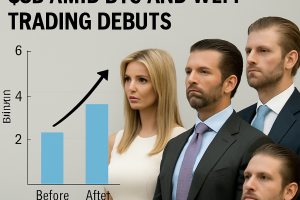

Trump Family Wealth Jumps $1.3B Amid ABTC and WLFI Trading Debuts

Bloomberg Billionaires Index data shows the Trump family’s collective net worth increased by $1.3 billion this week thanks to American Bitcoin (ABTC) and World Liberty Financial (WLFI) trading debuts. WLFI gains added $670 million, while ABTC stake valued over $500 million despite subsequent price retracements.

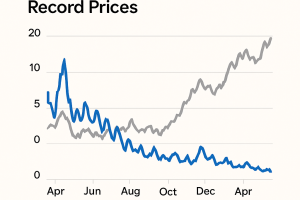

Ethereum Network Fees and Revenue Decline Despite Record Prices

Ethereum network fee revenue fell 44% in August to $14.1 million, down from July’s $25.6 million, amid an ETH price rally to $4,957. Overall network fees dropped by 20% month-over-month following the Dencun upgrade that reduced layer-2 transaction costs.

Michael Saylor’s Net Worth Rises by $1B on Bloomberg Billionaire Index

Michael Saylor, Strategy co-founder and executive chairman, saw a $1 billion net worth increase this year, coinciding with Strategy’s stock gains and Saylor’s ranking at 491st on the Bloomberg Billionaire 500 Index. Equity holdings in Strategy account for over 90% of his wealth growth.

🔎 Coin Research — Solidus Ai Tech (AITECH) — 08 September 2025

New weekly coin research for Solidus Ai Tech (AITECH). — Score: 7.00/10 TL;DR: Decentralized, eco-friendly HPC data centers offering on-demand AI compute resources and a multi-layer AI marketplace powered by a deflationary token model

Paxos Proposes USDH Stablecoin for Hyperliquid With HYPE Buybacks

Paxos submitted a proposal to launch USDH, a fully compliant stablecoin designed for Hyperliquid under GENIUS and MiCA frameworks. The plan allocates 95% of reserve interest to repurchase HYPE tokens, with distributions to validators, protocol partners and users to align ecosystem incentives.

El Salvador Marks Four-Year Bitcoin Anniversary With Mixed Outcomes

El Salvador’s national Bitcoin Office highlighted a 6,313 BTC strategic reserve and widespread public servant certification programs as part of Bitcoin Day. Recent IMF loan conditions prompted repeal of legal tender status and halted government wallet purchases, fueling community debate over adoption impact.

Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land

Tether CEO Paolo Ardoino refuted rumors of a Bitcoin sell-off, clarifying that recent transfers were for an internal initiative rather than asset disposal. The issuer reaffirmed its strategy to allocate profits into Bitcoin, gold, and land, maintaining holdings above 100,000 BTC valued at over $11 billion.

Bitcoin taps $111.3K as forecast says 10% dip ‘worst case scenario’

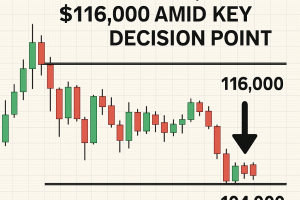

Bitcoin price rebounded above $111,000 into the weekly close, but Fibonacci retracement analysis suggests a potential maximum downside of about 10%, targeting $100,000 as a “logical” bounce zone. Traders highlight key resistance at $112,000 and major moving averages as decision points for the next move.

Ripple’s SEC Battle Is Over: Time to Challenge SWIFT?

Following the SEC’s decision to drop its lawsuit against Ripple, industry observers question whether XRP can now compete with SWIFT for cross-border payments, offering faster settlement and lower fees.

“Binance Dollars” Replace Venezuela’s Bolívar as Inflation Hits 229%

With annual inflation at 229 percent, Venezuelans increasingly use USDT stablecoins—dubbed “Binance dollars”—for daily payments. Chainalysis data rank Venezuela ninth in per-capita crypto use amid capital controls.

