Crypto Digest — 08 October 2025

📢 Read the daily digest for 2025-10-08: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

UK to Lift Four-Year Ban on Bitcoin ETNs for Retail Investors

The UK Financial Conduct Authority will lift its ban on crypto exchange-traded notes (ETNs) referencing Bitcoin and Ethereum on October 8, 2025, allowing retail investors to access regulated crypto exposure. Experts call the move symbolic without direct spot products but expect it to spur market development.

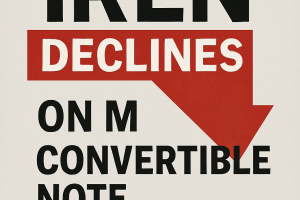

IREN Declines 6% on $875M Convertible Note Offering

Bitcoin miner and high-performance computing firm IREN saw its stock fall 6% after announcing an $875 million convertible note offering. Proceeds will fund AI-cloud expansion and capped call hedges. The notes mature in July 2031, with an option to increase the offering size to $1 billion.

🔎 Coin Research — DoubleZero (2Z) — 08 October 2025

New weekly coin research for DoubleZero (2Z). — Score: 7.00/10 TL;DR: DoubleZero is a DePIN protocol constructing a global fiber-optic network to reduce blockchain latency via token-incentivized infrastructure.

BitGo Secures VARA License Amid Regulatory Crackdown

Digital asset custody firm BitGo has obtained a broker-dealer license from Dubai’s Virtual Assets Regulatory Authority, enabling regulated trading services in the MENA region. The approval follows VARA enforcement actions against 19 firms for unlicensed activity. BitGo’s MENA arm can now serve institutional clients under enhanced compliance standards.

SEC to Formalize Innovation Exemption by Year End

The U.S. Securities and Exchange Commission plans to initiate formal rulemaking for a proposed"innovation exemption" by the end of 2025 or early 2026. The effort remains a priority despite a government shutdown slowing agency work. Chair Paul Atkins reaffirmed commitment at a legal industry panel.

Grayscale Integrates Staking into Ethereum ETFs

Grayscale has enabled staking for its Ethereum Mini Trust (ETH) and Ethereum Trust (ETHE) ETFs, allowing holders to earn rewards as reinvested gains or cash payouts. The firm also extended staking to its Solana Trust ahead of its prospective uplisting.

US Shutdown Freezes SEC and Delays Crypto Progress

A US government shutdown has halted most SEC operations, including crypto ETF approvals. TD Cowen warns that policy progress will remain stalled until funding is restored. Other agencies like the Fed and FDIC will handle crypto matters during the shutdown.

VanEck Forecasts Bitcoin to Capture Half of Gold’s Market Cap

VanEck’s Head of Digital Assets Research predicts Bitcoin could attain half of gold’s market capitalization after the April 2028 halving. The forecast reflects shifting preferences among younger investors toward digital store-of-value assets amid record highs for both Bitcoin and gold.

Bitcoin Surges Past $126,000 Amid Institutional Demand

Bitcoin breached $126,100 for the first time on Oct. 6, 2025, driven by record US spot ETF inflows and macro uncertainty. The rally retraced to $123,500, with support at the prior all-time high. Traders await Fed signals later this month.

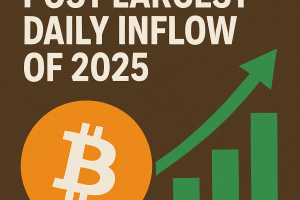

Bitcoin ETFs Post Largest Daily Inflow of 2025

US spot Bitcoin ETFs recorded $1.21B in net inflows on Oct. 6, 2025, the largest daily intake of 2025. Total ETF assets reached $169.48B, representing 6.79% of Bitcoin’s market cap. BlackRock’s iShares Bitcoin Trust contributed $969.95M of the inflows.

