High-Leverage Trader Opens 25x Ether Long as ETH Hits New High

Crypto trader James Wynn opened a 25x leveraged long on Ether worth $139,215 as ETH surged above $4,860 on August 23. The position shows unrealized gains of over 267%, while a parallel 10x Dogecoin long valued at $206,130 is slightly underwater. Wynn’s combined exposure highlights renewed appetite for high-risk trading strategies.

Crypto Futures Liquidations Hit $375M After Bitcoin and Ether Spike

Over $375 million in crypto futures positions were liquidated following a sharp rally in Bitcoin and Ether. High-leverage longs bore the brunt amid swift price movements. Derivatives exchanges reported record-high funding rates and order-book imbalances.

BlackRock-Led Spot Ether ETFs Attract $287M Net Inflows

US spot Ether exchange-traded funds recorded $287.6 million in net inflows, snapping a four-day outflow streak, led by $233.5 million into BlackRock’s iShares Ethereum Trust and $28.5 million into Fidelity’s fund.

CME Group and FanDuel Debut Event Contracts Platform for Mainstream Market Betting

CME Group has partnered with FanDuel to launch an event contracts platform enabling yes/no wagers on benchmarks including S&P 500, commodities, macro releases, and cryptocurrencies, aiming to democratize access to regulated derivatives.

Ark Invest Increases Positions in Bullish and Robinhood Shares

Cathie Wood’s Ark Invest boosted its holdings in Bullish by $21.2 million and in Robinhood by $16.2 million on August 19, reflecting an ongoing strategy to allocate capital toward crypto exchange and related trading platforms. The purchases extend a multi-day buying spree across multiple Ark ETFs, signaling persistent confidence in crypto-adjacent equities. Ark’s latest disclosures underscore institutional demand for digital asset infrastructure names.

Ethereum whale opens $16.3M long as ETH price eyes bounce

A single whale initiated a $16.35 million 25× leveraged long on Ether at $4,229.83, betting on a recovery toward $4,336 and beyond. Short liquidation clusters at $4,300–$4,360 support this strategy, with potential gains exceeding $450,000 if ETH reclaims these levels.

PLUME Token Rallies 2.6% After Binance Resolves Airdrop Distribution Issue

Binance fixed a technical error that hindered eligible users from receiving the PLUME HODLer airdrop, enabling distribution of 150 million tokens to BNB holders. Following resolution, PLUME’s price rebounded 2.6% to $0.1006, underlining exchange commitment to smooth token launches.

BTCS to pay out loyalty in ETH to deter ‘predatory short-sellers’

BTCS Inc. will issue a one-time Ether dividend of $0.05 per share and a loyalty payment of $0.35 per share in ETH. The “Bividend” aims to reward long-term shareholders and limit short-selling of company stock.

Bybit EU rolls out 10× spot margin trading under MiCA rules

Bybit EU launched 10× spot margin trading for European users under the MiCA framework, allowing crypto collateralized lending with real-time interest rates, margin requirements and liquidation controls designed to limit losses.

Gemini Hires Goldmans, Citi, Morgan Stanley and Cantor as Lead Bookrunners For its IPO

Crypto exchange Gemini filed an S-1 with the SEC, naming Goldman Sachs, Citigroup, Morgan Stanley and Cantor Fitzgerald as lead bookrunners for its planned IPO. Additional banks including Evercore and Mizuho will serve in supporting roles ahead of the Nasdaq debut under ticker GEMI.

Circle to Offer 10 Million Class A Shares at $130 Each

Circle announced a secondary offering of 10 million Class A shares at $130 each, more than four times its June IPO price. Existing shareholders will sell 8 million shares, while Circle itself will sell 2 million, with proceeds allocated for corporate purposes.

Crypto Platform Bullish Shares Debut Above $100, Doubling IPO Price

Crypto exchange Bullish opened on the NYSE at $102 per share versus a $37 IPO price, reflecting strong investor demand. The IPO expanded to 20.3 million shares amid interest from major funds like BlackRock and Ark. Since its 2021 launch, Bullish processed over $1.25 trillion in trading volume.

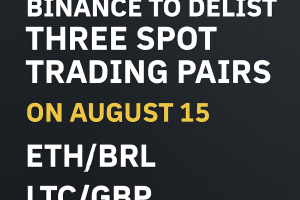

Binance to Delist Three Spot Trading Pairs on August 15

Binance announced removal of ANIME/FDUSD, HYPER/FDUSD, and STO/BNB spot pairs effective August 15 at 03:00 UTC due to low liquidity and project inactivity. New orders and open positions for these pairs will be cancelled, while underlying tokens remain available for withdrawal or alternative trading.

Circle Dips 6% After Hours on 10M Share Secondary Offering

Circle announced a secondary offering of 10 million shares, including 8 million from insiders, triggering a 6% drop in after-hours trading. The firm reported a $428 million Q2 loss, marking a significant shift in market sentiment following its IPO rally.

