Our Technology Engine

The heart of Moriarty Trade is a multi-layer AI platform that collects billions of market signals, processes them in real time, and turns them into profitable decisions.

View details

How it works — 4 steps

1. Data collection

Order books, social networks, on-chain, macro-news — everything flows into our global crawler 24/7.

2. Cleaning & normalization

ML filters remove noise and anomalies; aggregate latency < 60 ms.

3. Model ensemble

LSTM + Transformer + GBM find patterns on 15 PB of history.

4. Execution

Risk-core module checks the signal and sends the order via low-latency API.

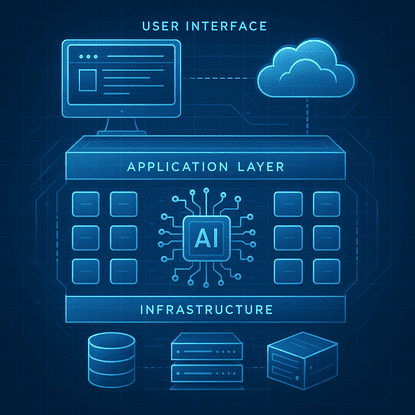

Platform architecture

The diagram below shows how data goes from ticker to your trade. All computation is distributed among four geo-clusters.

Key modules

Latency‑Aware Router

Selects the best liquidity provider by ping+depth, reducing slippage by 17%.

Anomaly Shield

Isolation Forest instantly cuts off flash-crash data, reducing false signals by 22%.

Cross‑Chain Liquidity Scanner

Tracks spot and derivatives in 8 L2 networks, opening arbitrage windows.

Explainable‑AI Console

Shows the trader which factors influenced the model decision.

Dynamic Position Sizer

Auto-calculates order volume based on market kurtosis and available margin.

Auto‑Strategy Compiler

Converts YAML strategy descriptions to bytecode without cluster restart.

Realtime Feature Store

1200+ features, updated every second. RedisCluster cache < 10 ms.

LLM‑Sentiment Oracle

GPT-4 analyzes 2 million tweets/day and computes the asset"emotions" index.

Adaptive Risk Matrix

Risk coefficient recalculated 50×/sec based on volatility and liquidity.

Step by step: How a trade is born

Multi-source data

• Order-book L2 (Binance, Bybit, OKX) in stream 50 ms

• On-chain metrics (gas, active wallets)

• 2M+ social posts/day via LLM-Sentiment

• Macro tracker (DXY, S&P 500 futs)

Cleaning and feature engineering

• Isolation Forest removes flash-noise

• 1,247 features into Redis-Feature-Store (< 12 ms)

• Z-score normalization catches liquidity spikes

Model ensemble

• LSTM catches the order of candles

• Transformer reads news/tweet context

• Gradient Boosting retrains on last 10 days

Bayesian Selector gives weights based on hour volatility

Risk-core

• Value-at-Risk calculated 50×/sec

• Dynamic-Position-Sizer sets volume

• If VAR < threshold — green light for execution

Low-latency execution

• REST fallback < 150 ms if WebSocket drops

• 87% of orders hit the first price level

Self-learning

• After closing the deal, the whole track (state-action-reward) is logged

• Night"Replay Trainer" recalculates weights; fresh models go to Prod without downtime (A/B canary release)

Live example: 14 seconds from signal to profit

00 : 00 : 00

L2 Order-book BTC/USDT shows bid spike +1,800 BTC in 90 ms.

00 : 00 : 03

LLM-Sentiment catches a series of tweets from Glassnode about BTC outflow from exchanges.

00 : 00 : 05

Model ensemble raises"long-probability" to 0.83 (threshold 0.75).

00 : 00 : 06

Risk-core calculates 0.37 BTC volume (VaR 1.4%).

00 : 00 : 07

Smart-Router chooses Bybit (lower spread), sends limit order.

00 : 00 : 14

Price +0.42% — TP hit, profit +0.0016 BTC, log sent to Replay Trainer.

Bank-level security

AES-256 Encryption

All user data is encrypted"at rest" and"in transit".

RBAC + MFA

Zero rights by default and mandatory two-factor authorization.

Zero‑Trust Network

Each service authenticates on every request; there are no"trusted zones".

Real‑Time Threat Detection

SIEM platform analyzes logs in stream and alerts the SOC team < 30 sec.

Numbers you can trust

< 70 ms

Average"signal → order" latency

87 %

Orders hit the first price level

15 PB

Data for model training

99.97 %

Inference-cluster uptime for 12 months

Frequently Asked Questions

What algorithm is at the heart of predictions?

LSTM + Transformer + Gradient Boosting ensemble with Bayesian Hyper-search.

How many servers does a client need?

None — everything is hosted on our clusters, you connect via API or enable copytrading.

How often are models retrained?

Base weights update monthly, online fine-tune — in real time.

Can I connect my own data?

Corporate clients get an SDK for ingesting private datasets.

What is the average API call latency?

p99=42 ms in EU datacenters.

Where are the servers located?

Frankfurt, Amsterdam, Virginia, Tokyo — 4 geo-clusters.

Are futures supported?

Yes. Binance, Bybit, OKX USDT-M and COIN-M contracts and others.

Minimum deposit?

$100 to start, ideally ≥ $300.

Can I export logs?

REST endpoint/v1/trades/export returns CSV.

Is there a white-label?

Yes, corporate license and 99.99% SLA.

What if the exchange is unavailable?

Fail-over switches WebSocket to backup in < 3 sec.

Ready to experience the power of technology?

Connect to Moriarty Trade and let our AI engine turn data into profit today.

Start for free