Bullish to launch bitcoin options trading with major industry partners

Bullish will launch bitcoin options trading on October 8, offering European-style contracts settled in USDC with tenors from three weeks to three months. The product leverages a unified margin system and will be supported by leading market makers.

BBVA partners with SGX FX to offer retail crypto trading in Europe

Spanish bank BBVA partnered with SGX FX to integrate its digital asset platform, enabling retail clients to trade bitcoin and ether 24/7 via existing channels. The move leverages MiCA regulations to expand crypto services across EMEA.

Dogecoin jumps 9% and Shiba Inu surges 6% amid memecoin momentum

Dogecoin jumped nearly 9% in 24 hours, breaking resistance on heavy trading amid U.S. ETF approval speculation, while Shiba Inu rose 6% as exchange reserves fell to multi-year lows, indicating reduced supply and institutional accumulation.

EU risk board urges urgent safeguards for stablecoins

The EU’s financial risk board called for immediate safeguards on stablecoins partly issued outside the bloc, warning that vulnerabilities in multi-issuer schemes could pose liquidity risks and undermine reserve stability. A policy response is needed.

Citigroup raises ether year-end outlook and lowers bitcoin forecast

Citigroup raised its 2025 year-end price target for ether to $4,500 while trimming bitcoin to $133,000, citing evolving investor flows and macroeconomic variables. Analysts project further upside driven by ETF inflows and DeFi staking.

Crypto Digest — 02 October 2025

📢 Read the daily digest for 2025-10-02: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

U.S. Senate Hearing Exposes Challenges in Crypto Tax Reporting

A Senate Finance Committee hearing revealed that major crypto brokers, including Coinbase, are set to submit unprecedented data volumes to the IRS, which may strain agency resources. Executives warned of administrative hurdles and unresolved policy questions around de minimis and staking gains reporting.

Memecoins Are No Longer a Joke, Galaxy Digital Says in New Report

Galaxy Digital research concludes that memecoins have matured into a significant market segment, driving liquidity, fees and community engagement. The report highlights the role of platforms like Pump.fun in spawning thousands of tokens, testing infrastructure and reshaping trading habits across chains.

When Could Bitcoin Break Out to New Highs? Watch Out for Gold

Bitcoin has traded in a narrow $100 000–$120 000 range for three months while gold surged past record highs. Historical data shows alternating cycles between the two assets, suggesting bitcoin may rally once gold’s momentum eases. Analysts monitor correlation shifts for a breakout signal.

🔎 Coin Research — Bitlight (LIGHT) — 02 October 2025

New weekly coin research for Bitlight (LIGHT). — Score: 7.00/10 TL;DR: Pioneering native Bitcoin smart contracts and stablecoin rails via RGB protocol integrated with the Lightning Network.

Sui Blockchain to Host Native Stablecoins Backed by Ethena and BlackRock’s Tokenized Fund

SUI Group, Ethena and the Sui Foundation announced two new native stablecoins, USDi and suiUSDe, on Sui blockchain. USDi will be backed by BlackRock’s tokenized BUIDL fund and suiUSDe will use synthetic backing via digital assets. Launch planned later this year to boost on-chain liquidity and protocol utility.

Leading Democrat Wyden Continues Probe Into Pantera Founder Morehead’s Taxes

Senator Ron Wyden opened a formal inquiry into whether Pantera Capital’s Dan Morehead misreported over $1 billion in crypto capital gains by claiming Puerto Rico residency. The probe examines if residency status was misrepresented to exploit tax incentives. The inquiry follows press reports suggesting potential avoidance of U.S. taxes on substantial gains.

Crypto Digest — 01 October 2025

📢 Read the daily digest for 2025-10-01: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Avantis (AVNT) — 01 October 2025

New weekly coin research for Avantis (AVNT). — Score: 7.00/10 TL;DR: Avantis is a zero-fee decentralized exchange on Base offering up to 500x leverage on crypto and real-world assets perps, combining institutional-grade trading w

Societe Generale’s Crypto Arm Deploys Euro and Dollar Stablecoins on Uniswap, Morpho

SG-FORGE, Societe Generale’s digital assets unit, has listed its EURCV and USDCV stablecoins on Ethereum-based Morpho and Uniswap. The move enables 24/7 lending, borrowing, and spot trading, with Flowdesk providing liquidity and MEV Capital managing vault collateral.

Deutsche Börse, Circle to Integrate Stablecoins Into European Market Infrastructure

Deutsche Börse and Circle have signed an MoU to integrate Circle’s EURC and USDC stablecoins into Europe’s trading, settlement, and custody infrastructure. Enabled by EU MiCAR regulation, the project will list tokens on 360T and Crypto Finance, with Clearstream handling custody.