Crypto Digest — 07 October 2025

📢 Read the daily digest for 2025-10-07: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

BNB Chain Integrates Chainlink to Onboard Official U.S. Economic Data Onchain

BNB Chain adopted the Chainlink Data Standard to make trusted US Department of Commerce data, such as GDP and PCE price index, available onchain. The integration aims to enhance reliability for DeFi, RWAs and prediction markets.

Griffin AI Relaunches GAIN Token After $3M Bridge Exploit

Griffin AI resumed GAIN token trading on major exchanges after a September bridge exploit that minted 5 billion counterfeit tokens. A $2.5 million buyback fund was established to compensate legitimate holders and restore investor confidence.

Stablecoins Could Draw $1 Trillion in Deposits from Emerging Market Banks

Standard Chartered analysts predict stablecoins may siphon $1 trillion from banks in vulnerable emerging markets over three years as depositors favor capital preservation and access. This represents about 2% of total deposits in countries like Egypt and Turkey.

🔎 Coin Research — Anoma (XAN) — 07 October 2025

New weekly coin research for Anoma (XAN). — Score: 8.00/10 TL;DR: Anoma is a privacy-preserving, intent-centric operating system that unifies multiple blockchains through MASP-based zero-knowledge multi-asset shielded pools an

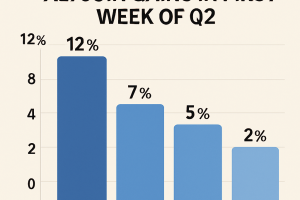

Layer-1 Sector Leads Altcoin Gains in First Week of Q4

Layer-1 blockchains outperformed other segments in the first week of October with a 12.5% gain, led by Solana, Avalanche and BNB. The layer-2 sector followed with 11.3% growth, while meme coins and DeFi tokens recorded modest advances under 5%.

Bitcoin Surges to ATH on Macro Tailwinds; Ether, DOGE and BNB Rally

Bitcoin rose to a new record of $126,223 amid a convergence of macroeconomic factors, including US government shutdown concerns and ETF inflows. Ether reached a three-week high above $4,700, while DOGE and BNB posted gains of around 6% amid broad market strength.

BNB tops $1.2K in 4% rally as chain activity and institutional demand accelerate

BNB surged over 4% to exceed $1,200, driven by spikes in trading volume and increased institutional interest. Active addresses on the BNB Chain rose sharply, with Aster Protocol TVL up 570%. Despite a late retracement, key support held above $1,200.

Dogecoin holds $0.25 support as whales add 30M DOGE amid ascending triangle pattern

Dogecoin found a floor near $0.251 after early volatility, supported by institutional flows and whale accumulation. The token consolidated inside an ascending triangle, with on‐chain data showing mid‐tier wallets adding 30 million DOGE. Traders now eye breakout targets in the $0.27–0.30 range.

XRP rejected above $3, closes lower as sellers dominate

XRP surged toward $3.07 but encountered heavy selling pressure, confirming resistance at that level. The token stabilized near $2.98 after institutional prints drove a high-volume rejection. Market structure suggests continued accumulation on dips despite bearish session control.

Bitcoin hits record high against yen as Japan’s new PM plans to revive Abenomics

Bitcoin reached an all-time peak versus the Japanese yen as markets anticipated aggressive fiscal and monetary stimulus under the new prime minister. The yen weakened sharply, and Japanese equities also gained on renewed policy optimism. The move highlights cross-asset demand for alternative stores of value.

Political waves send Nikkei, bitcoin, gold soaring to record highs

Japanese markets rallied sharply after the ruling party elected a new leader poised to revive fiscal stimulus. Gold climbed near $4,000 and bitcoin reached a lifetime peak above $125,000 amid demand for alternative assets. Global equities also gained on renewed risk appetite.

Crypto Digest — 06 October 2025

📢 Read the daily digest for 2025-10-06: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Morgan Stanley Recommends ‘Conservative’ Crypto Allocations for Advisors

Morgan Stanley’s October Global Investment Committee report recommends up to 4% cryptocurrency allocations in higher-risk “Opportunistic Growth” portfolios and up to 2% in balanced growth strategies, with zero allocation for wealth-preservation mandates. The guidance underscores growing institutional acceptance and the need for periodic rebalancing amid volatility and macro stress.