Crypto Market Sentiment Shifts to Fear as Interest in Altcoins Wanes

Crypto market sentiment moved into Fear as traders shift focus from obscure altcoins to major assets. Santiment data show subdued risk appetite, with Bitcoin, Ether and XRP dominating discussions on asset allocation.

Stablecoin Retail Transfers Break Records in August

Retail stablecoin transfers under $250 hit $5.84 billion in August, surpassing prior monthly highs as consumers in emerging markets increasingly turn to stablecoins to avoid high banking fees and slow transfers.

Senate Crypto Bill Clarifies Tokenized Stocks as Securities

The US Senate updated its crypto market structure bill by adding a clause to explicitly classify tokenized stocks under existing securities law. The amendment ensures on-chain stock representations are subject to SEC oversight, maintaining regulatory consistency and investor protections for tokenized assets.

Bitcoin Mining Difficulty Climbs to New All-Time High

The Bitcoin network’s mining difficulty reached a new all-time high after the latest difficulty adjustment, reflecting increased hash rate and miner competition. The adjustment, up 4.2%, signals strong miner confidence and ongoing network security improvements as more computational power joins the network.

Phishing Scams Cost Crypto Users Over $12M in August

Crypto phishing attacks siphoned more than $12 million from users in August, marking a 72% month-on-month increase, according to data from Scam Sniffer. The report identified 15,230 victims, with the largest single loss exceeding $3 million, underscoring the need for enhanced vigilance and security measures across the crypto ecosystem.

Michael Saylor’s Fortune Jumps $1B Amid Billionaire Index Inclusion

Michael Saylor’s net worth rose by $1 billion year-to-date following his debut on the Bloomberg Billionaire 500 Index. His estimated worth reached $7.37 billion, up nearly 16%, as Strategy’s share price rallied 12% over the same period, driven by the firm’s aggressive Bitcoin accumulation strategy.

Crypto Sentiment Shifts Into Fear as Altcoin Interest Wanes

Crypto market sentiment has slipped into Fear according to Santiment, with traders shifting focus from obscure altcoins to major assets like BTC and ETH. The Crypto Fear & Greed Index fell to 44, signaling cautious risk appetite and debate over which large-cap asset will lead the next breakout.

Crypto Memes — 2025-09-07

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-07. 🚀

Crypto Digest — 07 September 2025

📢 Read the daily digest for 2025-09-07: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — PinLink (PIN) — 07 September 2025

New weekly coin research for PinLink (PIN). — Score: 7.00/10 TL;DR: Fractionalized RWA-tokenized DePIN platform enabling AI developers to access decentralized compute (GPUs, TPUs, storage) at lower cost and asset owners to monet

Spot ether ETFs incur $952M outflows amid recession fears

Spot ether exchange-traded funds recorded five consecutive days of outflows, losing $952 million as investors rotated away over concerns of an economic downturn. Despite the withdrawals, ether’s price rose more than 16% over the past month driven by stablecoin and ETF developments.

FBOT framework deemed ill-suited for crypto exchanges

CFTC guidance clarified that the FBOT framework’s legacy settlement and clearing requirements are incompatible with offshore crypto exchanges serving U.S. clients. Licensed futures commission exchanges only qualify, leaving many platforms unable to meet stringent regulatory demands.

Belarus President Pushes Transparent Rules to Attract Crypto Investors

Belarus President Aleksandr Lukashenko urged regulators to finalize long-delayed crypto regulations, aiming to balance investor protections with the nation’s ambition to be a crypto-friendly hub. He cited inspection findings of platform violations and urged oversight that preserves a 'digital haven.'

