XRP Surges 9% Before Pullback Caps Rally Near $3

XRP price rallied 9 percent to test $3 before profit-taking capped gains, driven by Fed rate-cut speculation and rising institutional on-chain inflows. Volume quintupled amid breakout momentum on major exchanges.

Binance Sees $956 M Outflows in 24 Hours, Nansen Data Shows

Investors withdrew about $956 million from Binance over the past 24 hours, data firm Nansen reported, marking the largest net outflow since a $4.3 billion settlement and governance shake-up at the exchange.

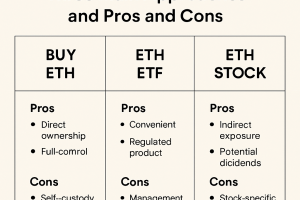

Getting ETH Exposure in 2025: Three Main Approaches and Pros and Cons

With Ethereum near record highs and forecasts eyeing $15,000 by year-end, investors weigh direct token ownership, spot ETFs and corporate treasuries for exposure. Each path offers different trade-offs in custody, regulation and market risk in the current bull cycle.

Getting ETH Exposure in 2025: Three Main Approaches

Ether’s record highs have prompted assessment of three exposure paths. Direct token ownership grants full DeFi and staking access but demands secure custody. Spot ETFs offer regulated exposure with potential staking yield. Corporate treasuries add equity-linked ETH exposure.

Canadian fintech funding hits $1.62B in H1 2025 amid crypto and AI investments

Canadian fintech companies raised $1.62 billion in the first half of 2025, led by digital asset and AI startups, according to KPMG Canada’s Pulse of Fintech report. That funding level trails the $2.4 billion raised in H1 2024 but reflects sustained investor interest. U.S. regulatory support for crypto and increasing AI adoption are expected to drive a strong second half.

XRP Surges 9% Before Pullback Caps Rally Near $3

XRP surged 8.56% to $3.03 after breaking above $3.00, driven by dovish Fed commentary and on-chain volume increase. Settlement volumes on the XRP Ledger rose 500%, indicating potential institutional interest. Support at $3.00 is key.

Ethereum Liquidations Top $388M Ahead of $10K Targets

Ethereum’s price surge past $4,800 on August 23 triggered $388 million in liquidations, the largest among all crypto assets in 24 hours. Total market liquidations reached $769 million, impacting over 183,000 traders. Analysts view the flush as a setup for a cleaner rebound toward $10,000 if institutional demand persists.

XRP and Solana Flash Bullish Signals Amid Institutional Flows

XRP rebounded above $3 and Solana rose 10% to near $206 on August 23 as institutional adoption and ETF optimism fueled buying. Analysts cite structural inflows and technical breakouts as drivers, with targets of $4 for XRP and $250-$260 for Solana if momentum holds above key support levels.

Ether Likely to Top $5K as Powell Sparks Crypto Rally

Ether and Bitcoin rallied on August 23 after Fed Chair Jerome Powell’s dovish remarks at Jackson Hole boosted rate-cut expectations. Analysts forecast new highs for both digital assets but warn of corporate treasury adoption challenges and equity market volatility. Spot ETF inflows and institutional buying remain key factors.

Dogecoin Forms Bullish Structure After High-Volume Breakout

Dogecoin surged 11% to $0.24 on August 23 following a high-volume breakout that doubled average trading volumes. Institutional interest drove the rally amid supportive signals from Federal Reserve policy and Wyoming’s state-backed stablecoin launch. Technical indicators point to sustained buying pressure above $0.21 support.

Ether Surges to Record $4,866 High

Ether reached a new record high of $4,866.73, surpassing its November 2021 peak after a 15% rally. The token has gained over 40% year-to-date, outpacing Bitcoin amid renewed institutional demand. The surge reflects growing confidence in Ethereum’s long-term utility and reserve asset status.

Circle, Coinbase, Strategy Stocks Surge on Rate Cut Hopes

Shares of Circle, Coinbase, and Strategy surged as traders bet on a potential Fed rate cut. Crypto-linked stocks outperformed broader indices, reflecting renewed institutional interest in digital asset equities. Trading volumes spiked by over 40%.

