Centrifuge Debuts First Licensed Tokenized S&P 500 Index Fund on Base Network

Real-world asset specialist Centrifuge launched SPXA, a licensed on-chain S&P 500 index fund trading 24/7 with transparent holdings. Janus Henderson serves as sub-investment manager, while Wormhole facilitates cross-chain expansion.

Onchain Asset Management AUM Surges 118% to $35 Billion in 2025

Assets under management onchain doubled this year to $35 billion, led by yield vaults, discretionary strategies and structured products. Report warns of concentration risk as top three protocols capture 31 percent of AUM.

🔎 Coin Research — ChainOpera AI (COAI) — 26 September 2025

New weekly coin research for ChainOpera AI (COAI). — Score: 8.00/10 TL;DR: A decentralized AI operating system and Layer-1 blockchain enabling collaborative intelligence through community-owned AI agents and federated learning infrastr

Citi Forecasts Stablecoin Market Could Reach $4 Trillion by 2030

Citi raised its 2030 issuance forecast for stablecoins to a $1.9 trillion base case and a $4 trillion bull case. Report highlights potential for $200 trillion in annual transactions and warns that bank tokens may overtake stablecoins in volume.

KuCoin Faces $14M Canadian Enforcement Action Over AML and Registration Failures

Exchange appealing Canadian enforcement action that resulted in a $14 million penalty for alleged registration lapses and AML control failures. Large-scale regulatory case highlights compliance challenges faced by crypto platforms and potential legal precedents.

Crypto Digest — 25 September 2025

📢 Read the daily digest for 2025-09-25: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Bless Network (BLESS) — 25 September 2025

New weekly coin research for Bless Network (BLESS). — Score: 8.00/10 TL;DR: Bless Network is a decentralized edge computing DePIN that leverages idle CPU/GPU resources from everyday devices to form a global shared computer, offering ver

Coinbase, Sony and Samsung back stablecoin startup Bastion in $14.6M raise

Stablecoin infrastructure firm Bastion raised $14.6 million in a funding round led by Coinbase Ventures, with participation from Sony, Samsung’s investment arm, Andreessen Horowitz Crypto, and Hashed. Bastion’s platform enables organizations to issue compliant, white-label stablecoins via API, offering custodial wallets, smart transaction routing, and analytics. The raise underlines growing corporate demand for regulated stablecoin solutions.

Crypto millionaires surge 40% as bitcoin market hits $3.3 trillion

The number of individuals with $1M+ in crypto holdings jumped 40% year-over-year to 241,700, according to Henley & Partners’ Crypto Wealth Report 2025. This increase coincides with a rally that boosted total digital asset market capitalization to $3.3 trillion in June, up 45% year-on-year. Singapore, Hong Kong, and the U.S. lead in crypto-friendly jurisdictions, reflecting growing institutional and retail interest.

Kazakhstan Launches Evo ($KZTE) Stablecoin on Solana

Kazakhstan introduced Evo ($KZTE) stablecoin on the Solana blockchain to enhance its digital finance infrastructure. The stablecoin is backed by the national currency and aims to improve domestic and cross-border transactions. This initiative positions Kazakhstan as a regional crypto hub and follows government efforts to integrate digital assets into its financial system.

Bitcoin, Ethereum, Solana Decline Amid Broad Crypto Market Selloff

Cryptocurrency markets declined on Wednesday following the largest deleveraging event of 2025. Bitcoin fell 0.6% to $112,584, Ethereum dropped 0.8%, and Solana slid 4.4% as investors digested excess leverage and recent Federal Reserve rate cuts. XRP managed a slight gain of 0.2%. Analysts warn that sustained weakness in bitcoin could trigger further panic selling among short-term holders.

SEC Streamlines Crypto ETF Approval Process, Triggering ETF Filing Surge

The US Securities and Exchange Commission updated its rules to expedite cryptocurrency ETF approvals, reducing the review timeline from up to 270 days to 75 days. Asset managers have submitted multiple filings for new products tied to coins like Solana and XRP, with expectations that the first ETFs under the streamlined standards will launch in early October. Industry experts predict a significant increase in ETF offerings in the fourth quarter of 2025.

