No question Bitcoin will hit $1M, says Eric Trump at BTC Asia 2025

Eric Trump stated at the BTC Asia 2025 conference that Bitcoin will reach $1 million in the next several years, citing widespread institutional and nation-state adoption. He noted current market participants remain early adopters.

Crypto ETF Surge Could Reshape Market, but Many Products May Fail

Over 90 crypto ETF applications are awaiting approval by U.S. regulators, potentially transforming institutional and retail access to digital assets. Analysts predict most filings will be greenlit but warn of inevitable closures among niche altcoin products. Investor demand is expected to determine the winners in this crowded field.

Bitcoin Whale Moves $1B from Bitcoin to Ethereum

A $5 billion Bitcoin holder shifted $1 billion into Ethereum via Hyperliquid, extending a recent buying spree that saw $2.5 billion in ETH acquisitions. The whale’s actions have contributed to a 14 % rise in ETH price and highlight growing confidence in Ethereum.

Eric Trump Predicts Bitcoin Will Reach $1 Million

Eric Trump forecast that bitcoin will hit $1 million within several years during a panel at the Bitcoin Asia conference in Hong Kong, highlighting surging institutional demand and limited supply. China’s efforts on yuan-backed stablecoins and Hong Kong’s stablecoin bill were also noted as key developments.

Bitcoin traders: BTC must close week above $114K to avoid ‘ugly’ correction

Traders warn that Bitcoin must close the week above $114,000 to prevent a deeper 6% correction toward $103,000. Technical analysis highlights failed support at $112,000 and a bear flag pattern signaling increased downside risk without recovery above key levels.

Bitcoin Projected to Reach $190K Based on Institutional Inflow Model

Tiger Research projects bitcoin could reach $190,000 using a model with a base price of $135,000, augmented by 3.5% fundamentals and 35% macro multipliers. The forecast reflects a 67% increase from current levels and is driven by institutional ETF demand and liquidity metrics.

ETH possibly bullish ‘for years’ as megaphone pattern to $10K emerges: Analyst

A weekly megaphone pattern on Ethereum’s chart suggests widening price swings and a long-term bullish cycle targeting $10,000. Analysts warn of short-term shakeouts but view the multi-year expansion phase as intact once resistance is cleared.

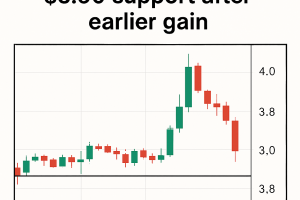

Polkadot’s DOT returns to $3.90 support after earlier gain

Polkadot’s DOT climbed as much as 2% intraday before retreating to the $3.90–$3.91 support zone on heavy volume. Institutional accumulation indicators suggest professional traders are repositioning ahead of further upside.

SOL Emerges as Next Major Altcoin Bet after ETH Rally

SOL outperformed major cryptocurrencies with a 7.68% 24-hour gain, trading above $208.24. Analysts cited technical breakouts, growing treasury demand and a potential SEC spot ETF approval as key drivers. Launch of a new institutional-grade validator further supports network adoption.

XPL Futures on Hyperliquid See $130M Wiped Out Ahead of Plasma Token Launch

More than 80% of open interest in Plasma’s XPL futures on Hyperliquid vanished overnight as a whale-triggered price spike of over 200% in two minutes auto-deleverage cascaded liquidations. Open interest collapsed from $160 million to $30 million, with a single whale netting $16 million and another $25 million in gains.

Bitcoin LTHs Realize 3.27M BTC in Profits, Exceeding 2021 Cycle

Since early 2024, long-term Bitcoin holders have realized 3.27M BTC in profits, surpassing the 2021 cycle and second only to 2017, driven by dormant coin movements and ETF-facilitated liquidity rotation.

Asia Morning Briefing: ETH Bulls Eyeing $5K as Flows Strengthen

Ethereum’s chances of reaching $5,000 this month have increased to 26% on Polymarket as institutional flows strengthen. Market liquidity is shifting towards Ethereum amid new altcoin narratives, while Bitcoin faces $940 million in liquidations. Macro data later this week may test the sustainability of current momentum.

