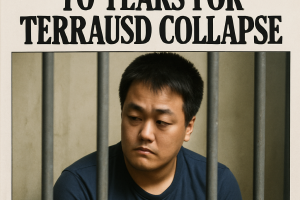

Do Kwon Sentenced to 15 Years for $40 B Terra USD Collapse

Terraform Labs founder Do Kwon received a 15-year prison sentence after pleading guilty to commodities, securities and wire fraud tied to the 2022 Terra USD collapse that wiped out $40 billion in value. Extradited from Montenegro, Kwon admitted orchestrating a scheme involving Luna token and smart contracts. Victim impact statements detailed significant investor losses.

Do Kwon sentenced to 15 years over $40 billion Terra collapse

Former Terraform Labs co-founder Do Kwon received a 15-year prison sentence for fraud involving TerraUSD and Luna, which collectively lost investors $40 billion in 2022. The judge condemned the scheme as"epic fraud" and highlighted widespread investor harm.

OCC Allows Banks to Serve as Crypto Intermediaries

The U.S. Office of the Comptroller of the Currency permitted national banks to act as intermediaries in crypto transactions under riskless principal rules. The guidance removes prior restrictions, aligning TradFi and crypto while raising systemic risk debates.

Binance Receives ADGM Approval for Global Platform Licensing

The Financial Services Regulatory Authority of ADGM granted formal approval for Binance.com under a three-entity structure covering exchange, clearing house and broker-dealer functions, effective January 2026, enhancing regulatory clarity.

A New Era Begins: CFTC Approves Spot Bitcoin Trading on US Regulated Markets

The CFTC has authorized listed spot Bitcoin and other crypto contracts to trade on federally regulated futures exchanges, marking the first such approval in the U.S. Bitnomial will launch leveraged and non-leveraged spot trading under CFTC oversight starting December 8.

CFTC approves spot crypto trading on registered futures exchanges

The U.S. Commodity Futures Trading Commission announced spot crypto contracts will trade for the first time on CFTC-registered futures exchanges, integrating digital assets into mainstream finance under the Trump administration push.

Spot crypto products to begin trading on CFTC-registered exchanges

CFTC announced spot crypto asset contracts will begin trading on registered futures exchanges, marking the first regulated listing of such products in the U.S. The move aims to enhance market safety and provide robust oversight amid offshore exchange failures.

UK takes ‘massive step forward,’ passing property laws for crypto

The UK granted royal assent to the Property (Digital Assets etc) Act, legally recognizing cryptocurrencies and stablecoins as personal property. The law codifies Law Commission recommendations, clarifying ownership rights, asset recovery and insolvency processes for digital assets.

'We Wear Your Loathing With Pride': Tether's Downgrade at S&P Sparks Online Battle

S&P Global downgraded Tether’s USDT stablecoin rating to its weakest level, citing concerns over reserve transparency and increased bitcoin backing. The move reignited debates over audit practices and collateral composition as industry figures criticized S&P’s methodology and called for independent audits.

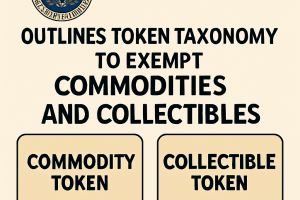

Senate, IRS, and SEC Unveil Key Cryptocurrency Regulatory Proposals

The U.S. Senate Agriculture Committee released a draft digital asset market structure bill, the IRS issued staking safe-harbor guidance, and the SEC introduced its 'Project Crypto' token taxonomy. These federal initiatives aim to clarify trading rules, tax treatment, and token classifications.

Nevada Court Rules Prediction Markets Contracts Are Not Swaps Under CEA

A federal court in Nevada ruled that sports outcome contracts on a regulated exchange are not swaps under the Commodity Exchange Act. The decision exposes prediction markets like Kalshi to state gambling laws and may trigger a state-by-state regulatory battle.

Senator Tim Scott pushes for December vote on crypto market bill

Senate Banking Chair Tim Scott announced plans to mark up a crypto market structure bill in December, aiming for Senate passage and Presidential signature in early 2026. The bill would align with the CLARITY Act and provide clear regulatory authority for digital assets.

SEC Outlines Token Taxonomy to Exempt Commodities and Collectibles

SEC Chairman Paul Atkins unveiled a token taxonomy under ‘Project Crypto’, clarifying that digital commodities, collectibles, and utility tokens fall outside securities regulation. Investment contract tokens remain regulated until managerial efforts end. The framework aims to support innovation by defining clear categories and coordination with CFTC and banking regulators.

