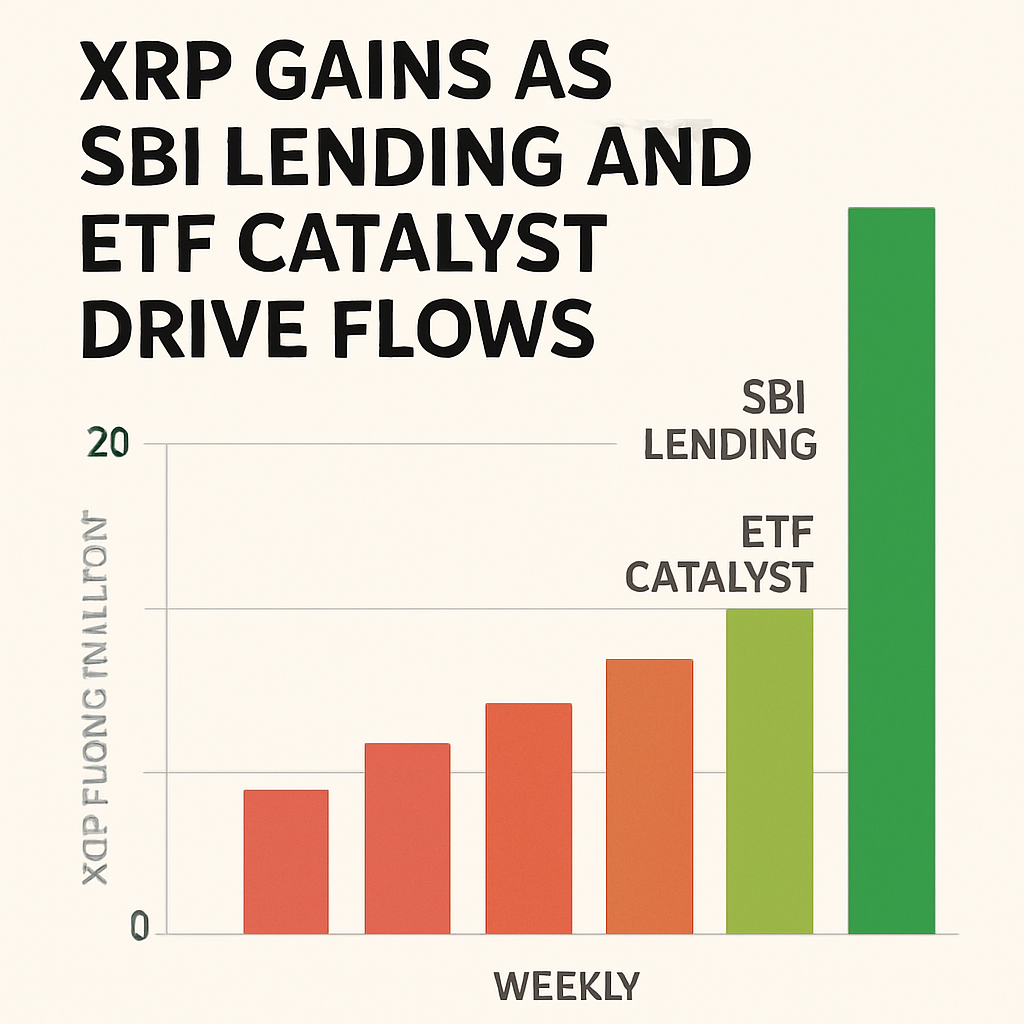

Institutional Lending Boosts XRP Demand

XRP extended gains above $3.00 after SBI Holdings rolled out expanded institutional lending services for the token. Lending desks reported increased borrow-side activity, with institutional accounts utilizing XRP as collateral for funding in Japan’s growing digital-asset lending market. The short-term support floor established near $2.99 has held through multiple intraday tests, reflecting firm bid interest at that level.

ETF Approval Speculation

Speculation over the approval of spot XRP ETFs by the U.S. Securities and Exchange Commission has underpinned speculative inflows. Seven separate ETF applications, including proposals from major issuers, remain under review with initial decision dates set for Oct. 18. Prediction markets currently price the probability of approval above 99%, reinforcing momentum-driven buying in anticipation of favorable regulatory outcomes.

Price Action and Technical Structure

Between Oct. 2, 04:00 UTC and Oct. 3, 03:00 UTC, XRP traded within a $0.15 range, rising from $2.95 to $3.03. Volume surges at key price points, including a 212 million token spike during a mid-session rally, indicate institutional participation. Resistance near $3.10 has capped upside attempts, carving a consolidation band above the $3.00 psychological threshold.

Outlook and Key Levels

Traders are monitoring daily closes above $3.10 for confirmation of a breakout toward $3.20. Institutional flows related to SBI lending and ETF positioning are expected to remain primary drivers. Broader market sentiment may hinge on the outcome of SEC rulings, slated for mid-October, and continued liquidity provision by major custodial and lending platforms.

Comments (0)