Standard Chartered Sees Ether Treasury Companies Undervalued After Recent Plunge

Since June, ether treasury companies and ETH ETFs have acquired a combined 4.9% of circulating ETH supply, according to Standard Chartered. Ether reached $4,955 before a recent pullback, which the bank views as a strong entry point. Valuations of Sharplink Gaming and Bitmine Immersion trail peers despite capturing staking yields.

Ethereum DeFi TVL Remains Below Past Peaks Despite Ether Price Record Highs

Ether topped a new all-time high of $4,946 but total value locked (TVL) in decentralized finance stands at $91 billion, below the $108 billion record from November 2021. Layer 2 growth and efficient staking protocols have drawn liquidity away from mainnet DeFi. Institutional inflows are driving price gains while retail participation in on-chain finance remains subdued.

Analysts Flag Downside Risk as Crypto Retreat Triggers $900 Million Liquidations

A crypto market downturn on August 26 led to $900 million in leveraged liquidations, primarily long positions, as Bitcoin fell to $110,000 and Ether dipped below $4,300. Analysts warn that further losses below $103,700 for BTC and $4,000 for ETH could initiate a deeper corrective phase.

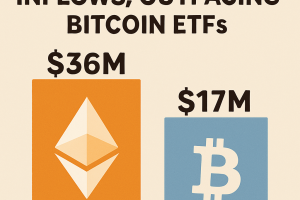

Spot Ethereum ETFs Post $444 Million in Daily Inflows, Outpacing Bitcoin ETFs

U.S. spot Ethereum ETFs logged $443.9 million in net inflows on August 25, marking a third consecutive day of positive flows. Inflows into spot ETH funds surpassed Bitcoin ETF volumes, highlighting growing institutional demand for Ether exposure and diversification trends.

Polymarket Bettors Doubt Trump Can Remove Fed Leaders

Prediction markets place just a 10% probability on Donald Trump forcing Fed Chair Jerome Powell from office in 2025, reflecting skepticism on executive power over an independent central bank. Bets also show a 27% chance of ousting Governor Lisa Cook by year end. Bitcoin prices remained largely unresponsive to political developments.

XRP Slides 3% Amid Institutional Liquidation Pressure

XRP experienced a 3.2% decline during the August 25–26 trading window as a wave of institutional liquidations drove sharp losses. Volumes tripled the daily average during peak selling between 19:00–20:00 UTC, triggering retail volatility. Recovery attempts late in the session brought XRP back above $2.90, but the market remains uncertain on sustaining upward momentum.

Bitcoin tumbles below $116K in bloodbath for crypto longs

A sudden downturn drove $585.9 million in long positions liquidations over 24 hours, with Bitcoin accounting for $140 million as price dipped below $116,000. Total crypto liquidations exceeded $731 million, as leveraged traders were caught in sharp sell-off.

Ether gains 10% after Fed’s Jackson Hole, ETF holdings top 6.4M ETH

Spot Ether ETFs posted $7.88 billion in inflows in July and August, boosting ETF custodial Ether holdings to 6.42 million. Ether rallied 10% to $4,650 after dovish comments from the Fed Chair at Jackson Hole. Supply reduction underpins technical breakouts.

ETH ‘god candle’ emerges amid Fed rate cut hopes

A 13% surge in Ether price followed Federal Reserve Chair’s dovish comments at Jackson Hole, driving the token above $4,700. Record spot ETF inflows tightened supply, lifting custodial ETH holdings to over 6.4 million. Technical signals point to further upside toward $6,000.

Trump Adviser Predicts No Bitcoin Bear Market for Years Despite August Price Bottom

Trump crypto adviser David Bailey stated that Bitcoin will avoid any bear market for years due to growing institutional adoption, even as prices retreated to around $112,000 in August. Corporate holdings now exceed $215 billion, reinforcing his bullish outlook.

Trump Adviser Predicts No Bitcoin Bear Market for Years Despite August Price Bottom

Trump crypto adviser David Bailey stated that Bitcoin will avoid any bear market for years due to growing institutional adoption, even as prices retreated to around $112,000 in August. Corporate holdings now exceed $215 billion, reinforcing his bullish outlook.