Bitcoin Options Tied to BlackRock’s IBIT Are Now Wall Street’s Favorite

Open interest in BlackRock’s IBIT bitcoin options reached nearly $38 billion after Friday’s expiry, overtaking Deribit’s $32 billion. The shift reflects growing institutional appetite on regulated venues, with IBIT and Deribit now capturing almost 90% of global BTC options market share.

Visa Pilots Pre-Funded Stablecoins for Cross-Border Payments

Visa has begun a pilot allowing clients to pre-fund Visa Direct accounts with US dollar and euro stablecoins instead of fiat. The initiative aims to reduce funding friction, accelerate liquidity access, and lower cross-border transaction costs by treating stablecoin balances as cash equivalents.

Chainlink, UBS Advance $100T Fund Industry Tokenization via Swift Workflow

Pilot enables banks to instruct tokenized fund subscriptions and redemptions via Swift messaging, using Chainlink Runtime Environment to translate ISO 20022 messages into on-chain transactions. UBS collaboration targets over $100 trillion in global fund assets, aiming to streamline institutional access to blockchain infrastructure.

Maple Finance to Tie Into Elwood to Bring Institutional Credit Strategies On-Chain

Maple Finance and Elwood Technologies have partnered to integrate institutional execution, portfolio, and risk management tools with Maple’s on-chain lending platform, aiming to streamline digital asset credit markets.

Chainlink Teams With Major Financial Institutions to Fix $58B Corporate Actions Problem

Chainlink is working with 24 global financial institutions, including SWIFT and DTCC, to pilot blockchain-and-AI-based processing of corporate actions. The initiative aims to cut the $58 billion annual industry cost.

AllUnity and Stripe’s Privy Join Forces to Enable Euro Stablecoin Payments

AllUnity, issuer of the EURAU euro stablecoin, and Stripe’s Privy have partnered to integrate EURAU into fintech and enterprise applications. The move allows programmable euro payments under BaFin’s e-money license.

🔎 Coin Research — Orderly Network (ORDER) — 30 September 2025

New weekly coin research for Orderly Network (ORDER). — Score: 8.00/10 TL;DR: Omnichain on-chain orderbook infrastructure providing unified liquidity across EVM and non-EVM chains, enabling decentralized perpetual trading with institution

SWIFT to Develop Blockchain-Based Ledger for 24/7 Cross-Border Payments

SWIFT is collaborating with over 30 financial institutions to build a blockchain-based ledger for continuous cross-border payments. The ledger, based on a ConsenSys prototype, aims to record and validate transactions in real time.

Leveraged Bitcoin Longs are Back in Force, Trading Firm Says

BTC perpetual futures open interest and funding rates have increased, indicating renewed long-position confidence. QCP Capital reports open interest rose from $42.8 billion to $43.6 billion and annualized funding rates jumped above 13%.

AllUnity and Stripe’s Privy Join Forces to Enable Euro Stablecoin Payments

AllUnity, issuer of the EURAU euro stablecoin, and Stripe-owned Privy have partnered to integrate EURAU wallets into fintech and enterprise applications. The collaboration supports programmable treasury functions and anticipates the EU’s MiCAR framework set for 2026 enforcement.

SWIFT to Develop Blockchain-Based Ledger for 24/7 Cross-Border Payments

SWIFT is collaborating with over 30 financial institutions and Ethereum developer Consensys to build a blockchain-based ledger for its network, enabling continuous cross-border payments with transaction sequencing, validation, and enforcement via smart contracts.

Maple Finance to Tie Into Elwood to Bring Institutional Credit Strategies On-Chain

Maple Finance and Elwood Technologies have partnered to integrate institutional execution, portfolio, and risk management tools with Maple’s on-chain lending platform. The collaboration aims to reduce infrastructure gaps, enabling banks and asset managers to access tokenized credit markets with professional-grade systems.

IBIT’s Options Market Fuels Bitcoin ETF Dominance

A recent report finds that IBIT now controls 57.5 % of Bitcoin ETF assets under management after ETF options launch in November 2024. Daily options volumes of $4–5 billion have reshaped market flows, eclipsing futures and altering volatility patterns.

Revolut Weighs $75B Dual Listing in London and New York

Revolut, valued at $75 billion with 65 million users, is exploring a dual listing in London and New York for its upcoming IPO. The move could mark the first simultaneous entry into the FTSE 100 and a U.S. exchange listing, leveraging new FTSE rules to boost liquidity.

