On August 9, 2025 at 10:05 UTC, Ripple (XRP) closed its landmark lawsuit with the U.S. Securities and Exchange Commission after nearly five years of litigation. As part of a settlement finalized on August 7, Ripple agreed to pay a $125 million fine, with $50 million directed to the U.S. Treasury and $75 million returned to Ripple from escrow. This resolution follows the SEC’s decision to drop remaining appeals and marks the end of contentious debates over XRP’s classification.

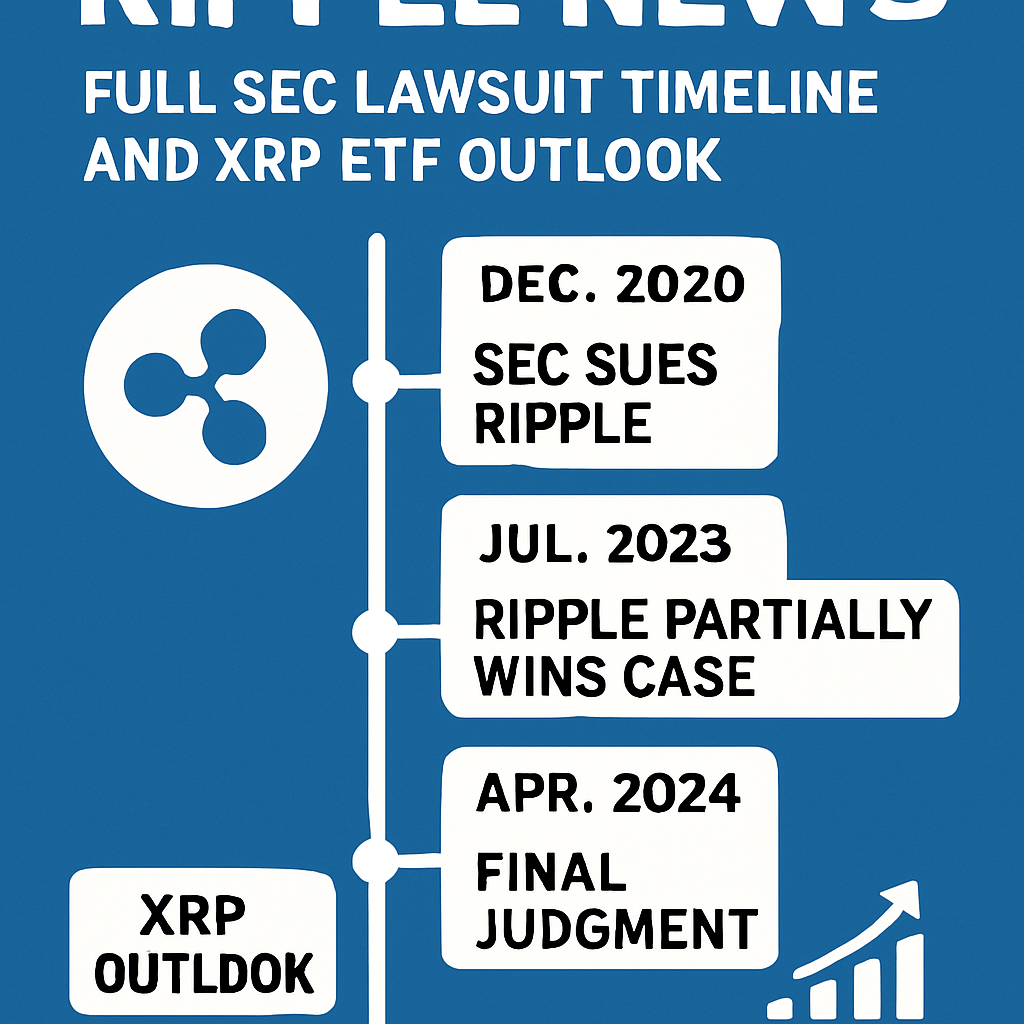

The case began on December 22, 2020, when the SEC accused Ripple Labs and its executives of conducting unregistered securities offerings totaling $1.3 billion. After multiple rulings on discovery, institutional sales, and legal definitions, both parties reached a mutual agreement in May 2025. Judge Analisa Torres’s mixed verdict in July 2023, which exempted retail XRP sales from securities laws but found certain institutional sales non-compliant, set the stage for settlement negotiations.

This legal clarity has significantly altered market sentiment. Bloomberg analysts Eric Balchunas and James Seyffart now assign a 95% probability of XRP ETF approval, while odds on specialized platforms increased to 77%. Major asset managers—including Grayscale, Bitwise, and WisdomTree—have filed or updated XRP ETF registration statements, and speculation has arisen that BlackRock may enter the market pending regulatory green lights.

Following the settlement announcement, XRP’s spot price rose 11% within 24 hours, climbing from $2.99 to $3.30 and restoring its market capitalization above $180 million. Institutional interest also surged, with on-chain metrics indicating increased wallet inflows and exchange deposits by key market makers. ETF Store president Nate Geraci suggested that the lawsuit’s end could trigger BlackRock’s filing for an iShares XRP Trust, though BlackRock officially denied immediate ETF plans.

With legal uncertainty removed and trading venues poised to support institutional products, the next phase for XRP centers on ETF approval processes, token utility developments, and integration in emerging real-world asset applications. Market participants will watch SEC filings, public commentary, and regulatory guidance closely as the industry seeks to capitalize on renewed confidence in XRP’s compliance status.

Comments (0)