Broad Crypto Market Declines Following August Volatility, Majority of Top Coins in Red

The cryptocurrency market saw a 2.4% drop in total capitalization to $3.96 trillion, with the vast majority of top 100 tokens recording losses. Bitcoin and Ethereum fell about 3% each, while institutional flows showed mixed signals across ETFs. Trading volume reached $187 billion.

Broad Crypto Market Declines Following August Volatility, Majority of Top Coins in Red

The cryptocurrency market saw a 2.4% drop in total capitalization to $3.96 trillion, with the vast majority of top 100 tokens recording losses. Bitcoin and Ethereum fell about 3% each, while institutional flows showed mixed signals across ETFs. Trading volume reached $187 billion.

Bitcoin flash crashes after whale sells 24,000 BTC reversing post-Powell gains

A single whale reportedly sold 24,000 BTC into an illiquid market, triggering a rapid flash crash that reversed gains following Fed Chair Powell’s speech, erasing over 2% of Bitcoin’s value within minutes.

Here’s what happened in crypto today

Summary of key developments in crypto markets over the past 24 hours: Telegram founder updates on French probe, Ethereum network sues AI firm, Fed chatter may warn of a market top. Overview of major events and trends in one briefing.

Getting ETH Exposure in 2025: Ether Near Record Highs, Tom Lee Sees $15K by Year End

ETH is trading near record highs as Tom Lee projects $15,000 by year’s end. Investors weigh direct token ownership, regulated spot ETFs with staking proposals pending, and corporate treasury investments for indirect exposure.

Crypto in Late 2025 and Beyond: What Powell’s Speech Signals

Fed Chair Jerome Powell’s Jackson Hole address highlighted upside risks to inflation and downside risks to employment, arguing for a cautious approach to rate cuts in Q4 2025. Potential successor shifts and fiscal dynamics may reshape policy and impact crypto markets.

Ether Poised to Top $5K as Powell Spurs Rally

Ethereum ETFs saw $287.6 million inflows as Ether rallied over 10%, nearing $4,800, after Fed Chair Powell signaled rate cuts. Asset managers forecast Ether exceeding $5,000 soon, though corporate treasury deal quality and equity volatility pose risks. Bitcoin also eyed new all-time highs.

Bitcoin Breaks Above $117K, Bears Get Liquidated

Bitcoin surged over 5% to an intraday peak of $117,300 after Fed Chair Powell hinted at a September rate cut at Jackson Hole. Short positions worth $379.9 million were liquidated, with Ether accounting for $193 million of that total. The move signals renewed bullish momentum in crypto markets.

Bitcoin Price to Hit $1.3M by 2035, Says Asset Manager Bitwise

Crypto asset manager Bitwise projects bitcoin could reach $1.3 million by 2035, driven by institutional adoption, inflation-hedge demand, and its fixed supply. The firm warns that volatility and regulatory shifts remain key risks to projections. The prediction implies a 28.3% annualized return.

Bitcoin Volatility Collapse Forces Speculative Traders Elsewhere

Annualized volatility for Bitcoin has dropped to around 38%, comparable to blue-chip stocks, driving speculative traders to seek higher-risk opportunities elsewhere. Market behavior reflects increased institutional adoption.

Strategy Executive Insists Bitcoin Buys Do Not Influence Market Price

MicroStrategy’s corporate treasurer stated that the company’s continuous Bitcoin purchases are executed to minimize price impact by using over-the-counter desks and liquidity-sourcing techniques. Strategy currently holds over 629,000 BTC and structures buys to align with market depth rather than move prices.

Bitcoin Falters in Choppy Market, Ether Remains Resilient

Bitcoin fell below USD 116 000 amid choppy trading as investors reprice risk ahead of the Jackson Hole symposium, extending a modest pullback from recent peaks. Ether held firm above USD 4 200, supported by bullish ETF sentiment and network growth. Traders track Fed policymaker comments for cues on U.S. rates, while DeFi and institutional demand keep mid-cap tokens steady during broader market swings.

Xapo Bank Forecasts over $200B Bitcoin Inflow in Wealth Transfer

Xapo Bank’s report projects $160–$225 billion of inheritance-driven Bitcoin inflows over the next two decades. An estimated $10.6 trillion in U.S. assets will transfer to digital-native heirs by 2030, creating sustained daily buying pressure of $20–$28 million.