Crypto Digest — 24 September 2025

📢 Read the daily digest for 2025-09-24: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

UXLink hack turns ironic as attacker gets phished mid-exploit

A breach of UXLink’s multisignature wallet allowed a hacker to mint 10 trillion UXLINK tokens and steal over $30 million in assets, only for the perpetrator to lose a large portion of the ill-gotten tokens in a phishing attack.

Blockchain networks will stop crypto deepfake scams

Centralized deepfake detectors are failing to prevent AI-powered crypto fraud, prompting development of blockchain-based detection networks that reward independent model providers to verify authenticity onchain in real time.

🔎 Coin Research — DeAgentAI (AIA) — 24 September 2025

New weekly coin research for DeAgentAI (AIA). — Score: 7.00/10 TL;DR: Decentralized AI agent infrastructure enabling trust-minimized autonomous agents across Sui, BSC, and Bitcoin ecosystems

US SEC eyes ‘innovation exemption’ to fast-track digital asset products: Atkins

SEC Chair Paul Atkins announced plans to propose an “innovation exemption” to allow cryptocurrency firms to launch new products under a lighter regulatory framework while tailored rules are developed, targeting implementation by year’s end.

Judge denies Justin Sun’s bid to block Bloomberg over crypto holdings

A US district judge denied a request to bar Bloomberg from publishing details of Justin Sun’s cryptocurrency assets, ruling that Sun failed to show confidentiality obligations or risk of harm from the information’s release.

Crypto Whales Panic Sell ETH, HYPE & PUMP Amid September Market Chaos

Major whale addresses liquidated positions across Ethereum, Hyperliquid (HYPE), and PUMP tokens, realizing losses of up to $4.19 million on single trades. Liquidations approached $1.7 billion, reflecting peak risk aversion among large holders and heightened market volatility.

Helius Medical Launches $500M Digital Asset Treasury Plan with 760K SOL Purchase

Helius Medical initiated a $500 million digital asset treasury strategy by purchasing 760,190 SOL at an average price of $231. The company retains $335 million in cash for further acquisitions and plans staking and DeFi activities under a conservative framework. Shares dipped 14% post‐announcement.

Arthur Hayes Predicts Bitcoin to Hit $250K by Year-End on Wave of Liquidity

Arthur Hayes forecasted Bitcoin rising to $250,000 by December, driven by anticipated US liquidity expansion. The prediction followed comments on expected Treasury currency expansion and Fed rate cuts under the new administration. The outlook also covered potential Fed governance changes.

Crypto Market Stabilizes After $1.7B Flush as Bitcoin Dominance Surges to 57%

Markets cooled after $1.7 billion in leveraged positions were liquidated, driving traders back into Bitcoin and raising its dominance to 57%. Ethereum remained near $4,100 while institutions continued to buy through the dip. Options markets prepare for major September expiry.

Ourbit SuperCEX Launches Puzzle League Registration with $2 Million Prize Pool

Registration opened for the quarterly Puzzle League on September 23, featuring gamified trading events and a record $2 million prize pool. The event runs through October 13 and includes Mystery Box challenges and a Futures Team Showdown. Rewards cover USDT allocations, trading incentives, and referral bonuses.

Crypto Digest — 23 September 2025

📢 Read the daily digest for 2025-09-23: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Water150 sponsors ETHSofia and JFEX 2025 conferences

Water150, a Longhouse Foundation project, became the hydration sponsor for ETHSofia and JFEX 2025 conventions. The initiative will showcase premium spring water in blockchain ecosystems at events in Bulgaria and Jordan from September 23 to 25, aiming to raise awareness of its MiCAR-compliant W150 token.

Fragmetric to launch first Solana DAT for South Korean market

Fragmetric Labs will form the first Solana digital asset treasury (DAT) in Korea through a reverse merger with a listed South Korean company. Partnership with DeFi Development Corp extends re-staking infrastructure for liquid staked SOL, aiming to boost network security and passive income.

