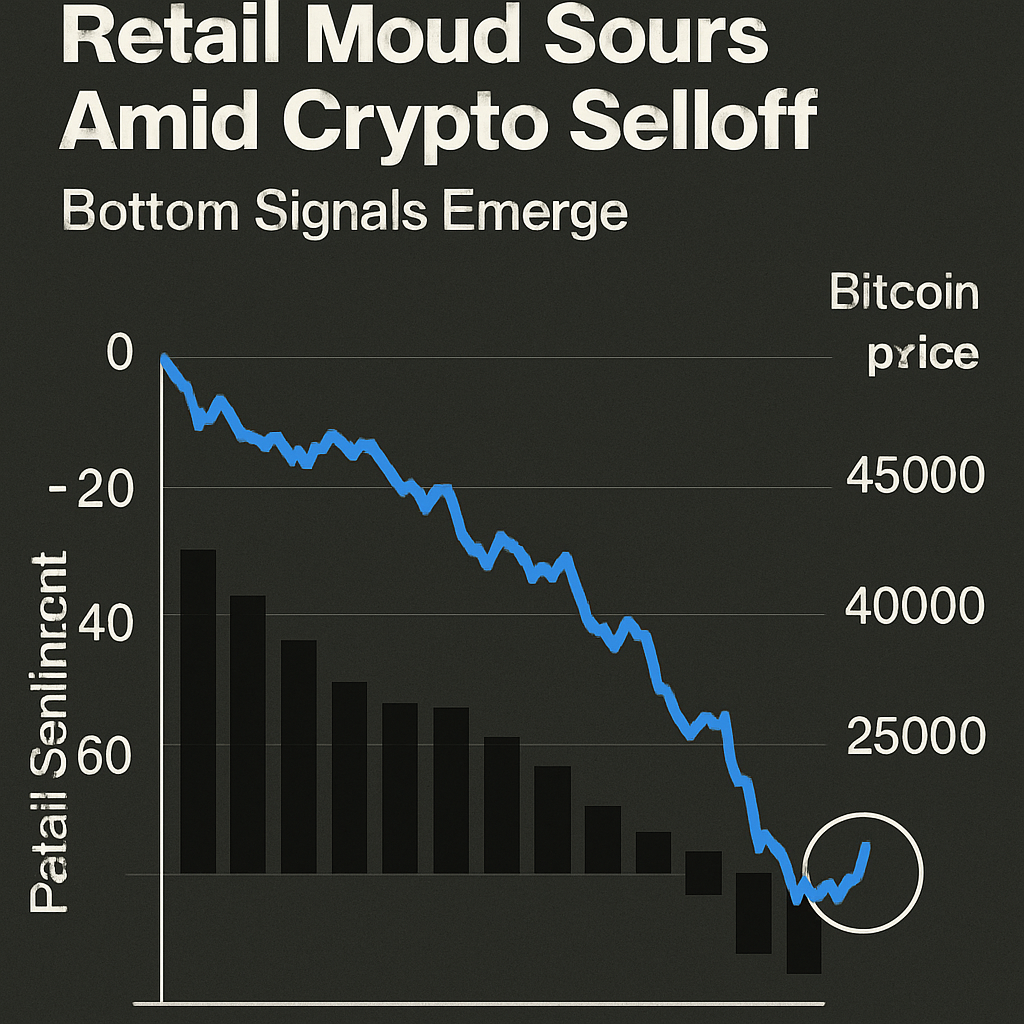

Retail sentiment across Bitcoin, Ethereum and XRP deteriorated sharply during Thursday’s selloff, with social media analytics indicating a significant shift toward bearish commentary. Traders displayed defensive positioning as prices continued to grind lower, reflecting growing fatigue among smaller market participants.

Despite the pessimism, on-chain indicators point to potential short-term bottom formation. Bitcoin’s Net Unrealized Profit (NUP) ratio fell to 0.476, a threshold that has historically signaled inflection points and preceded subsequent price rebounds. Similar readings in 2024 led to double-digit percentage rallies in the days following extreme sentiment troughs.

Institutions maintained a cautiously bullish outlook amid the selloff. A survey by Sygnum revealed that 61% of asset managers plan to increase digital asset allocations in anticipation of forthcoming altcoin ETF approvals and clearer regulatory frameworks in 2026. Strategic on-chain flows also supported accumulation: MicroStrategy added 487 BTC to its treasury over the past week.

Exchange reserve data for Ethereum reached lows not seen since May 2024, suggesting reduced selling pressure and potential demand for on-chain holdings. Large whale wallets moved to accumulate during price dips, leveraging stablecoin reserves to acquire ETH and BTC at discounted levels.

Technical analysis shows Bitcoin trading near $98,000, pressured by broader risk-off sentiment in equities and tightening liquidity conditions. However, the contraction in exchange holdings and sustained institutional bids provide counterbalance to retail capitulation, creating conditions for reflexive technical rebounds typically observed after extreme sentiment shifts.

Market participants will watch funding rate dynamics and derivatives positioning for further clues. A normalization of perpetual swap funding and a decrease in put-call skew would reinforce the outlook for a market turnaround, potentially ushering in short, sharp rallies rather than deeper structural declines.

Overall, the interplay between negative retail mood and stabilizing on-chain data frames a complex market environment where sentiment extremes may offer buying opportunities for more sophisticated investors. The next few sessions will be critical in determining whether the current selloff fully exhausts weak hands or marks the beginning of a more extended correction.

Comments (0)