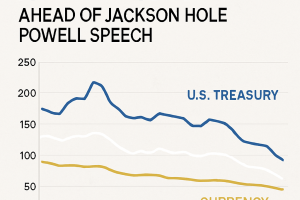

Liquidity Drain From US Treasury Weighs on Bitcoin and Equity Markets

Analysts attribute the recent decline in bitcoin and major equity indices to a $400 billion liquidity drain driven by planned Treasury General Account refill, rather than central bank policy signals from Jackson Hole. Treasury operations are expected to reduce system liquidity, hampering risk asset performance.

Bitcoin and Stocks Hit by $400B Treasury Liquidity Drain

Analysts attribute the recent decline in Bitcoin, Ether and equity markets to fears of a $400 billion liquidity drain from the U.S. Treasury General Account rather than central bank policy events. The Treasury’s planned account refill is expected to withdraw significant cash from financial markets, intensifying funding pressures. This dynamic may exert downward force on risk assets until issuance and demand rebalance.

All roads lead to inflation: Fed cut or not, Bitcoin may stand to gain

Whether the Fed cuts rates under political pressure or holds steady, inflationary forces are set to rise through trade policy and fiscal stimulus. Bitcoin is positioned to benefit as either a rapid hedge during rate cuts or a long-term store of value amid dollar erosion.

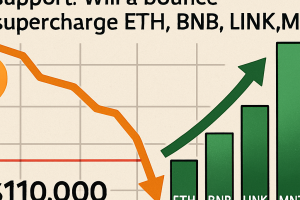

Bitcoin falls closer to $110K support: will a bounce supercharge ETH, BNB, LINK, MNT?

Bitcoin approached the $110,530 support zone amid profit-taking, risking further declines to $107,000–$105,000. A rebound could revive altcoins, with Ether eyeing resistance at $4,576 and BNB targeting $900, while Chainlink and Mantle also show key levels.

Crypto market sell-off accelerates but SOL data predicts recovery to $200

Solana’s native token fell over 15% from recent highs as broader crypto markets weakened amid risk aversion. Institutional engagement in SOL futures and ETPs remains robust, supported by rising on-chain fees and TVL growth, pointing to a potential near-term rebound to $200.

Bitcoin enters mild danger zone signalling profit-taking risk

Market Value to Realized Value (MVRV) ratio for Bitcoin has risen to +21%, suggesting most holders are in profit. Historical data links this level to increased profit-taking and sideways price action. Near-term upside appears limited.

Time for a Web3 reality check: Which altcoin sectors are really delivering?

Analysis of Web3 activity reveals shifting sector dominance in user activity, transaction volumes, and gas consumption. While DeFi and gaming lead in transactions, emerging areas like RWA and DePIN now dominate gas usage. Price performance aligns with infrastructure and yield-focused sectors.

Bitcoin shows bearish signals as price breaches bullish trendline

Technical indicators show Bitcoin has broken below a long-term bullish trendline and weekly stochastic oscillator has rolled over from overbought levels, signaling increasing downside risk and potential retest of support around $111,982 and $100,000.

Volatility Collapses Across Markets Ahead of Jackson Hole Powell Speech

Volatility across asset classes has plunged to multi-year lows as traders await Fed Chair Powell’s Jackson Hole address. Bitcoin’s implied volatility hit two-year troughs, fueling complacency concerns amid possible economic and policy risks.

LINK Surges 18% on Undervaluation Claims, Backed by Reserve and ICE Partnership

LINK jumped 18% to $26.05, topping the 50 largest cryptocurrencies as analysts highlight undervaluation and strong chart signals. Key catalysts include the on-chain Chainlink Reserve and a new data integration with ICE, boosting infrastructure demand.

Crypto Leverage Returns to Bull-Market Levels Amid $1B Liquidation Warning

Crypto‐collateralized loans expanded 27% last quarter to $53.1 billion, approaching early 2022 highs. Bitcoin’s price drop triggered over $1 billion in liquidations, highlighting heightened fragility due to rapid leverage buildup.

Bitcoin risks new 2025 correction as BTC uptrend starts seventh week

Analysis by Rekt Capital indicates Bitcoin may enter its seventh consecutive week of price discovery uptrend, a phase historically prone to ‘price discovery corrections’ after six to eight weeks. Historical patterns suggest a corrective dip could precede fresh all-time highs in Q4.

