Cryptocurrencies sink as $1.5B in bullish bets wiped out

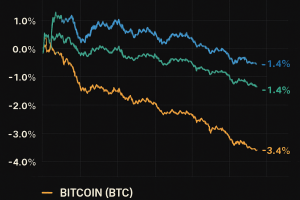

Cryptocurrency traders saw over $1.5 billion in long positions liquidated on Monday, triggering a sharp selloff that drove Ether down around 9% and Bitcoin nearly 3%. Broad market declines extended to Solana, Avalanche and Algorand amid heavy forced selling.

Bankrupt exchange FTX set to repay $1.6B to creditors on Sep. 30

FTX’s bankruptcy estate will distribute $1.6 billion to verified creditors starting September 30 as part of its ongoing repayment process. The payout marks the third major distribution following prior rounds totaling over $6 billion. Funds will be routed through BitGo, Kraken or Payoneer services.

Stellar’s XLM slips below $0.40 support amid heavy institutional selling

Stellar’s native token XLM dropped 3.58% from $0.40 to $0.39 as institutional sell orders surged, breaching critical support despite new corporate partnerships at the Meridian conference including PayPal and Centrifuge initiatives.

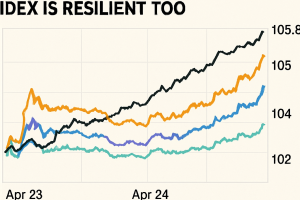

BTC, XRP, SOL, DOGE Resume Slow Grind Higher After Fed, Dollar Index Is Resilient Too

Following the Fed’s 25 bps rate cut, bitcoin topped $117,900—the highest since Aug. 17—while ether rose 2.7% and altcoins including dogecoin, solana and XRP rallied over 3%. Despite dovish Fed projections, the dollar index rebounded to 97.30, presenting a potential headwind. Analysts cite renewed momentum from easing expectations, balanced against tail risks priced into derivatives.

BNB Hits $1,000 All-Time High as Binance Nears DOJ Deal, Rumors of CZ’s Return Grow

BNB surged 4.5% to a record $1,004, reclaiming its position as the fifth-largest cryptocurrency by market cap near $140 billion. The rally was fueled by reports that Binance is in talks with the U.S. Department of Justice to conclude a compliance monitor agreement and by speculation over Changpeng Zhao’s potential return to leadership, offsetting regulatory uncertainties.

Crypto Market Extends Pullback as Bitcoin Holds $115K

Market continued two-day correction as GameFi sector led losses with a 4.41% decline. Bitcoin remained near $115,000, while Ethereum fell by 1.93% and major meme tokens dropped over 4%.

Bitcoin whale resumes dumping amid flat $116K price

A major long-term Bitcoin holder deposited 1,176 BTC, valued at over $136 million, into the Hyperliquid exchange and initiated sell-off. Whale had previously swapped over 35,900 BTC for Ether in late August. Whale movements may signal shifting market sentiment.

Bitcoin ETFs Record Fourth Consecutive Day of Inflows, Adding $550M

U.S. spot Bitcoin ETFs recorded a fourth consecutive day of inflows, adding $552.78 million on Thursday. Spot Ether ETFs logged a third straight day of inflows. Net ETF flows reached the highest level since mid-July, reflecting growing institutional interest.

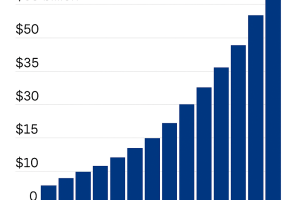

Stablecoin Reserves on Exchanges Soar to a Record $70 Billion

Exchange-based stablecoin reserves on Ethereum and Tron reached a record $70 billion, exceeding the 2021 high. On-chain data from CryptoQuant shows USDC balances nearly doubled in a month while USDT holdings held steady. Historical correlations suggest potential buying pressure for major cryptocurrencies.

Bitcoin price up as producer price index drop boosts Fed rate cut bets

Bitcoin gained 0.5%, trading above $114,000, after U.S. producer prices fell 0.1% in August, boosting odds of a Federal Reserve rate cut. Traders await upcoming consumer inflation data for additional market catalysts.

Bitcoin Crosses $112K as Traders Brace for Data Week; Rotation Lifts SOL, DOGE

Bitcoin price surged past $112,000 as traders prepared for key U.S. economic data. Rotation lifted Solana and Dogecoin amid cautious market sentiment. Anticipation of U.S. CPI, PPI and Federal Reserve decisions shaped positioning.

