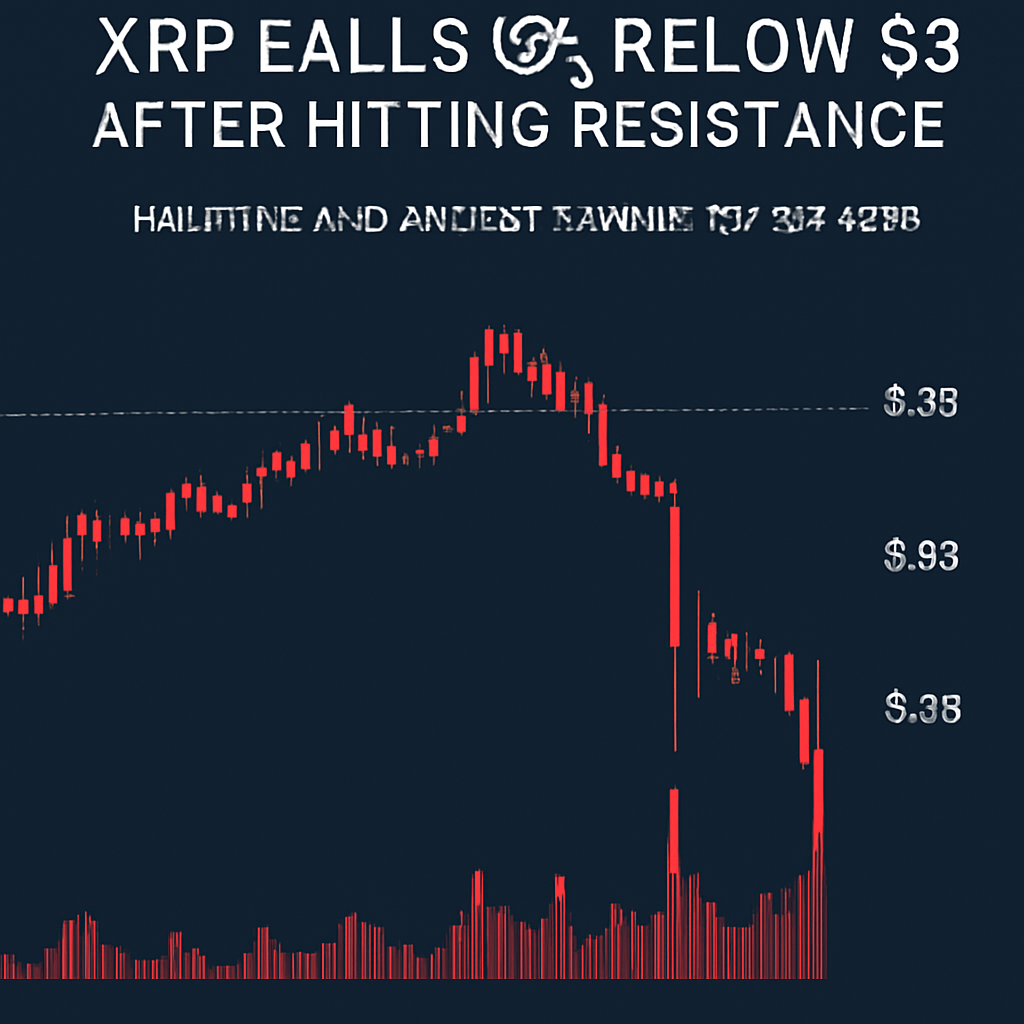

XRP experienced a sharp 8% decline in a single trading session, falling from $3.17 to a low of $2.94 before recovering marginally to $2.98 at session close. Momentum indicators skewed bearish after the token encountered significant resistance near $3.05 and underwent high-volume sell-offs, with the steepest hourly drop of 2.7% during the midnight window on August 1. Trading volume reached 259.21 million units—nearly four times the 24-hour average—indicating intense liquidation pressure among leveraged positions.

Despite the downtrend, a rebound to $2.98 suggested that institutional investors stepped in to absorb excess supply at key support zones. On-chain data revealed that large holders liquidated an average of $28 million worth of XRP daily over the trailing 90-day period, reflecting persistent distribution. Simultaneously, 310 million XRP tokens, valued near $1 billion at recent prices, were accumulated during the correction, as exchange balances declined significantly.

Technical analysis highlighted the importance of the $2.94 support zone, which held firm during intraday tests and enabled short-covering rallies. Resistance remained overhead at $3.02-$3.05, where renewed selling pressure could cap further upside without fresh inflows. Traders will monitor whale activity and institutional positioning at Ripple’s upcoming Swell 2025 conference for additional sentiment cues. Overall, the price action underscored a mixed landscape of distribution and accumulation, reinforcing the view that XRP’s near-term trajectory hinges on balance sheet flows and macro liquidity conditions.

Comments (0)