Chainlink to bring more Trump admin agencies on-chain with eye on aiding elections

Chainlink revealed partnerships with Trump administration agencies to bring election-related data on-chain, aiming to bolster transparency and security. The move positions the oracle network for broader government use amid rising on-chain governance and policy interest.

🔎 Coin Research — Union (U) — 11 September 2025

New weekly coin research for Union (U). — Score: 8.00/10 TL;DR: A zero-knowledge interoperability layer enabling secure, trustless cross-chain asset transfers and message passing.

Solana hits seven-month high as Bitwise exec predicts epic year-end run

Solana surged over 4% to a seven-month high near $225, fueled by corporate treasury accumulations and ETF anticipation. Bitwise CIO Matt Hougan projected an 'epic' year-end rally, citing pending spot ETF approvals and major private investments.

Bitcoin price up as producer price index drop boosts Fed rate cut bets

Bitcoin gained 0.5%, trading above $114,000, after U.S. producer prices fell 0.1% in August, boosting odds of a Federal Reserve rate cut. Traders await upcoming consumer inflation data for additional market catalysts.

CoinShares Bitcoin Mining ETF Hits Record High as AI Stocks Rally

CoinShares Bitcoin Mining ETF (WGMI) reached a record $33.13 following an AI-driven rally in tech stocks. Nebius Group’s GPU supply deal with Microsoft and Oracle’s upgraded cloud forecast fueled mining stock performance. Fund assets under management rose to $175.7 million.

Bitcoin Retakes $112K, SOL Hits 7-Month High as Economists Downplay Recession Fears

Major tokens reclaimed highs as economists downplayed fears of stagflation and recession after significant U.S. jobs data revision. Bitcoin and Solana led gains following a downward adjustment of 911,000 jobs. Market reaction reflected confidence in trend resilience.

Bitcoin Crosses $112K as Traders Brace for Data Week; Rotation Lifts SOL, DOGE

Bitcoin price surged past $112,000 as traders prepared for key U.S. economic data. Rotation lifted Solana and Dogecoin amid cautious market sentiment. Anticipation of U.S. CPI, PPI and Federal Reserve decisions shaped positioning.

Kraken Expands Tokenized Equities Platform, xStocks, to European Investors

Kraken expanded xStocks tokenized equities to European Union investors, enabling on-chain access to U.S. stocks and ETFs. Partnership with Swiss fintech Backed facilitates trading on Solana. Multi-chain integration and DeFi composability were highlighted.

Belarus President Backs Crypto and Cash Adoption to Navigate Sanctions

Belarusian President Aleksandr Lukashenko urged adoption of cryptocurrency and cash payments amid international sanctions. Regulatory oversight for crypto market and instant payment rollout were emphasized. Criticism targeted banks’ practices and de-dollarization strategy.

Time to Put a Digital Euro Ahead of Bank Interests

ECB is accelerating plans for a digital euro to counter growing U.S. dollar stablecoins and preserve monetary sovereignty amid declining cash usage. Proposed measures include standalone digital wallets and reconsidered holding limits to ensure public adoption without harming bank deposits.

Asia Morning Briefing: Bitcoin’s Calm Masks Market Tension

Bitcoin remains confined near $111,000 amid multi-month low volatility as markets brace for U.S. CPI data and the Fed’s September meeting. Prediction markets nearly fix odds on a 25 bp cut, while gold hits record highs and U.S. stocks close at new peaks ahead of key economic releases.

What Next as XRP Slumps After Failed Breakout Above $3

XRP failed to sustain gains above $3 following heavy institutional selling that pushed the price back to $2.94. Traders now monitor SEC’s October ETF decisions, Fed’s September 17 rate cut, and record-high exchange custody balances for near-term selling pressure.

GameStop Posts Narrower Loss as Bitcoin Holdings Bolster Balance Sheet

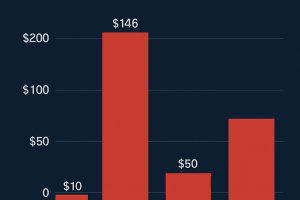

GameStop reported a second-quarter net loss of $18.5 million, narrower than the prior quarter’s $44.8 million profit, as the firm’s 4,710 BTC holdings generated $28.6 million in unrealized gains. Revenue dipped to $673.9 million amid hardware and software declines, offset by higher collectibles sales.

SEC Delays Decision on Grayscale’s Hedera Trust Amid Expanded ETF Filings

SEC pushes listing decision on Grayscale’s Hedera Trust to November while Grayscale simultaneously files updated registration statements for its Bitcoin Cash and Litecoin trusts under Form S-3. Bank of New York Mellon, Coinbase and Nasdaq’s Arca exchange feature prominently in planned launches and ETF review extensions.