Asia Morning Briefing: Bitcoin’s Calm Masks Market Tension

Bitcoin remains confined near $111,000 amid multi-month low volatility as markets brace for U.S. CPI data and the Fed’s September meeting. Prediction markets nearly fix odds on a 25 bp cut, while gold hits record highs and U.S. stocks close at new peaks ahead of key economic releases.

Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land

Tether CEO Paolo Ardoino refuted rumors of a Bitcoin sell-off, confirming ongoing profit allocations into Bitcoin, gold, and land. The firm transferred BTC to XXI, clarifying assets movement rather than liquidation of stablecoin reserves.

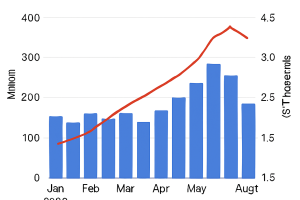

Ethereum revenue dropped 44% in August amid ETH all-time high

Ethereum network revenue, comprising token burns and transaction fees accruing to ETH holders, fell 44% in August despite Ether reaching an all-time high. Total revenue declined to $14.1 million from July’s $25.6 million amid Dencun upgrade effects.

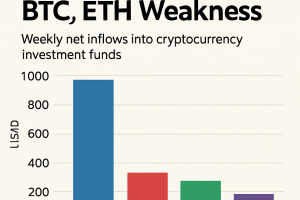

Crypto ETFs post $352 million outflows as Ether funds shed $912 million

Crypto investment products saw $352 million net outflows in early September, driven by $912 million exiting Ether funds despite $524 million inflows into Bitcoin products. Weekly trading volumes fell by 27 percent as profit-taking and macro developments influenced risk-asset demand. Despite cooling activity, year-to-date inflows remain ahead of last year.

DOGE Leads Gains as Bitcoin Holds Above $111K Amid New BTC Treasury Plan

Bitcoin held above $111,000 awaiting U.S. inflation data while Dogecoin outperformed with a 7% rise to $0.2328. Altvest Capital aims to raise $210 million to purchase BTC for treasury, planning Africa Bitcoin Corp. rebrand. Japan bond sell-off adds macro uncertainty.

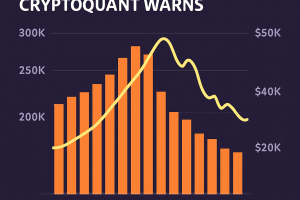

Institutional Bitcoin Treasury Demand Dips, CryptoQuant Warns

Bitcoin treasury companies showed an 86% drop in average purchase sizes despite record holdings, suggesting cautious buying. Asia’s Sora Ventures launched a $1 billion fund to fuel regional treasury growth amid shifting institutional flows.

Tether Denies Selling Bitcoin for Gold amid Rumors

Tether CEO Paolo Ardoino refuted claims of Bitcoin sales, asserting no BTC was sold. Clarification followed rumors citing asset reports, with explanation that BTC transfers funded separate projects rather than gold purchases.

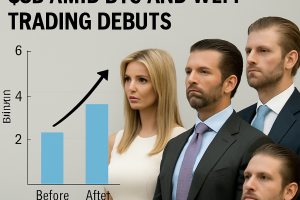

Trump Family Wealth Jumps $1.3B Amid ABTC and WLFI Trading Debuts

Bloomberg Billionaires Index data shows the Trump family’s collective net worth increased by $1.3 billion this week thanks to American Bitcoin (ABTC) and World Liberty Financial (WLFI) trading debuts. WLFI gains added $670 million, while ABTC stake valued over $500 million despite subsequent price retracements.

Michael Saylor’s Net Worth Rises by $1B on Bloomberg Billionaire Index

Michael Saylor, Strategy co-founder and executive chairman, saw a $1 billion net worth increase this year, coinciding with Strategy’s stock gains and Saylor’s ranking at 491st on the Bloomberg Billionaire 500 Index. Equity holdings in Strategy account for over 90% of his wealth growth.

Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land

Tether CEO Paolo Ardoino refuted rumors of a Bitcoin sell-off, clarifying that recent transfers were for an internal initiative rather than asset disposal. The issuer reaffirmed its strategy to allocate profits into Bitcoin, gold, and land, maintaining holdings above 100,000 BTC valued at over $11 billion.

Stablecoin Retail Transfers Break Records in August

Retail stablecoin transfers under $250 hit $5.84 billion in August, surpassing prior monthly highs as consumers in emerging markets increasingly turn to stablecoins to avoid high banking fees and slow transfers.