'If They Can Do It to Sun, Who's Next?' Say Insiders as WLFI Claims Freeze Was to 'Protect Users'

World Liberty Financial froze hundreds of wallets, including Justin Sun's, to protect users from phishing-related compromises after onchain data showed Sun’s transfers followed WLFI’s crash. Insiders attribute the drop to widespread shorting and dumping across exchanges.

Binance to List OpenLedger (OPEN) Following HODLer Airdrop

Binance has announced the listing of OpenLedger’s OPEN token after featuring it in its HODLer Airdrops program. Eligible users who staked BNB in specified products during the snapshot period will receive retroactive OPEN rewards. Trading for OPEN is set to begin on Binance soon.

Coinbase AI Coding Tool Vulnerable to CopyPasta Exploit

Coinbase’s AI-powered code assistant is exposed to a prompt injection technique dubbed ‘CopyPasta’ that hides malicious instructions within markdown comments. The exploit can cause unauthorized code execution and data exfiltration across generated files. Coinbase is investigating and working on mitigations.

Crypto Memes — 2025-09-06

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-06. 🚀

Crypto Digest — 06 September 2025

📢 Read the daily digest for 2025-09-06: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Hyperliquid Advances Plan to Launch Proprietary Stablecoin

Decentralized exchange Hyperliquid announced plans to introduce USDH, its own U.S. dollar stablecoin, via an on-chain governance vote. The move aims to reduce reliance on USDC, capture reserve yield revenues, and support trading volume exceeding $398 billion per month.

🔎 Coin Research — RedStone (RED) — 06 September 2025

New weekly coin research for RedStone (RED). — Score: 7.00/10 TL;DR: Modular on-demand blockchain oracle delivering scalable, cost-efficient off-chain data feeds secured on Arweave and protected by provider collateral.

Clarity Act Bill Draft Emerges in Senate Banking Committee

A new draft of the Digital Asset Market Clarity Act circulated to Senate Banking Committee members on September 5. The text includes enhanced developer protections, RWA tokenization studies, and bankruptcy provisions for digital assets. Stakeholder feedback is ongoing.

Michael Saylor’s Strategy Snubbed by S&P 500 Amid Robinhood Surprise

Strategy (MSTR) failed to secure inclusion in the S&P 500 despite meeting all criteria, causing a 3% after-hours drop in its stock. Robinhood (HOOD) was unexpectedly added, lifting its shares by 7%. Changes take effect on September 22, reshaping crypto-linked equity exposure.

FIL Rises 3% Amid Pronounced Trading Volatility, Volume Surges

Filecoin rebounded 3% to $2.32 after a prior 2% decline, as high-volume volatility unfolded. Technical analysis identified support in the $2.23–$2.24 range and resistance at $2.38, reflecting shifting market dynamics amid institutional selling pressure.

Elliptic Unveils Crime-Tracking Tool as Stablecoins Enter the Mainstream

Elliptic launched a Stablecoin Issuer Due Diligence product designed for banks and compliance teams. The tool tracks stablecoin flows across blockchains, aiding institutions in monitoring addresses tied to Tether and Circle to mitigate money-laundering risks.

Crypto Exchange Bullish's European Arm Wins MiCA License in Germany

Bullish's European subsidiary obtained a Markets in Crypto-Assets (MiCA) license from Germany's financial regulator BaFin, enabling passporting of its services across the EU. The firm had previously secured brokerage and custody approvals and now aims to expand its regulated footprint.

SEC, CFTC Chiefs Say Crypto Turf Wars Over as Agencies Move Ahead on Joint Work

The SEC and CFTC chairs affirmed collaborative regulatory efforts, announcing a joint roundtable on September 29 to address DeFi, prediction markets and 24/7 trading. The agencies pledged greater harmonization to attract crypto innovators and modernize oversight.

Bitcoin Hits $113K as BTC Dominance Approaches Two-Week High of 59%

Bitcoin price recovered to $113,000, marking the highest level since August 28 as market dominance reached 59%, a two-week peak. The uptick coincided with a Deribit options expiry valued at $3.28 billion and adherence to the max pain theory, underscoring renewed technical momentum.