Crypto Memes — 2025-09-10

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-10. 🚀

Crypto Digest — 10 September 2025

📢 Read the daily digest for 2025-09-10: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Senate Democrats Unveil Bipartisan Crypto Market Structure Framework

A group of 12 Senate Democrats released a detailed framework on Sep 9, 2025 for bipartisan crypto market structure legislation. The proposal outlines seven pillars, including illicit finance safeguards, spot market clarity, and enhanced SEC/CFTC coordination.

Stablecoins Fuel Treasury Demand Amid Federal Liquidity Focus

Stablecoins have emerged as efficient liquidity channels for U.S. Treasury operations, enabling instant settlement and transparency. Their integration into corporate and government treasuries is reshaping funding strategies, as traditional bank settlement systems face modernization pressures.

FIL Pares Gains After Testing $2.50 Resistance Level

Filecoin’s FIL token retraced to $2.43 on Sep 9, 2025 after encountering resistance near $2.50. On-chain and trading data highlight a support zone around $2.38, while trading volumes remain subdued compared to recent volatility spikes, indicating mixed sentiment among traders.

🔎 Coin Research — Qubic (QUBIC) — 10 September 2025

New weekly coin research for Qubic (QUBIC). — Score: 7.00/10 TL;DR: A feeless, AI-driven Layer 1 blockchain that repurposes Proof-of-Work into Useful Proof of Work for decentralized AGI training with sub-second finality

Crypto Mining Stocks Soar After $17.4B Microsoft GPU Supply Deal

Shares of public bitcoin miners surged on Sep 9, 2025 following Nebius Group’s $17.4 billion GPU supply agreement with Microsoft for AI infrastructure. Bitfarms led gains with a 22% rise, while Cipher Mining and Hut 8 climbed over 15%, highlighting investor focus on mining firms’ computing capacity amid the AI boom.

Grayscale Files S-1 for Litecoin ETF and S-3 for Bitcoin Cash and Hedera ETFs

Grayscale submitted an S-1 registration for a Litecoin ETF and S-3 filings for Bitcoin Cash and Hedera ETFs on Sep 9, 2025, expanding its potential crypto fund lineup amid ongoing SEC delays. The filings follow a recent bid to convert its Chainlink Trust and come as Fidelity and VanEck also await regulatory approval.

South Korean Fintech Toss Plans Global Push and Won Stablecoin

Toss, the Seoul-based fintech unicorn, plans to launch its all-in-one finance app in Australia by year-end 2025 and expand further internationally. The company also intends to issue a won-based stablecoin pending regulatory approval, aligning with Korea’s proposed stablecoin oversight framework.

Exclusive: Winklevoss-Founded Exchange Gemini Taps Nasdaq as Investor

Gemini Space Station has secured a $50 million strategic investment from Nasdaq ahead of its New York IPO. The agreement grants Nasdaq clients access to Gemini custody and staking services and integrates institutional clients with Nasdaq’s Calypso platform. Gemini expects to begin trading under ticker GEMI.

Transparency in Action: CoinEx Confirms 100% Reserve

CoinEx published its Proof of Reserve report showing full backing of user deposits across major assets as of September 8, 2025, 07:00 UTC. Reported reserves include BTC at 101.3%, ETH at 100.05%, and stablecoins above 108%. The disclosure reinforces CoinEx’s commitment to transparency and asset security.

Upbit Operator Dunamu Unveils Layer-2 Blockchain GIWA

Dunamu, operator of the Upbit cryptocurrency exchange, launched its GIWA Web3 brand at the Upbit Developer Conference in Seoul. GIWA comprises the GIWA Chain, an Optimistic Rollup-based layer-2 blockchain, and the GIWA Wallet for multi-chain asset transfers. The launch follows trademark filings and aims to foster local and global developer adoption.

Ripple extends custody partnership with BBVA in Spain

Ripple will provide digital asset custody technology to BBVA for Spanish retail clients under EU’s MiCA regulation. The integration follows BBVA’s launch of bitcoin and ether services and builds on Ripple’s custody deals in Switzerland and Turkey.

Ledger CTO warns of NPM supply-chain attack impacting over 1 billion downloads

Ledger’s CTO Charles Guillemet alerted developers to a large-scale supply-chain breach of an NPM account, with malicious code inserted into popular JavaScript packages downloaded over 1 billion times. The code swaps wallet addresses in transactions, risking fund diversion. Users urged to use hardware wallets with secure screens to verify details.

Toss plans Australia launch and won-based stablecoin

South Korean fintech unicorn Toss will launch its all-in-one finance app in Australia by year-end and expand to other markets, offering core services like peer-to-peer transfers. The company aims to issue a won-pegged stablecoin once regulations permit. Toss plans a U.S. IPO in 2026.

