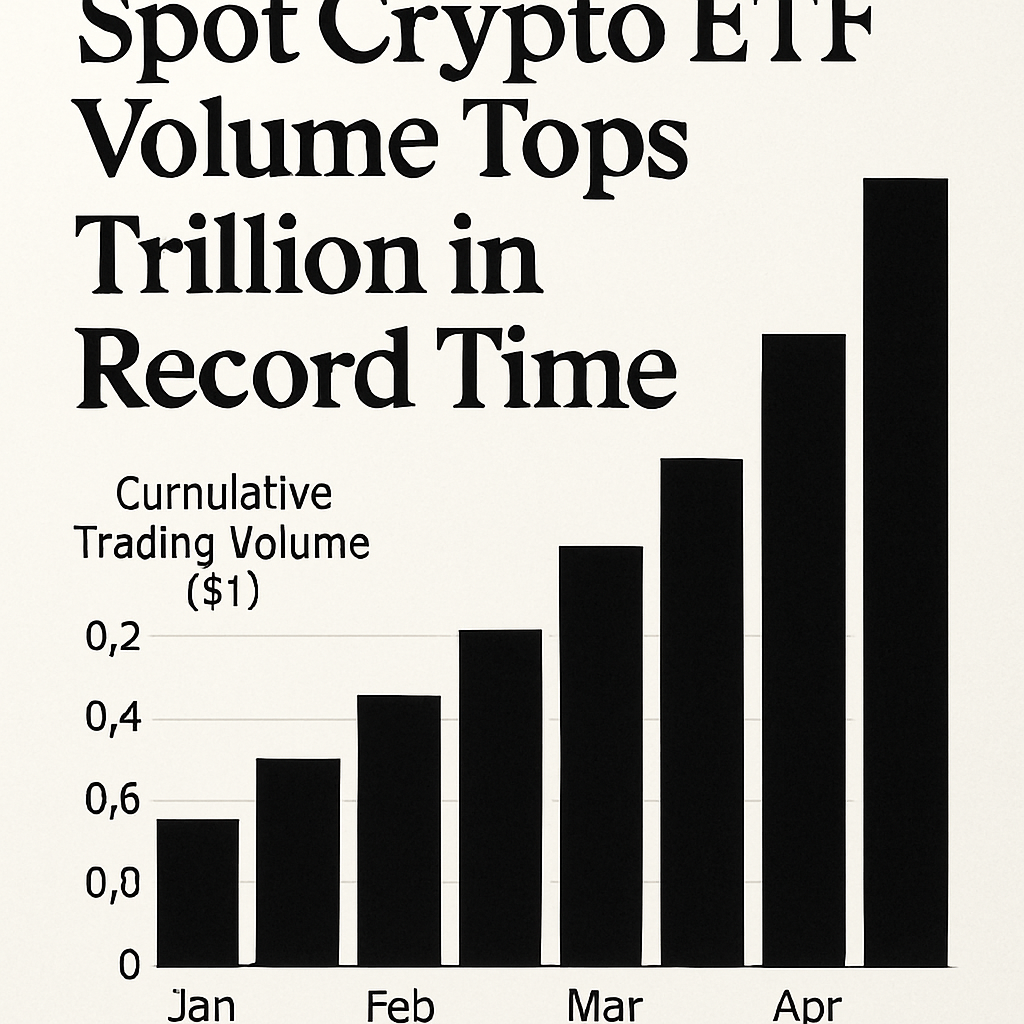

Cumulative volume in U.S. spot cryptocurrency exchange-traded funds has now exceeded $2 trillion, marking a rapid acceleration in adoption by institutional and retail investors. Spot Bitcoin and Ethereum ETFs launched in early 2024 crossed this threshold less than two years after debut, roughly half the time taken to reach the first $1 trillion milestone.

Trading data for January 2 showed net inflows of $645.6 million into Bitcoin and Ethereum funds, driven by renewed confidence in digital asset allocation amid macroeconomic uncertainty. Analysts note that low volatility compared to 2021 peak levels and growing regulatory clarity have attracted portfolio managers seeking diversification and yield alternatives.

BlackRock’s IBIT and Fidelity’s FBTC maintained leadership through high volume days, while newer issuers captured incremental flow, contributing to the momentum. Market participants cite factors such as simplified on-ramp via brokerage platforms, tax-efficient wrapper, and institutional mandates aligning with environmental, social and governance criteria.

Despite concerns over potential liquidity constraints in tight markets, trading desks report ample depth across major ETFs, supported by authorized participant mechanisms and market-making support. Open interest and redemption data indicate that creation redemptions have functioned smoothly, preserving arbitrage efficiencies between ETF shares and underlying spot holdings.

With approval of additional product variations and expanded listing venues anticipated this year, industry forecasts project another wave of inflows. Observers caution that ETF flows may moderate if Bitcoin and Ether prices correct significantly, but consensus holds that the structural benefits of regulated wrappers will sustain long-term growth in digital asset investment products.

Comments (0)