🔎 Coin Research — ChainOpera AI (COAI) — 29 September 2025

New weekly coin research for ChainOpera AI (COAI). — Score: 7.00/10 TL;DR: Decentralized full-stack AI agent platform leveraging an AI-native Layer-1 blockchain with Proof-of-Intelligence consensus for collaborative model training, inf

KuCoin Appeals C$19.6M Canadian AML Penalty Over Reporting Failures

KuCoin appealed a C$19.6 million fine by FINTRAC for alleged failures in reporting large cryptocurrency transactions and suspicious activity, disputing its classification as a Foreign Money Services Business. The exchange denies wrongdoing and plans a federal court appeal. This action follows prior US regulatory scrutiny of crypto exchanges.

Retail Onboarding Shifts from Bitcoin to Altcoins

A CoinGecko survey of 2,549 crypto participants found that only 55% of new investors started with Bitcoin, 37% with altcoins and 10% never bought Bitcoin. Analysts attribute the shift to lower unit costs, community appeal and maturing market access but expect Bitcoin to retain core portfolio relevance.

HyperDrive DeFi Loses $773K in Router Exploit

A critical router contract vulnerability in Hyperliquid’s HyperDrive DeFi was exploited, resulting in a $773,000 loss from two Treasury Bill market accounts. Stolen funds were bridged to BNB Chain and Ethereum via deBridge. HyperDrive paused money markets and launched an investigation with security experts.

Retailers and Airlines Accept BTC, ETH, and XRP in 2025

Major coffee shops, fast-food chains, retailers and airlines now accept Bitcoin, Ether and XRP. Payment processors and gift cards simplify transactions, enabling consumers to use crypto for everyday purchases, travel bookings and luxury services. Institutional and remittance use cases continue to expand.

Crypto Treasury Firms Could Become Long-Term Giants like Berkshire Hathaway

Syncracy Capital’s Ryan Watkins forecasts that digital asset treasury firms holding $105 billion could evolve into enduring financial players by deploying on-chain assets, funding operations and governance. Watkins likens them to profit-driven crypto foundations capable of building businesses within networks. Successful firms will combine disciplined capital allocation with operational expertise.

Government Shutdown Impact on Crypto Policy

A potential U.S. government shutdown may delay crypto market structure legislation and regulatory rulemaking. Congressional committees face funding lapses that could push back scheduled hearings. Bipartisan support remains, but short-term delays are expected.

Crypto Digest — 28 September 2025

📢 Read the daily digest for 2025-09-28: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Crypto Treasury Firms Could Become Long-Term Giants

Analyst Ryan Watkins of Syncracy Capital argues that digital asset treasury firms holding $105 billion could evolve into enduring ecosystem players, deploying capital into operations, governance, and infrastructure akin to Berkshire Hathaway’s model.

Luke Dashjr Denies Bitcoin Hard Fork Allegations

Bitcoin developer Luke Dashjr has denied reports that he proposed a hard fork led by a trusted committee to alter the blockchain. The controversy reignited longstanding debates over censorship and protocol immutability within the community.

Government Shutdown’s Effects on Crypto Policy and Markets

An impending U.S. government shutdown will delay crypto market structure legislation and stymie regulatory rulemakings but is unlikely to derail long-term policy progress. Agencies like the SEC and CFTC will pause non‐critical initiatives, slowing down hearings and bill markups.

🔎 Coin Research — Subsquid (SQD) — 28 September 2025

New weekly coin research for Subsquid (SQD). — Score: 7.00/10 TL;DR: Subsquid (SQD) is a decentralized query engine and data lake providing permissionless, cost-efficient access to petabyte-scale Web3 data across EVM and Substrat

TeraWulf Plans $3B Google-Backed Debt Raise for Data Centers

Crypto miner TeraWulf is arranging a $3 billion debt financing deal supported by Google to expand data center operations. The funding, structured via bonds or loans, will enable TeraWulf to repurpose its power-intensive infrastructure for AI workloads, reflecting growing tech‐crypto convergence.

Corporate Clients Hold 10–15% of Assets on Mercado Bitcoin

Brazilian exchange Mercado Bitcoin reports that corporate clients, mainly SMEs, account for 10–15% of assets under custody, holding BTC and stablecoins for conservative treasury management. This trend is reducing market volatility and may spur broader enterprise adoption in Brazil.

Crypto ETFs to flood US market after SEC streamlines approvals

The SEC’s updated ETF listing standards eliminate individual reviews, cutting approval time to 75 days and prompting a rush of filings by U.S. asset managers. Products tied to solana, XRP and other altcoins could debut in early October alongside bitcoin and ethereum ETFs.