KuCoin launches cloud platform for 10% of Dogecoin mining

KuCoin unveiled a new cloud mining service targeting 10% of global Dogecoin hash rate. The platform offers scalable hashrate packages and pay-as-you-mine billing. KuCoin aims to attract retail and institutional hashrate investors with transparent performance metrics and low upfront costs.

WLFI thwarts hacking via on-chain blacklisting

World Liberty Financial’s WLFI token project reports successful prevention of multiple theft attempts through on-chain blacklisting. The team flagged and froze addresses linked to phishing and compromised keys. The measure has safeguarded over $50 million in user funds this week, reinforcing trust in token governance.

DeFi lending jumps 72% on institutional RWA adoption

DeFi lending volumes surged 72% in August as institutional demand for real-world asset collateral grows, according to Binance Research. Stablecoins backed by tokenized bonds and commercial paper underpinned much of the increase. Protocols offering RWA mortgages and asset-backed tokens attracted significant capital flows.

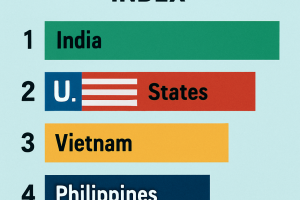

U.S. climbs to second in 2025 global crypto adoption index

Chainalysis reports that the United States has risen to second place in its 2025 Global Crypto Adoption Index. Regulatory clarity and burgeoning ETF inflows were cited as key drivers. India retained the top position, while APAC led regional growth, and Eastern Europe topped population-adjusted rankings.

U.S. Bancorp revives crypto custody service for institutions

U.S. Bancorp has resumed its cryptocurrency custody offerings for institutional clients following an SEC accounting rule repeal. The service, originally launched in 2021 and paused in 2022, now supports spot Bitcoin ETFs. NYDIG will serve as sub-custodian while U.S. Bank handles client relationships and regulatory compliance.

First Dogecoin ETF ‘Coming Soon’: REX-Osprey Teases US Launch

REX Shares announced a forthcoming Dogecoin ETF, DOJE, under the ETF Opportunities Trust. The fund seeks to mirror DOGE’s performance through direct holdings and derivatives via a ‘40-Act open-end structure. Approval hinges on effective registration and exchange listing.

Investigators find no fraud in Cardano’s decade-old voucher initiative

A forensic report by McDermott Will & Emery and BDO commissioned by Input Output found no evidence of insider fraud in Cardano’s 2017 ADA voucher program. The study confirmed 99.7% of vouchers were redeemed and only 14 remain unclaimed. Allegations of misconduct were deemed baseless.

Grayscale’s new ETF targets income from Ethereum’s changing tides

Grayscale launched the Ethereum Covered Call ETF (ETCO) to generate income via a covered call strategy on existing Ethereum trusts. The fund distributes biweekly dividends and aims to enhance yield while mitigating downside volatility. Initial assets under management exceed $1.4 million.

Bitcoin consolidates between $104,000 and $116,000 amid key decision point

Bitcoin trades in a narrow range between $104,000 and $116,000 after a mid-August peak. On-chain data indicates investor accumulation around $108,000, filling a cost-basis gap. Breach below $104,100 could signal exhaustion, while recovery above $114,300 may renew upward momentum.

Crypto Memes — 2025-09-05

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-05. 🚀

Crypto Digest — 05 September 2025

📢 Read the daily digest for 2025-09-05: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — PinLink (PIN) — 05 September 2025

New weekly coin research for PinLink (PIN). — Score: 7.00/10 TL;DR: PinLink is a DePIN protocol that uniquely tokenizes real-world physical infrastructure assets as ERC-1155 tokens, enabling fractional ownership and revenue shar

Fireblocks Launches Payments Network for Stablecoins

Fireblocks launched the Fireblocks Network for Payments, a stablecoin payments network connecting over 40 participants including Circle, Bridge and Yellow Card. The network unites multiple stablecoin rails and local payment systems under unified APIs to reduce engineering costs and operational risks.

