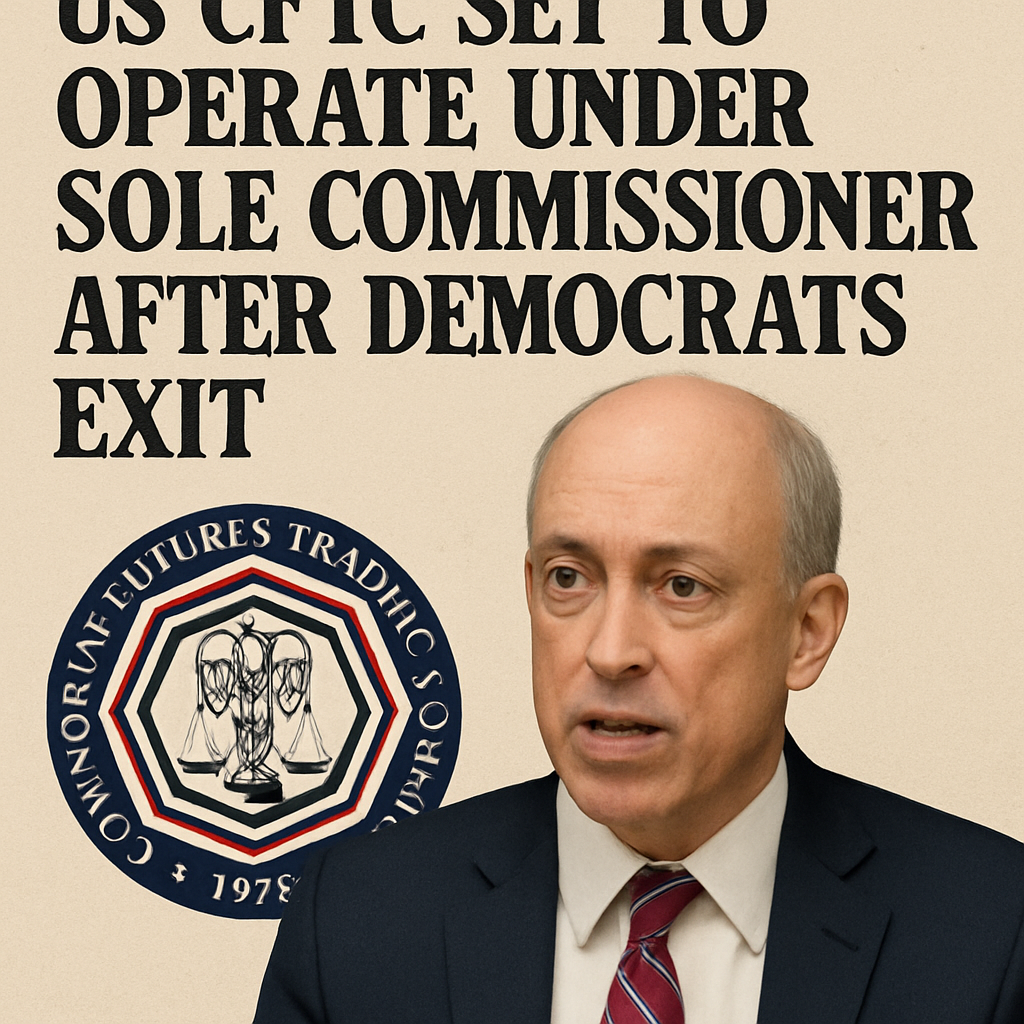

Leadership Change at U.S. CFTC

On Sept 3, Commissioner Kristin Johnson will step down from the U.S. Commodity Futures Trading Commission (CFTC), marking the departure of the agency’s last Democratic member. Her exit will leave the commission with a single commissioner, Acting Chairman Caroline Pham, until President Trump’s nominee, Brian Quintenz, secures Senate confirmation. This shift reduces the five-member panel to a one-person body, raising questions about procedural norms and the pace of pending regulatory actions.

Implications for Crypto Oversight

The CFTC serves as the primary regulator of derivatives markets, including futures and swaps on major cryptocurrencies such as bitcoin and Ether. With a sole commissioner, the agency may face operational bottlenecks in rulemaking, enforcement, and coordination with other federal bodies. Industry stakeholders have expressed concern that a reduced quorum could slow the implementation of reforms aimed at integrating digital commodities into existing regulatory frameworks.

Nomination of Brian Quintenz

Brian Quintenz, a former CFTC commissioner and policy chief at venture firm a16z, was nominated by President Trump earlier this year to lead the agency. His confirmation has been delayed amid broader partisan disputes over agency staffing. Quintenz’s return is supported by many in the crypto industry, which favors clarity on the agency’s jurisdiction and the prospect of tailored rules for spot commodity trading.

Industry Reaction and Lobbying Efforts

Crypto lobby groups have urged swift confirmation of a full commission to ensure balanced, bipartisan decision-making. They argue that a single-commissioner format undermines procedural safeguards and may expose rulemaking to legal challenges. Conversely, some consumer advocates warn that reduced oversight could delay critical protections against fraud and market manipulation. The dynamic underscores the polarizing nature of crypto policymaking in Washington.

Future Regulatory Agenda

Pending CFTC initiatives include proposals for clearing standards, margin requirements, and guidance on decentralized finance (DeFi) activities. The timeline for these actions now hinges on the availability of a quorum and the commission’s capacity to vote on key rulemakings. Stakeholders will watch closely for interim procedural orders that may enable the agency to function under limited membership.

Next Steps for the Commission

In the coming weeks, Acting Chairman Pham has indicated plans to maintain continuity and advance high-priority items. Industry participants anticipate further engagement with CFTC staff on consultation papers and roundtables. Ultimately, the confirmation of additional commissioners will determine the agency’s ability to chart a comprehensive regulatory path for digital assets and derivatives markets.

Comments (0)