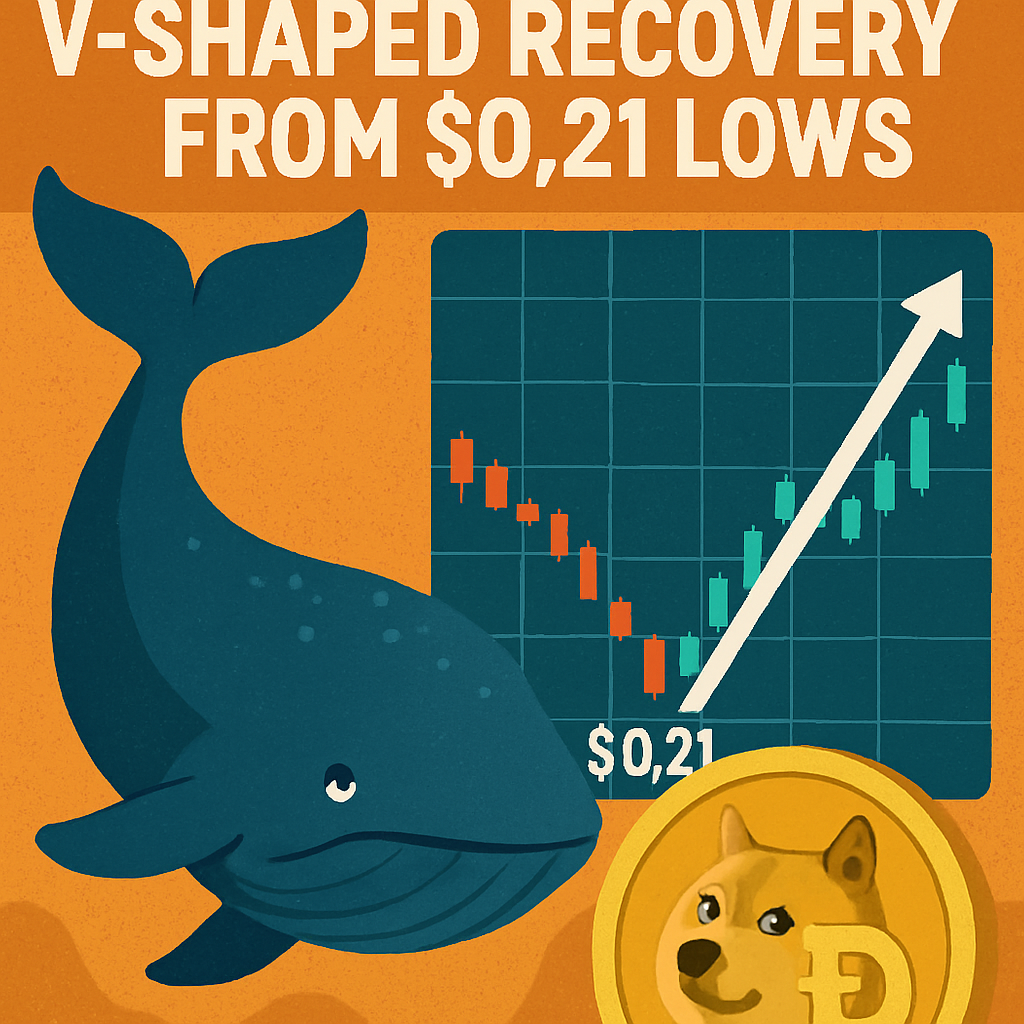

Dogecoin experienced a pronounced V-shaped recovery on Aug. 21 after dropping to an intraday low of $0.21. The token surged to $0.22 by the session close, marking a 5 percent gain driven by a late-session volume spike and heavy buying from large holders. Despite renewed worries around Qubic’s potential 51 percent attack vector, whale cohorts quietly amassed more than 680 million DOGE over the past month, according to on-chain analytics. This accumulation helped absorb selling pressure and set the stage for the observed rebound.

Intraday trading data reveal that the low of $0.21 was reached around 13:00 UTC before a dramatic reversal. Volume in the final hour spiked to 9.29 million DOGE, confirming institutional-scale flows that underpinned the move. Technical indicators show the Relative Strength Index (RSI) swiftly moving from oversold territory back toward neutral, while the 20-day moving average acted as short-term resistance, now tested and potentially poised to flip to support.

Key factors contributing to the session’s dynamics included a renewed focus on memecoin resilience amid a broader market consolidation in Bitcoin and Ethereum. Traders highlighted four pivotal areas: the stability of the Qubic ecosystem, recent on-chain whale behavior, low-cost entry from retail participants, and potential spillover from macroeconomic catalysts. The confluence of these drivers prompted a surge in demand, particularly from high-net-worth investors seeking opportunistic entry points.

On-chain metrics underscore the shift in supply distribution: the share of DOGE held by addresses with balances exceeding one million has climbed by 2 percent this month. This trend contrasts with a flattening distribution among small addresses, suggesting larger stakeholders are positioning for an extended rally. Analysts note that if the $0.22 level holds as new support, Dogecoin may retrace to $0.24, guided by Fibonacci extension levels at 1.272 and 1.414. A break above $0.23 could trigger accelerated momentum toward a local high of $0.25.

Risk management considerations remain paramount: while the V-shaped recovery signals robust demand, the token’s inherent volatility requires cautious position sizing. Stop-loss orders below $0.21 could protect against a retest of the session low, while profit-taking near $0.24 may lock in gains amid potential market noise. Open interest in Dogecoin futures on major exchanges rose 8 percent on the session, marking the largest single-day increase since mid-July and underscoring renewed speculative interest.

Looking ahead, traders will monitor upcoming on-chain developments and broader market cues, such as changes in BTC funding rates and altcoin rotations. Should whale-driven flows persist alongside improving technicals, Dogecoin could sustain its recovery trajectory into next week. However, any deterioration in Qubic security sentiment or macro headwinds may dampen buying pressure. For now, market participants remain focused on the immediate technical pivot at $0.22 as the critical indicator of Dogecoin’s next directional move.

Comments (0)