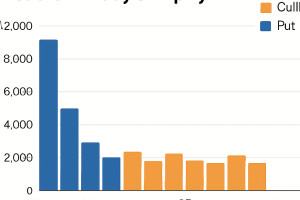

Bitcoin Options Tilt Bearish Ahead of Friday's Expiry

Crypto options open interest leans bearish ahead of the $4.5 billion Deribit expiry on Friday, with bitcoin put volume dominating and a max pain point at $112,000. Ether options remain balanced but show growing call interest above $4,500 ahead of key macroeconomic events.

Bitcoin Slips Below $110K as Analysts Weigh Risk of Deeper Pullback

Bitcoin fell below $110,000 following a stalled midweek rebound, sliding 2.2% to trade near $109,500. Bitfinex analysts forecast a potential support zone between $93,000 and $95,000 for this correction. Strategic factors may set the stage for a renewed rally in the last quarter.

Stripe and Paradigm Incubate Tempo Blockchain for Stablecoin Payments

Paradigm and Stripe have launched a private testnet for Tempo, a payments-focused blockchain capable of over 100,000 transactions per second with sub-second finality. Design partners include Visa, Deutsche Bank and OpenAI, with support for stablecoin gas payments and Ethereum compatibility.

XRP Army Credited with Influencing Ripple SEC Case

Ripple’s four-year legal battle with the US SEC concluded with a mixed ruling this August. The judge and Ripple’s lawyers acknowledged research and filings by the XRP Army as key influences in the case outcome. XRP price spiked after the decision and later stabilized around $2.85.

Dogecoin Price Analysis: Lower Highs Form as Volume Expands on Declines

Dogecoin advanced 4% as volumes surged, testing $0.223 resistance while holding $0.214 support. Analysts disagree on next move: breakdown toward $0.17 Fibonacci support or upside to $1.00 based on historical patterns and ETF approval odds.

Ripple Rolls Out $700M RLUSD Stablecoin in Africa with Weather Insurance Pilots

Ripple partners with Chipper Cash, VALR and Yellow Card to deploy $700M of its USD-pegged RLUSD stablecoin to African institutions. Mercy Corps tests RLUSD-based drought and rainfall insurance programs using satellite-triggered payouts.

Gold Outshines Bitcoin in 2025 as BTC-Gold Ratio Poised for Q4 Breakout

Gold’s 33% year-to-date gain has outpaced bitcoin and equity benchmarks, reducing the BTC-XAU ratio to its lowest since late 2021. Technicals show an ascending triangle pattern dating to 2017, signaling a potential breakout in Q4 or early 2026.

Crypto Hackers Now Use Ethereum Smart Contracts to Conceal Malware

Malicious NPM packages exploit Ethereum smart contracts to hide second-stage payload URLs, evading traditional security checks. ReversingLabs uncovered two affected packages posing as simple utilities. Developers warned of rising supply chain risks in crypto tooling.

Asia Morning Briefing: Bitcoin Holds Steady as Traders Turn to Ethereum

Bitcoin consolidates near $112,000 amid macro hedge positioning, while traders shift to Ethereum for upside potential into September. Asia-Pacific stocks rise on Wall Street tech gains. Options and prediction markets show renewed ETH convexity ahead of the Fusaka upgrade.

Etherealize Secures $40M Series A for Institutional Ethereum Infrastructure

Etherealize raised $40 million in a Series A funding round co-led by Electric Capital and Paradigm to develop private settlement tools and tokenization systems for Wall Street institutions on Ethereum. Founders include Ethereum veteran Danny Ryan and trader Vivek Raman. The funding follows grants from Vitalik Buterin and the Ethereum Foundation.