Survey Overview

The Morgan Stanley survey interviewed over 500 finance interns in North America between June 10 and June 27 and 147 interns in Europe from June 26 to July 7. Survey questions covered digital asset awareness, usage patterns, and future interest. The structured questionnaire measured interns’ familiarity with blockchain, token ownership, and investment motives. A panel of analysts then processed the data for insights. The sample was balanced by region and internship function to ensure representativeness.

Adoption Metrics

The results indicated that only 18% of respondents reported ownership or active use of cryptocurrencies, marking a rise from 13% in the prior year. Meanwhile, 26% expressed some interest in exploring digital assets, an increase from 23% last year. Despite bitcoin’s price exceeding $100,000, more than half of the surveyed interns—55%—remained uninterested in acquiring crypto holdings. This disparity points to a gap between market valuations and on-ground adoption among emerging finance professionals.

ETF Influence on Perception

Eleven spot bitcoin ETFs launched early last year have collectively amassed $53.7 billion in inflows, according to Farside Investors data. Ether ETFs accounted for an additional $12.4 billion in net inflows over the same period. However, ETF success has not fully translated into grassroots adoption. Interns acknowledged ETF visibility in news cycles but cited regulatory and technical barriers as deterrents to direct participation. The survey highlights the importance of product innovation to bridge institutional momentum with individual engagement.

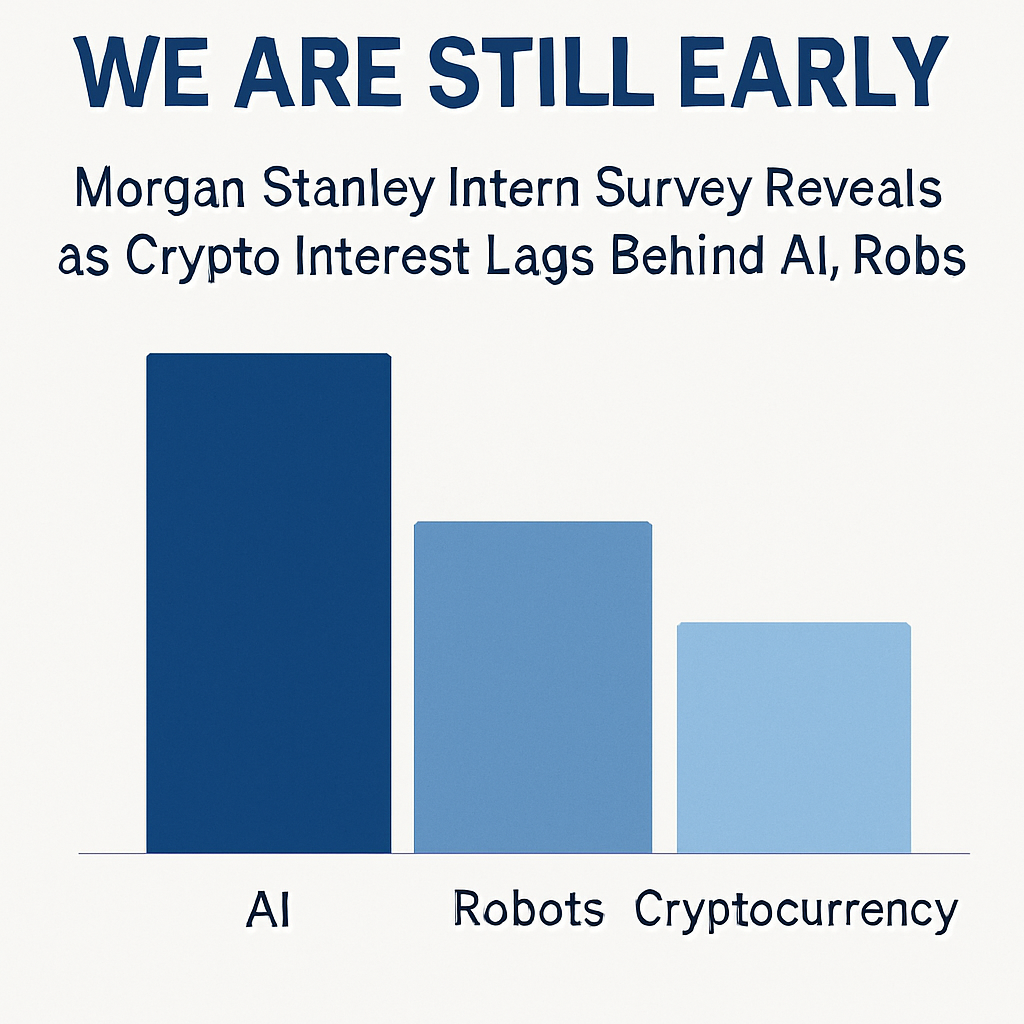

AI vs Crypto Usage

Artificial intelligence emerged as the leading technology among survey participants, with 96% of U.S. interns and 91% of European interns reporting at least occasional AI tool usage. Nearly all respondents agreed that AI solutions “save time” and are “easy to use,” although 88% also noted accuracy concerns. The contrast between high AI adoption and low crypto engagement suggests that technology usability and clear value propositions drive early adoption more effectively than asset performance alone.

Broader Industry Implications

These adoption indicators imply that digital assets remain in an early stage of integration among future finance leaders, despite significant institutional investment and market valuations. Education initiatives, targeted training programs, and simplified access points could help convert ETF inflows and corporate treasury endorsements into broader participation. Award-winning schemes, such as token grants or simulated trading platforms, may accelerate familiarity and reduce entry friction for new entrants.

Conclusion and Recommendations

The survey underscores the need for a multi-pronged approach to drive retail engagement, combining regulatory clarity, product innovation, and educational outreach. Market participants and regulators alike may find value in collaborating on internship programs and university partnerships to embed digital asset literacy. As the industry evolves, these early adopters will influence future fintech strategy and could shape the next wave of digital asset demand and policy design.

Comments (0)