Citi Forecasts Stablecoin Market Could Reach $4 Trillion by 2030

Citi raised its 2030 issuance forecast for stablecoins to a $1.9 trillion base case and a $4 trillion bull case. Report highlights potential for $200 trillion in annual transactions and warns that bank tokens may overtake stablecoins in volume.

Crypto millionaires surge 40% as bitcoin market hits $3.3 trillion

The number of individuals with $1M+ in crypto holdings jumped 40% year-over-year to 241,700, according to Henley & Partners’ Crypto Wealth Report 2025. This increase coincides with a rally that boosted total digital asset market capitalization to $3.3 trillion in June, up 45% year-on-year. Singapore, Hong Kong, and the U.S. lead in crypto-friendly jurisdictions, reflecting growing institutional and retail interest.

Arthur Hayes Predicts Bitcoin to Hit $250K by Year-End on Wave of Liquidity

Arthur Hayes forecasted Bitcoin rising to $250,000 by December, driven by anticipated US liquidity expansion. The prediction followed comments on expected Treasury currency expansion and Fed rate cuts under the new administration. The outlook also covered potential Fed governance changes.

‘Diamond Hand’ APX Holder Turns $226K into $7M Amid ASTER Swap Rally

Wallet 0x9d22, which acquired APX tokens worth $226 000 in 2022, now holds $7.07 million following a 120 percent surge after ASTER swap upgrade. APX Finance runs a high-leverage DeFi exchange on BNB Chain and Arbitrum. TVL crossed $2 billion briefly post-swap.

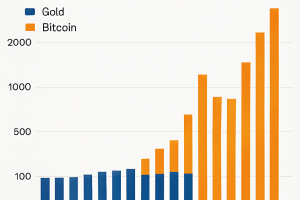

Gold vs Bitcoin: Performance through Money Supply Lens

Analysis comparing gold’s and bitcoin’s peaks relative to M2 money supply reveals divergent performances. Gold remains below its 2011 high against money supply. Bitcoin set a new record high relative to M2 in its latest bull cycle, underscoring differing roles as hedging and growth assets.

Hayes Predicts ‘Up Only’ Crypto Market as ETH Staking Exit Queue Grows

BitMEX co-founder Arthur Hayes predicted the crypto market will be “up only” once the US Treasury’s General Account hits $850 billion. The week’s digest highlighted Ethereum’s 45-day staking exit queue and a poll showing 40% of Americans are open to DeFi under proposed legislation.

Bitcoin consolidates at $115K as BlackRock ETF inflows fuel $125K rally odds

Bitcoin consolidated near $115,000 as BlackRock’s spot Bitcoin ETF recorded $3.1 billion inflows over ten days. Kalshi bettors now assign a 69% probability of BTC reaching $125,000 by November 2025. A golden cross at $114,000 underpins bullish momentum.

Crypto whales accumulate LINK, CRO, and TON this week

On-chain data reveals major whale addresses acquired 2.5 million LINK valued at $61 million, increased Cronos (CRO) holdings by 29%, and boosted Toncoin (TON) balances by 5% over mid-September. The concentrated purchases suggest bullish sentiment for these altcoins and potential price rallies toward key resistance levels.

Analyst Predicts ‘Uptober’ Rally for Bitcoin Regardless of Fed’s FOMC Decision

Two crypto analysts highlight bitcoin’s seasonal strength ahead of October, noting bitcoin’s relative underperformance versus gold and the S&P 500 since the post-election rally. Analysis of past September FOMC meetings suggests a tendency for bitcoin gains in the period, reinforcing the “Uptober” trend. The report finds bitcoin trading near key support while markets await the Fed announcement.

How High Can Bitcoin Price Go?

Bitcoin rallied over 10% since June 5 to reach $110,000, driven by strong market-wide momentum. Analysts project further gains toward $120,000–$150,000, while some forecast a long-term target of $1 million based on institutional interest and macro tailwinds.

Can XRP Outperform Bitcoin Further This Bull Cycle?

XRP/BTC has gained around 300% since November, fueled by Ripple’s SEC settlement and ETF speculation. A classic bullish reversal pattern against bitcoin signals a 100–250% upside potential for XRP/BTC in the current bull cycle if momentum sustains.