Chainlink's LINK Rallies 12% to New 2025 High Amid Token Buyback

LINK surged 12% following dovish comments by Federal Reserve Chair Jerome Powell, breaking through its strongest price since December. Institutional buying and recent token purchase initiatives underpinned the rally. Security certifications further bolstered market confidence.

$4.8B Crypto Options Expiry Looms on Deribit Ahead of Jackson Hole

Over $4.8 billion in crypto options on Deribit are set to expire on August 22, 2025 at 08:00 UTC, with Bitcoin options representing $3.83 billion and a put/call ratio of 1.31. Ethereum options worth $948 million show a more balanced put/call ratio of 0.82. The event follows last week’s $5 billion expiry and coincides with Fed Chair remarks at Jackson Hole.

Whale accumulation drives Dogecoin’s V-shaped recovery from $0.21 lows

Dogecoin rebounded sharply after testing support at $0.21, closing at $0.22 following a surge in trading volume and aggressive whale buying. On-chain data shows investors accumulated over 680 million DOGE in August, offsetting retail outflows and countering security concerns. Traders are watching whether $0.22 becomes a new support level.

Bitcoin and Ether ETFs Record Nearly $1B in Outflows

Investors withdrew $523 million from spot Bitcoin ETFs and $422 million from Ether funds on Tuesday, marking the second-largest outflows for both asset classes this month. Three consecutive days of redemptions have drained $1.3 billion, driven by an 8.3% slide in BTC and a 10.8% decline in ETH over the past week.

Chainlink's LINK Token Surges 8% on Bullish Volume

Chainlink's native token LINK rallied 8.3% to over $26 amid high trading volume, outperforming major cryptocurrencies. Surge supported by the Chainlink Reserve’s buyback program, which has accumulated over $2.8 million in tokens in two weeks.

Bitcoin Structure Appears Weak Even as Industry Strengthens

Glassnode data indicates fragile market positioning following Bitcoin’s recent pullback from record highs, even as inflows into spot ETFs and institutional initiatives signal deeper structural progress. Divergent views from market observers highlight a short-term disconnect between price action and long-term industry maturation. Markets await key economic signals from the Federal Reserve to gauge the next directional move of major cryptocurrencies.

Traders turn bearish on BTC and ETH amid retail weakness

Bitcoin and Ether declined 1.1% and 3.8% respectively as retail sentiment shifted to bearish ahead of the Jackson Hole symposium. Profit-taking by individual investors follows recent price highs above $124,000 for BTC and $4,300 for ETH, with derivative markets showing elevated put options and institutions maintaining cautious accumulation.

Amdax plans Bitcoin treasury firm listing on Euronext

Amsterdam-based crypto service provider Amdax intends to launch a bitcoin treasury vehicle named AMBTS on Euronext Amsterdam. The move underscores institutional appetite for bitcoin after record highs, aiming to hold at least 1% of supply over time.

Metaplanet expands Bitcoin treasury by 775 BTC, assets outpace debt

Tokyo-listed Metaplanet acquired 775 BTC for approximately ¥13.73 billion ($94 million), lifting its total holdings to 18,888 BTC valued at $1.95 billion. The purchase over-collateralizes ¥117 million in zero-coupon bonds by 18.67× and boosted share price by 4%.

Week 3 Crypto News: Metaplanet Turns Profitable with BTC Strategy

Metaplanet reports its Bitcoin acquisition strategy has led to profitability in Q3 2025 after lifting its BTC holdings to nearly 18 900 coins. Corporate treasury models continue to gain traction as firms allocate part of cash reserves into digital assets.

Institutions Lead $Billions in Bitcoin ETF Purchases as Q2 Exposure Surges

Wall Street institutions increased BTC exposure in Q2 via spot ETFs and crypto-linked stocks, with Brevan Howard nearly doubling its IBIT holding to $2.3 billion and Goldman Sachs holding $3.3 billion. Harvard and other major investors also boosted positions.

Adam Back’s $2.1B Bitcoin Treasury Play Set to Challenge MARA in BTC Holdings

Bitcoin Standard Treasury Co. plans to merge via SPAC with Cantor Equity Partners, bringing 30,021 BTC on balance sheet and raising up to $1.5 billion in fiat capital. Founders and early investors will contribute 30,021 BTC to build a corporate treasury rivaling MARA.

