CFTC reminds offshore crypto firms they can register to serve US clients

The Commodity Futures Trading Commission issued a reminder that offshore crypto firms registered as Foreign Boards of Trade can directly handle US customers under FBOT rules, broadening paths for foreign platforms.

US regulator opens pathway for Americans to trade on offshore crypto exchanges

The US Commodity Futures Trading Commission announced a pathway for offshore crypto exchanges to register as Foreign Boards of Trade and legally serve American customers under existing FBOT regulations.

U.S. Government Starts Pushing Economic Data Onto Blockchains as 'Proof of Concept'

The U.S. Department of Commerce has released its July GDP figures via nine blockchains, including Bitcoin and Ethereum, as a proof of concept. Secretary Lutnick credited President Trump’s support and signaled plans to expand this approach to other federal data releases.

China’s stablecoin push raises questions on dollar dominance and market trust

Beijing’s exploration of a yuan-backed stablecoin marks a surprising pivot amid strict crypto curbs and digital yuan deployment. Experts caution that trust, surveillance controls, and liquidity challenges may limit its appeal compared with entrenched dollar-linked tokens.

CFTC’s Johnson confirms she will depart regulator next week

Outgoing US CFTC Commissioner Kristin Johnson announced she will leave the agency on September 3 after completing her term. Her departure will leave the commission with only Acting Chair Caroline Pham, potentially slowing crypto market rulemakings and enforcement actions amid pending nominations.

U.S. CFTC Set to Operate Under Sole Commissioner After Democrat’s Exit

Commissioner Kristin Johnson will depart the U.S. Commodity Futures Trading Commission on Sept 3, leaving a sole commissioner, Acting Chairman Caroline Pham. President Trump’s nominee Brian Quintenz remains in limbo as the crypto regulator prepares to operate with a single member.

Philippine Congressman Proposes Bitcoin Reserve to Attack National Debt

A bill in the Philippine Congress would establish a Strategic Bitcoin Reserve, mandating annual purchases of 2,000 BTC over five years and locking holdings for two decades to pay down national debt. The proposal includes secure storage and quarterly audits.

Japan's Finance Minister Says Crypto Assets Can be Part of Diversified Portfolio

Japan’s Finance Minister Katsunobu Katō stated that despite high volatility, cryptocurrencies can be included in diversified investment portfolios. The government seeks to foster innovation without stifling growth through overregulation, amid concerns over rising debt-to-GDP ratios.

Telegram founder Pavel Durov says case going nowhere, slams French gov

Pavel Durov criticized French authorities for an ongoing probe that has yet to find any wrongdoing by him or Telegram one year after his arrest. He warned that the case has harmed France’s reputation and reiterated Telegram’s commitment to privacy and legal compliance.

Brazil’s 17.5% Crypto Tax Signals End of Tax-Friendly Era

Brazil replaced minor crypto gain exemptions with a flat 17.5% capital gains tax on digital assets. The move follows Portugal’s 2023 tax revisions and may prompt other jurisdictions to tighten crypto rules. Retail investors face increased tax burdens.

US DOJ to Ease Enforcement on Decentralized Crypto Platforms

US Department of Justice said it will no longer target developers of decentralized crypto platforms acting without criminal intent. The policy shift abandons money transmitter charges for code writers, focusing instead on bad-faith actors. Tornado Cash co-founder case highlighted debate over code vs intent.

EU Proposes Tight Limits on Non-EU Crypto Firms

European Securities and Markets Authority proposed strict conditions for crypto companies based outside the EU to serve EU customers directly. The draft rules aim to prevent regulatory arbitrage and ensure a level playing field by requiring foreign firms to host critical functions within the bloc. Final approval pending member-state sign-off.

US SEC Denies Coinbase Petition for New Crypto Rules

US Securities and Exchange Commission rejected a petition from Coinbase Global requesting new rulemaking for digital assets. The denial maintains existing regulatory framework and may prompt legal action from the exchange. The decision reinforces SEC’s cautious stance on creating bespoke crypto regulations.