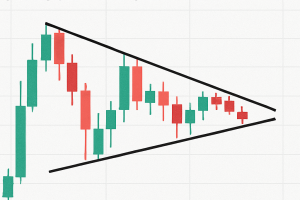

Dogecoin Targets $0.60 After 40% Weekly Rally

Dogecoin broke out of a symmetrical triangle on weekly charts with trading volumes tripling during the breakout. The technical setup and on-chain momentum suggest a potential rally of up to 95%, targeting a $0.60 price level in the coming weeks.

Bitcoin Climbs as Economy Cracks — Bullish or Bearish

CPI increased 0.4% MoM vs 0.3% forecast while U.S. job data revisions showed the largest downward adjustment in history. Bitcoin topped $116,000, maintained higher lows near the $117,300 CME gap, and held its 200-day moving average, signaling resilience.

Three Risks That Could Spoil Bitcoin Rally to $120K

Bitcoin’s breakout case faces three key headwinds: a bull fatigue zone near the 50-day SMA, possible dollar index overpricing of Fed cut expectations, and constrained downside in 10-year Treasury yields. Caution advised despite inverse head-and-shoulders breakout potential.

Crypto Pundits Remain Bullish Despite Stagflation Risks

Despite early signs of U.S. stagflation with August CPI at 2.9% and unemployment claims surging, experts maintain a bullish outlook on Bitcoin and select altcoins. Anticipated Fed rate cuts on September 17 underpin market optimism, with resilience noted in MAG7 stocks and tokens like SOL and HYPE.

Solana hits seven-month high as Bitwise exec predicts epic year-end run

Solana surged over 4% to a seven-month high near $225, fueled by corporate treasury accumulations and ETF anticipation. Bitwise CIO Matt Hougan projected an 'epic' year-end rally, citing pending spot ETF approvals and major private investments.

Bitcoin Retakes $112K, SOL Hits 7-Month High as Economists Downplay Recession Fears

Major tokens reclaimed highs as economists downplayed fears of stagflation and recession after significant U.S. jobs data revision. Bitcoin and Solana led gains following a downward adjustment of 911,000 jobs. Market reaction reflected confidence in trend resilience.

What Next as XRP Slumps After Failed Breakout Above $3

XRP failed to sustain gains above $3 following heavy institutional selling that pushed the price back to $2.94. Traders now monitor SEC’s October ETF decisions, Fed’s September 17 rate cut, and record-high exchange custody balances for near-term selling pressure.

FIL Pares Gains After Testing $2.50 Resistance Level

Filecoin’s FIL token retraced to $2.43 on Sep 9, 2025 after encountering resistance near $2.50. On-chain and trading data highlight a support zone around $2.38, while trading volumes remain subdued compared to recent volatility spikes, indicating mixed sentiment among traders.

Bitcoin climbs above $112,000 while derivatives data reflect trader caution

Bitcoin surpassed $112,000 amid mixed signals from derivatives markets, where options delta skew and futures funding rates point to persistent risk aversion. Spot ETF outflows and Macro factors may also be influencing sentiment. The move above $110,000 failed to trigger a sustained surge, as traders weigh broader market dynamics.

XRP Consolidates Under $3 Amid Descending Triangle Pattern

XRP has consolidated below the $3 level after testing resistance at $2.90–$2.92 on high volume, facing repeated rejections. Futures markets price nearly certain Fed rate cuts on September 17, shaping institutional inflows. Traders watch for a sustained break above $2.90 to target $3.00–$3.30.

Dogecoin Forms Higher Lows as Resistance Persists

Dogecoin exhibited controlled intraday trading between $0.213 and $0.221, with buyers defending lower bounds and sellers capping rallies. Technical indicators signal consolidation under resistance, awaiting volume-backed breakout confirmation.

MYX Finance ATH Surge Raises Pump-and-Dump Concerns

MYX Finance token hit a record high after a 167% rally, doubling market cap and spiking volume. Analysts flagged potential manipulation due to token unlocks, whale-triggered liquidations, and thin liquidity amplifying price movements.

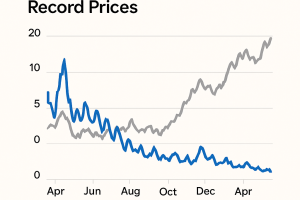

Ethereum Network Fees and Revenue Decline Despite Record Prices

Ethereum network fee revenue fell 44% in August to $14.1 million, down from July’s $25.6 million, amid an ETH price rally to $4,957. Overall network fees dropped by 20% month-over-month following the Dencun upgrade that reduced layer-2 transaction costs.

