🔎 Coin Research — Brevis (BREV) — 08 January 2026

New weekly coin research for Brevis (BREV). — Score: 8.00/10 TL;DR: Decentralized marketplace for ZK-proof generation leveraging continuous auctions to coordinate off-chain computation and on-chain verification.

SEC now fully Republican, set for pro-crypto rulemaking in 2026

Departure of SEC Commissioner Caroline Crenshaw leaves commission fully Republican, clearing path for pro-crypto rulemaking in 2026. Regulatory procedures still mandate public notice and comment, but major policy shifts are anticipated.

Morgan Stanley files S-1s for Bitcoin and Solana ETFs

Morgan Stanley filed S-1 registration statements with the SEC on Jan. 6, 2026, to launch spot Bitcoin and Solana ETFs. The proposed trusts will hold underlying tokens directly and aim for passive exposure via public exchange listings.

🔎 Coin Research — Depinsim (ESIM) — 07 January 2026

New weekly coin research for Depinsim (ESIM). — Score: 7.00/10 TL;DR: Depinsim is a decentralized connectivity protocol that tokenizes mobile data via eSIM technology, enabling users to earn and trade connectivity as on-chain valu

Morgan Stanley Files for Bitcoin and Solana ETFs

Morgan Stanley filed with the US SEC to launch ETFs linked to Bitcoin and Solana, marking a major bank’s entry into crypto products. The move follows recent regulatory updates that eased bank involvement in digital assets. ETFs aim to provide liquidity and simplified compliance.

Ledger Faces Fresh Data Breach via Payment Processor Global-e

Hardware wallet maker Ledger confirmed a data exposure incident stemming from its payment partner Global-e. Customer names and contact details were accessed, though private keys and payment data remain secure. Affected users have been notified and advised to monitor for phishing.

Crypto Digest — 06 January 2026

📢 Read the daily digest for 2026-01-06: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Depinsim (ESIM) — 06 January 2026

New weekly coin research for Depinsim (ESIM). — Score: 7.00/10 TL;DR: Depinsim transforms mobile connectivity into a decentralized programmable asset by combining eSIM technology with blockchain-based incentives.

$35 million cryptocurrency theft linked to LastPass data breach

Blockchain investigators traced a $35 million crypto theft from LastPass users to Russian cybercriminal infrastructure. Attackers converted stolen assets through mixing services before funneling funds to sanctioned Russian exchanges, revealing coordinated laundering phases over multiple years.

Crypto markets edge higher despite US-Venezuela tensions; Bitcoin near $93,000

Crypto markets remained resilient despite U.S.–Venezuela tensions, with Bitcoin near $93,000 and Ethereum above $3,000. Bullish technical setups, stablecoin inflows, and institutional interest underpinned gains, while major altcoins and memecoins posted notable advances.

Crypto Digest — 05 January 2026

📢 Read the daily digest for 2026-01-05: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Openverse Network (BTG) — 05 January 2026

New weekly coin research for Openverse Network (BTG). — Score: 7.00/10 TL;DR: Layer0 blockchain infrastructure enabling high-speed, low-cost cross-chain value transfer

Crypto Digest — 04 January 2026

📢 Read the daily digest for 2026-01-04: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — zkPass (ZKP) — 04 January 2026

New weekly coin research for zkPass (ZKP). — Score: 7.00/10 TL;DR: zkPass is a privacy-preserving oracle protocol that transforms private Web2 data into verifiable on-chain proofs using a novel zkTLS protocol without requiring

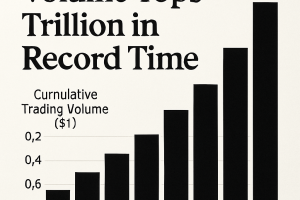

Spot Crypto ETF Volume Tops $2 Trillion in Record Time

Cumulative trading volume for U.S. spot Bitcoin and Ethereum ETFs surpassed $2 trillion, doubling the prior milestone in half the time. Combined net inflows reached $645.6 million on January 2, signaling robust institutional demand at the start of 2026.

Coinbase exec defends CLARITY Act delay: 'I completely understand'

Coinbase Institutional head John D’Agostino said the US CLARITY Act’s complexity justifies its timeline, contrasting it with the simpler Genius Act. He highlighted global regulatory momentum and warned delays have driven $952 million of outflows from crypto investment products.