Bitget Launchpool adds 0G with over 1.7M token rewards

Bitget launched 0G token support in its Launchpool campaign with 1,766,670 0G in rewards. Trading for the 0G/USDT pair began on September 22 at 10:00 UTC, with withdrawals from September 23 at 11:00 UTC. Campaign runs through September 25, enabling users to lock BGB or 0G to earn rewards.

🔎 Coin Research — 0G (0G) — 23 September 2025

New weekly coin research for 0G (0G). — Score: 7.00/10 TL;DR: 0G is a modular, infinitely scalable Layer-1 blockchain optimized for on-chain AI workloads with dedicated compute, storage, and data availability layers.

Strive to acquire Semler in $1.34B all-stock deal to expand bitcoin treasury

Strive Inc., backed by Vivek Ramaswamy, agreed to buy Semler Scientific in an all-stock transaction valued at $1.34 billion. Semler shareholders will receive 21.04 Strive shares per Semler share. Combined entity will hold over 10,900 BTC with plans to purchase additional bitcoin.

Cryptocurrencies sink as $1.5B in bullish bets wiped out

Cryptocurrency traders saw over $1.5 billion in long positions liquidated on Monday, triggering a sharp selloff that drove Ether down around 9% and Bitcoin nearly 3%. Broad market declines extended to Solana, Avalanche and Algorand amid heavy forced selling.

Crypto Digest — 22 September 2025

📢 Read the daily digest for 2025-09-22: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

‘Diamond Hand’ APX Holder Turns $226K into $7M Amid ASTER Swap Rally

Wallet 0x9d22, which acquired APX tokens worth $226 000 in 2022, now holds $7.07 million following a 120 percent surge after ASTER swap upgrade. APX Finance runs a high-leverage DeFi exchange on BNB Chain and Arbitrum. TVL crossed $2 billion briefly post-swap.

Stablecoin Adoption Set to Surge After GENIUS Act, Hit $4T Volume

Survey of 350 executives by EY-Parthenon indicates stablecoin use is rising among firms due to regulatory clarity from the GENIUS Act and cost savings. Forecast suggests stablecoins could handle 5–10 percent of cross-border payments by 2030, valued at $2.1–$4.2 trillion.

🔎 Coin Research — GraphAI (GAI) — 22 September 2025

New weekly coin research for GraphAI (GAI). — Score: 7.00/10 TL;DR: Blockchain data indexing platform providing AI-ready knowledge graphs for DeFi, RWAs, and autonomous agents

First Chinese CNH Stablecoin Debuts as Global Race Heats Up

AnchorX launched AxCNH, the first regulated stablecoin pegged to offshore Chinese yuan, at the Belt and Road Summit in Hong Kong. South Korean firm BDACS also introduced KRW1, a won-pegged stablecoin. Overcollateralization and regulatory support aim to boost cross-border trade and geopolitical currency influence.

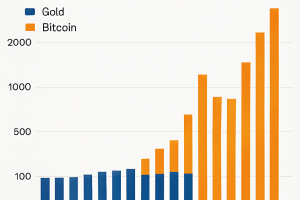

Gold vs Bitcoin: Performance through Money Supply Lens

Analysis comparing gold’s and bitcoin’s peaks relative to M2 money supply reveals divergent performances. Gold remains below its 2011 high against money supply. Bitcoin set a new record high relative to M2 in its latest bull cycle, underscoring differing roles as hedging and growth assets.

Coinbase CEO Outlines Vision for Super App Evolution

Vision described for platform to integrate banking, payments, trading and investing under one “super app” framework. Bipartisan regulatory momentum cited as catalyst for expansion of services. Prediction offered for bitcoin to reach $1 million by 2030 based on ETFs and strategic reserve.