The Fed’s Next Move on Oct. 29 Could Derail Crypto and Equities

A partial U.S. government shutdown has delayed key economic data ahead of the Fed’s Oct. 28–29 meeting, leaving markets pricing in a 25 bps cut but facing uncertainty if labor reports remain frozen. Missing data and persistent inflation raise the risk of a surprise pause, which could trigger sharp downward moves in both crypto and U.S. stocks.

Solana’s Alpenglow Upgrade to Deliver Millisecond Finality and Slash Fees

VanEck’s report details Solana’s upcoming Alpenglow consensus overhaul, promising finality cuts from 12 seconds to 150 milliseconds, off-chain voting, reduced gossip overhead, and ticket-based validator costs. The upgrade enhances decentralization by lowering barriers for smaller nodes, boosts block capacity by 25%, and powers new P-token efficiency.

🔎 Coin Research — Swarm Network (TRUTH) — 06 October 2025

New weekly coin research for Swarm Network (TRUTH). — Score: 7.00/10 TL;DR: Decentralized AI-agent swarms with human oversight and zero-knowledge proofs to verify off-chain data in real time, creating an on-chain economy for truth.

Asia Morning Briefing: Sanctioned Ruble Stablecoin Appears at Token2049

A ruble-backed stablecoin issued by a Russian state bank under U.S. sanctions sponsored Token2049 in Singapore, exploiting Hong Kong-based organizer exemptions. Former White House crypto director Bo Hines praised Tether amid shutdown-driven haven demand that lifted bitcoin above $125,000. The incident highlights compliance risks at global events.

Bitcoin Surges to Record High Above $125K After $3.2B Spot ETF Inflows

Bitcoin rallied above $125,000 on Oct. 5, driven by a record $3.24 billion in net inflows into U.S.-listed spot ETFs for the week ended Oct. 3. The rally extended October gains to 11% and reflected heightened safe-haven demand amid a U.S. government shutdown. Other major tokens including XRP, ETH, SOL and DOGE also rose 1–3% during Asian trading hours.

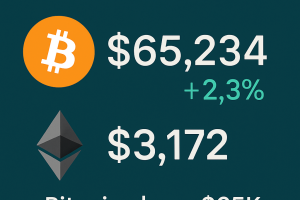

Crypto market snapshot: BTC above $20K, Ether holds $1.3K

The crypto market opened in positive territory, with Bitcoin trading at $20,194 and Ether at $1,355, up 3.07% and 2.09% in the last 24 hours, respectively. Trading volumes for Bitcoin surged over 23%, while Ether volumes increased by 6.5%. Toncoin, LUNA, HNT, and EGLD led deep-value gains, while RSR, CHZ, POLY, and BTRST were the top losers. The fear & greed index rose to 25, remaining in “extreme fear.”

Crypto trader turns $3K into $2M after CZ post sends memecoin soaring

A trader transformed a $3,000 BNB stake into nearly $2 million after Binance co-founder Changpeng Zhao reposted the BNB Chain’s phishing incident post alongside a new “4” memecoin. Blockchain data shows the trader was among the first buyers, achieving a 650× return and retaining $1.88 million in unrealized gains. “Smart money” wallets also accumulated the token following the viral social media mention.

Bitcoin corrects from $125K all-time high after record surge

Bitcoin entered a brief retracement phase, falling over $2,000 from its $125,000 record high as traders assessed potential support levels around $118,000–$124,000. Derivative data indicated short sellers were trapped near the peak, driving stop-loss liquidations and heightened volatility. Analysts noted institutions are monitoring price action to gauge continued momentum in the “debasement trade.”

