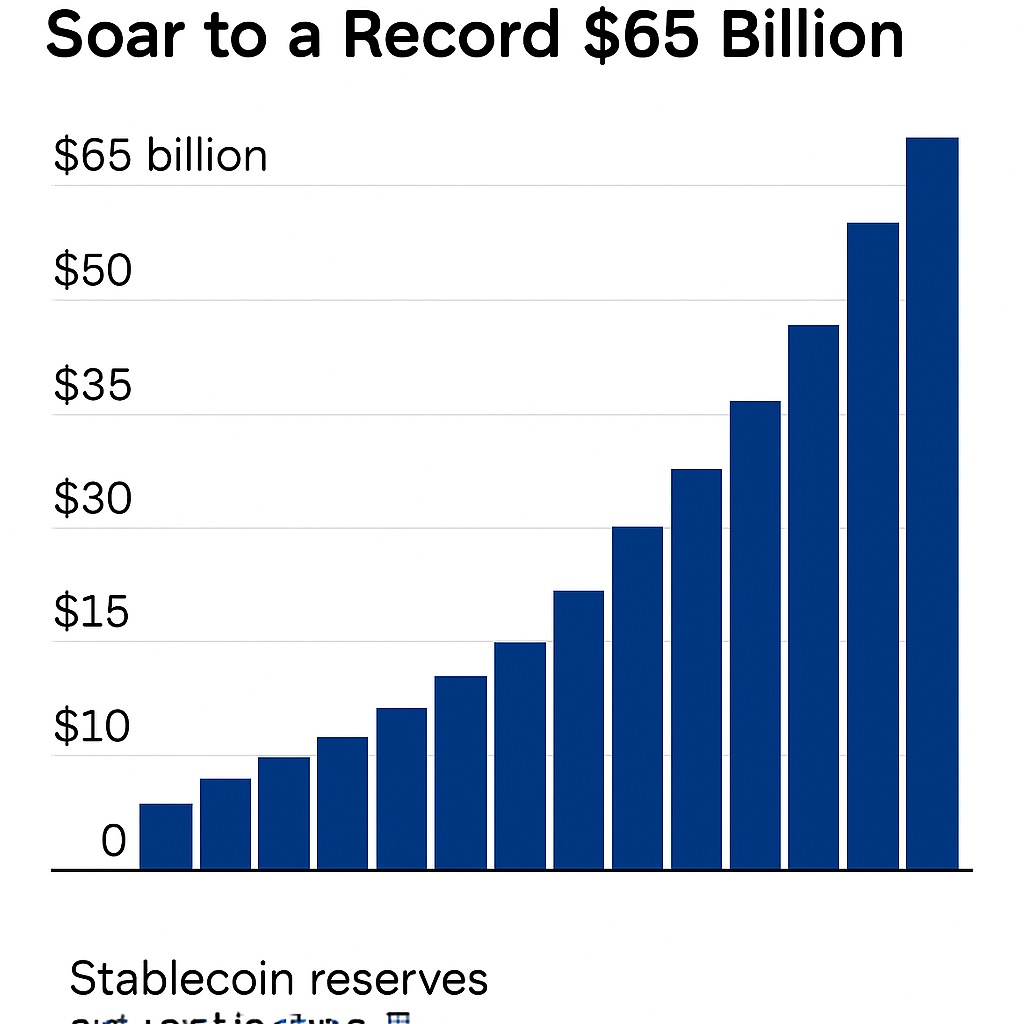

Exchange-based stablecoin holdings on the Ethereum and Tron blockchains reached a new high of $70 billion as of early September 2025, surpassing the previous peak of $60 billion recorded during the 2021 bull market. On-chain data from CryptoQuant indicates that the current reserve balance represents a substantial pool of potential buying pressure for major cryptocurrencies.

Historical Growth Patterns

Stablecoin reserves on exchanges remained largely flat throughout early 2025, trading between $55 billion and $60 billion until a sharp uptick began in August. USDC balances on exchanges increased from $6.8 billion on August 1 to $14 billion by early September, while USDT holdings rose modestly from $52.6 billion to $53.1 billion. Past cycles demonstrate that doubling of exchange-based stablecoin reserves preceded major rallies in Bitcoin and Ethereum.

Market Implications

Analyst CryptoOnchain describes the buildup as an “extremely strong bullish signal.” Historical comparisons show that a similar reserve buildup in 2021 coincided with a 3.3x surge in Bitcoin prices and a 2.5x rise in Ethereum prices. The on-chain metric therefore serves as a leading indicator of market sentiment and liquidity availability.

Regulatory Considerations

Regulatory scrutiny of stablecoin issuers has intensified amid concerns over systemic risk. US Treasury and SEC statements released in mid-2025 emphasize enhanced reporting requirements and reserve audits for stablecoin issuers, which could influence reserve deployment strategies on exchanges.

Outlook

With the US Federal Reserve expected to signal possible rate adjustments in upcoming FOMC meetings, exchange-based stablecoin reserves may fluctuate. Continued monitoring of on-chain reserve metrics will remain critical for assessing potential liquidity flows and anticipating price breakout scenarios in major cryptocurrencies.

Comments (0)