Hayes Predicts ‘Up Only’ Crypto Market as ETH Staking Exit Queue Grows

BitMEX co-founder Arthur Hayes predicted the crypto market will be “up only” once the US Treasury’s General Account hits $850 billion. The week’s digest highlighted Ethereum’s 45-day staking exit queue and a poll showing 40% of Americans are open to DeFi under proposed legislation.

Yzi Labs Deepens Stake in Ethena, Boosting USDe Expansion

Yzi Labs increased its investment in Ethena, issuer of the USDe stablecoin, to drive adoption across decentralized and centralized platforms. The funding will support USDe expansion on BNB Chain and development of USDtb and Converge settlement tools.

Low-risk DeFi Could Drive Stable Fees on Ethereum, Vitalik Says

Ethereum co-founder Vitalik Buterin proposed that fee revenue from low-risk DeFi protocols, like stablecoin lending on Aave, could economically sustain the network similar to Google’s search model. He argued this aligns financial incentives with Ethereum’s cultural values.

Flora Growth Raises $401M Treasury to Back Zero Gravity AI Blockchain

Nasdaq-listed Flora Growth raised $401 million to establish a treasury supporting Zero Gravity (0G), a decentralized AI blockchain. The funding combines cash and in-kind digital assets and leads to rebranding as ZeroStack.

EU Chat Control Law Could Push Users to Decentralized Web3 Platforms

Experts warn the EU’s Chat Control regulation mandating private message scanning breaches confidentiality and undermines user trust. The measure is expected to drive migration to decentralized Web3 platforms.

🔎 Coin Research — Boundless (ZKC) — 21 September 2025

New weekly coin research for Boundless (ZKC). — Score: 8.00/10 TL;DR: Boundless is a universal zero-knowledge proof protocol providing off-chain proof generation and on-chain verification for any blockchain to enhance scalability

Watchdog labels Trump’s WLFI ‘American Sell-Out’ over alleged foreign token sales

Accountable.US reported that Trump’s World Liberty Financial sold tokens to sanctioned actors, including North Korea’s Lazarus Group and Iran-linked users. Highlighted transactions included a $10,000 purchase by ‘Shryder.eth’ tied to Lazarus accounts. National security concerns were raised.

Bitcoin consolidates at $115K as BlackRock ETF inflows fuel $125K rally odds

Bitcoin consolidated near $115,000 as BlackRock’s spot Bitcoin ETF recorded $3.1 billion inflows over ten days. Kalshi bettors now assign a 69% probability of BTC reaching $125,000 by November 2025. A golden cross at $114,000 underpins bullish momentum.

Crypto whales accumulate LINK, CRO, and TON this week

On-chain data reveals major whale addresses acquired 2.5 million LINK valued at $61 million, increased Cronos (CRO) holdings by 29%, and boosted Toncoin (TON) balances by 5% over mid-September. The concentrated purchases suggest bullish sentiment for these altcoins and potential price rallies toward key resistance levels.

Anchorage Digital applies for a Federal Reserve master account

Anchorage Digital Bank filed for a Federal Reserve master account on August 28, aiming for direct access to central bank payment services. The application follows the OCC lifting a 2022 consent order and reflects increasing federal oversight of digital asset firms. Ripple, Circle and other institutions are also pursuing federal charters.

CFTC adds top crypto executives to digital asset advisory group

The CFTC appointed eight industry leaders to its Global Markets Advisory Committee and Digital Asset Markets Subcommittee on September 19. Appointees include legal and technology executives from Uniswap Labs, Chainlink Labs, Aptos Labs, JPMorgan and Franklin Templeton. The advisory group will inform regulatory frameworks for digital asset markets.

Bankrupt exchange FTX set to repay $1.6B to creditors on Sep. 30

FTX’s bankruptcy estate will distribute $1.6 billion to verified creditors starting September 30 as part of its ongoing repayment process. The payout marks the third major distribution following prior rounds totaling over $6 billion. Funds will be routed through BitGo, Kraken or Payoneer services.

ARK Invest acquires $162M in Solmate shares following $300M funding

ARK Invest purchased nearly $162 million of Solmate shares after joining a $300 million funding round alongside Pulsar Group, RockawayX and the Solana Foundation. Shares peaked at $52.95 before closing at $24.90, reflecting strong initial demand.