Binance aims to turn Thailand into cryptocurrency hub

Binance identified Thailand’s clear legal framework, rising public crypto awareness, and supportive macroeconomic conditions as key pillars to foster growth. Chainalysis data ranked Thailand seventh in Asia-Pacific for crypto adoption, with nearly 2.83 million accounts and THB100 billion in assets under management as of August 2025. The exchange targets Thailand in its drive to reach one billion users by year-end.

Bitcoin hits all-time high above $125,000

Bitcoin surged to a record peak, climbing 2.7% to $125,245.57 after breaking its previous high set in mid-August. The rally reflects strong institutional demand, inflows into spot bitcoin ETFs, and a broader risk-on environment amid U.S. market gains. The U.S. dollar weakened as investors weighed uncertainty over a potential government shutdown and delayed economic data.

Crypto Digest — 05 October 2025

📢 Read the daily digest for 2025-10-05: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Linea (LINEA) — 05 October 2025

New weekly coin research for Linea (LINEA). — Score: 8.00/10 TL;DR: A fully EVM-equivalent zkEVM rollup with native ETH burn and yield mechanics strengthening Ethereum’s security and economic model

Bitcoin Nears $124K as Total Crypto Market Cap Tops $4.21T

Bitcoin rallied 14% over the past week to near $124,000 amid a US government shutdown and dovish Fed outlook. On-chain data indicated a $1.6B surge in buy volume and a $92 Coinbase premium gap, signaling strong US-led demand.

VanEck Details Significant Impacts of Ethereum’s Fusaka Upgrade

Asset manager VanEck outlined how Ethereum’s upcoming Fusaka upgrade will reduce rollup data burdens via PeerDAS, enhancing layer-2 scalability and reinforcing ETH’s role as a monetary asset in a rollup-centric ecosystem.

Ripple Engineer Outlines Privacy-First Roadmap for XRP Ledger

Ripple cryptographer Ayo Akinyele detailed enhancements to the XRP Ledger focusing on privacy, compliance and scalability, highlighting zero-knowledge proofs and confidential tokens. The roadmap aims to position XRPL as the institutional blockchain of choice.

Crypto Digest — 04 October 2025

📢 Read the daily digest for 2025-10-04: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

LINK Gains Momentum as Plasma Integrates Chainlink Oracle Services

Chainlink’s LINK token established a higher low after a slight pullback, posting a 6.7% weekly gain. Plasma has adopted Chainlink Scale, integrating CCIP, Data Streams, and Data Feeds to support stablecoin use cases. Institutional pilots signal growing adoption.

Aave Breaks Resistance as DeFi Market Hits Record $219B Size

Aave’s native token rebounded by 2% to $287.10 after breaking key resistance levels, contributing to a 6% weekly gain. The broader DeFi market reached a record $219 billion in total value locked, with Aave deposits topping $74 billion.

UK Orders Apple iCloud Backdoor, Poses Crypto Wallet Security Risk

The UK ordered Apple to enable access to encrypted iCloud backups of British users, which may expose cryptocurrency wallet keys to hacking. Experts warn that this backdoor undermines end-to-end encryption and heightens risks of identity theft and fraud.

🔎 Coin Research — EVAA Protocol (EVAA) — 04 October 2025

New weekly coin research for EVAA Protocol (EVAA). — Score: 8.00/10 TL;DR: Telegram-native decentralized lending protocol on TON offering seamless DeFi via Telegram Mini App, featuring integrated leveraged liquid staking

Tether Plans Tokenized Gold Treasury Firm with Antalpha Funding

Tether is working with Antalpha to raise at least $200 million for a digital asset treasury focused on tokenized gold. The firm plans to stockpile XAUT, a gold-backed token, under custody in Swiss vaults. The move builds on Tether’s expanding asset strategies.

Coinbase Applies for Federal Trust Charter, Aims to Avoid Bank Status

Coinbase applied for a national trust charter with the U.S. OCC to secure federal oversight. This would enable expansion of payments and settlement services without state-by-state approvals. The company affirmed it will not convert into a full-service bank.