Australia Orders External Audit of Binance AML Controls

Australia’s financial crime agency has mandated Binance’s local unit to appoint an external auditor to assess its anti-money laundering and counter-terrorism financing controls, citing oversight weaknesses and limited review scope.

CFTC Launches Second"Crypto Sprint" to Enhance Spot Market Oversight

The U.S. Commodity Futures Trading Commission initiated its second “crypto sprint” to implement recommendations from the President’s Working Group on Digital Asset Markets. The sprint focuses on spot trading oversight, transparency, systemic risk reduction and consumer protection, with public consultation open until October 20, 2025.

China explores yuan-backed stablecoin framework for global use

China’s State Council will review a roadmap to authorize yuan-backed stablecoins as part of an internationalization strategy. Proposals include regulatory guidelines, risk management protocols, and pilot launches in Hong Kong and Shanghai to enhance the yuan’s cross-border payments and compete with US dollar–pegged digital currencies.

US DOJ to deprioritize money transmitter prosecutions for crypto developers

The US Department of Justice will cease pursuing charges against software developers for creating decentralized crypto platforms without criminal intent. Acting Assistant Attorney General Matthew Galeotti stated that writing code alone is not a crime, marking a shift away from unlicensed money transmitter prosecutions in the digital assets sector.

Kyrgyz President Seeks Support After UK Sanctions Cryptocurrency Networks

Kyrgyzstan’s president has appealed to the U.S. and U.K. for assistance following sanctions on local cryptocurrency networks imposed over alleged support for Russian evasion of international financial controls.

South Korean Financial Executives to Meet With Tether and Circle to Discuss Stablecoin Distribution

Executives from Tether and Circle will meet with top South Korean banks this week to explore distribution of dollar-pegged and won-backed stablecoins ahead of the country’s planned stablecoin regulatory framework.

China Weighs Yuan-Backed Stablecoins to Boost Currency Internationalisation

China’s State Council is set to review a plan this month to permit yuan-backed stablecoins, marking a reversal from the 2021 ban on crypto trading and mining. Roadmap drafts include usage targets, domestic regulator roles and risk guidelines, with Hong Kong and Shanghai to pilot implementations. Move aims to enhance yuan’s global payment share amid U.S. dollar dominance and ahead of a G20 summit discussion in Tianjin.

Crypto groups reject bank lobby’s rewrite of GENIUS stablecoin act

Crypto trade bodies, including the Crypto Council for Innovation and the Blockchain Association, urged Congress to oppose banking industry amendments to the GENIUS Act’s stablecoin provisions. They warned such changes would undermine consumer protections, weaken reserve standards, and stifle innovation in digital payments.

Fed governor tells bankers DeFi is nothing to be afraid of

Federal Reserve Governor Christopher Waller said decentralized finance and stablecoins pose no threat and will drive innovation in the US payments system. He compared crypto transactions using smart contracts to debit card purchases and highlighted recent regulatory shifts supporting stablecoin integration. Waller noted the GENIUS Act as a key step for stablecoin adoption.

Crypto Groups Oppose Bankers’ Push to Amend GENIUS Act

Major industry bodies, the Crypto Council for Innovation and the Blockchain Association, urged the Senate Banking Committee to reject calls from the American Bankers Association to tighten yield-breach provisions in the new U.S. stablecoin law. They warned that closing the current loophole could fragment interstate commerce and hinder innovation.

UK Sanctions Russian-Linked Crypto Networks and Kyrgyz Firms

Britain imposed sanctions on entities it accused of using crypto infrastructure to help Russia evade existing Western measures. The targets include Kyrgyzstan-based networks behind a rouble-pegged stablecoin and firms linked to a Kyrgyz bank used for military procurement. The move follows similar U.S. actions and high-level diplomatic talks on Ukraine.

China Weighs Yuan-Backed Stablecoins to Boost Global Usage

China’s State Council is reviewing a roadmap for allowing yuan-pegged stablecoins to foster internationalisation of its currency. The plan includes risk management guidelines and targets for offshore roll-out, with Hong Kong and Shanghai set to pilot local implementation ahead of wider global deployment.

