Ether Price Target Raised to $7.5K by Year-End and $25K by 2028

Standard Chartered analysts lifted Ether price forecasts to $7,500 by end-2025 and $25,000 by end-2028, citing accelerating institutional demand, favorable regulation, and network upgrades. The analysts highlighted stablecoin growth and corporate treasury allocations as key drivers.

NEAR Rallies on Institutional Inflows, Surges Past Resistance Levels

NEAR Protocol climbed 5.82% to $2.91 between August 12 16:00 and August 13 15:00, driven by over $7.6 million in institutional inflows. The rally broke multiple resistance points and established support at $2.76 before short-term volatility capped gains near $2.94.

XRP gains 4% as Ripple-SEC settlement spurs institutional buying

XRP rose 4% on August 13, climbing from $3.15 to $3.25 after Ripple Labs and the SEC dismissed their appeals, concluding years of litigation. Daily trading volumes increased by 208%, with mid-session rallies testing $3.30 resistance. Technical indicators show support at $3.25–$3.26 and resistance at $3.30 amid controlled profit-taking in final trading hours.

ETHUSD Surpasses $4,500 Resistance in Recent Rally

ETHUSD price breached the $4,500 resistance mark amid a continued short-term bullish trend. Trading remained above EMA50, and RSI entered overbought territory. Positive momentum may persist if support at the moving average holds.

Bitcoin Faces Resistance Around $120,000 Level

Bitcoin price declined after testing the $120,000 resistance zone, supported by short-term bullish trend dynamics. EMA50 maintained a support base while RSI signalled oversold conditions. Potential for renewed upward momentum exists if resistance barrier is breached.

Ether, Cardano, XRP Among Cryptos Taking New Leg Higher as Scott Bessent Floats 50 Basis Point Rate Cut

Altcoins rallied following U.S. Treasury Secretary Scott Bessent’s suggestion of a 50 bps rate cut, with Ether topping $4,600 and Cardano, Solana, XRP, Avalanche and Litecoin logging strong gains. Bitcoin remained near $120,000 underperforming major altcoins.

Bitcoin Weekend Surge Leaves CME Futures Gap

CME bitcoin futures closed Friday at $117,430 and reopened Monday at $119,000, creating a price gap. Historical patterns suggest such gaps often fill, but strong momentum near all-time highs could leave it open longer.

Calm Before the Storm as Bitcoin Volatility Wakes Up

Bitcoin’s implied volatility rose from 33 to 37 after hitting multi-year lows, signalling potential for sharp price swings. A spot-driven weekend rally from $116,000 to $122,000 suggests underlying strength while open interest trends lower.

Calm Before the Storm Expected as Bitcoin Volatility Wakes Up

Bitcoin’s implied volatility index (DVOL) jumped from 33 to 37 after hitting multi-year lows, suggesting a return of market risk appetite. Weekend spot rally drove prices from $116,000 to $122,000. Rising volatility often precedes sharper price swings, prompting traders to prepare for potential breakout or corrective moves.

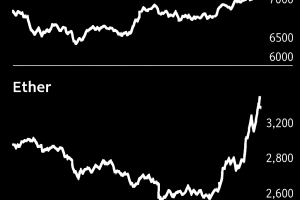

Ether Volatility Spikes on Rally as Bitcoin Edges Back Toward Record Highs

Ether volatility (IV) rose sharply to 37 after reaching multi-year lows, reflecting increased trader expectations for larger price moves. Bitcoin also advanced, approaching record highs. Pro-crypto regulatory signals and ETF inflows underpin market strength, with further upside anticipated ahead of key macroeconomic releases.

Almost 97% of All Ether Holders Are Now in the Green. What Next?

Ether’s rally has resulted in 97% of addresses holding profits, marking the highest in-year figure. Rising profitability may increase sell-side pressure and dampen further price gains. Data shows profit-taking has already climbed to a seven-day average of $553 million per day.