Gemini exchange secures Nasdaq as strategic investor

Gemini Space Station has lined up Nasdaq to invest $50 million in its upcoming IPO via a private placement, securing strategic support ahead of its New York listing this week. The partnership grants Nasdaq clients access to Gemini’s custody and staking services. Trading expected under the ticker “GEMI” on Friday.

Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land

Tether CEO Paolo Ardoino refuted rumors of a Bitcoin sell-off, confirming ongoing profit allocations into Bitcoin, gold, and land. The firm transferred BTC to XXI, clarifying assets movement rather than liquidation of stablecoin reserves.

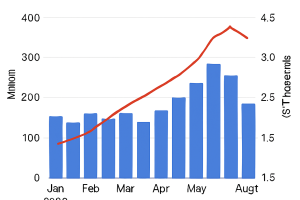

Ethereum revenue dropped 44% in August amid ETH all-time high

Ethereum network revenue, comprising token burns and transaction fees accruing to ETH holders, fell 44% in August despite Ether reaching an all-time high. Total revenue declined to $14.1 million from July’s $25.6 million amid Dencun upgrade effects.

Lion Group doubles down on Hyperliquid as HYPE breaks a new high

Lion Group Holding announced plans to convert its Solana and Sui token holdings into Hyperliquid’s HYPE token, aiming to capitalize on institutional custody offerings and market volatility. The move follows HYPE’s new all-time price high.

Sky joins bidding war to launch Hyperliquid’s USDH stablecoin

Sky protocol, co-founded by Rune Christensen, has submitted a proposal to support Hyperliquid’s planned USDH stablecoin, offering a 4.85% yield and customizable compliance features. It joins four other major bids for stablecoin issuance governance.

Putin adviser claims US using stablecoins, gold to devalue its $37T debt

An adviser to President Putin asserted that the United States is using stablecoins and gold to devalue its $37 trillion national debt by shifting obligations onto alternative currency platforms. The claim was made at the Eastern Economic Forum without detailed mechanism explanation.

Crypto Memes — 2025-09-09

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-09. 🚀

Crypto Digest — 09 September 2025

📢 Read the daily digest for 2025-09-09: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

OpenSea launches $1 million NFT reserve with CryptoPunk as inaugural acquisition

OpenSea announced a $1 million NFT reserve fund dedicated to acquiring culturally significant art on its platform, beginning with CryptoPunk #5273. A cross-functional team will guide future purchases to build a living collection. The initiative marks a shift toward strategic NFT treasury management.

SwissBorg hacked for $41 million in SOL after staking partner API breach

SwissBorg revealed that hackers exploited a vulnerability in its staking partner Kiln’s API, draining 193,000 SOL (≈$41 million) from its Solana Earn program. Impacted users represent about 1 percent of base and 2 percent of assets. SwissBorg pledged full reimbursement and is collaborating with authorities to investigate.

🔎 Coin Research — MYX Finance (MYX) — 09 September 2025

New weekly coin research for MYX Finance (MYX). — Score: 8.00/10 TL;DR: A decentralized perpetual derivatives exchange leveraging a proprietary Matching Pool Mechanism for zero-slippage, high-leverage trading with chain abstraction

Crypto ETFs post $352 million outflows as Ether funds shed $912 million

Crypto investment products saw $352 million net outflows in early September, driven by $912 million exiting Ether funds despite $524 million inflows into Bitcoin products. Weekly trading volumes fell by 27 percent as profit-taking and macro developments influenced risk-asset demand. Despite cooling activity, year-to-date inflows remain ahead of last year.

Kazakhstan president proposes national crypto reserve and digital asset law by 2026

Kazakhstan president Kassym-Jomart Tokayev called for creation of a state digital asset fund under the national bank's investment arm and drafting of comprehensive crypto legislation before 2026. Plans include establishing a pilot ‘CryptoCity’ in Alatau. The proposals aim to formalize digital assets within the national financial framework.

Bitcoin climbs above $112,000 while derivatives data reflect trader caution

Bitcoin surpassed $112,000 amid mixed signals from derivatives markets, where options delta skew and futures funding rates point to persistent risk aversion. Spot ETF outflows and Macro factors may also be influencing sentiment. The move above $110,000 failed to trigger a sustained surge, as traders weigh broader market dynamics.

Robinhood Stock Jumps 15% on S&P 500 Inclusion; Strategy Slips as Analysts/Saylor Downplay Snub

Robinhood shares climbed 15% after being added to the S&P 500 index effective September 22, while Strategy’s (MSTR) stock dipped following its exclusion despite meeting eligibility. Analysts and Saylor remained unbothered by the index decision.

Worldcoin’s WLD Surges 25% as $250M Treasury Deal Fuels Momentum

Worldcoin’s WLD token jumped 25%, extending weekly gains near 50%, driven by 530,000 new user verifications and a $250 million private placement by Eightco Holdings. New academic operators joined its AMPC verification network.