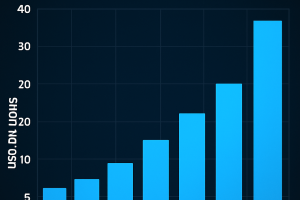

Spot Bitcoin and Ethereum ETFs hit record $40B weekly trading volume

US-based Spot Bitcoin and Ether ETFs recorded $40 billion in trading volume over the past week, marking their biggest ever week. Ether ETFs outpaced Bitcoin inflows for five consecutive days amid strong institutional participation.

XRP Sheds 7% on $437M Sell Spike as $1B Liquidations Hit Crypto Market

XRP fell 7.19% after a $437 million sell spike triggered over $1 billion in market liquidations. The token dropped from $3.34 to $3.10, testing critical support near $3.05. Late-session buying indicated renewed accumulation by large holders.

XRP Drops 7% as $1B Liquidations Expose Support Levels

XRP tumbled 7.2% to $3.10 following over $1 billion in market-wide liquidations triggered by inflation fears. Heavy selling tested the $3.05 support zone before late-session buying hinted at renewed accumulation by large holders. Technical levels at $3.13 and $3.20 now shape near-term outlook.

Bullish Bets Lose $860M to Liquidations After Sudden Crypto Sell-Off

Over $1 billion in leveraged crypto positions were liquidated following hotter-than-expected U.S. PPI data. Bitcoin briefly reached a new high above $123,500 before a sharp sell-off wiped $866 million in long positions. Traders now await further economic signals for policy direction.

Asia Morning Briefing Highlights ETH Selling Pressure Amid Rally

Ethereum’s price slipped 3% to $4,600 despite strong performance over the past month. Exchange inflows of ETH have surpassed Bitcoin’s, indicating profit-taking ahead of potential consolidation. Macro data and ETF flows continue to influence market sentiment amidst stretched positioning.

Bitcoin Hits Fresh Record as Fed Easing Bets Add to Tailwinds

Bitcoin hit a record peak at $124,002.49 amid growing Fed rate-cut expectations and financial reforms support. Ether rallied to $4,780.04, the strongest since late 2021, on sustained institutional purchases and regulatory tailwinds.

Bitcoin Becomes Fifth-Largest Asset by Market Cap, Surpasses Google

Bitcoin market capitalization surpassed $2.4 trillion, overtaking Google to become the fifth-largest global asset after a rally mirroring record highs in U.S. equities. The surge was driven by favorable macro data, expectations of Fed rate cuts, and sustained corporate treasury allocations to Bitcoin.

Long-Term Holders Sell Bitcoin at Record Highs Above $120K

Blockchain data shows a decline of over 300,000 BTC in long-term wallets over the past four weeks, coinciding with a new all-time high above $124,000. Dormant addresses reactivated, contributing to renewed selling pressure and temporary momentum loss. Institutional and retail demand near $118,000 has helped absorb supply, holding price above key support.

Bitcoin holds near $120K as Ether rallies towards $4.7K

Crypto markets extended gains as traders reacted to dovish Federal Reserve expectations, political developments and substantial ETF inflows into ether. Bitcoin traded just below $120,000, while ether surged nearly 30% to approach $4,700, supported by $520 million of inflows in a single day. Comments on potential 401(k) crypto exposure and rate-cut bets fueled optimism.

LINK Surges 10% as Chainlink Reserve, ICE Partnership Fuel Explosive Rally

LINK surged 10% to a seven-month high, extending weekly gains to 42%, driven by a new Chainlink-ICE partnership and a token buyback initiative dubbed the Chainlink Reserve. Technical indicators signal continued upside above near-term resistance around $24.

Kazakhstan’s Fonte Capital Introduces Central Asia’s First Spot Bitcoin ETF

Fonte Capital launched the region’s first spot Bitcoin ETF (BETF) on the Astana International Exchange, with BitGo providing custody and insurance. The physically backed fund begins trading Aug. 13, offering regulated access to bitcoin and targeting low tracking error.