Bitcoin taps $111.3K as forecast says 10% dip ‘worst case scenario’

Bitcoin price rebounded above $111,000 into the weekly close, but Fibonacci retracement analysis suggests a potential maximum downside of about 10%, targeting $100,000 as a “logical” bounce zone. Traders highlight key resistance at $112,000 and major moving averages as decision points for the next move.

“Binance Dollars” Replace Venezuela’s Bolívar as Inflation Hits 229%

With annual inflation at 229 percent, Venezuelans increasingly use USDT stablecoins—dubbed “Binance dollars”—for daily payments. Chainalysis data rank Venezuela ninth in per-capita crypto use amid capital controls.

Crypto Market Sentiment Shifts to Fear as Interest in Altcoins Wanes

Crypto market sentiment moved into Fear as traders shift focus from obscure altcoins to major assets. Santiment data show subdued risk appetite, with Bitcoin, Ether and XRP dominating discussions on asset allocation.

Crypto Sentiment Shifts Into Fear as Altcoin Interest Wanes

Crypto market sentiment has slipped into Fear according to Santiment, with traders shifting focus from obscure altcoins to major assets like BTC and ETH. The Crypto Fear & Greed Index fell to 44, signaling cautious risk appetite and debate over which large-cap asset will lead the next breakout.

Spot ether ETFs incur $952M outflows amid recession fears

Spot ether exchange-traded funds recorded five consecutive days of outflows, losing $952 million as investors rotated away over concerns of an economic downturn. Despite the withdrawals, ether’s price rose more than 16% over the past month driven by stablecoin and ETF developments.

FIL Rises 3% Amid Pronounced Trading Volatility, Volume Surges

Filecoin rebounded 3% to $2.32 after a prior 2% decline, as high-volume volatility unfolded. Technical analysis identified support in the $2.23–$2.24 range and resistance at $2.38, reflecting shifting market dynamics amid institutional selling pressure.

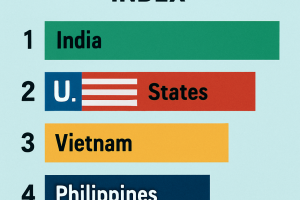

U.S. climbs to second in 2025 global crypto adoption index

Chainalysis reports that the United States has risen to second place in its 2025 Global Crypto Adoption Index. Regulatory clarity and burgeoning ETF inflows were cited as key drivers. India retained the top position, while APAC led regional growth, and Eastern Europe topped population-adjusted rankings.

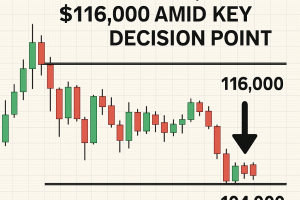

Bitcoin consolidates between $104,000 and $116,000 amid key decision point

Bitcoin trades in a narrow range between $104,000 and $116,000 after a mid-August peak. On-chain data indicates investor accumulation around $108,000, filling a cost-basis gap. Breach below $104,100 could signal exhaustion, while recovery above $114,300 may renew upward momentum.

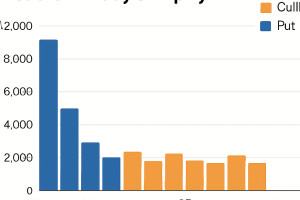

Bitcoin Options Tilt Bearish Ahead of Friday's Expiry

Crypto options open interest leans bearish ahead of the $4.5 billion Deribit expiry on Friday, with bitcoin put volume dominating and a max pain point at $112,000. Ether options remain balanced but show growing call interest above $4,500 ahead of key macroeconomic events.

Bitcoin Slips Below $110K as Analysts Weigh Risk of Deeper Pullback

Bitcoin fell below $110,000 following a stalled midweek rebound, sliding 2.2% to trade near $109,500. Bitfinex analysts forecast a potential support zone between $93,000 and $95,000 for this correction. Strategic factors may set the stage for a renewed rally in the last quarter.

Dogecoin Price Analysis: Lower Highs Form as Volume Expands on Declines

Dogecoin advanced 4% as volumes surged, testing $0.223 resistance while holding $0.214 support. Analysts disagree on next move: breakdown toward $0.17 Fibonacci support or upside to $1.00 based on historical patterns and ETF approval odds.

Gold Outshines Bitcoin in 2025 as BTC-Gold Ratio Poised for Q4 Breakout

Gold’s 33% year-to-date gain has outpaced bitcoin and equity benchmarks, reducing the BTC-XAU ratio to its lowest since late 2021. Technicals show an ascending triangle pattern dating to 2017, signaling a potential breakout in Q4 or early 2026.

