🔎 Coin Research — Bless (BLESS) — 17 October 2025

New weekly coin research for Bless (BLESS). — Score: 7.00/10 TL;DR: A decentralized edge computing network leveraging idle CPU/GPU resources from everyday devices via a browser extension to provide on-demand compute for applicat

SEC says unclear if proposed 3x and 5x leveraged ETFs will be approved

The SEC stated it is unclear whether filings for new 3x and 5x leveraged equity-linked ETFs comply with Rule 18f-4, amid limited review capacity during the US government shutdown. Volatility Shares has filed for 27 leveraged ETF products including the first proposed 5x offering, raising investor risk concerns.

🔎 Coin Research — Walrus (WAL) — 16 October 2025

New weekly coin research for Walrus (WAL). — Score: 8.00/10 TL;DR: Decentralized secure blob storage protocol on Sui enabling data markets for AI applications

Crypto-Native Traders Drive $12B Bitcoin Deleveraging Event

Roughly $12 billion in Bitcoin futures positions were liquidated in a single day, marking the largest intra-day open interest drop on record. Data indicates that crypto-native venues led the sell-off, while institutional platforms remained largely stable. This event may signal a market inflection point.

Tether to Launch Open-Source Wallet Development Kit This Week

Tether confirmed that it will release a fully open-source Wallet Development Kit (WDK) this week, including iOS and Android starter wallets. The WDK features non-custodial support, multiple mnemonic backup options, and a comprehensive DeFi module covering USDT, USDT0, lending, swapping, and asset management.

U.S. Takes $14B in Bitcoin in Largest-Ever Government Seizure

U.S. authorities executed a coordinated action against Cambodian scam operations, indicting Prince Group’s founder and seizing 127,271 BTC (≈$14.4 billion) as part of the DOJ’s largest crypto confiscation, while sanctions cut Huione from U.S. financial markets.

🔎 Coin Research — Nockchain (NOCK) — 15 October 2025

New weekly coin research for Nockchain (NOCK). — Score: 7.00/10 TL;DR: Programmable sound money L1 blockchain using Zero-Knowledge Proof of Work consensus to secure a hard-capped digital asset and enable scalable app-rollups with f

Crypto Digest — 14 October 2025

📢 Read the daily digest for 2025-10-14: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — ChainOpera AI (COAI) — 14 October 2025

New weekly coin research for ChainOpera AI (COAI). — Score: 7.00/10 TL;DR: AI native layer-1 blockchain and operating system enabling co-creation and co-ownership of decentralized AI agents and services.

After record crypto crash, rush to hedge against further freefall

Options investors purchased hedges after a record $19B crypto liquidation on Oct 10–11, with bitcoin down 14% and ether off 12.2%. The sell-off was triggered by Trump’s 100% tariff on Chinese imports, and despite a partial rebound, volatility remains high.

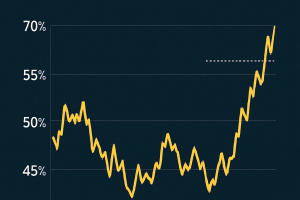

BlackRock’s IBIT ETF surpasses $100B in assets under management

BlackRock’s IBIT spot Bitcoin ETF reached $100 billion in AUM, becoming the fastest crypto-linked ETF to achieve this milestone. The surge reflects strong institutional demand and continued adoption of regulated digital asset products. IBIT’s growth highlights the evolving landscape of crypto investments within traditional asset management frameworks.

Singapore court approves WazirX recovery scheme for hack victims

Singapore’s High Court approved the WazirX restructuring plan, enabling customers to recover up to 55% of the $235 million stolen in the July 2024 hack. The scheme mandates fair distribution of recovered assets and oversight by the appointed scheme administrator. Approval marks a significant step in restitution for affected users and sets a precedent for crypto exchange insolvency proceedings.

MARA Holdings adds 400 BTC to reserves in $46 M purchase

MARA Holdings purchased 400 BTC valued at approximately $46.31 million via institutional platform FalconX, boosting its total Bitcoin holdings to 52 850 BTC. The transaction, executed two hours prior to reporting, underscores continued institutional commitment amid broader market volatility. MARA’s reserves now approximate $6.12 billion in Bitcoin assets.

Uphold research chief alleges targeted Binance margin exploit

Dr. Martin Hiesboeck of Uphold Research claimed the October 10–11 crypto crash was a targeted attack exploiting a flaw in Binance’s Unified Account margin system. The exploit allegedly used unstable collateral pricing for USDe, BNSOL and WBETH to trigger cascading liquidations. Binance has acknowledged dislocations and pledged compensations alongside risk control enhancements.

Binance compensates users $283M after stablecoin depeg chaos

Binance announced a $283 million compensation for users affected by the depeg of three Binance Earn assets during last Friday’s market crash. The payout covers futures, margin and loan collateral losses incurred between 21:36 UTC and 22:16 UTC. New risk controls and pricing logic updates are being implemented to prevent recurrence.