Major Ethereum Holders Withdraw Over $1.4B from Binance

Data from CryptoOnchain reveals top 10 transactions included 413,000 ETH withdrawals by major holders, totaling over $1.4 billion. Net outflows reached 106,000 ETH as institutional investors moved assets to private wallets. Analysts interpret the shift as a sign of long-term confidence and potential supply squeeze, though derivatives volumes and open interest remain elevated, indicating ongoing speculative activity.

Brazil Central Bank Implements Crypto Regulations and $7M Capital Bar for Firms

Brazil’s central bank issued comprehensive crypto regulations requiring service providers to obtain licenses, adhere to foreign exchange and capital market rules, and report cross-border transactions. Firms must meet capital thresholds up to 37.2 million reais and have nine months to comply. Foreign entities must establish local operations or face prohibition.

ClearToken Wins UK Regulator Approval for Digital Asset Settlement Service

ClearToken has secured authorization from the U.K. Financial Conduct Authority to launch CT Settle, a delivery-versus-payment settlement platform for crypto, stablecoins and fiat transfers. The service eliminates pre-funding requirements, enabling simultaneous asset and payment exchanges and freeing up institutional liquidity. Its design mirrors established settlement infrastructure like forex CLS.

U.S. Clears Way for Crypto ETPs to Get Into Yield Without Triggering Tax Problems

IRS issued guidance allowing crypto ETPs to stake digital assets without jeopardizing tax status. Industry insiders view the safe harbor as removing a major barrier for fund sponsors. Treasury leaders called the move a boost for innovation and investor benefits.

Bank of England softens stablecoin stance with new proposals

Bank of England proposals would allow stablecoin issuers to invest up to 60 percent of reserves in short-term government debt while retaining caps on holdings. Temporary regime for FCA-regulated tokens would permit up to 95 percent allocation in debt instruments. Central bank liquidity facilities under consideration to backstop systemic tokens during market stress.

U.S. Fed's Miran Says Policy Needs to Adjust to Stablecoin Boom That Could Reach $3T

Federal Reserve Governor Stephen Miran warned that stablecoin adoption could drive $1–3 trillion in Treasury demand by decade end, potentially influencing monetary policy. Regulatory frameworks under the GENIUS Act may not permit yield, shifting global dollar flows via stablecoins.

Irish regulator fines Coinbase Europe €21.5M over AML failures

Ireland’s central bank imposed a €21.5 million penalty on Coinbase Europe for misconfiguring its anti-money laundering systems, which left over 30 million transactions unmonitored for a year. The oversight delayed reporting of 2,708 suspicious transfers linked to serious crimes.

Trump Says He Wants U.S. to Be ‘The Bitcoin Superpower,’ Cites Competition From China

In Miami, the U.S. president declared intent to transform the country into a leading bitcoin and crypto hub, claiming executive orders ended a federal “war on crypto.” Remarks included support for dollar strength and warnings of rival advances if U.S. policy missteps occur.

EU mulls SEC-like oversight for stock, crypto exchanges to bolster startup landscape

Proposal would grant ESMA authority over stock and crypto exchanges to streamline cross-border trading and foster startup growth. National regulators would cede direct supervision under a unified framework. Draft expected in December.

Indian court blocks WazirX XRP redistribution plan

The Madras High Court granted interim relief to a WazirX user, blocking redistribution of her XRP under a Singapore restructuring. The ruling recognizes crypto as property held in trust and may shape future Indian exchange-related litigation.

Crypto.com Applies for OCC National Trust Bank Charter for Institutional Custody

Crypto.com filed an application with the U.S. Office of the Comptroller of the Currency on October 25, 2025, seeking a national trust bank charter to expand federally supervised custody services for institutional clients. The filing complements its existing New Hampshire–chartered custodian operations and aims to streamline trust services across multiple blockchains.

Binance’s CZ Granted Pardon by U.S. President Trump

President Donald Trump granted a full pardon to Binance founder Changpeng Zhao, who pleaded guilty to Bank Secrecy Act violations in November 2023. Zhao served a four-month sentence, paid a $50 million fine, and stepped down as CEO under his plea deal. The pardon follows Binance’s record $4.3 billion settlement with U.S. regulators.