Zora Surges 50% as Perps Listings and Base Ecosystem Flows Drive Breakout

Zora jumped nearly 50% to $0.13 as a major whale purchase triggered a wave of momentum trades amid strong on-chain minting activity. Trading volume spiked to $284 million after Binance and other venues listed ZORA perpetual contracts, deepening liquidity and compressing spreads.

Bitcoin Bulls Take Another Shot at the Fibonacci Golden Ratio Above $122K as Inflation Data Looms

Bitcoin tested the 1.618 Fibonacci extension at $122,056 amid rising U.S. inflation expectations, with BTC briefly topping $122,000. Call option open interest at $140,000 hit $3 billion as traders awaited core CPI data, while a failure to hold above the golden ratio could trigger a deeper correction.

XRP Rallies Above $3.25 After Ripple-SEC Settlement as Institutional Interest Surges

XRP jumped 11% to $3.27 following the formal dismissal of the SEC’s lawsuit against Ripple Labs, as institutional trading volumes surged 208% to $12.4 billion. The breakout cleared key resistance at $3.24, with $3.15 acting as a new support zone amid heightened derivatives activity.

Ether Volatility Spikes on Rally as Bitcoin Edges Back Toward Record Highs

Ether rallied over 21% in the past week, driving implied volatility sharply higher even as Bitcoin climbed 3% toward new record highs. Heavy inflows into ETH and BTC ETFs and supportive regulatory signals underpinned the gains amid a broader equity market rally.

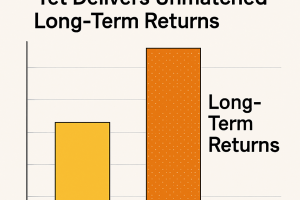

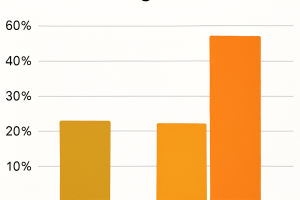

Bitcoin trails gold in 2025 yet delivers unmatched long-term returns

Bitcoin’s 25.2% gain so far this year ranks second only to gold’s 29% advance. Since 2011, bitcoin has outperformed gold by over 308,000×, eclipsing returns from stocks, real estate and other major asset classes, highlighting its long-term strength.

Bitcoin Price Could Reclaim $95,000 — But Watch Out For Resistance Level

Analyst Ali Martinez identifies a symmetric triangle pattern on Bitcoin’s four-hour chart, narrowing toward its apex. A breakout above the descending trendline could propel BTC 15 percent higher to $95,000. Key resistance converges near $87,000, requiring close monitoring to validate bullish continuity.

Ether Price Target Now $20K as ETH Prepares All-Time High in 1–2 Weeks

Ether has broken above $4,200, trading within a long-established ascending channel. Popular analyst Merlijn projects a breakout above the channel ceiling to $20,000 within two weeks, driven by momentum coiling and RSI reset. ETH/BTC still requires 150 percent gains to revisit 2021 relative highs.

XRP Stalls But Holds Line at $3.30 After Explosive Rally

XRP stalled at $3.30 resistance after a bullish surge, with indecisive daily candlesticks signalling consolidation. On the BTC pair, prices held above 0.0028750 BTC. Key support at $2.80 must hold to avoid deeper correction.

Bitcoin Trails Gold in 2025 but Dominates Long-Term Returns

Bitcoin has risen 25.2% year-to-date in 2025, second only to gold’s 29.3% gain. Since 2011, bitcoin’s total return of nearly 38.9 million percent dwarfs gold’s 126% cumulative gain, highlighting its unmatched long-term performance. The annualized return of 141.7% for bitcoin far exceeds gold’s 5.7% and equity benchmarks.

Commodity-Backed Cryptos Hit 5-Year Minting High Amid Gold Trade Turmoil

Commodity-backed tokens led by gold-backed cryptocurrencies saw issuance volumes surge to $439 million this week, the highest in five years. The minting spike followed gold futures hitting $3,500 amid U.S. tariffs on Swiss gold exports. Tokens like Tether Gold and Paxos Gold briefly topped $3,390 before retreating.