Polkadot’s DOT Advances Over 4% Amid Robust Recovery Rally

Polkadot’s native token DOT rallied over 4% to $4.12 after defending support near $3.88–$3.92 on surging volume. Technical indicators signal potential upside toward $4.15–$4.20 Fibonacci extension targets amid institutional accumulation.

Ether Pumps to Five-Year High of $4.47K on Rate-Cut Hopes and Treasury Bets

Ether surged to $4,470, its highest since December 2021, as mixed U.S. CPI data increased expectations for a September Fed rate cut. Tom Lee’s Bitmine Immersion disclosed plans to raise up to $20 billion for further ETH purchases, fueling additional upside.

U.S. Spot Ether ETFs Record Over $1B in Daily Inflows

U.S.-listed spot Ether ETFs achieved a record $1 billion of net inflows on August 12. BlackRock’s ETHA led with $640 million, while Fidelity’s FETH contributed $276.9 million, lifting total ETF assets to $25.71 billion.

Metaplanet Acquires 518 BTC in $61M Treasury Purchase

Tokyo-based Metaplanet bought 518 Bitcoin at an average price of $118,519 to boost its corporate reserves to 18,113 BTC. The transaction, valued at approximately $61 million, underlines a 26.5% BTC yield for the third quarter and continued institutional accumulation.

Bitcoin $115K Put Options Surge Ahead of U.S. CPI Release

Demand for Bitcoin put options in the $115,000–$118,000 range spiked ahead of the U.S. Consumer Price Index report. Traders are positioning for potential downside if the July CPI exceeds the expected 2.8% year-on-year increase.

Metaplanet Adds 518 BTC, Total Bitcoin Reserves Cross 18,000 Mark

Metaplanet acquired an additional 518 BTC at an average price of $100,561 each, bringing total corporate holdings to 18,113 BTC. The Tokyo Stock Exchange-listed firm financed the purchase through zero-interest bonds, moving-strike warrants, and preferred shares. The company aims to reach 210,000 BTC by 2027 under its “555 Million Plan.”

Ether Rally Pulls Bitcoin Along

Ether gained over 7% this weekend, leading wider crypto gains and prompting bitcoin to rally from $119,000 to $122,300. Spot volumes drove the move amid record on-chain activity and a narrowing futures-to-spot volume ratio.

Zora Surges 50% as Perps Listings and Base Ecosystem Flows Drive Breakout

Zora token jumped nearly 50% in 24 hours, reaching a market cap of $450 million. Rally driven by large on-chain purchases, record coin creation, and new perpetual contracts introduced by major exchanges. Trading volume spiked to $284 million as Base App integration enhanced retail access.

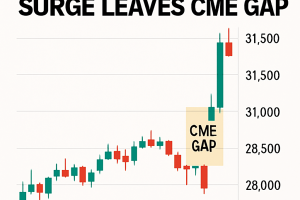

Watch Out Below: Bitcoin’s Weekend Surge Leaves CME Gap

Weekend rally in bitcoin created a gap in CME futures, with Friday’s closing at $117,430 and Monday’s open at $119,000. Historical patterns suggest such gaps often fill within days but strong momentum can prevent immediate retracement. Traders will monitor whether price approaches $120,000 to test gap fill.

Crypto Market Cap Rises 0.50% with Aerodrome Finance Leading Gainers

The total cryptocurrency market capitalization increased by 0.50% to $3.90 trillion, driven by gains across major assets. Bitcoin rose 0.18% to $116,739, while Aerodrome Finance led top gainers with a 20.61% surge.

ETH Jumps 7% to $4,200, Highest Since December 2021

ETH surged 7% to $4,200 on Binance, marking its highest level since December 2021. The rally was driven by $207 million in short liquidations and analysts noted potential altcoin rotations as bullish sentiment increased.

CoinDesk 20 Index Update: Stellar Surges 12.3%, Index Higher

Stellar (XLM) led gains in the CoinDesk 20 with a 12.3% increase while XRP added 8%. Nineteen of twenty index constituents traded higher, pushing the index up 2.8% to 4044.63 since Thursday afternoon.

Ether Soars Above $4K for First Time Since December

Ether climbed above $4,000 for the first time since December, reflecting a 3.5% gain over 24 hours and year-to-date growth exceeding 25%. Bitcoin price remained flat, pushing the ETH/BTC ratio to near its highest level of the year.