Fed Governor Waller Affirms Crypto Safety and Innovation

Federal Reserve Governor Chris Waller addressed the SALT conference in Jackson Hole, stating that smart contracts, tokenization and distributed ledgers pose no inherent threat. Remarks highlighted exploration of central bank digital currency use cases and stablecoins as payment infrastructure.

Crypto Industry Petitions Trump for CFTC Nomination

A coalition of leading crypto associations, including the Crypto Council for Innovation and the Blockchain Association, petitioned President Trump to accelerate Brian Quintenz’s confirmation as CFTC chair. The move addresses regulatory uncertainty and counters prior White House delays.

Crypto Industry Pushes Back Against Effort to Amend US Stablecoin Law

Major crypto industry groups opposed proposals by banking associations to remove core provisions of the GENIUS Act, arguing that rewrites would favor legacy institutions and stifle competition. A letter sent to Senate Banking Committee leaders on August 19 urged rejection of changes targeting Section 16(d) and yield programs.

UK Bitcoin ETNs Return to London After FCA Lifts Ban

Financial Conduct Authority lifted a four-year retail ban on bitcoin exchange traded notes, enabling UK access to ETNs on approved exchanges from October 8. Market analysts predict substantial inflows and onshore demand growth comparable to US ETF launches.

US Fed Official Urges Allowing Staff to Hold Crypto

Federal Reserve Vice Chair for Supervision Michelle Bowman proposed easing investment restrictions that currently bar central bank employees from holding small crypto positions. Bowman argued that hands-on experience with digital assets would enhance regulatory insight, recruitment and retention of skilled examiners. The remarks reflect a more supportive policy stance toward crypto under current administration leadership.

India’s Tax Board Seeks Feedback on Crypto Oversight, TDS and Loss Offset Rules

India’s Central Board of Direct Taxes has invited stakeholders to comment on new virtual digital asset legislation, regulatory oversight mechanisms and the impact of the 1% TDS rate and disallowed loss offset provisions on trading volumes. The consultation aims to inform comprehensive VDA regulation later in the year, addressing taxation, compliance and market migration concerns.

Finance Bodies Urge Basel Committee to Rethink Crypto Rules for Banks

A coalition of major finance industry groups has called on the Basel Committee to pause and revise new standards set in 2022 that they argue are too conservative for modern crypto markets. The letter claims the rules could make bank participation in crypto uneconomical and requests updated data and adjustments before implementation scheduled for January 2026.

Japan startup to issue first yen-pegged stablecoin

JPYC received a license to issue Japan’s first yen-pegged stablecoin, backed by domestic savings and Japanese government bonds. The token will be fully convertible to yen, charge zero transaction fees, and initially target institutional investors, hedge funds, and family offices in Japan, with plans for global digital yen usage.

Illinois governor blasts Trump’s ‘crypto bros’ in new bill signing

Illinois Governor JB Pritzker signed two bills establishing crypto consumer protections, including exchange oversight and ATM fee caps at 18%. The legislation grants regulatory authority to the state Department of Financial and Professional Regulation.

US Treasury weighs digital ID verification in DeFi to tackle illicit finance

The US Treasury is exploring integration of digital identity checks into DeFi smart contracts under the GENIUS Act consultation. Proposals include government-issued credentials, biometrics, and portable IDs embedded in on-chain protocols to enhance KYC/AML safeguards.

US Treasury calls for public comment on GENIUS stablecoin bill

The US Treasury issued a notice under the GENIUS Act, soliciting feedback by Oct. 17 on methods for detecting illicit finance in digital assets. The consultation focuses on APIs, AI, digital identity, and blockchain monitoring. Reports will inform congressional committees.

SEC pushes back decisions on Truth Social, Solana, XRP crypto ETFs

US Securities and Exchange Commission extended review deadlines for three major crypto ETF applications. New decision dates set for October across Bitcoin-Ethereum, Solana and XRP products. Extensions follow standard protocol as the SEC gathers further feedback.

