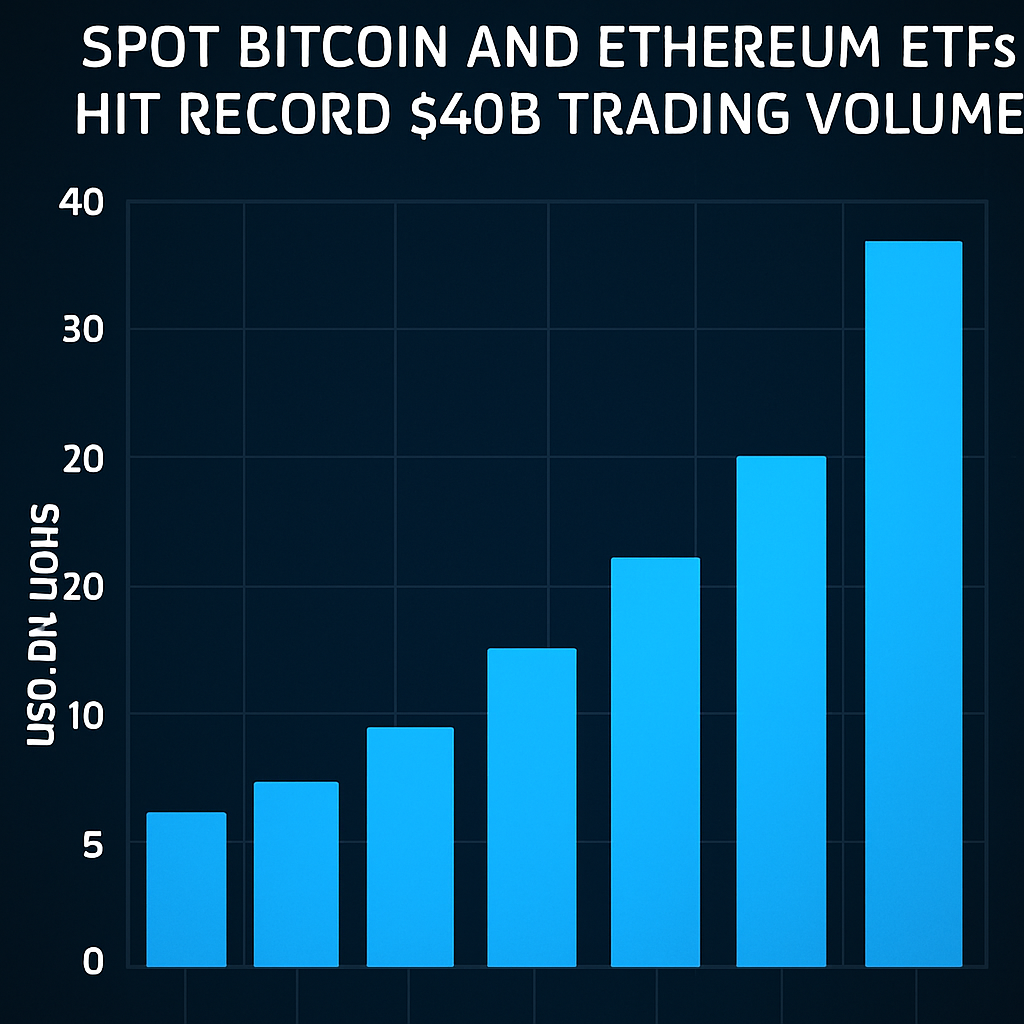

Spot Bitcoin and Ether exchange-traded funds (ETFs) achieved a new milestone by generating $40 billion in trading volume over the past week.

According to data from Bloomberg, this volume represents the largest week on record for these products, comparable in scale to top-five traditional ETFs and top-ten individual stocks.

Analysis of inflows reveals that Ether ETFs led the charge by registering approximately $17 billion in weekly volume, more than 60 percent of the total crypto ETF volume for the period.

These figures underscore a shift in institutional demand, as analysts observed that Ether products have drawn net inflows for five consecutive days, a streak that has historically been rare for digital asset funds.

Market observers attribute the surge to a confluence of factors, including recent price appreciation, renewed interest from asset managers, and the introduction of new distribution channels for Ether-based ETFs.

Bitcoin ETFs continued to dominate overall assets under management (AUM), with combined holdings exceeding $152 billion, while Ether product AUM surpassed $25 billion for the first time.

Volatility in both markets did not deter volume, as Bitcoin price movements above $124,000 and Ether rallies to within striking distance of $4,878 all-time highs coincided with elevated trading activity.

Interviews with institutional allocators highlighted a preference for the regulated ETF structure, which offers simplified access, capital efficiency, and familiar settlement mechanisms compared to alternative vehicles.

Despite recent profit-taking and corrections that took Bitcoin below $117,000 and Ether near $4,400, demand for these funds remained resilient, reflecting a broader trend of institutional portfolio diversification into digital assets.

Strategic positioning by fund sponsors, including marketing initiatives and expanded distribution agreements, further supported record volume, with reports indicating a notable increase in participation from defined contribution plans and endowments.

Liquidity provision remains a key challenge, as market makers adjust bid-ask spreads to accommodate larger block trades, and exchanges optimize order routing to ensure minimal market impact.

On-chain metrics suggest that this record volume also corresponded with significant token transfers between institutional custody accounts and secondary trading platforms, indicative of strategic rebalancing across portfolios.

Regulatory developments, including recent statements on staking guidelines and tax interpretations, could further shape product demand, prompting asset managers to adapt offerings and revise disclosure materials accordingly.

Comments (0)