Crypto Digest — 13 October 2025

📢 Read the daily digest for 2025-10-13: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Q4 Crypto Surge? Historical Trends, Fed Shift and ETF Demand Align

Q4 historically delivers average gains of 79% for bitcoin since 2013, driven by institutional treasury accumulations and ETF inflows. With the Fed’s latest rate cut and $18 billion in BTC and ETH ETF inflows in Q3, CoinDesk Indices projects continued market momentum into year-end.

Green Shoots on China Lifts Crypto in Sunday Action

Crypto markets rebounded Sunday as China’s Ministry of Commerce clarified rare-earth export controls are limited and President Trump’s conciliatory Truth Social post reassured investors. Bitcoin rose about 3% while ether, solana and dogecoin gained 6-8%, partially reversing Friday’s steep losses.

Binance to Compensate Users Affected by Crash in Wrapped Ether, Staked Solana and Ethena’s USDe

Binance announced it will compensate users who suffered losses from a severe crash in wrapped tokens wBETH, BNSOL and USDe after infrastructure stress impeded market makers, causing large price dislocations. The exchange will review cases individually and adopt conversion-ratio pricing for wrapped assets.

🔎 Coin Research — Tea Protocol (TEA) — 13 October 2025

New weekly coin research for Tea Protocol (TEA). — Score: 7.00/10 TL;DR: Monetizing open-source contributions via a novel OP-based Layer 2 network with Proof of Contribution algorithm

Altcoins Cratered in Oct. 10 Crypto Flash Crash as Bitcoin Held Up, Wiston Capital Says

Wiston Capital founder Charlie Erith reported that altcoins plunged about 33% in roughly 25 minutes on Oct. 10, erasing $18.7 billion in liquidations, while bitcoin fell less severely. Erith plans to track bitcoin’s 365-day EMA, market breadth and volatility metrics before re-leveraging.

Tether CEO Paolo Ardoino: ‘Bitcoin and Gold Will Outlast Any Other Currency’

Tether CEO Paolo Ardoino stated that bitcoin and gold will outlast all other currencies, reiterating Tether’s strategy of allocating up to 15% of net profits to bitcoin reserves and expanding gold backing via XAUt. Investors await the next reserve attestation to gauge shifts in asset allocations.

FTC Settles with Voyager Digital for $1.65B as CFTC Charges Former CEO

U.S. FTC reached a $1.65 billion settlement with bankrupt crypto lender Voyager Digital over consumer protection violations. Concurrently, CFTC filed fraud and registration-related charges against ex-CEO Steven Ehrlich. Settlement bars future financial service offerings and mandates payment after creditor compensation in bankruptcy proceedings.

Bitcoin’s On-Chain Strength Sets Stage for Fourth-Quarter Gains, Says ARK Invest

ARK Invest research highlights Bitcoin’s sustained on-chain metrics, including rising active addresses and declining exchange reserves, as bullish indicators for Q4 performance. Institutional inflows via ETFs and increasing network security support the projection of renewed upward momentum.

Coinbase’s Upcoming Amex Card With BTC Cashback: Everything We Know So Far

Coinbase plans to introduce a new American Express credit card offering up to 4 percent Bitcoin cashback on select purchases. Product details include tiered rewards on dining, groceries, and streaming services, with launch slated for Q1 2026 after regulatory approvals.

AAVE Sees 64% Flash Crash as DeFi Protocol Endures Largest Stress Test

Decentralized lending protocol AAVE underwent a 64 percent flash crash on major exchanges, triggering $180 million in collateral liquidations within one hour. Smart contract safeguards prevented protocol insolvency, but rates and incentives are under review to bolster risk thresholds.

🔎 Coin Research — HONO Protocol (HONO) — 12 October 2025

New weekly coin research for HONO Protocol (HONO). — Score: 6.00/10 TL;DR: HONO Protocol is an algorithmic real-yield rebase token fully backed by wstETH, designed to grow in value through multiple revenue streams including Uniswap V3

Ethena’s USDe Briefly Loses Peg During $19B Crypto Liquidation Cascade

Stablecoin USDe deviated from its $1 peg amid a $19 billion market liquidation wave, dropping to $0.996 before recovering within hours. Ethena Labs confirmed that mint and redeem functionality remained operational and collateral levels held above required thresholds.

Largest Ever Crypto Liquidation Event Wipes Out 6,300 Wallets on Hyperliquid

A record liquidation event on Hyperliquid erased over $1.23 billion in trader capital and left 6,300 wallets in the red amid a broader $19 billion market sell-off triggered by new U.S. tariffs and geopolitical uncertainty.

Largest Crypto Liquidation Ever Sees $16B Longs Wiped Out Amid Trade Fears

Trump’s 100% tariff threat on China triggered a risk-off wave that liquidated over $16 billion in crypto longs, marking the largest such event on record. Bitcoin and Ether tumbled 10% and 16% respectively, while stablecoin USDe saw minor peg deviations during the turmoil.