Solana Surges 33% Since August, Analyst Sees More Upside

Solana has outperformed major cryptocurrencies with a 33% gain since early August, driven by fund inflows and rotation from BTC and ETH. Up to $2.6 billion in treasury and ETF demand could fuel further upside. Retail and institutional flows underpin bullish patterns.

Crypto Markets Today: Bitcoin Languishes as Altcoins Outperform

Bitcoin traded near $112,470 on Sept. 3, underperforming major altcoins such as Ether and Solana. Open interest climbed to $114 billion, with liquidation clusters signaling key resistance at $112,200 and support near $110,000. Market breadth favored smaller tokens amid muted volatility.

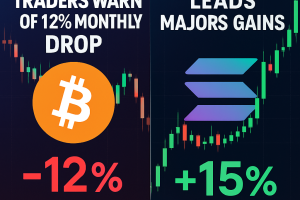

Bitcoin Traders Warn of 12% Monthly Drop as Solana Leads Majors Gains

Seasonal precedent and fragile sentiment warn of further bitcoin weakness in September after historical average losses of 12%. Crypto market cap slid to a three-week low of $3.74 trillion as Solana outperformed with 4% gains. Traders cite macro uncertainty, thin volumes and lack of catalysts as drivers of caution.

Crypto.com CEO Foresees Q4 Rally on Fed Rate Cut

Crypto.com CEO Kris Marszalek predicts that a Fed rate cut at the Sept. 17 meeting will drive a strong fourth-quarter for digital assets. With a 91.7% probability priced into CME futures, Marszalek expects improved revenue and plans to explore prediction market and IPO opportunities under easing policy.

XRP Trading Idea: Triangle Setup Eyes $3.30 Rally

XRP traded between $2.76 and $2.86 amid geopolitical and Fed rate-cut uncertainties, with whale accumulation of 340 million tokens over two weeks. A symmetrical triangle pattern supports a breakout toward $3.30 if key resistance levels at $2.86 and $3.00 are cleared.

DOGE/BTC Breakout Signals Upside if $0.22 Clears

Dogecoin reversed midday pressure with a 4% intraday swing and closed up 1% at $0.213 on 21% above-average volume. A descending triangle pattern on DOGE/BTC pairs has broken upward, suggesting a continuation toward $0.25 if the $0.22 level holds.

Asia Morning Briefing: Stablecoins Link Crypto Liquidity to Fed Policy

Stablecoin market has almost doubled to $280 billion in a year, tying crypto liquidity directly to Federal Reserve policy. Analysts forecast growth to $1.2 trillion by 2028 and debate potential stability risks akin to a 2008-style liquidity crunch. Experts call for unified market structures to deliver efficiency and resilience.

Investors Eye Volatility Risks as September Market Reset Arrives

Wall Street reopened from Labor Day with heightened uncertainty. Investors are bracing for volatility spikes as seasonal factors, tariff policy outlook and economic data releases converge this week.

Bitcoin Long-Term Holders Spend 97K BTC in Largest One-Day Move of 2025

Long-term BTC holders offloaded 97,000 BTC in a single day, marking the largest patient-holder sell-off this year and triggering a 3.7% price drop to $108,000, while market trading held near $103,330 amid elevated 14-day average spending.

XRP Set for Higher Prices as MACD Nears Potential Bullish Crossover

XRP rose 3% over the past 24 hours as MACD histogram approached a bullish crossover, supported by whale buys of 340M tokens and institutional volumes nearly doubling average, amid lingering September seasonality and pending ETF rulings.

Bitcoin Clings To $109K As Whales Rotate Into Ethereum

Bitcoin hovered near $109 000 as large holders shifted significant capital into Ether and UK government bonds. Rising bond yields and looming US jobs data weighed on Bitcoin’s near-term outlook, while further rotations raised market uncertainty.

Polygon Leads Crypto Gains With 16% Weekend Surge as CoinDesk 20 Index Holds Steady

Polygon’s POL token surged 16% over the weekend, topping $0.29 after integration announcements and U.S. government blockchain initiatives. The CoinDesk 20 Index remained largely unchanged amid modest bitcoin and ether movements.