Does India Need a New Crypto Law? Tax Authority Questions Local Players

India’s tax authority plans to mandate detailed reporting for all crypto transactions to enhance transparency and combat illicit finance. The proposal requires exchanges to collect and share granular transaction data, prompting industry feedback on compliance costs and privacy concerns.

Japan to approve first yen-pegged stablecoins this fall

Japan’s Financial Services Agency plans to authorize the issuance of yen-denominated stablecoins as early as this fall, led by JPYC’s registration as a money transfer business. The approval represents the country’s first regulated fiat-pegged digital currency offering and could shift significant demand toward Japanese government bonds.

US Treasury Seeks Input on Digital ID in DeFi to Combat Illicit Finance

The U.S. Treasury has opened a public consultation under the Genius Act on embedding digital identity verification into DeFi smart contracts. Options include integrating KYC and AML checks directly into protocol code to reduce compliance costs and enhance privacy. Comments are due by October 17.

U.S. Federal Reserve Ends Specialized Crypto Oversight Program

The U.S. Federal Reserve announced the termination of its Novel Activities Supervision Program effective August 15, 2025, moving crypto oversight into standard bank supervision. This shift is intended to reduce compliance burdens and manage crypto risks under existing frameworks.

U.S. Fed officially scraps specialist group for crypto and fintech oversight

The U.S. Federal Reserve has closed its Novel Activities Supervision Program, a dedicated unit formed in 2023 to monitor banks’ crypto and fintech engagements. The Fed cited enhanced expertise and matured risk frameworks as reasons for reintegrating digital asset oversight into routine supervision. The change aims to streamline processes, though some warn of reduced focus on emerging risks.

New York legislator pushes bill to tax cryptocurrency transactions

New York Assembly member Phil Steck introduced Bill 8966 to impose a 0.2% excise tax on cryptocurrency and NFT transactions, effective September 1 if enacted. The legislation seeks new revenue for New York City and may affect exchanges, traders and DeFi protocols. Several states are exploring similar measures.

U.S. Fed officially scraps specialist group meant to oversee crypto issues

Federal Reserve ended its Novel Activities Supervision Program for banks’ crypto activity, folding responsibilities into routine supervision. The action aligns with OCC and FDIC in easing digital-asset scrutiny following the withdrawal of prior crypto guidance. Fed cited strengthened internal expertise since 2023.

Hong Kong issues strict new crypto custody rules for cold wallets

Hong Kong SFC issued guidance banning smart contracts in cold wallets and requiring certified hardware security modules and whitelisted withdrawals. Custodians must maintain 24/7 security operations, air-gapped key generation and strict multi-factor physical access controls. The measures aim to enhance security and harmonise custody standards.

Hong Kong Regulator Tightens Custody Standards for Licensed Crypto Exchanges

Hong Kong’s SFC issued new custody standards for licensed crypto exchanges covering management responsibility, cold wallet operations and real-time threat monitoring. The measures aim to strengthen cyber defenses after a regulatory review found inadequacies.

New York Bill Would Tax Crypto Sales and Transfers

New York Assembly Bill 8966 proposes a 0.2% excise tax on all crypto sales and transfers, including NFTs, effective from Sept. 1. The tax revenue will fund substance abuse programs in upstate schools. The bill must pass committee, Assembly, Senate and receive the governor’s approval.

US Treasury’s Bessent Backpedals, Bitcoin Purchases Still Explored

Treasury Secretary Scott Bessent clarified that budget-neutral methods to buy Bitcoin for the Strategic Reserve remain under exploration. Earlier comments suggesting no further purchases triggered a market sell-off, wiping $55 billion from crypto value. The government also confirmed a halt on selling existing holdings.

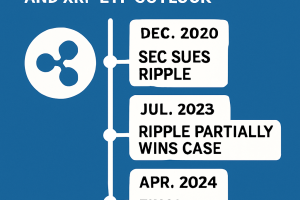

XRP Breaks Key Resistance After Ripple-SEC Win Is $8 Next

XRP broke above key resistance at $3.27 on high volume after a legal victory in the Ripple-SEC case, signalling renewed institutional interest. Technical momentum suggests potential targets up to $8, driven by stronger market sentiment and regulatory clarity.