Lion Group Plans to Swap SOL, SUI Holdings for HYPE

Lion Group announced a full exit from SOL and SUI positions to acquire HYPE tokens issued by Hyperliquid. The Singapore-based platform aims to leverage custody services provided by BitGo to optimize its treasury and enhance yields.

Nasdaq Seeks Nod From U.S. SEC to Tokenize Stocks

Nasdaq filed a proposal with the U.S. SEC to permit on-chain trading of tokenized equities alongside traditional shares. The move aims to integrate real-world asset tokenization into regulated markets with the same execution priority as legacy trading.

MegaETH Unveils Native Stablecoin with Ethena, Aiming to Keep Blockchain Fees Low

A new stablecoin called USDm launches on MegaETH in partnership with DeFi protocol Ethena. The token will be backed by Ethena’s USDtb, itself backed by BlackRock’s money market fund, and may include USDe reserves to subsidize sequencer fees on the network.

Backpack Launches Regulated Perpetuals Exchange in Europe Post-FTX EU Deal

Backpack Exchange launched its European arm under MiFID II with perpetual futures offering up to 10x leverage. The Cyprus-based platform completed the FTX EU acquisition, began customer fund restitution and plans expansion to Japan. CEO emphasizes daily proof-of-reserves attestations.

DOGE Leads Gains as Bitcoin Holds Above $111K Amid New BTC Treasury Plan

Bitcoin held above $111,000 awaiting U.S. inflation data while Dogecoin outperformed with a 7% rise to $0.2328. Altvest Capital aims to raise $210 million to purchase BTC for treasury, planning Africa Bitcoin Corp. rebrand. Japan bond sell-off adds macro uncertainty.

Nemo Protocol on Sui Exploited for $2.4M USDC

Nemo, a Sui blockchain yield protocol, suffered a $2.4 million exploit when a malicious actor moved USDC from Arbitrum to Ethereum. Total value locked dropped from over $6 million to $1.53 million. Peckshield traced the attack via blockchain analytics.

Nasdaq Firm Raises $1.65B for Solana Treasury Launch

Forward Industries secured $1.65 billion in cash and stablecoin via a PIPE led by Galaxy Digital, Jump Crypto and Multicoin Capital. FORD shares jumped 128% pre-market while SOL rose 2.3%. Multicoin’s Kyle Samani to chair board following largest Solana treasury financing to date.

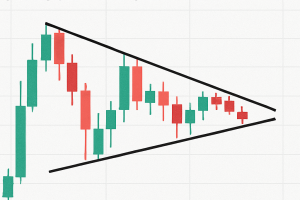

XRP Consolidates Under $3 Amid Descending Triangle Pattern

XRP has consolidated below the $3 level after testing resistance at $2.90–$2.92 on high volume, facing repeated rejections. Futures markets price nearly certain Fed rate cuts on September 17, shaping institutional inflows. Traders watch for a sustained break above $2.90 to target $3.00–$3.30.

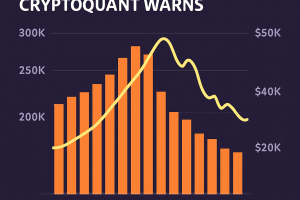

Institutional Bitcoin Treasury Demand Dips, CryptoQuant Warns

Bitcoin treasury companies showed an 86% drop in average purchase sizes despite record holdings, suggesting cautious buying. Asia’s Sora Ventures launched a $1 billion fund to fuel regional treasury growth amid shifting institutional flows.

Dogecoin Forms Higher Lows as Resistance Persists

Dogecoin exhibited controlled intraday trading between $0.213 and $0.221, with buyers defending lower bounds and sellers capping rallies. Technical indicators signal consolidation under resistance, awaiting volume-backed breakout confirmation.

Stripe’s Tempo Blockchain Criticized for Undermining Decentralization

Meta’s Libra co-creator Christian Catalini argued that Stripe’s Tempo blockchain sacrifices decentralization. He cited corporate incentive structures and regulatory compromises as risks to crypto’s permissionless ethos.

Tether Denies Selling Bitcoin for Gold amid Rumors

Tether CEO Paolo Ardoino refuted claims of Bitcoin sales, asserting no BTC was sold. Clarification followed rumors citing asset reports, with explanation that BTC transfers funded separate projects rather than gold purchases.

MYX Finance ATH Surge Raises Pump-and-Dump Concerns

MYX Finance token hit a record high after a 167% rally, doubling market cap and spiking volume. Analysts flagged potential manipulation due to token unlocks, whale-triggered liquidations, and thin liquidity amplifying price movements.

Crypto Memes — 2025-09-08

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-08. 🚀

Crypto Digest — 08 September 2025

📢 Read the daily digest for 2025-09-08: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!