Kraken in talks to raise funds at $20 billion valuation

Crypto exchange Kraken is in advanced talks to raise funds at a valuation of about $20 billion with $200–300 million from a strategic investor, Bloomberg reported. The potential round follows a $500 million fundraising at a $15 billion valuation earlier this year.

Crypto Digest — 27 September 2025

📢 Read the daily digest for 2025-09-27: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

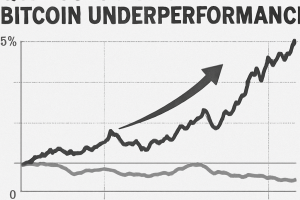

Grayscale Sees ‘Distinct’ Q3 Altcoin Season amid Bitcoin Underperformance

Grayscale reports that Q3 2025 saw a unique altseason characterized by falling Bitcoin dominance and selective altcoin rallies. Performance drivers included sector rotation, DeFi protocols and emerging Layer-2 networks, diverging from previous dominance-driven cycles.

Layer-1 Blockchains Emerge as Crypto’s 2025 Backbone

Layer-1 blockchains are shifting from speculative assets to core infrastructure in 2025, supporting tokenisation, stablecoins and emerging DeFi use cases. Key challenges include scalability, interoperability and user experience enhancements to drive broader adoption.

Deutsche Bank Partners with Taurus for Crypto Custody Services

Deutsche Bank has teamed up with Swiss firm Taurus to offer institutional clients custody solutions for cryptocurrencies and tokenised assets. The partnership marks the bank’s first direct involvement in digital-asset custody, with trading services earmarked for potential future expansion.

🔎 Coin Research — Plasma (XPL) — 27 September 2025

New weekly coin research for Plasma (XPL). — Score: 8.00/10 TL;DR: Plasma is a stablecoin-focused Layer 1 blockchain enabling zero-fee USDT transfers with sub-second finality.

SoftBank and Ark in Talks to Join Tether Funding Round

SoftBank Group and Ark Investment Management are among investors in early discussions to fund Tether, seeking $15–$20 billion for a 3% stake that could value the stablecoin issuer at up to $500 billion. The round underscores Tether’s strategy to diversify capital and expand beyond core digital assets.

Kraken Secures $500M Funding at $15B Valuation

Kraken reportedly raised $500 million at a $15 billion valuation, reinforcing its financial position amid IPO speculation. The round aligns with earlier reports of a move toward public listing, as the exchange readies an S-1 filing with the SEC.

Near $30M Ether wipeout on Hyperliquid stands out as crypto market sees $1B in liquidations

A $29.1 million ETH-USD long on Hyperliquid triggered the largest individual liquidation in 24 hours amid a $1.19 billion market-wide wipeout. Long positions accounted for nearly 90% of liquidations, with over 260,000 traders affected, highlighting increased risk-taking on decentralized perpetual exchanges.

Curve Finance founder launches Bitcoin yield protocol

Michael Egorov, founder of Curve Finance, launched Yield Basis, a decentralized protocol designed to deliver sustainable Bitcoin yield on-chain while eliminating impermanent loss. The launch includes capped liquidity pools, a vote-escrow governance model (veYB), and targets institutional demand backed by $5 million in funding.

Crypto adoption in emerging markets poses risks to financial resilience: Moody's

Moody’s Ratings warned that growing cryptocurrency use in emerging markets poses risks to monetary sovereignty and financial resilience. The report highlights that widespread stablecoin adoption can undermine domestic currency pricing and settlement and notes that crypto ownership reached 562 million people by 2024, up 33% from 2023.

SharpLink Gaming set to tokenize its shares on Ethereum with Superstate

SharpLink Gaming (SBET) plans to tokenize its equity on the Ethereum blockchain through Superstate’s Opening Bell platform, issuing SEC-registered shares as native tokens. The initiative aims to explore compliant secondary trading of tokenized shares on decentralized exchanges under U.S. securities regulations.

Ethereum co-founder shifts $6M of ETH as whales buy $1.6B

Ethereum co-founder Jeffrey Wilcke transferred 1,500 ETH (≈$6 M) to Kraken, potentially preparing a future sale. At least 15 large wallets acquired over 406,000 ETH (≈$1.6 B) in the past two days, reflecting substantial institutional accumulation.

Crypto Digest — 26 September 2025

📢 Read the daily digest for 2025-09-26: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Cloudflare Introduces NET Dollar Stablecoin for AI-Driven Agentic Web

Cloudflare unveiled NET Dollar, a U.S. dollar–backed stablecoin designed to power microtransactions by autonomous software agents. Initiative aims to shift internet revenue models from ads to pay-per-use mechanisms.