ETH Jumps 7% to $4,200, Highest Since December 2021

Ether surged 7% to $4,200 on Binance early Saturday after breaking the $4,000 resistance, propelled by $207 million in short liquidations and heavy trading. Analysts forecast that this rally could trigger an altcoin rotation and precede a shift back into Bitcoin toward $120,000–$140,000.

Capriole founder says Bitcoin undervalued vs energy value metric

Charles Edwards of Capriole Investments asserts that Bitcoin’s market price at $116,000 trades at a significant discount to its proprietary Energy Value metric, which suggests fair value up to $167,800. The model ties valuation to mining cost, energy input, and supply growth.

XRP Surges 12% as Traders Bet on Big Price Swings with 'Straddle' Strategy

XRP rallied 12% to $3.37 as traders used straddle options strategies to profit from expected volatility. Open interest in XRP options rose sharply, reflecting confidence in large intraday price movements amid regulatory clarity.

XRP Bull Flag Points to $8 as Ripple-SEC Case Reaches End

XRP climbed 11% with trading volume reaching 300 million, driven by institutional buying and a legal resolution ending the SEC’s appeal against Ripple. Bull-flag chart patterns suggest a breakout target near $8 amid renewed market interest.

Policy, Innovation and Market Trends Fueling Institutional Crypto M&A

AlphaPoint’s Reba Beeson outlines key policy shifts—spot BTC and ETH ETF approvals, Project Crypto, and MiCA discussions—driving a surge in crypto M&A. Regulatory clarity combined with strategic acquisitions is reshaping digital asset infrastructure and cross-border expansion.

XRP Pushes Through $3 as Ripple-SEC Appeal Decision Looms

XRP climbed above $3 after breaking through multiple resistance levels, driven by high-volume buying on Korean exchanges. The price surge coincides with an upcoming SEC hearing on Ripple’s appeal withdrawal, while SBI Holdings filed for a Bitcoin-XRP ETF, signaling growing institutional interest.

Bitcoin Steadies as Short-Term Holder Profit-Taking Slows

On-chain indicators show a retreat in Bitcoin profit-taking by short-term holders after recent rallies, pointing to potential price stabilization. Key metrics such as the spent output profit ratio have moderated, reflecting a drop in liquidations and growing confidence among market participants.

Ethereum Treasury Companies Surpass Spot ETH ETF Inflows, Standard Chartered Reports

Standard Chartered Bank data shows corporate Ethereum treasury holdings have grown by 1.6% of circulating supply since June, matching the pace of U.S. spot ETH ETF purchases. Treasury companies benefit from staking yields and DeFi access, making them more attractive to institutional investors than ETFs.

Bitcoin Holds Above $114,500 as Institutional Inflows Return

Bitcoin steadied above $114,500 after investment products saw renewed inflows, lifting institutional sentiment. Ethereum and major altcoins also recorded gains. Analysts highlighted key liquidity zones and forecast a potential rally if critical resistance levels are breached.

Bitcoin, Ether, XRP Price Bump Pushes Market Sentiment to ‘Greed’

The Crypto Fear & Greed Index rose to 62, returning to “Greed” as major cryptocurrencies saw gains. Bitcoin gained 1%, Ether rallied over 2%, and XRP added 2.14% in 24 hours. Analysts cite the uptick as a sign of near-term market stability and potential bullish breakout.

Standard Chartered Flags ETH Treasury Stocks Over ETFs as Better Buys

Standard Chartered research shows Ethereum treasury companies and ETH ETF holders each purchased 1.6% of circulating ETH since June, normalizing NAV multiples and enhancing appeal. Analyst Geoff Kendrick argues treasury stocks offer regulatory arbitrage and similar price exposure with lower ETF import risks, recommending treasury plays over spot ETH ETFs.

