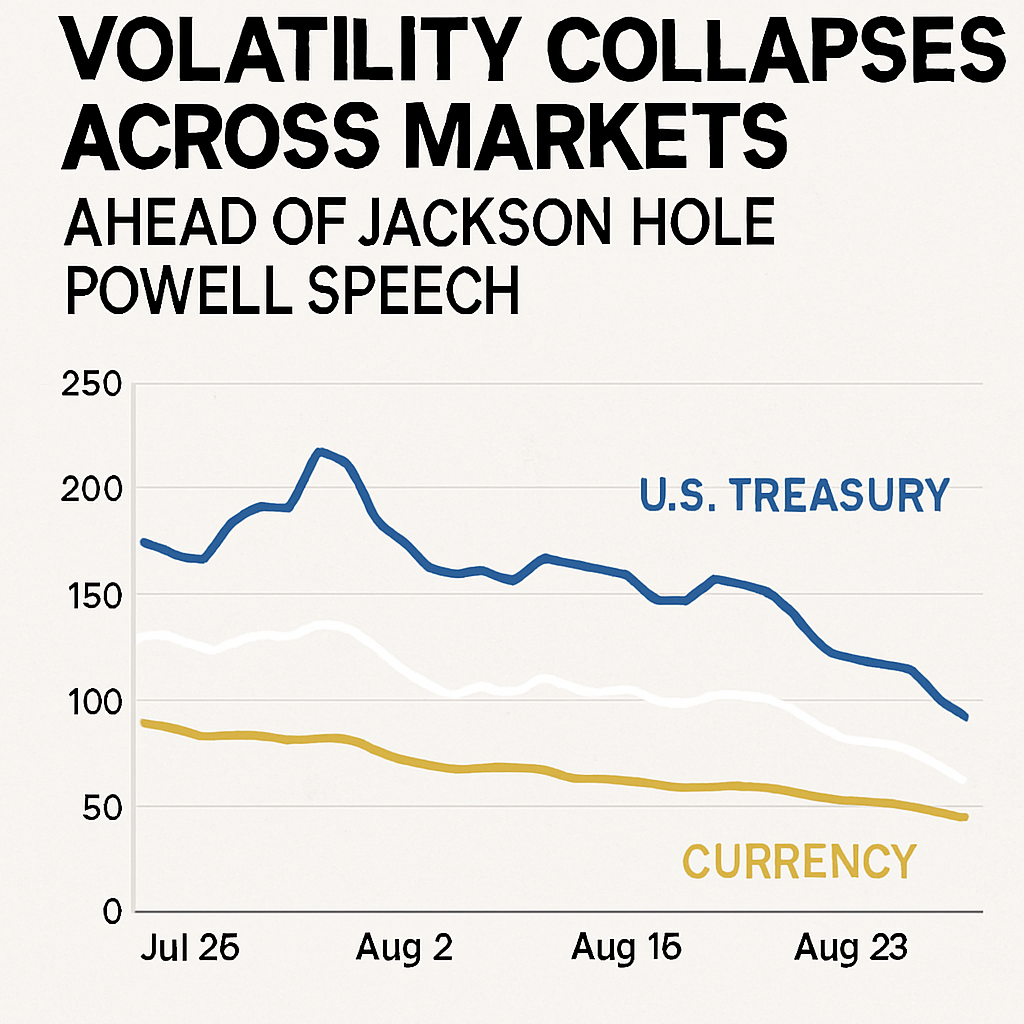

Volatility indices for major asset classes have contracted sharply as market participants anticipate Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium. The cooling of volatility reflects widespread expectations for renewed monetary easing in September.

Bitcoin’s 30-day implied volatility, measured by industry benchmarks such as BVIV and DVOL, has dropped to around 36%, levels not seen since mid-2023. This decline parallels a slide in the CME Gold Volatility Index (GVZ), which has fallen to 15.22%, its lowest point since January, underscoring cross-market tranquility.

Further, Treasury implied volatility, tracked by the MOVE index, has reached a 3.5-year low near 76%, while the VIX — Wall Street’s “fear gauge” — dipped below 14%. FX majors such as EUR/USD have exhibited similar compression, signaling broad-based complacency ahead of key policy announcements.

Market consensus anticipates a 25-basis-point rate cut at the September Fed meeting, fueled by persistent disinflation and slowing growth indicators. However, some strategists warn that easing from restrictive levels may still leave real rates positive, potentially dampening growth more than in previous cycles and challenging the dicey balance between accommodation and constraint.

Pseudo-anonymous observers have noted that the current environment differs from crisis-driven volatility collapses, as central banks are cutting from high rates rather than emergency lows. This dynamic may reshape the transmission of monetary policy across markets, with equity, bond, and crypto participants adjusting positioning accordingly.

Despite the calm, contrarian voices caution that extreme complacency can presage sudden volatility spikes. Corporate bond spreads have narrowed to levels unseen since 2007, and global trade tensions and stickier inflation readings pose latent risks that could rapidly reverse low-volatility conditions.

Analysts at major banks, including Goldman Sachs, have recommended hedging strategies to guard against potential drawdowns, given the atypical convergence of low volatility and elevated asset prices. They highlight that periods of low volatility have historically set the stage for abrupt market shifts.

In crypto markets, dragon-scaled declines in volatility have been accompanied by record Bitcoin and Ether price levels. Traders are monitoring on-chain and off-chain signals for signs of liquidity stress, mindful that complacency today may amplify turbulence tomorrow.

With Powell’s remarks poised to influence expectations for the next policy cycle, volatility dynamics will remain in focus. Market participants seek to reconcile the current calm with the potential for heightened volatility around key macro events, underscoring the importance of dynamic risk management.

As the Jackson Hole Symposium approaches, the evolving interplay between policy outlook and volatility may reshape positioning across asset classes, highlighting both the opportunities and hazards of a tranquil market backdrop.

Comments (0)