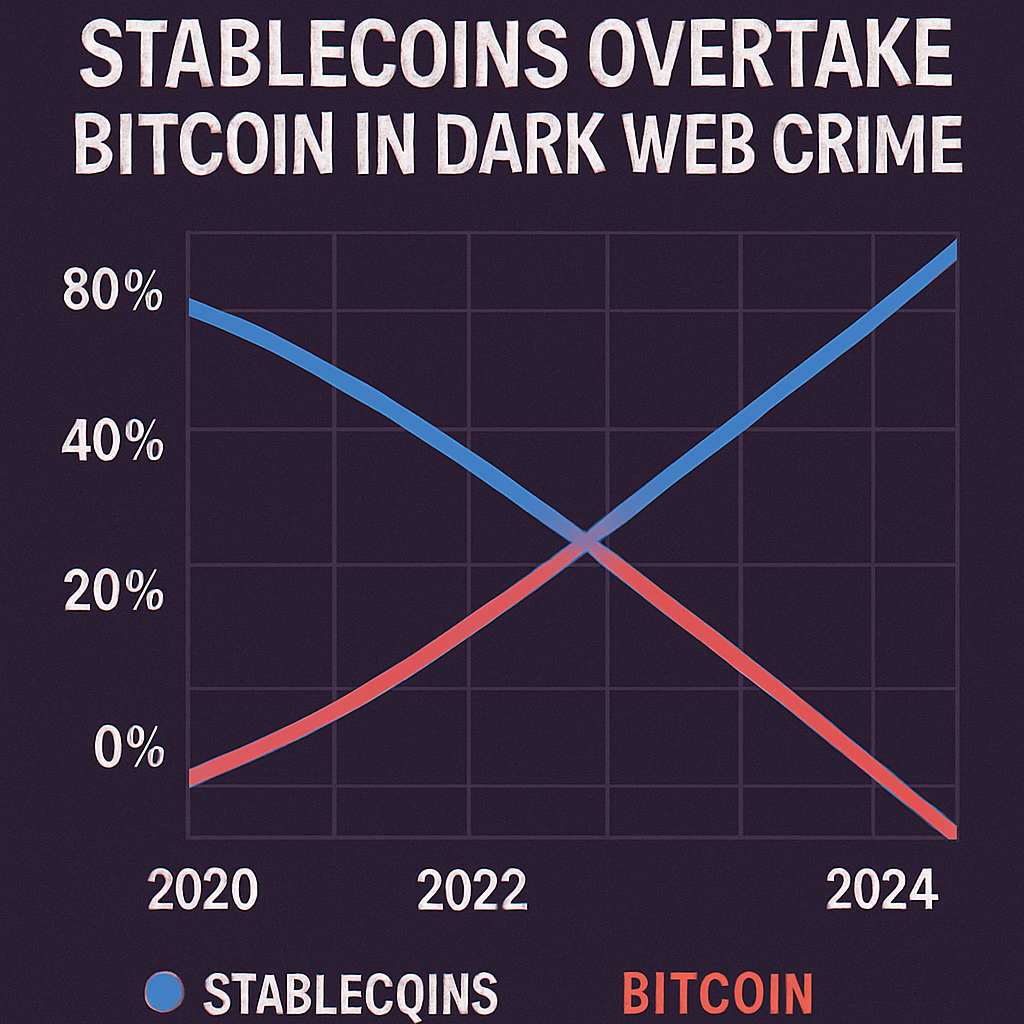

The era of the hooded hacker hoarding Bitcoin in a dark web wallet is over. In 2025, Chainalysis data reveals stablecoins accounted for 84% of the $154 billion illicit transaction volume, up from under 60% in 2024. This dramatic shift illustrates criminals’ preference for dollar-pegged tokens that provide predictable value and seamless cross-border transfers.

Programmable Dollars Drive Professional Laundering

Stablecoins’ stability and smart-contract programmability enabled the emergence of integrated laundering-as-a-service platforms. Networks operated by Chinese crime syndicates built full-stack offerings combining wallet creation, on-chain mixing, and covert off-ramps, scaling illicit flows while evading traditional enforcement mechanisms.

Nation-State Exploitation

Major actors like North Korea, Russia, and Iran tapped into these rails to bypass sanctions. In February 2025, Russia’s ruble-backed A7A5 token launched, transacting over $93.3 billion in its first year. At the same time, DPRK-linked hackers stole approximately $2 billion, driven by mega-hacks, including the February Bybit exploit that netted $1.5 billion in losses.

Industrialization of Crypto Crime

These trends mark a shift from niche cyber heists to industrial-scale illicit finance. Chinese money laundering networks, once small-scale hosting services, transformed into robust criminal enterprises offering domain registration, bulletproof hosting, and continuous service despite takedown efforts.

Convergence with Physical Violence

On-chain crime has spilled into the physical world. Reports indicate an uptick in human trafficking using crypto for logistics and coercion attacks timed with price peaks. Criminals now combine on-chain efficiency with real-world violence to compel fund transfers.

Regulatory and Security Response

Despite illicit volumes remaining under 1% of the total crypto economy, the qualitative shift is alarming. Compliance teams, law enforcement, and exchanges face a growing challenge: curbing professionalized, state-sponsored shadow economies that weaponize programmable dollars. Cooperation among regulators, intelligence agencies, and industry stakeholders will be critical to disrupt this new wave of crypto crime.

Comments (0)