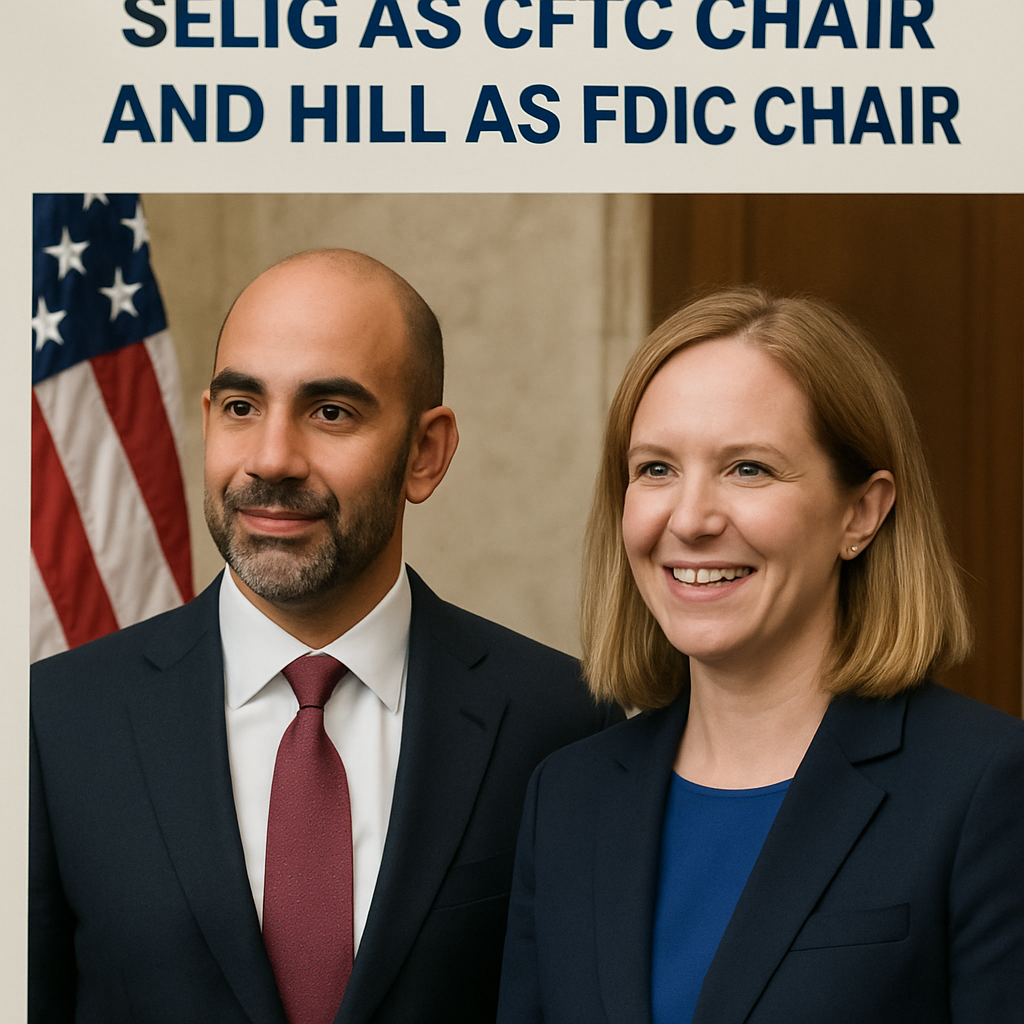

A confirmation vote in the United States Senate resulted in a 53–43 approval of Michael Selig as chairman of the Commodity Futures Trading Commission and Travis Hill as chair of the Federal Deposit Insurance Corporation. Both nominees had been advanced by the executive branch to lead agencies with significant roles in the oversight of financial markets. The Commodity Futures Trading Commission, traditionally tasked with regulating swaps and derivatives markets, is expected to see an expanded mandate in digital asset regulation pending legislative developments. The Federal Deposit Insurance Corporation, responsible for deposit insurance and bank supervision, will oversee stablecoin custodial policies and banking services for crypto businesses under new leadership.

Michael Selig brings extensive experience as counsel to the Securities and Exchange Commission’s Crypto Task Force and advisor on digital asset policy. The confirmation restores a permanent chair for the five-member CFTC while Caroline Pham, the acting chair, transitions to the private sector. Selig’s mandate includes implementation of the digital asset provisions in pending legislation and coordination with other federal regulators. Travis Hill, previously serving as acting FDIC chair, has signaled support for responsible stablecoin frameworks, emphasizing balanced oversight to foster innovation while protecting deposit insurance fund integrity.

Opposition to the nominations cited concerns over potential conflicts of interest and regulatory capture. Critics argued that a more diverse regulatory leadership team was necessary to address consumer protection gaps in encrypted asset markets. Supporters highlighted the nominees’ technical expertise and familiarity with evolving digital asset ecosystems. Senate committee hearings provided an opportunity for public stakeholders and industry representatives to submit commentary on regulatory priorities, including token custody standards, stablecoin reserve requirements, and international coordination on crypto enforcement.

These confirmations coincide with broader legislative efforts to establish clarity in digital asset definitions and jurisdictional boundaries. Proposed measures aim to assign primary oversight of spot virtual currencies to the CFTC, while the Securities and Exchange Commission retains authority over asset tokens deemed securities. Meanwhile, the FDIC is drafting guidelines for insured depository institutions engaging with stablecoin issuers, addressing reserve custody, transparency, and audit protocols.

Market impact included brief fluctuations in derivatives pricing and stablecoin deposit volumes. Futures basis spreads reflected hedging adjustments as counterparties updated assumptions on regulatory timelines. Banking sector analysts revised risk-weighted asset forecasts for institutions with crypto services, pending FDIC rulemaking. Industry bodies anticipate that regulatory clarity will bolster institutional participation and support infrastructure growth across custody, trading, and compliance solutions.

Comments (0)