Michael Saylor’s Fortune Jumps $1B Amid Billionaire Index Inclusion

Michael Saylor’s net worth rose by $1 billion year-to-date following his debut on the Bloomberg Billionaire 500 Index. His estimated worth reached $7.37 billion, up nearly 16%, as Strategy’s share price rallied 12% over the same period, driven by the firm’s aggressive Bitcoin accumulation strategy.

Bitcoin Hits $113K as BTC Dominance Approaches Two-Week High of 59%

Bitcoin price recovered to $113,000, marking the highest level since August 28 as market dominance reached 59%, a two-week peak. The uptick coincided with a Deribit options expiry valued at $3.28 billion and adherence to the max pain theory, underscoring renewed technical momentum.

Asia Morning Briefing: Bitcoin Holds Steady as Traders Turn to Ethereum

Bitcoin consolidates near $112,000 amid macro hedge positioning, while traders shift to Ethereum for upside potential into September. Asia-Pacific stocks rise on Wall Street tech gains. Options and prediction markets show renewed ETH convexity ahead of the Fusaka upgrade.

Bitcoin Treads Water Ahead of U.S. Jobs Report

Bitcoin traded in a narrow range on Sept. 3 as investors awaited the U.S. Bureau of Labor Statistics jobs data. A softer jobs figure could spur rate-cut expectations and boost crypto markets, while stronger data might weigh on risk assets amid Fed tightening concerns.

Strategy Raises Dividend on STRC Offering to Attract Yield-Seeking Investors

Strategy (MSTR) increased the annual dividend on its STRC preferred stock to 10% from 9% to drive the price toward the $100 par target. The September payout was set at $0.8333 per share. Dividends for STRF, STRK and STRD were also declared, reflecting broader distribution of yield across preferred offerings.

Ether Machine Secures $654 M in Private ETH Funding

Ether Machine raised roughly 150,000 ETH (≈$654 million) in private financing ahead of its Nasdaq debut. The funding will support growth initiatives as the company prepares a public listing expected later this year.

Crypto ETPs Attract $2.48B Inflows Despite BTC, ETH Weakness

Crypto exchange-traded products recorded $2.48 billion of net inflows last week, led by $1.4 billion into Ether products. Bitcoin ETPs saw smaller inflows amid broad market pressure, reflecting continued investor interest in crypto vehicles despite price declines.

BNB Slips Below $860 as Traders Brace for U.S. Jobs Data

BNB traded between $849.88 and $868.76 in a 24-hour window, failing to hold above key resistance near $868. Chain activity doubled with daily active addresses rising to 2.5 million, while volume declined. Focus shifted to upcoming U.S. payroll figures that could influence rate cut expectations.

XLM Plunges 5% in Wild Trading Session Before Staging Sharp Recovery

Stellar’s XLM token experienced a 5% intraday decline from $0.36 to $0.34 amid heavy institutional selling and network upgrade disruptions, then recovered to $0.36. Volume spikes above 70 million units accompanied both the selloff and rebound, indicating active whale participation.

XRP Breaks $2.80 as Bearish September Begins

XRP declined 4% to $2.75 in the Aug. 31–Sept. 1 session amid $1.9 billion in institutional liquidations since July, even as whales added 340 million tokens. On-chain metrics reveal symmetrical triangle formations and liquidity pockets up to $4.00. Technicals suggest oversold conditions and potential recovery if key resistance breaks.

Bitcoin Hovers Around $107K as Weakest Month Begins

Bitcoin opened September near $107,000 after slipping below key supports, marking the historically weakest month with average declines of around 6% over the past 12 years. Market sentiment is clouded by seasonal pressure, ETF outflows and doubts over corporate treasury models. Focus shifts to potential Fed rate cuts and ETF flows as drivers of near-term price action.

BTC Whale Now Holds $3.8B in ETH, Signaling Market Maturity

An OG Bitcoin whale rotated $435 million of BTC into 96,859 Ether over a weekend, raising ETH holdings to $3.8 billion. Analysts view the move as a sign of market diversification and maturation amid positive US regulations.

Here’s what happened in crypto today

Daily crypto trends highlight a forecast that AI-driven innovation will drive investors to Bitcoin as a safe-haven asset, while California’s governor teases a ‘Trump Corruption Coin’ in political jab. A surge in ‘buy the dip’ calls may paradoxically signal further market downside.