Asia Morning Briefing: August ETF Flows Show Massive BTC to ETH Rotation

U.S. Bitcoin ETFs saw $751 million in net outflows in August as Ethereum spot funds attracted $3.9 billion. On-chain data reveals Bitcoin holders under water, risking further declines toward $93,000–$95,000. Ethereum’s steady inflows delivered 25% gains over 30 days, indicating institutional rotation.

Bitcoin Risks Labor Day Crash to $105K Amid Whale Selling

Closed US markets for Labor Day and possible selling by an OG Bitcoin whale have created bearish pressure, risking a drop to $105,000. Sellers dominate futures and spot markets despite dip-buying activity.

Red September: Bitcoin Risks Sliding to $100K After Monthly Drop

Bitcoin breached key support levels, indicated by Ichimoku cloud and moving average breakdowns, signaling bearish momentum. A 6.5% August drop ended a four-month rally amid $751 million ETF outflows. Seasonal trends point to risk toward $100,000.

Bitcoin bull market will be 'over' if $100K BTC price is lost

Bitcoin faces a critical support retest at $100,000, which a popular trader warns will end the current bull market if breached. RSI divergences are clashing, with bearish signals dominating, though some analysts see buying opportunities near six-figure levels.

Bitcoin’s Rough August Wiped Out Summer Rally; September May Bring More Pain

Bitcoin fell 8% in August, erasing gains from its summer rally and closing below Memorial Day levels. Ether outperformed with a 14% gain, driven by treasury and ETF inflows. Historical seasonality suggests September is often bearish for bitcoin.

Major Bitcoin Breakout Brewing as Retail and Institutions Stack ‘Relentlessly’

Data indicates retail and institutional bitcoin accumulation reached the highest levels since April, absorbing over 140,000 BTC in July–August. Institutional demand in 2025 has outpaced new bitcoin supply by more than 6×, suggesting a potential breakout while price remains near $109,000.

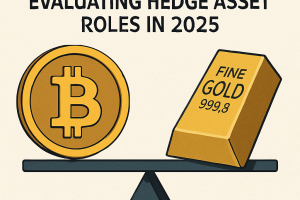

Bitcoin vs Gold: Evaluating Hedge Asset Roles in 2025

Analysis from Bitwise highlights that gold remains the preferred hedge during equity market downturns, while bitcoin offers stronger protection against bond market stress. Year-to-date, gold has rallied over 30%, bitcoin about 16%, reflecting diverging responses to equity volatility and rate pressures.

Will Bitcoin Price Drop in September?

September has historically been a weak month for Bitcoin, with 8 of the past 12 Septembers closing lower, averaging −3.8% returns. However, green Septembers often follow painful August drawdowns. Technical patterns show hidden bullish divergence and key support at $105k-$110k, suggesting potential for a rebound toward $124,500 within 4-6 weeks.

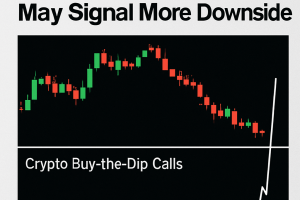

Crypto ‘Buy the Dip’ Calls Are Spiking, Which May Signal More Downside

Social media mentions of “buy the dip” have surged following Bitcoin’s 5% decline over the past week, according to Santiment. Historically, peak ‘buy the dip’ chatter can precede further market weakness, as real bottoms form in fear-driven environments. Crypto Fear & Greed Index remains in Neutral as traders eye altcoin season ahead.

XRP Bullish Patterns Point to $5 as Korean Buyers Start to Accumulate

XRP fell 4.3% in 24 hours to $2.89 on above-average volumes before recovering toward $2.83-$2.89 support. Korean exchanges absorbed 16 million XRP, indicating institutional demand. Technical indicators show RSI recovery from oversold territory and a potential cup-and-handle pattern targeting $5 if key resistance at $3.02 breaks.

Given Trump’s Pro-Crypto Stance, Is It Time to Fully Ditch Gold for Bitcoin

Bitwise’s André Dragosch argues that gold hedges equity risk while Bitcoin offers resilience against bond stress. Historical data show gold outperforms during stock declines and Bitcoin during Treasury sell-offs. Year-to-date, gold rose 30% and Bitcoin 15% as investors weigh macro risks.

Crypto treasury firms draw comparisons to 2008 CDO risks, warns exec

Crypto treasury firms are introducing layered risks akin to 2008’s collateralized debt obligations, according to industry executives. These structures may reintroduce counterparty and systemic vulnerabilities into digital asset portfolios.