Exec Predicts Over 50% Chance Bitcoin Hits $150K Before Next Bear Market

Canary Capital’s CEO warns of a potential bear market but expects Bitcoin to reach between $140K and $150K first. Recent ETF inflows and treasury purchases have driven price to $117,867, with large institutions, including sovereign funds, entering the market.

Behind Ethereum’s pullback: Institutions keep buying while retail panics

On-chain data over the past week reveals a divergence in Ethereum behavior after prices pulled back from an all-time high. Retail investors reduced holdings sharply during the decline, while institutional entities continued accumulation via OTC and exchange flows.

Ether Accumulation Heats Up: $882M in ETH Snapped Up by BitMine and Whale

BitMine Immersion Technology and an unidentified whale acquired $882 million in Ether via OTC desks and exchange withdrawals. BitMine’s purchases lifted its holdings to 1,297,093 ETH, and the whale amassed 92,899 ETH in recent days, signaling robust institutional demand.

Ether unstaking queue hits $3.8B, marking historic backlog

Ether unstaking queue reached a record $3.8 billion, creating a 15 day withdrawal backlog after the Shanghai upgrade. Major liquid staking services Lido, EthFi and Coinbase account for over 63 percent of queued withdrawals. Institutional reserves and spot ETF holdings have surged 140 percent since May, mitigating potential sell pressure.

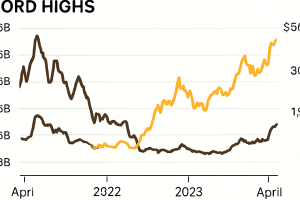

Ethereum ETFs continue $3.7B inflow streak, Bitcoin funds trail behind

U.S. spot Ethereum ETFs logged $639.61M in net inflows on August 15, marking eight consecutive days and $3.7B total in August. BlackRock’s iShares Ethereum Trust contributes $2.6B of this. U.S. spot Bitcoin ETFs recorded $230.93M on August 14, extending a seven-day $1.34B inflow streak.

Altcoin Season Could Begin in September as Bitcoin’s Grip on Crypto Market Weakens

Coinbase Institutional’s report forecasts that September could mark the start of an altcoin season driven by declining bitcoin dominance, improved liquidity and growing investor risk appetite. Rotational capital flows may favor large-cap altcoins initially.

Bitcoin Tops $124K, Now Larger Than Google by Market Cap

Bitcoin surged above $124,000 to overtake Google’s market capitalisation and become the fifth-largest global asset. This movement reflects strong institutional investment and favourable macroeconomic conditions supporting continued digital asset growth.

Morning Bid: Bitcoin Joins the Risk-On Party

Bitcoin rallied alongside global equities, driven by expectations of US interest rate cuts and regulatory support. Ether also advanced toward multi-year highs as institutional inflows sustain bullish momentum.

Bitcoin Realized Price Breaks Above 200WMA Signaling More Room to Run

Bitcoin’s realized price climbed above the 200-week moving average for the first time since June 2022, a historical signal often preceding sustained bull runs. On-chain data indicates renewed investor confidence and technical support around $51,344.

XRP Breaks Key Resistance Following Ripple-SEC Win, Eyes $8 Target

XRP climbed from $3.24 to $3.33 in 24 hours after Ripple and the SEC withdrew appeals, clearing regulatory overhang. Institutional buyers drove exceptional volume of 217 million tokens at breakout, with support at $3.20–3.22 and profit-taking near $3.34 ahead of next targets in the $6–$8 range.

Dogecoin Rallies 7% on $200M Whale Buys as Futures Open Interest Tops $3B

Dogecoin surged over 7% in 24 hours, fueled by more than $200 million in whale purchases and rising futures open interest above $3 billion. Breakout above $0.25 resistance triggered a volume-driven rally, with technical patterns indicating further upside toward $0.27 and sustained bullish sentiment.

ETH transaction count rising amid $5K push, but competition erodes market share

Ethereum daily transaction volume has climbed above 1.7 million as ETH targets $5 000, yet layer-2s like Arbitrum and Base are processing billions of transactions, diverting revenue and user traffic away from the base layer.