Market Overview

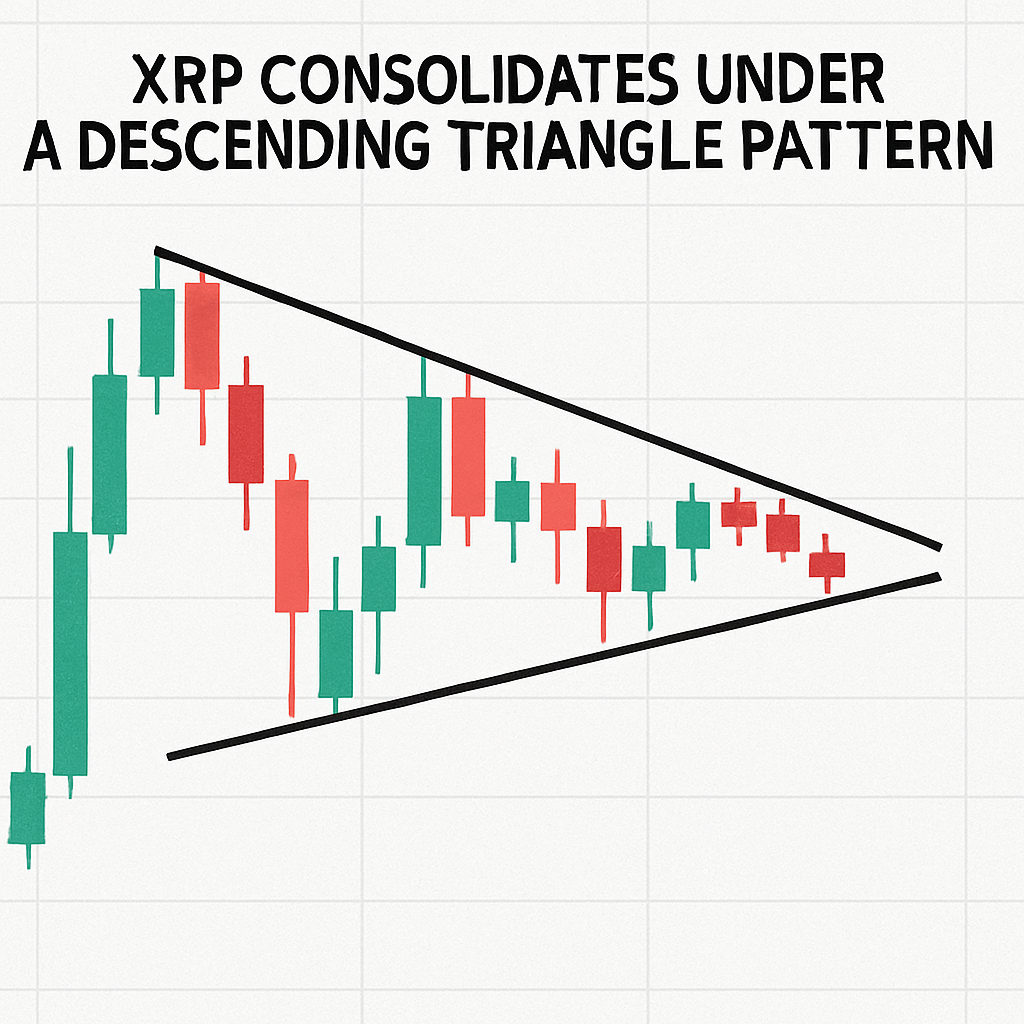

XRP has entered a phase of consolidation under the $3.00 threshold following a breakout attempt that tested the $2.90–$2.92 resistance zone. Trading volumes during the breakout window reached six times the 24-hour average, highlighting significant participation despite the failure to sustain new highs. The descending triangle pattern observed on weekly charts indicates a tightening range, with support anchored near $2.86 and resistance forming a flat ceiling just below $2.92.

Institutional flows have been influenced by near-100% market pricing of a 25-basis-point rate cut at the Federal Reserve’s September 17 meeting. Futures contracts imply strong expectations of monetary easing, which have underpinned buying pressure in stablecoin pegged corridors and fueled accumulation across major exchanges. Liquidity conditions remain favorable for bull-biased positioning, although macro headwinds from U.S.-China trade tensions continue to inject volatility into risk asset allocations.

Technically, the RSI reading in the mid-50s suggests a neutral-to-bullish bias, while the MACD histogram approaches a bullish crossover. A confirmed close above $2.90 on a daily basis could trigger an upside move toward next resistance levels at $3.00 and $3.30. Conversely, failure to defend the $2.86 floor may accelerate downside momentum, with potential targets near $2.70.

Key Drivers

- Federal Reserve rate cut bets: Near-100% chance of 25 bps cut at 17 September FOMC.

- Technical pattern: Descending triangle consolidating under critical resistance.

- Volume dynamics: Six-fold average volume during recent breakout test.

- Support/resistance: $2.86 floor defended; $2.90–$2.92 ceiling repeatedly tested.

Market participants now focus on the September 17 meeting for directional cues, while monitoring on-chain whale accumulation levels, which have surged by 340 million XRP over recent weeks. Approval of spot XRP ETFs by U.S. regulators later in October remains a longer-term catalyst, with the potential to unlock structured inflows from institutional vehicles. Strategic positioning ahead of these events will determine whether XRP can break above the descending triangle or resume its consolidation near current levels.

Comments (0)