Crypto Digest — 03 January 2026

📢 Read the daily digest for 2026-01-03: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Bio Protocol (BIO) — 03 January 2026

New weekly coin research for Bio Protocol (BIO). — Score: 7.00/10 TL;DR: Decentralized science platform integrating autonomous AI agents to democratize biotech research funding and development

'Hundreds' of EVM wallets drained in mysterious attack

An attacker has drained small sums from hundreds of EVM‐compatible wallets across multiple chains in a wide‐scale exploit. On‐chain investigator ZachXBT linked the incident to the December Trust Wallet hack, warning users to revoke approvals and enhance security.

Crypto tax data to be collected in 48 countries ahead of CARF 2027

Starting Jan. 1, crypto service providers in 48 jurisdictions must collect detailed wallet transaction data for the OECD’s Crypto-Asset Reporting Framework (CARF), with data exchanges set to begin in 2027. The initiative targets tax evasion and money laundering by mandating centralized and decentralized platforms record user activity. A second group of 27 jurisdictions will follow in 2027, expanding the scope of international transparency efforts.

Crypto Digest — 02 January 2026

📢 Read the daily digest for 2026-01-02: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Openverse Network (BTG) — 02 January 2026

New weekly coin research for Openverse Network (BTG). — Score: 7.00/10 TL;DR: Openverse Network is a Layer0 hub infrastructure enabling seamless cross-chain value transfer with high-throughput protocols (VTP, IBC, VRC10/11/12) and DPOS+PO

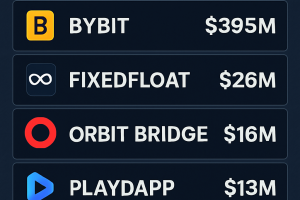

From Bybit to GMX: The 10 biggest crypto hacks of 2025

Crypto attackers siphoned an estimated $2.2 billion across the ten largest security breaches in 2025, including record thefts at Bybit, Cetus, Balancer V2, and more, highlighting persistent infrastructure risks.

Bitcoin set for first yearly loss since 2022 as macro trends weigh on crypto

Bitcoin is on track to post its first annual loss since 2022, ending 2025 over 6% lower after a mid-year rally peaked in October. The decline follows market liquidations exceeding $19 billion triggered by U.S. tariff announcements and growing correlation with stock market trends.

Crypto Digest — 01 January 2026

📢 Read the daily digest for 2026-01-01: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Lighter (LIT) — 01 January 2026

New weekly coin research for Lighter (LIT). — Score: 8.00/10 TL;DR: A zk-rollup based perpetual futures DEX on Ethereum offering verifiable on-chain order matching, zero fees for retail traders, and institutional-grade performan

Senate Banking Panel to Mark Up CLARITY Act on January 15

US senators have scheduled a January 15 markup of the CLARITY Act in the Senate Banking Committee. The bill seeks to define digital commodities, token classifications, and stablecoin regulations. Bipartisan support is required to secure the 60 Senate votes necessary for final passage.

Crypto-Asset Reporting Framework goes live in 48 jurisdictions Jan 1, 2026

The OECD’s Crypto-Asset Reporting Framework (CARF) will begin data collection in 48 jurisdictions on January 1, 2026. Crypto platforms must gather detailed tax-residency data, verify user identities and report balances and transactions annually to domestic tax authorities.

Trust Wallet confirms $8.5M supply-chain hack via leaked Chrome API key

Trust Wallet confirmed that a malicious Chrome extension update caused a supply-chain hack with $8.5 million in stolen funds. Attackers used a leaked Google Chrome Web Store API key to push a compromised extension and exfiltrate mnemonic seed phrases.

🔎 Coin Research — Bitcoin Munari (BTCM) — 31 December 2025

New weekly coin research for Bitcoin Munari (BTCM). — Score: 6.00/10 TL;DR: Bitcoin Munari reimagines Bitcoin’s fixed 21 million supply by launching as a Solana SPL token for immediate utility and later migrating to an independent EVM-c

Crypto Digest — 30 December 2025

📢 Read the daily digest for 2025-12-30: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — TradeTide (TTD) — 30 December 2025

New weekly coin research for TradeTide (TTD). — Score: 7.00/10 TL;DR: An AI-powered trading agent infrastructure on BNB Chain that integrates market analysis, strategy generation, and automated execution across centralized exchang

Crypto Digest — 29 December 2025

📢 Read the daily digest for 2025-12-29: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Flow (FLOW) — 29 December 2025

New weekly coin research for Flow (FLOW). — Score: 7.00/10 TL;DR: Flow is a consumer-grade, proof-of-stake blockchain built for high-throughput Web3 applications and digital assets, featuring a multi-node architecture and reso

Arrest made in $355M Coinbase insider extortion scheme

Coinbase reported the arrest of a former support agent in India tied to a $355 million insider extortion plot that targeted nearly 70,000 customers. Investigation highlights gaps in outsourced security controls and underscores regulatory scrutiny of exchange access workflows.

