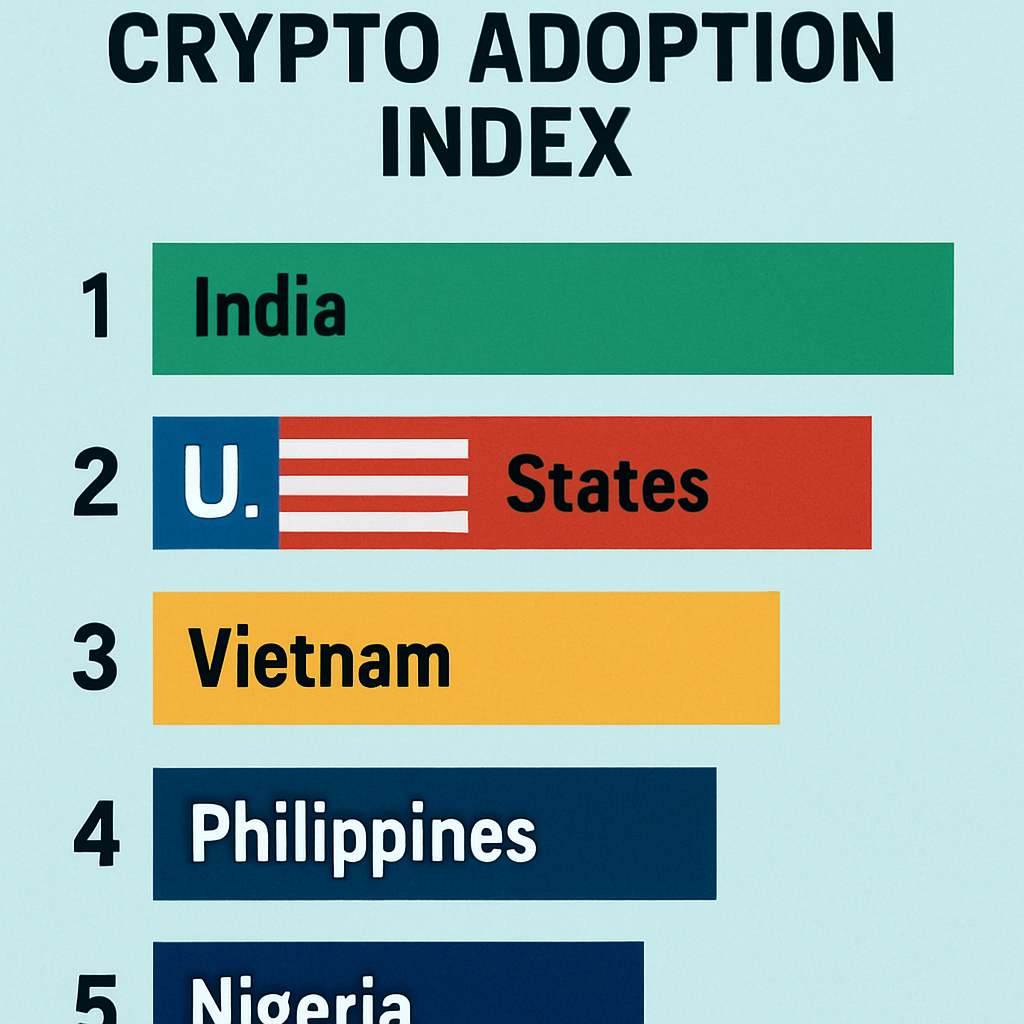

Chainalysis released its 2025 Global Crypto Adoption Index, placing the United States in second position for overall cryptocurrency adoption. The study measures on-chain value received per capita across centralized and decentralized services, adjusted for purchasing power parity. India maintained the top slot for the third consecutive year.

The report highlights significant inflows into U.S. spot Bitcoin and Ether ETFs since their approval in January 2024. Farside Investors data recorded $54.5 billion of net inflows into Bitcoin ETFs through mid-2025, while institutional purchases of Ether ETFs exceeded $2 billion, underscoring growing mainstream acceptance among asset managers and hedge funds.

Asia-Pacific emerged as the fastest-growing region, with transaction volume up 69% year-over-year, driven by robust retail and institutional engagement in India, Vietnam, and Pakistan. In population-adjusted rankings, Eastern European countries such as Ukraine, Moldova, and Georgia led, reflecting high per-capita transaction activity amid economic and political uncertainty.

Chainalysis introduced methodological enhancements, including a new institutional activity sub-index for transfers above $1 million and the removal of the retail DeFi sub-index to reduce skew. The refined metrics provide a comprehensive view of both grassroots and large-scale participation, underscoring the United States’ growing prominence in regulated crypto markets.

.

Comments (0)