BNB Breakout Over $1.1K Leaves Bitcoin, Dogecoin Behind, With Ecosystem Tokens in Focus

BNB surged past $1,100, boosting attention to BNB Chain protocols and driving increased network activity. Binance founder endorsements and PancakeSwap trading fees rose, while the total value locked on the chain increased only modestly, suggesting cautious long-term capital allocation.

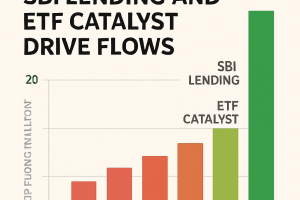

XRP Gains 3% as SBI Lending and ETF Catalyst Drive Flows

XRP rose 3% to above $3.00 amid expanded institutional lending by SBI Holdings and pending ETF approval speculation. Short-term floor identified near $2.99, with resistance capping at $3.10. Seven XRP ETF applications remain under SEC review ahead of mid-October deadlines.

Bitcoin to $200K by End of 2025? This Cycle Indicator Points to Explosive Months Ahead

On-chain demand metrics have increased since July, mirroring previous bull cycles and potentially driving bitcoin beyond $200,000 by year-end. Trader’s Realized Price at $116,000 is identified as a key threshold for bull phase transition. ETF inflows and whale accumulation underpin the bullish outlook.

Nomura-Owned Laser Digital Plans Crypto License Application in Japan: Bloomberg

Laser Digital, a subsidiary of Nomura Group, is preparing to apply for a crypto trading license in Japan. Pre-consultation talks are underway with the Financial Services Agency to offer institutional digital-asset services. Expansion reflects optimism in Japan’s digital-asset ecosystem.

Accumulation Trends Strengthen as Bitcoin Breaks Through $120K

Aggregate Accumulation Trend Score rose above 0.5 for the first sustained time since August, indicating renewed demand over supply. Mid-size wallets have shifted into accumulation mode while whales continue distribution pressure. Bitcoin gained roughly 8% during U.S. trading hours this week.

Crypto Digest — 03 October 2025

📢 Read the daily digest for 2025-10-03: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Citi Sees Bitcoin Hitting $181K in 2026 as ETF Flows Drive Crypto Higher

Citi forecasts Bitcoin at $133K by end-2025 and $181K in 12 months, with Ether at $4.5K by year-end. Institutional demand and ETF inflows remain key drivers amid favorable regulation.

Crypto for Advisors: Is Bitcoin Lending Back?

A pilot resurgence in institutional crypto lending is underway with stricter collateral rules post-2022 crash. DeFi transparency and regulated CeFi services offer renewed trust for wealth managers.

BBVA Teams With SGX FX to Launch Retail Crypto Trading in Europe

Spanish bank BBVA is partnering with SGX FX to integrate crypto trading infrastructure, enabling retail customers to trade Bitcoin and Ether 24/7 via existing platforms under MiCA compliance.

🔎 Coin Research — OpenVPP (OVPP) — 03 October 2025

New weekly coin research for OpenVPP (OVPP). — Score: 6.00/10 TL;DR: OpenVPP is the first decentralized payment and tokenization layer for the $10T global electric utility industry, enabling stablecoin micropayments, DER routing,

White House Weighing Candidates for Multiple CFTC Spots: Giancarlo

The Trump administration is reportedly near naming a new CFTC chairman nominee after dropping its first pick. Former Chairman Chris Giancarlo said Mike Selig may be considered for a commission slot.

Bitcoin Hits $120K With Traders Eyeing Bullish October Rally

Bitcoin surged past $120,000 for the first time since August as futures open interest hit a record $32.6 billion amid macro uncertainty from a U.S. government shutdown and renewed ETF hopes.

Bullish to launch bitcoin options trading with major industry partners

Bullish will launch bitcoin options trading on October 8, offering European-style contracts settled in USDC with tenors from three weeks to three months. The product leverages a unified margin system and will be supported by leading market makers.