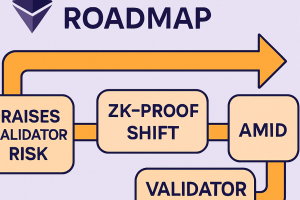

Ethereum 2026 roadmap raises validator risk amid ZK-proof shift

Ethereum’s planned 2026 upgrade relies on validators transitioning from block re-execution to zero-knowledge proof verification, introducing potential liveness and bandwidth risks. The roadmap includes data blob capacity increases via Fusaka and ambitious gas limit changes under the “Glamsterdam” brand.

Flow Network Exploit Triggers Panic Selling, Plunges Price by 46%

An attacker exploited a vulnerability in Flow’s execution layer on Dec. 27, draining $3.9 million by routing funds through Celer, Debridge, Relay and Stargate bridges. Networks and exchanges froze exit paths, yet panic selling pushed FLOW down 46% to a new low before partial rebound.

Coinbase Predicts Three Sectors to Dominate Crypto Market by 2026

Coinbase Institutional forecasts three sectors will lead crypto markets in 2026: perpetual futures to drive volume, prediction markets evolving into core infrastructure, and stablecoins expanding real-world payments. A structural reset is expected as leverage declines.

Crypto Digest — 28 December 2025

📢 Read the daily digest for 2025-12-28: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — TronBank (TBK) — 28 December 2025

New weekly coin research for TronBank (TBK). — Score: 6.00/10 TL;DR: Energy leasing and TRX staking platform on the TRON blockchain integrating AI algorithms to optimize energy efficiency and yield generation

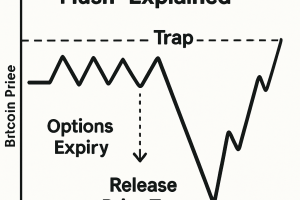

Record $27B Bitcoin and Ethereum Options Expiry Looms on Deribit

Crypto markets face a historic year-end event as over $27 billion in options on Bitcoin ($23.6 billion) and Ethereum ($3.8 billion) expire on Deribit today, accounting for 50% of open interest. Call options outnumber puts nearly 3:1, signaling institutional bullish sentiment, while ‘max pain’ levels near $95 000 (BTC) and $3 000 (ETH) may anchor short-term price action.

Trust Wallet Browser Extension Breach Drains $7M From Users

Trust Wallet browser extension version 2.68 was compromised on December 26, 2025, resulting in unauthorized drains of approximately $7 million from hundreds of user wallets. Blockchain investigator ZachXBT and PeckShield identified the exploit, prompting an emergency update to version 2.69 and assurances of full compensation. The breach highlights persistent risks in browser-based wallets.

Crypto Digest — 27 December 2025

📢 Read the daily digest for 2025-12-27: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Planck Network (PLANCK) — 27 December 2025

New weekly coin research for Planck Network (PLANCK). — Score: 8.00/10 TL;DR: Modular Layer-0 protocol powering sovereign AI chains and DePIN via on-chain GPU compute

Crypto Derivatives Trading Hits $86 Trillion in 2025, Binance Commands Nearly 30%

Crypto derivatives trading surged to a record $86 trillion in 2025, averaging $265 billion per day. Binance led with nearly 30% market share, followed by OKX and Bybit. The growth reflects deeper institutional participation and evolving risk profiles.

Uniswap community approves UNIfication with fee switch and token burns

Uniswap’s governance vote passed the UNIfication proposal, activating the protocol fee switch to burn UNI tokens and consolidating operations under Uniswap Labs. A one-time 100 million UNI burn is scheduled post-timelock.

Crypto Digest — 26 December 2025

📢 Read the daily digest for 2025-12-26: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Bitcoin Gamma Flush Explained: $24B Options Expiry to Release Price Trap on Dec 26

A major gamma flush is set for December 26 as $23.7 billion in Bitcoin options expire, termed the “boss level” of this week’s expiries. The associated trading dynamics could break the current $85K–$90K price trap by removing dealer hedging pressures, freeing Bitcoin price to respond to fundamental supply and demand. Anticipated key levels include support at $85K–$88K, a flip zone at $90,616, and a long-term target near $118K.