Canada’s Fintrac Issues Record $126M Fine to Cryptomus

Fintrac fined cryptocurrency platform Cryptomus C$176.96 million ($126 million) for failing to report over 1,000 suspicious transactions tied to various illicit activities. The record penalty addresses violations including fraud, ransomware payments and sanctions evasion. Canada’s regulator cited widespread compliance failures.

APAC's Biggest Stock Exchanges Push Back Against Digital Asset Treasury Strategies

Major Asia-Pacific stock exchanges in Hong Kong, India, and Australia have challenged companies adopting Digital Asset Treasury models. Firms seeking to hold large crypto reserves have faced listing rejections and regulatory pushback, reflecting concerns over market volatility and investor protection. Japan remains an outlier by allowing crypto treasury strategies under existing disclosure rules.

Hong Kong Approves First Solana Spot ETF

Hong Kong Securities and Futures Commission has approved the first Solana spot ETF, marking Asia’s first such product and the third crypto ETF in the region. The ChinaAMC Solana ETF will begin trading on October 27 in HKD, RMB, and USD. U.S. approval remains pending amid a government shutdown.

SEC says unclear if proposed 3x and 5x leveraged ETFs will be approved

The SEC stated it is unclear whether filings for new 3x and 5x leveraged equity-linked ETFs comply with Rule 18f-4, amid limited review capacity during the US government shutdown. Volatility Shares has filed for 27 leveraged ETF products including the first proposed 5x offering, raising investor risk concerns.

U.S. Takes $14B in Bitcoin in Largest-Ever Government Seizure

U.S. authorities executed a coordinated action against Cambodian scam operations, indicting Prince Group’s founder and seizing 127,271 BTC (≈$14.4 billion) as part of the DOJ’s largest crypto confiscation, while sanctions cut Huione from U.S. financial markets.

FTC Settles with Voyager Digital for $1.65B as CFTC Charges Former CEO

U.S. FTC reached a $1.65 billion settlement with bankrupt crypto lender Voyager Digital over consumer protection violations. Concurrently, CFTC filed fraud and registration-related charges against ex-CEO Steven Ehrlich. Settlement bars future financial service offerings and mandates payment after creditor compensation in bankruptcy proceedings.

‘Bitcoin Jesus’ Roger Ver Nears U.S. Tax Fraud Settlement

Early Bitcoin investor and advocate Roger Ver is reportedly close to settling U.S. tax fraud charges, according to the New York Times. Under the proposed agreement, Ver would pay approximately $48 million for unreported capital gains. The settlement remains subject to judicial review and is scheduled for a hearing in December.

Senate Democrats’ DeFi Regulation Proposal Sparks Industry Outcry

A draft proposal circulated among Senate Democrats would require anyone profiting from a DeFi front-end to register as a broker with the SEC or CFTC, industry leaders warn. Observers say language could effectively ban most DeFi platforms in the US by imposing unworkable compliance burdens. The Blockchain Association and legal experts call for revisions to avoid driving innovation overseas.

North Dakota plans U.S. dollar stablecoin launch with Fiserv partnership

The Bank of North Dakota will issue a state-backed U.S. dollar stablecoin built on Fiserv’s digital asset platform, targeting roll-out in 2026. Dubbed Roughrider Coin, the token aims to streamline interbank transfers and merchant payments. State participation follows the GENIUS Act and Wyoming’s Frontier Stable Token test phase.

Crypto race to tokenize stocks raises investor protection flags

A race by crypto firms to launch tokenized stock products has prompted warnings over insufficient investor rights and market fragmentation. Traditional financial institutions and regulatory experts caution that these tokens lack standard equity protections. Critics argue inconsistent disclosures and derivative-like structures could undermine market stability.

BitGo Secures VARA License Amid Regulatory Crackdown

Digital asset custody firm BitGo has obtained a broker-dealer license from Dubai’s Virtual Assets Regulatory Authority, enabling regulated trading services in the MENA region. The approval follows VARA enforcement actions against 19 firms for unlicensed activity. BitGo’s MENA arm can now serve institutional clients under enhanced compliance standards.

SEC to Formalize Innovation Exemption by Year End

The U.S. Securities and Exchange Commission plans to initiate formal rulemaking for a proposed"innovation exemption" by the end of 2025 or early 2026. The effort remains a priority despite a government shutdown slowing agency work. Chair Paul Atkins reaffirmed commitment at a legal industry panel.