On Monday, August 25, 2025, United States spot Ethereum exchange-traded funds (ETFs) recorded collective net inflows of $443.9 million, outpacing inflows into spot Bitcoin ETFs and extending the positive flow streak to three days. The surge underscores institutional investors’ shifting preferences toward Ether amid evolving digital asset strategies.

Flow Dynamics and Fund Leaders

BlackRock’s iShares Ethereum Trust (ETHA) led inflows with approximately $314.9 million, followed by Fidelity’s Fidelity Ether ETF (FETH) which attracted $87.4 million in new capital. Grayscale’s Ethereum Mini Trust (ETHE) saw modest outflows of $29.2 million, yet overall Ether ETF balances increased, reflecting confidence in Ether’s role as a decentralized finance (DeFi) engine.

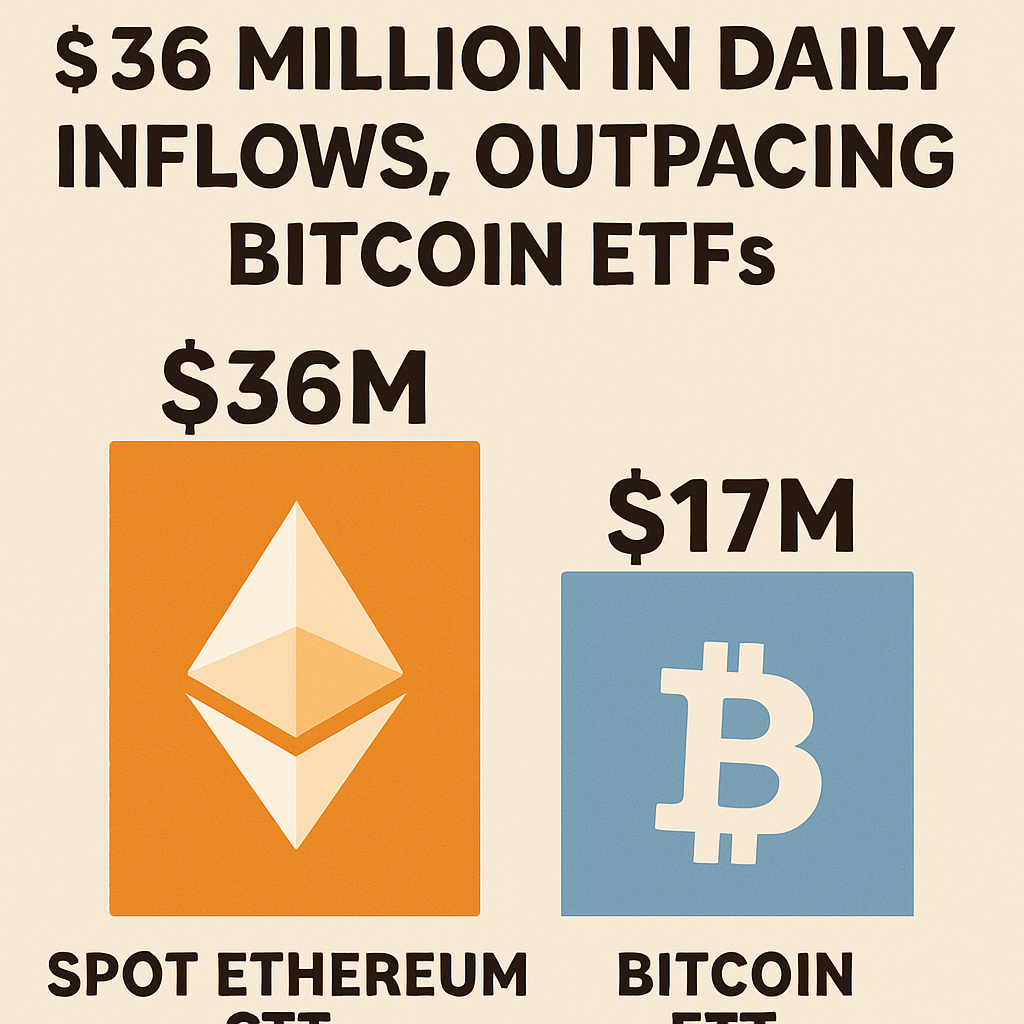

Comparative Bitcoin ETF Performance

Spot Bitcoin ETFs experienced net inflows of $240 million on the same day, with BlackRock’s IBIT receiving $163.6 million and Fidelity’s FBTC adding $37.3 million. Despite positive flows, aggregate Bitcoin ETF volumes trailed those of Ether, indicating a notable rotation into altcoin exposure and diversification beyond Bitcoin dominance.

Institutional Drivers and Market Context

Analysts attribute Ether ETF demand to upcoming protocol upgrades, rising DeFi activity, and favorable macroeconomic conditions that support broader adoption of smart-contract platforms. Continued inflows suggest institutional confidence in Ether as both a transactional medium and yield-generating collateral, contrasting with the more mature Bitcoin market.

ETF Maturation and Market Impact

Since inception in July 2024, spot Ether ETFs have amassed $9.33 billion in cumulative net inflows, indicating rapid uptake by institutional allocators. The current daily inflow tally of $443.9 million ranks among the top five episodes of Ether ETF capital injections, reinforcing the narrative of growing mainstream acceptance.

Outlook and Potential Volatility

Market participants caution that Ether ETF flows may amplify volatility around key regulatory developments and network events. Yet, sustained positive flows are expected to reinforce pricing support for Ether, potentially leading to further narrowing of the ETH/BTC price ratio and increased correlation with DeFi token performance.

The ascending inflow trajectory into spot Ether ETFs marks a significant milestone in digital asset investment, reflecting evolving institutional strategies that prioritize exposure to programmable blockchain infrastructure alongside traditional store-of-value assets.

.

Comments (0)