ETF Inflows Reach New Heights

Spot Bitcoin exchange-traded funds drew $2.72 billion in net inflows over the past week, according to CoinDesk data, marking the largest weekly institutional demand since the funds launched. This surge in capital allocation reflects growing investor appetite for regulated crypto exposure amid macroeconomic uncertainty. Despite Bitcoin’s failure to sustain gains above $122,000, the inflows underscore a structural shift toward digital assets as a portfolio diversifier and hedge.

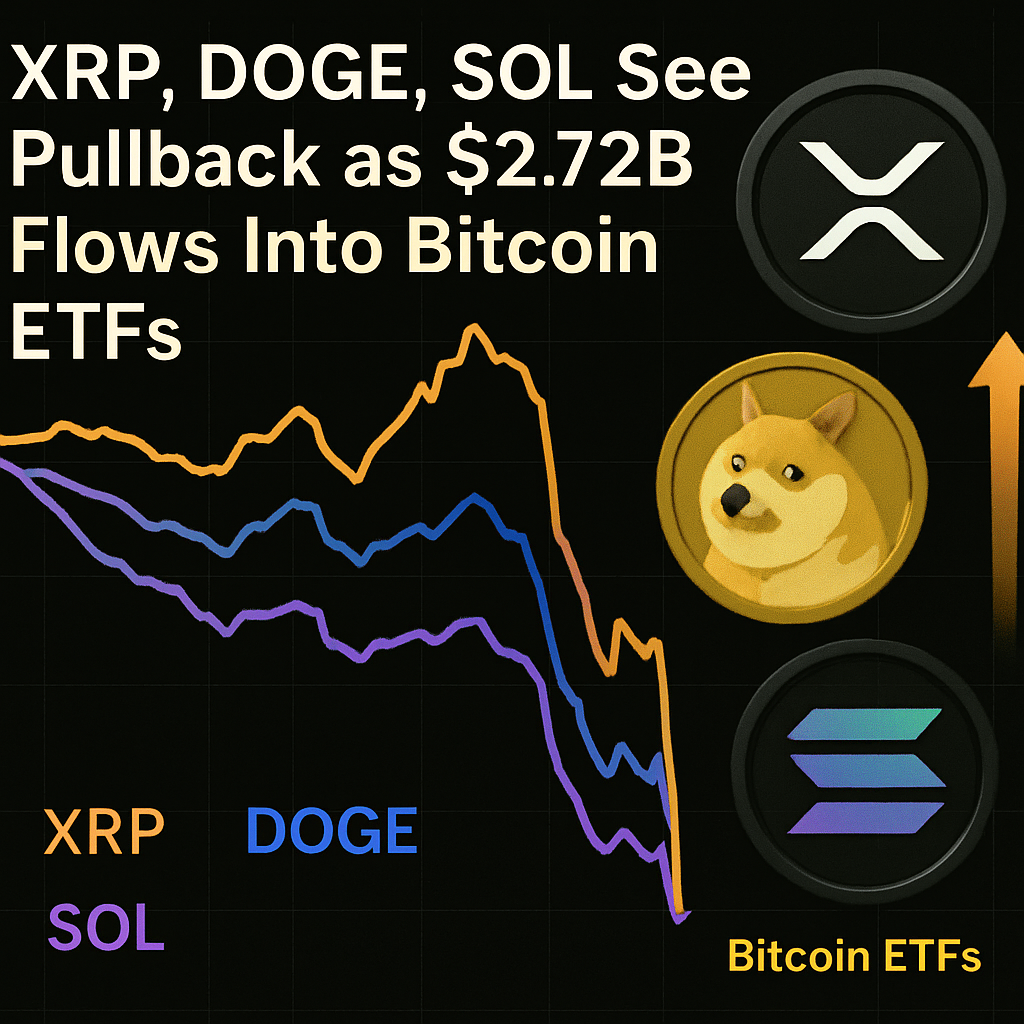

Altcoin Profit-Taking and Market Rotation

Profit-taking in major altcoins accompanied Bitcoin’s modest pullback. XRP, Dogecoin and Solana retreated between 2% and 3% during Friday trading sessions. Traders cited the sharp ETF demand for Bitcoin as a primary driver pulling liquidity away from smaller tokens. In contrast, privacy-focused digital assets such as Zcash and Monero recorded relative outperformance, suggesting a rotation toward underappreciated market segments.

Macro Context and Hedging Appeal

The recent US government shutdown and dovish central bank outlook bolstered Bitcoin’s appeal as a digital hedge. With traditional safe havens like gold recently smashing the $4,000 per ounce resistance, investors view crypto alongside precious metals to navigate periods of fiscal uncertainty. Commodity-linked markets also experienced volatility as traders repositioned ahead of upcoming macro announcements, further supporting diversified exposure strategies.

Derivatives and On-Chain Indicators

Derivatives metrics pointed to resilient sentiment despite spot price consolidation. Funding rates on Bitcoin perpetual swaps remained elevated, indicating continued bullish positioning among leverage users. On-chain data reflected sustained accumulation by long-term holders, who refrained from taking profits at current price levels. This harmony between spot ETF demand and on-chain holder behavior bodes well for medium-term price resilience.

Outlook and Potential Catalysts

Looking ahead, ETF flow patterns will be crucial to sustaining Bitcoin’s momentum. Seasonal market analysis suggests October traditionally delivers strong performance, potentially supporting a push beyond $125,000 if inflows persist. Investors will monitor US regulatory developments, macroeconomic prints and derivatives expiry schedules for directional cues. Meanwhile, broader adoption benchmarks may emerge as key catalysts driving digital asset allocations through year-end.

.

Comments (0)