XRP surges over 13% after Ripple and SEC drop final appeals in landmark case

XRP climbed more than 13% following news that Ripple Labs and the U.S. Securities and Exchange Commission have withdrawn their remaining appeals in a four-year legal battle. Traders cited renewed confidence in XRP’s regulatory status and potential relisting on major exchanges.

DOGE Surges 8% as Whale Buying Signals Bullish Breakout

Dogecoin rallied 8.4% to $0.22 in a two-wave breakout, driven by whale accumulation surpassing 1 billion tokens in 48 hours. Trading volume exceeded 1 billion, establishing resistance at $0.222–$0.224 and support at $0.220.

ICP Drops 2.4% After Intraday Bounce Off Sub-$5 Support

Internet Computer (ICP) declined 2.4% over the last 24 hours to $5.08, despite a bullish intraday rebound from $4.97 to $5.13 on elevated trading volume. New support emerged at $5.04 after a 56% volume surge during the U.S. morning session, highlighting mixed market sentiment.

DOT Gains as Much as 4% in Strong Bullish Breakout

Polkadot’s DOT token rose up to 4% in a 24-hour period ending at 15:00 UTC on August 7, climbing from $3.65 to $3.80. The breakout occurred on triple-average volume, driven by institutional buying, with key support and resistance levels forming at $3.68 and $3.80.

ATOM Surges 3% as Cosmos Ecosystem Gains dYdX Integration

ATOM price rose 3.40% from $4.26 to $4.41 between August 6 15:00 and August 7 14:00 UTC, driven by high trading volume. The rally followed Coinbase’s launch of native dYdX integration on the Cosmos network. Broader market rotation favored decentralized platforms amid geopolitical tensions.

Bitcoin Rises on Improved Risk Appetite After Tariffs Take Effect

Bitcoin climbed 0.8% to $115,003 amid reduced market uncertainty following the implementation of U.S. reciprocal tariffs. Broader crypto markets also saw gains, led by Ethereum, Solana and XRP, as correlated tech stocks rallied. The move is attributed to renewed inflows and a more positive risk tone in equity markets.

Polkadot DOT Rises 4% on Institutional Buying Surge

Polkadot’s DOT rose by as much as 4 % amid increased institutional buying and corporate treasury allocations driven by regulatory clarity. Bifrost secured over 81 % of DOT’s liquid staking token market, boosting total value locked by more than $90 million.

BONK Memecoin Slides 4% as Intraday Volatility Tops 50%

Solana-based memecoin BONK dropped 3.9% to $0.00002383 over 24 hours and swung 50.3% intraday between $0.00002486 and $0.00002360. A late-session 0.53% rebound stemmed from institutional short covering.

ICP Price Dips 2.4% Before Bouncing Off $5 Support Level

Internet Computer (ICP) retreated 2.4% to $5.08 over 24 hours but recovered 3.2% from intraday lows of $4.97 to $5.13. Volume surged 56% above average at 05:00 UTC, indicating buyer interest at key support.

Bitcoin ETFs Bleed Millions for 4th Straight Day as U.S. Stagflation Fears Weigh on BTC and Stocks

Investors withdrew $196 million from U.S.-listed bitcoin ETFs for a fourth consecutive day amid stagflation concerns after weak U.S. ISM services PMI data. Ether ETFs attracted $73.22 million in inflows. Market declines in tech stocks and cryptocurrencies followed the release of pressing economic indicators.

Bitcoin ETFs Suffer Fourth Consecutive Day of Outflows Amid Stagflation Concerns

U.S.-listed bitcoin ETFs saw net outflows of $196 million over four consecutive days. Ether ETFs attracted $73.22 million in inflows after SEC staking guidance. Stagflation fears from U.S. services PMI pressured risk assets.

Bitcoin Struggles to Hold $115K; Solana and Dogecoin Show Strength

Bitcoin remains below $115,000 after a drop that triggered over $1 billion in leveraged liquidations. Ethereum recovered toward $3,650 amid institutional inflows, while Solana and Dogecoin underperformed amid fragile sentiment.