🔎 Coin Research — ChainOpera AI (COAI) — 26 December 2025

New weekly coin research for ChainOpera AI (COAI). — Score: 8.00/10 TL;DR: Decentralized AI agent network enabling collaborative intelligence through a full-stack AI OS and blockchain L1

Uniswap Governance Approves 100M UNI Burn and Protocol Fee Activation

The Uniswap community has passed the UNIfication proposal with 125.34 million votes in favor, exceeding the 40 million vote quorum. The approved changes include a one-time burn of 100 million UNI tokens from the treasury and activation of protocol-level fee switches after a two-day timelock. This marks a major shift from interface-level monetization toward direct economic capture at the protocol layer, reducing circulating supply and aligning Uniswap’s incentives with token-holders.

Trust Wallet Browser Extension Incident Drains Over $6M in Crypto

A supply-chain compromise of the Trust Wallet Chrome extension led to seed phrase imports being intercepted and user wallets drained of over $6 million across multiple blockchains, according to on-chain analysis and community reports. The issue centered on a malicious JavaScript payload in version 2.68 released December 24, which monitored imported seed phrases and transmitted them to an attacker-controlled domain before initiating immediate unauthorized transfers. Trust Wallet has acknowledged the incident, advising users to disable version 2.68 and upgrade to the patched 2.69 release.

Bitcoin and Ether ETFs See $200M Outflows Ahead of Christmas

Spot Bitcoin and Ether ETFs recorded combined net outflows of around $200 million on December 24, led by BlackRock’s IBIT with $91.37 million and Grayscale’s GBTC with $24.62 million. Ethereum ETFs saw $95.5 million in redemptions. Analysts attribute the declines to seasonal repositioning and thin holiday liquidity ahead of Christmas.

North Korean Groups Account for $2.7B Crypto Hacks in 2025

Crypto hacks reached a record $2.7 billion in 2025, led by state-linked North Korean groups responsible for over $2 billion in thefts, including the $1.5 billion Bybit heist. Centralized exchanges and DeFi protocols both suffered high-impact breaches.

🔎 Coin Research — Subsquid (SQD) — 25 December 2025

New weekly coin research for Subsquid (SQD). — Score: 7.00/10 TL;DR: Decentralized data lake and query engine enabling permissionless, cost-efficient multi-chain on-chain data access for dApps and AI agents

Polymarket Accounts Hacked via Third-Party Auth Vulnerability

Decentralized prediction market Polymarket reported user account breaches linked to a third-party authentication provider. Affected wallets, created via Magic Labs email login, suffered unauthorized fund transfers. Polymarket has patched the flaw and will notify impacted users.

2025 Bitcoin Volatility Fuels Rise in Private Litigation

Bitcoin’s 2025 price surge to $126,000 and subsequent 30% correction have generated regulatory gaps filled by private lawsuits. Reduced SEC enforcement under Trump has led to class actions and arbitration over token misrepresentations and marketing practices.

XRP holders can now earn yield without selling tokens

Flare Network has launched earnXRP, a fully on-chain vault that allows XRP holders to deposit FXRP and earn compounded returns in XRP via staking, liquidity provision, and carry trades, eliminating token sales and complex strategies.

🔎 Coin Research — Solana Optimistic Network (SOON) — 24 December 2025

New weekly coin research for Solana Optimistic Network (SOON). — Score: 7.00/10 TL;DR: SOON is a Solana Virtual Machine-based optimistic rollup combining high performance of Solana’s SVM with secure optimistic settlement using zero-knowledge fraud

Gnosis announces hard fork to recover funds from Balancer exploit

Gnosis Chain operators executed a hard fork to recover assets from a November Balancer exploit that siphoned about $116 million in crypto. The fork follows a prior soft fork and aims to enable affected users to reclaim lost funds.

IMF confirms negotiations to sell El Salvador’s state-run Chivo Bitcoin wallet

IMF mission chief confirmed ongoing negotiations for sale of El Salvador’s state-run Chivo Bitcoin wallet under terms of a 2024 funding agreement, indicating potential government divestment. The move follows a deal requiring the halt of new Bitcoin acquisitions.