Crypto ETF ‘floodgates’ open with generic SEC listing standards

The U.S. Securities and Exchange Commission approved generic listing standards for spot crypto exchange-traded products, simplifying filings and setting the stage for a wave of new ETFs. Analysts warn that listing alone won’t guarantee significant inflows without fundamental demand.

Stellar’s XLM slips below $0.40 support amid heavy institutional selling

Stellar’s native token XLM dropped 3.58% from $0.40 to $0.39 as institutional sell orders surged, breaching critical support despite new corporate partnerships at the Meridian conference including PayPal and Centrifuge initiatives.

🔎 Coin Research — Cookie DAO (COOKIE) — 20 September 2025

New weekly coin research for Cookie DAO (COOKIE). — Score: 7.00/10 TL;DR: Cookie DAO is a decentralized platform providing a modular data layer aggregating on-chain and social data for AI agents, enabling developers to build and opera

Bankrupt FTX estate to distribute $1.6B to creditors on September 30

FTX’s bankruptcy estate will release $1.6 billion to verified creditors beginning September 30, marking the third major payout since the November 2022 exchange collapse. U.S. customer claims will recover 40%, dotcom users 6% and unsecured debts 24%.

U.S. Treasury advances GENIUS Act implementation for stablecoin regulations

The U.S. Treasury Department has initiated an advance notice of proposed rulemaking to translate the GENIUS Act into enforceable stablecoin regulations, opening a public comment period on sanctions, AML, custody and oversight.

🔎 Coin Research — Lombard (BARD) — 19 September 2025

New weekly coin research for Lombard (BARD). — Score: 8.00/10 TL;DR: Lombard's BARD token powers a Bitcoin DeFi ecosystem by securing and governing the LBTC liquid staking protocol, enabling cross-chain Bitcoin liquidity, restaki

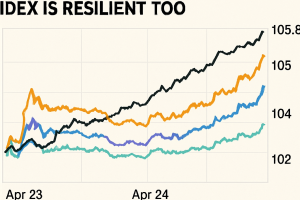

BTC, XRP, SOL, DOGE Resume Slow Grind Higher After Fed, Dollar Index Is Resilient Too

Following the Fed’s 25 bps rate cut, bitcoin topped $117,900—the highest since Aug. 17—while ether rose 2.7% and altcoins including dogecoin, solana and XRP rallied over 3%. Despite dovish Fed projections, the dollar index rebounded to 97.30, presenting a potential headwind. Analysts cite renewed momentum from easing expectations, balanced against tail risks priced into derivatives.

BNB Hits $1,000 All-Time High as Binance Nears DOJ Deal, Rumors of CZ’s Return Grow

BNB surged 4.5% to a record $1,004, reclaiming its position as the fifth-largest cryptocurrency by market cap near $140 billion. The rally was fueled by reports that Binance is in talks with the U.S. Department of Justice to conclude a compliance monitor agreement and by speculation over Changpeng Zhao’s potential return to leadership, offsetting regulatory uncertainties.

Bitcoin ETF Inflows Reverse as Fed’s Hawkish Outlook Triggers Market Caution

Spot bitcoin ETFs saw their first daily outflows in over a week, losing $51.28 million after the Federal Reserve signaled fewer future rate cuts. The outflow halted a seven-day inflow streak that totaled nearly $3 billion, though assets under management remain above $150 billion. Ethereum ETFs also registered redemptions of $1.89 million amid cautious market sentiment.

Ripple, Franklin Templeton and DBS to Offer Token Lending and Trading

Ripple, Franklin Templeton and DBS signed a memorandum of understanding to launch trading and lending solutions using tokenized money market funds on the XRP Ledger. Franklin Templeton will tokenize its U.S. dollar money market fund as sgBENJI, which DBS Digital Exchange will list alongside RLUSD. Institutions may use sgBENJI as collateral, enhancing liquidity and yield efficiency.