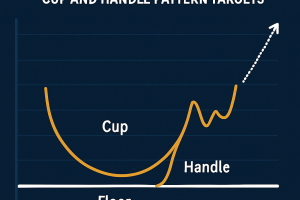

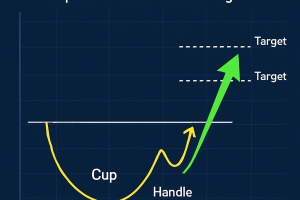

DOGE Rebounds From $0.21 Floor, Cup-and-Handle Pattern Targets $0.30

Dogecoin slipped 5% over the prior 24 hours amid broader risk-asset weakness and a whale transfer of 900 million DOGE to Binance. On-chain data show 680 million DOGE accumulated in August, underscoring institutional participation. Technical analysis highlights $0.21 as key support and $0.23 resistance, with a cup-and-handle pattern pointing to potential upside toward $0.30.

Given Trump’s Pro-Crypto Stance, Is It Time to Fully Ditch Gold in Favor of Bitcoin?

Bitwise research shows gold remains a stronger hedge during equity sell-offs, while bitcoin offers more resilience under bond market stress. In 2025 gold is up over 30% and bitcoin up about 15%, illustrating their distinct roles. The heuristic suggests using both assets for portfolio diversification rather than replacing one with the other.

XRP Bullish Patterns Point to $5 as Korean Buyers Start to Accumulate

XRP fell 4.3% in 24 hours before recovering toward $2.85–$2.86 support, with Korean exchanges absorbing 16 million XRP. Technical indicators suggest potential upside toward $3.02 resistance, while on-chain and regional institutional flows underpin a floor ahead of September’s event calendar.

DOGE Rebounds From $0.21 Floor, Cup-and-Handle Pattern Targets $0.30

Dogecoin fell 5% in 24 hours amid broader risk-asset weakness and whale activity before stabilizing at $0.21. On-chain data shows continued institutional accumulation of 680 million DOGE in August, underpinning support above the $0.21 floor.

Crypto Daily Recap: EU explores digital euro on public blockchains, YZY wallets profit, State Street joins tokenized debt

EU officials are evaluating using public blockchains Ethereum and Solana for the digital euro pilot. Data shows top YZY wallets profited nearly $25 million trading the token. State Street became the first custodian on JPMorgan’s tokenized debt platform.

Spot BTC and ETH ETFs See Outflows as Inflation Surges

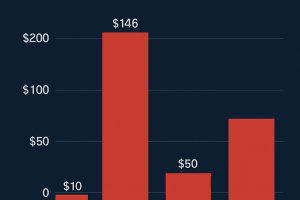

Spot Bitcoin and Ether ETFs experienced significant outflows on Friday after stronger-than-expected core PCE data signaled inflation pressures. Ether funds saw $164.6 million exit while Bitcoin ETFs shed $126.6 million, marking the first net outflows since Aug. 22. The data stoked concerns over Fed rate paths under rising import costs from tariffs.

BlackRock Overtakes Exchanges as Top Crypto Custodian

BlackRock’s iShares Bitcoin Trust holds 745,357 BTC, surpassing Coinbase and Binance as top custodian. US spot Bitcoin ETFs saw net outflows of $126.7 million on August 30, evidencing institutional preference for regulated ETF custody.

Avalanche leads blockchain transaction growth amid US gov’t implementation

Avalanche transaction volume surged 66% over the past week, outpacing other networks amid growing US Department of Commerce adoption. Real GDP data will be posted on Avalanche and eight other blockchains, reinforcing government use of decentralized ledgers.

Bitcoin remains under pressure as gold quietly targets new record high

An early crypto rally was dampened by US afternoon sessions as Bitcoin fell back under $112K. Meanwhile, gold climbed nearly 1% to $3,477 per ounce, approaching its all-time high amid macro drivers that have failed to boost digital assets.

Crypto Markets Today: Bitcoin Underperforms Ether, Broader Market

Bitcoin held above $111,000 after bouncing from earlier European lows, gaining under 1% in 24 hours while the CoinDesk 20 and CoinDesk 80 indexes added over 3%. Options expiry dynamics and strong index performance suggest month-end upside potential. The 200-day moving average remains supportive above $100,000.

Metaplanet Shares Jump 6% on International Stock Sale and Bond Moves

Metaplanet plans to issue up to 555 million new shares via a ¥130.3 billion international offering, primarily to acquire Bitcoin; it also exercised 27.5 million warrants and redeemed ¥5.25 billion in bonds early, with warrant exercises suspended.

Asia Morning Briefing: ETH Bulls Eyeing $5K as Flows Strengthen

Ethereum’s chance of reaching $5,000 rose to 26% on Polymarket, driven by institutional accumulation and shifting BTC–ETH flows. ETH outpaced BTC over the past 30 days amid $940 million in liquidations in Bitcoin markets, boosting ETH sentiment.