Standard Chartered Flags Ethereum Treasury Stocks Over ETFs

Standard Chartered analyst recommends ether treasury companies as more attractive than ETH spot ETFs, citing normalized NAV multiples and similar supply exposure. Treasury firms and ETFs each hold about 1.6% of circulating ether.

Benchmark Sees 3× Upside in Semler Scientific Stock

Benchmark reiterated a buy rating and $101 price target on Semler Scientific, citing undervaluation relative to its bitcoin holdings. Semler’s strategy combines operating cash flow, convertible debt and ATM issuances to grow BTC treasury.

Long-Term BTC Bullishness Evaporates as Options Skew Turns Neutral

Bitcoin’s 180-day implied volatility skew has retreated to zero, signaling a shift from bullish to neutral sentiment. Rising inflation concerns and disappointing economic data have weighed on far-dated call premiums, complicating a sustained rally outlook.

Lookback Call Option Gains Appeal Amid Low Volatility

Lookback call options allow acquisition of bitcoin at the lowest price during a set period, offering strategic entry. Low implied volatility has increased appeal for this structured product, despite a higher premium of 12.75% versus 9.25% for standard calls.

Bitcoin Treasury Firm Semler Scientific Still Has 3X Upside: Benchmark

Benchmark analyst Mark Palmer reiterated a buy rating and $101 price target on Semler Scientific (SMLR) after second-quarter results, noting the stock trades near the value of its bitcoin holdings and overlooks leverage plans. Semler’s slow-growth strategy uses operating cash flow and convertible debt to expand BTC reserves, targeting 10,000 BTC by year-end and 105,000 by 2027.

A Year Ago, Bitcoin Hit $49K on Yen Carry Trade Unwind; Now Up 130%

On August 5, 2024, Bitcoin fell to $49,000 following an unwind of the yen carry trade. Over the past year, the largest cryptocurrency surged 130% amid rising bond yields and equity gains. Long-term holders now control over 8% of the circulating supply, indicating deepening conviction in Bitcoin’s value proposition.

Bitcoin's Long-Term Bullishness Evaporates From Options Market as Inflation Concern Rises

Long-term Bitcoin options skew has shifted to neutral territory, with the 180-day skew retreating to zero amid rising inflationary pressure and macroeconomic uncertainty. Analysts warn that tariffs and supply chain disruptions may elevate core inflation, complicating potential Federal Reserve rate cuts. Market sentiment reflects increased demand for downside protection.

Ethereum Price Battles Key Levels – Will Buyers Step Back In?

Ethereum price found support near $3,400 and reclaimed levels above $3,550 and the 100-hour SMA, with a bullish trend line at $3,620. Key resistance zones at $3,720 and $3,750 must be cleared to target $3,800 and beyond in the coming sessions.

XRP leads market gains, Bitcoin nears $115K as Trump tariffs sour bullish crypto mood

Bitcoin and ether stabilized after U.S. spot ETF outflows drove prices lower, while fresh tariffs and Fed rate-cut skepticism added volatility. XRP surged over 5% to lead market gains, with opportunistic buyers stepping in amid a cautious institutional liquidity backdrop.

Dogecoin Dragged Lower by Outflows With Technicals Flagging Bearish Continuation

Dogecoin fell four percent in 24 hours, sliding from $0.20 to $0.19 amid heightened trading volumes and global economic headwinds. Technical analysis indicated resistance around $0.202–$0.203 and support near $0.188–$0.190, with surging volume signaling strong selling pressure and potential for continued volatility.

Analyst flags $112K pullback zone as optimal entry for Bitcoin bulls

CoinDesk analysis notes bitcoin’s climb toward $120 K leaves late entrants debating risk-reward. 10x Research’s Markus Thielen suggests a retest of May’s $111,673 breakout would offer a 1:2 risk ratio, while a clean break above $120 K could justify tighter stops.