16 New & Upcoming Binance Listings in 2025

Cryptonews has identified 16 projects poised for Binance listings in 2025 based on factors such as liquidity, utility, security audits and community engagement. Highlighted tokens include Bitcoin Hyper, Maxi Doge, TOKEN6900 and Snorter Bot, each evaluated for launch date, tokenomics and potential market impact.

Bullish Upsizes IPO to $990M, Valuation Hits $4.8B

Bullish raised its IPO size to $990 million by offering 30 million shares at $32–$33 each, valuing the crypto exchange at $4.8 billion. BlackRock and Ark Invest committed $200 million, reflecting robust investor demand.

Arthur Hayes Buys Back Ethereum at Higher Price, Pledges Not to Sell Again

BitMEX co-founder Arthur Hayes repurchased 2,373 ETH at above $4,150 using $10.5 million USDC shortly after selling the same amount at $3,507 a week earlier. On-chain data shows the buyback occurred on Saturday amid an ETH rally. Hayes announced on X he will never take profit again.

Spanish Bank BBVA to Offer Off-Exchange Custody for Binance Customers

Binance enlisted BBVA as a custody provider, allowing client assets to be parked in U.S. Treasuries held by the bank. Treasuries will serve as margin for trading, reducing counterparty risk and isolating funds from platform operations.

Binance teams up with BBVA to let customers keep assets off exchange, FT reports

Binance has partnered with Spanish bank BBVA to enable clients to hold crypto assets in accounts outside the exchange, according to the Financial Times. The arrangement aims to offer users custodial flexibility and reduce on-platform custody risk by leveraging BBVA’s banking infrastructure.

Ethereum Treasury Stocks Outperform Spot ETH ETFs, Standard Chartered Finds

Standard Chartered research indicates that publicly traded firms holding ether for treasury purposes offer better upside than U.S. spot ETH ETFs. Both groups have acquired roughly 1.6% of total ETH supply since June, but treasury firms now trade near NAV multiples above 1 with added staking and DeFi exposure.

ProShares Debuts Ultra CRCL ETF for Twice Daily Exposure to Circle

ProShares launched the first 2x leveraged ETF tracking Circle Internet Group stock, offering twice the daily return of CRCL without margin borrowing. The fund began trading on the NYSE Arca on August 6, following CRCL’s 134% post-IPO surge.

SBI Files for Bitcoin–XRP ETF in Japan, Pushing Dual Crypto Exposure Into Regulated Markets

SBI Holdings filed for a dual-asset ‘Crypto-Assets ETF’ in Japan, offering simultaneous exposure to bitcoin and XRP in a single product. The filing, disclosed in its Q2 2025 earnings report, represents Japan’s first potential institutional product bundling XRP with bitcoin. SBI also proposed a Digital Gold Crypto ETF combining gold ETFs with gold-backed cryptocurrencies.

SBI Files for Dual Bitcoin and XRP ETF in Japan’s Regulated Markets

SBI Holdings filed for a dual-asset ‘Crypto-Assets ETF’ in Japan to track Bitcoin and XRP simultaneously. A separate Digital Gold Crypto ETF would blend gold ETFs with gold-backed tokens. Approval is pending, which would mark Japan’s first XRP-inclusive institutional product.

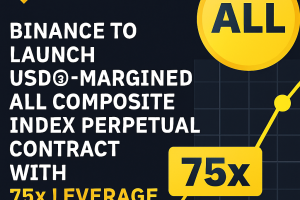

Binance to Launch USDⓈ-Margined ALL Composite Index Perpetual Contract with 75x Leverage

Binance Futures will introduce a new USDⓈ-M perpetual contract tracking an ALL composite index of USDT-quoted contracts, excluding select instruments. The contract offers up to 75× leverage and rebalances daily at 08:00 UTC. The launch is scheduled for 2025-08-06T09:00 UTC to enable broader market participation in a diversified index structure.

Worried About Timing the Bitcoin Market? A 'Lookback Call' Might Be the Answer

A lookback call option offers traders the right to buy Bitcoin at its lowest price during a predetermined lookback period, providing a strategic entry when implied volatility is low. Orbit Markets recommends a three-month lookback with a one-month observation window, setting strike at the period’s low for optimal dip capture.

Blockchain-based loans firm Figure files confidential submission for IPO

Figure Technology Solutions filed confidential paperwork with the SEC to pursue an IPO later this year. The firm has originated over $16 billion in home equity lines of credit on the Provenance Blockchain and merged with Figure Markets, issuer of a tokenized money market stablecoin.

Peter Thiel-backed Bullish seeks up to $4.2 billion valuation in US IPO

Crypto exchange Bullish, backed by Peter Thiel, filed for a U.S. IPO targeting a valuation up to $4.23 billion by offering 20.3 million shares at $28–$31 each. The proposed range reflects a significant discount to its 2021 SPAC valuation. Bullish plans to use proceeds to expand its institutional exchange and stablecoin strategies.