Ripple’s XRP token saw heightened volatility over the last 23 hours, oscillating between $2.76 and $2.86 as of Sept. 3, 02:00 UTC. Price fluctuations were driven by geopolitical uncertainties and shifting expectations for U.S. Federal Reserve monetary policy. Despite broader market selling since July, on-chain data indicates whales have accumulated approximately 340 million XRP—valued near $960 million—over the past two weeks.

Session Highlights

The token opened around $2.79 UTC and held the $2.76 support level through multiple retests, reinforced by volume spikes exceeding 180 million tokens—more than double the 24-hour average. A recovery initiated at 13:00 GMT drove XRP to a session high of $2.86, establishing a key near-term resistance zone. Final-hour activity reinforced the bullish bias, with sustained buying lifting price back toward $2.86.

Technical Indicators

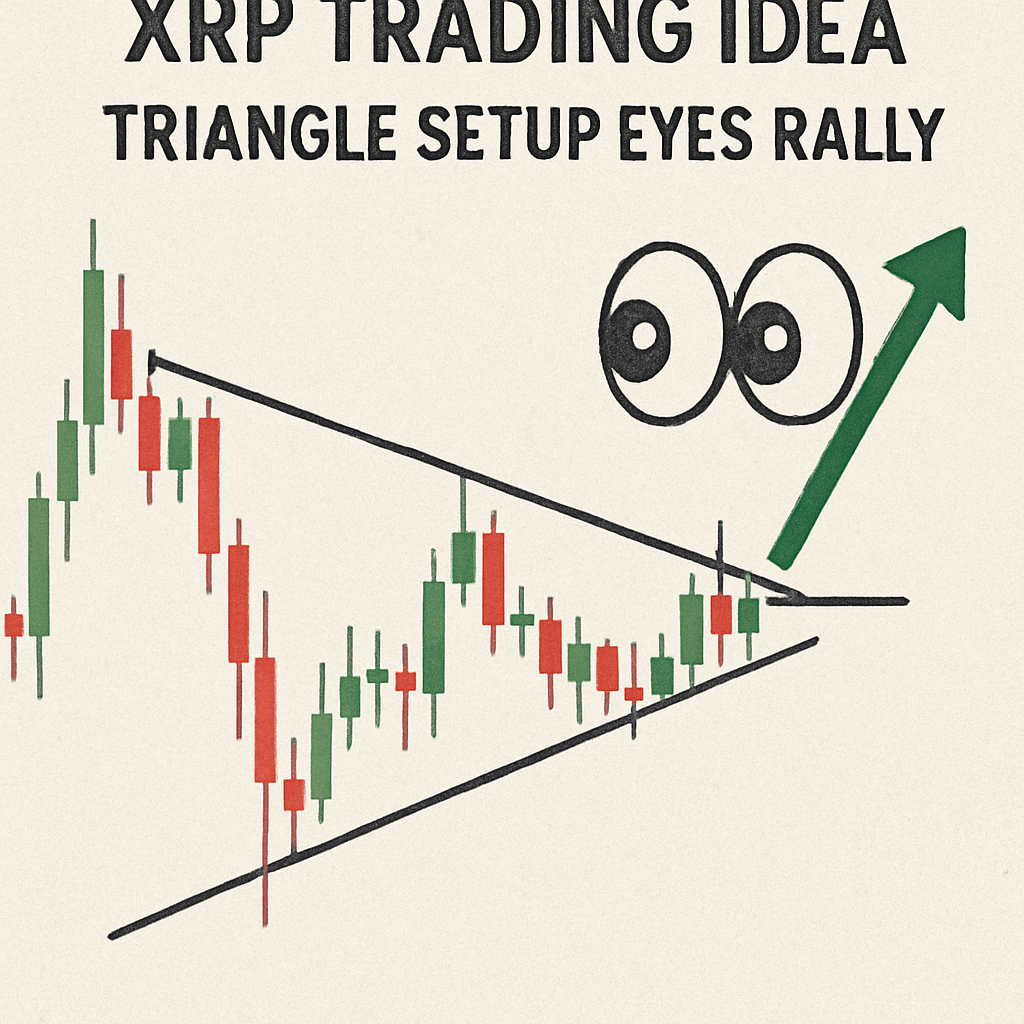

A symmetrical triangle pattern has formed below the $3.00 level, setting up an apex decision point. Momentum oscillators such as RSI have stabilized in the mid-50s, indicating a neutral-to-bullish bias. MACD histogram bars are converging toward a bullish crossover, reinforcing a buildup of buying pressure. Key technical thresholds include $2.86 as the first breakout line, followed by $3.00 and $3.30 for extended targets.

Trading Strategy and Outlook

Short-term traders are eyeing a sustained close above $2.86 as an entry trigger for positions targeting $3.00 and $3.30. A breakdown below $2.76 would expose downside risk toward $2.50. Market catalysts include spot ETF approval timelines, macroeconomic releases and institution-driven flows. Elevated trading volume and whale accumulation trends will be monitored to validate breakout strength.

.

Comments (0)