XRP Eyes $3.20 as Bull-Flag Pattern Forms Near Key Support

CME Group’s crypto futures open interest topped $30 billion, with XRP futures hitting $1 billion in three months. XRP rose from $2.89 to $2.99, spiking at $3.08 before consolidating near $3.00 ahead of potential breakout.

XRP Eyes $3.20 as Bull-Flag Pattern Forms, Key Support at $2.89

XRP price gained 3.6% to $2.99 following a volume-driven test of $3.08 resistance, then consolidated near the $3.00 mark. Technical indicators highlight support at $2.89 and a potential breakout above $3.08. Traders are monitoring for a move toward $3.20 as open interest and institutional flows strengthen.

XRP Jumps 6% as Bitcoin Reclaims $111K

XRP led a broad crypto rebound, gaining 6% as traders re-entered positions after Monday’s sell-off. CME Group’s crypto futures notional open interest topped $30 billion, while analysts warned that sentiment ahead of upcoming PCE inflation data may risk a market pullback.

Dogecoin Jumps to 21 Cents After $200M Whale Transfer to Binance

Dogecoin surged to $0.21 following a 900 million DOGE transfer worth $200 million to Binance, which briefly unsettled traders due to sell-off fears. Despite the influx, large holders continued accumulating over 680 million DOGE in August. Technical analysis indicates potential for a bullish reversal amid split market sentiment.

Bitcoin Price Under Pressure Amid Weak On-Chain Activity and High Liquidations

Bitcoin rebounded from near-term lows but remains under pressure as on-chain metrics point to weak network adoption. Futures liquidations of $940 million, predominantly from long positions, have weighed on sentiment. Blue-chip NFT collections also saw steep weekly declines amid broader market volatility.

Ethereum ETFs Attract $625M Inflows Amid Bitcoin ETF Outflows

Ethereum-based ETFs drew $625 million in inflows in the week ending August 22, 2025, reversing earlier outflows and signaling renewed institutional and retail interest. In contrast, Bitcoin ETFs experienced a six-day outflow streak totaling $1.3 billion, with the largest single-day withdrawal of $523 million. Analysts highlight Ethereum’s yield and utility advantages in driving reallocation.

Bitcoin price charges to $116K as Fed’s Powell hints at interest-rate cut

Bitcoin spiked over 3% to $116,000 after Fed Chair Jerome Powell delivered dovish remarks at Jackson Hole, boosting dovish rate cut expectations for September. Trading activity surged and short-term technical indicators turned positive on heightened risk-asset demand.

Bitcoin Whale Dumps 24,000 BTC, Flash Crash Triggers $4,000 Drop; ETH Briefly Tops $4,900

A single whale liquidation of 24,000 BTC initiated a rapid market selloff, driving Bitcoin below $110,000 and erasing recent gains. Ethereum briefly surged past $4,900 before reversing amid broad liquidations exceeding $500 million. Markets remain volatile after Powell’s dovish remarks.

Bitcoin Whale Dumps 24,000 BTC, Flash Crash Triggers $4,000 Drop; ETH Briefly Tops $4,900

A single whale liquidation of 24,000 BTC initiated a rapid market selloff, driving Bitcoin below $110,000 and erasing recent gains. Ethereum briefly surged past $4,900 before reversing amid broad liquidations exceeding $500 million. Markets remain volatile after Powell’s dovish remarks.

Bitcoin Flash Crash Triggers $550M in Sunday Liquidations as Ether Rotation Builds

Bitcoin dropped below $111,000 after a whale sold 24,000 BTC, triggering over $550 million in liquidations. Ether held near $4,707 as funds rotated from bitcoin to Ethereum. Analysts say liquidations could clear the path for a rebound.

Fed dovish turn lifts XRP toward $3.10, analysts eye $5–$8 targets

Regulatory clarity following Ripple’s litigation outcome continues to support institutional flows into XRP, while analysts now forecast potential price targets between $5 and $8 if near-term resistance is decisively broken.

Asia Morning Briefing highlights Bitcoin ETF fee squeeze on miners

Capital continues to flow into Bitcoin ETFs and custodians, while retail activity shifts to Solana. Transaction fees on the Bitcoin network have fallen sharply, raising concerns about miner revenue sustainability.

Saylor signals third consecutive Strategy Bitcoin buy in August

Strategy co-founder Michael Saylor indicated an impending Bitcoin purchase, marking the third acquisition for the firm in August. The company’s holdings now total 629,376 BTC valued at over $72 billion amid institutional accumulation.