Google Play’s new rules won’t affect non-custodial crypto wallets

Google Play will require licensed status for custodial crypto wallet apps in over 15 jurisdictions, including the US and EU, effective October 29, but updated policy explicitly exempts non-custodial wallets from the new requirements.

US banks urge narrowing of stablecoin yield loophole in GENIUS Act

A coalition of U.S. banking groups led by the Bank Policy Institute has urged Congress to amend the GENIUS Act to close a loophole allowing stablecoin issuers to offer yield via affiliates and exchanges. They warned that failure to act could trigger up to $6.6 trillion in deposit outflows, destabilizing traditional lending markets and raising interest rates. The letter emphasizes that stablecoins must remain payment instruments.

Do Kwon pleads guilty to US fraud charges in $40B crypto collapse

Do Kwon, co-founder of Terraform Labs, entered a guilty plea to two counts of conspiracy to defraud and wire fraud in Manhattan federal court relating to the 2022 collapse of TerraUSD and Luna. Under a plea agreement, prosecutors agreed to recommend no more than 12 years in prison, though he faces up to 25 years. The hearing took place before Judge Paul Engelmayer on August 12, 2025.

Do Kwon Pleads Guilty to TerraUSD Fraud

Terraform Labs founder Do Kwon entered a guilty plea for commodities fraud, securities fraud, and wire fraud connected to TerraUSD. Court documents outline false claims about stablecoin stability and a plan that resulted in a $41 billion loss for investors. Sentencing scheduled for December.

President Trump Appoints Patrick Witt as Senior Crypto Adviser

Yale alumnus and former quarterback Patrick Witt is set to succeed Bo Hines as executive director of the President’s Council of Advisers on Digital Assets. The move places a non-technical insider at the helm of U.S. crypto policy amid stablecoin regulation efforts.

Bithumb to Scale Back Crypto Lending Services After Regulatory Pressure

South Korea’s Bithumb exchange has halved its crypto lending leverage from 4× to 2× and cut maximum caps by 80%, reducing the cap from 1 billion KRW to 200 million KRW. The service, launched in July and briefly suspended on July 29, resumed on August 8 under stricter terms. Industry sources expect official guidelines by month-end.

Trump Media Files Amendment to Bitcoin ETF Registration, Crypto.com to Offer Custody

An amendment to the S-1 registration for Truth Social’s Bitcoin ETF was filed without specifying a fee or ticker. Crypto.com will act as custodian and liquidity provider, with Yorkville America Digital as sponsor. The filing added disclosures on airdrop policies and stablecoin risks.

Bo Hines departs White House Crypto Council

Bo Hines resigned as Executive Director of the White House Crypto Council after an eight-month tenure. His leadership advanced the Crypto Summit, the Genius Act and a market-friendly digital assets framework before he returned to the private sector.

White House expands 401(k) access to crypto and private assets with risk alerts

Executive order directs regulators to open 401(k) plans to alternative investments including cryptocurrencies, private equity and startups under new rules. Advisors warn of higher fees, reduced liquidity and disclosure gaps in these assets. Criticism emphasizes need for clearer safeguards.

Ripple News: Full SEC Lawsuit Timeline and XRP ETF Outlook

Ripple’s five-year legal battle with the SEC concluded on August 7, 2025, with a $125 million settlement. The case’s end has boosted XRP ETF approval odds to 77%, prompting asset managers to file or prepare ETF applications amid renewed regulatory clarity.

Ukraine to Introduce 10% Tax on Crypto Holdings Under New Bill

Ukraine’s parliament will review an EU-aligned crypto regulation bill in late August 2025, introducing a 10% tax on crypto holdings (5% personal income tax and 5% military levy). The bill also aims to enhance transparency and permit the central bank to consider crypto in national reserves.