Trump Tariff Threat Sparks Crypto Flash Crash, Bitcoin Dips Below $110K

Trump’s threat of 100% tariffs on China sparked a crypto flash crash that drove Bitcoin below $110 000 and liquidated $7 billion in leveraged positions. Ether, XRP and Solana plunged over 15% as forced liquidations amplified volatility.

Gold-Backed Tokens Hold Firm Amid $19B Crypto Rout with Overbought Signals

Gold-backed tokens PAXG and XAUT recorded under-1% losses during a $19 billion crypto liquidation, outperforming major cryptocurrencies. Gold’s eight-week rally has pushed prices into overbought territory, raising the prospect of a near-term consolidation.

BTC, ETH, XRP and SOL Enter Slow Bottoming Process After $16B Liquidations

A $16 billion liquidation event forced leveraged positions across Bitcoin, Ether, XRP and Solana, triggering a major sell-off. Weekend liquidity constraints and cautious market maker behavior are expected to prolong a gradual, multi-phase bottoming process.

XRP Plunges 42% to $1.64 Before Partial Recovery to $2.36

XRP plunged 42% to $1.64 amid large-scale liquidations and a fall in futures open interest. The token rebounded to $2.36 as volume spiked 164% above its 30-day average and open interest contracted by $150 million.

Privacy Tokens Surge as Market Rotates to 2018 Narratives

Privacy-focused tokens rallied as Zcash gained over 40% and Railgun jumped 117% in 24 hours. Dash, Monero and other anonymity assets saw double-digit gains amid broader market consolidation. Spot volumes for privacy coins spiked above $1.1 billion across exchanges.

Privacy Tokens Surge as Market Rotates to 2018 Narratives

Privacy-focused tokens rallied as Zcash gained over 40% and Railgun jumped 117% in 24 hours. Dash, Monero and other anonymity assets saw double-digit gains amid broader market consolidation. Spot volumes for privacy coins spiked above $1.1 billion across exchanges.

Bitcoin Implied Volatility Hits 2.5-Month High

Bitcoin’s 30-day implied volatility index climbed above 42%, marking its highest level in 2.5 months. Historical data indicate similar October spikes, with average late-month gains near 6% and November returns exceeding 45%. Traders view elevated volatility as a bullish seasonal signal.

Bitcoin Implied Volatility Hits 2.5-Month High

Bitcoin’s 30-day implied volatility index climbed above 42%, marking its highest level in 2.5 months. Historical data indicate similar October spikes, with average late-month gains near 6% and November returns exceeding 45%. Traders view elevated volatility as a bullish seasonal signal.

Hyperliquid Launches Based Streams Live Trading Platform

Hyperliquid rolled out Based Streams, a decentralized live-streaming platform that integrates real-time trading overlays, chat and tokenized donations via its Hypercore protocol. The feature debuted at 12:30 UTC with @LH_0302 opening 500 blind boxes on camera. Creators can now monetize and reward viewers seamlessly.

Hyperliquid Launches Based Streams Live Trading Platform

Hyperliquid rolled out Based Streams, a decentralized live-streaming platform that integrates real-time trading overlays, chat and tokenized donations via its Hypercore protocol. The feature debuted at 12:30 UTC with @LH_0302 opening 500 blind boxes on camera. Creators can now monetize and reward viewers seamlessly.

Bitcoin Miners Rally as Sector Nears $90B Market Cap

Public bitcoin mining firms extended gains in pre-market trading, driving the sector’s market cap toward $90 billion. AI and high-performance computing demand fueled share price rallies for IREN, TerraWulf and others. Data center shortages cited as key catalyst for mining infrastructure investment.

XRP, DOGE, SOL See Pullback as $2.72B Flows Into Bitcoin ETFs

Bitcoin briefly dipped below $120,000 amid profit-taking, while spot Bitcoin ETFs attracted a record $2.72 billion inflow this week. XRP, Dogecoin and Solana all pulled back 2–3% as traders weighed ETF dynamics. Privacy coins outperformed amid renewed hedging demand.

Crypto Digest — 10 October 2025

📢 Read the daily digest for 2025-10-10: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Aave Governance Token Dips Below Key Support Level After 5% Plunge

Aave’s governance token (AAVE) fell 5% to trade just below the $270 support mark, driven by high-volume selling as the overall market weakened. Technical models indicate bearish momentum, with failed recovery attempts confirming sustained pressure. The broader CoinDesk 20 Index was down over 4% during the session.

Filecoin Plunges 7% Amid Intensified Selling Pressure

Filecoin’s FIL token dropped as much as 7% in 24 hours, sliding from $2.39 to $2.23 amid a broader market decline. Trading volume spiked to nearly 6 million tokens, well above the 3.4 million daily average. Technical models signal potential base formation above $2.23 but warn of sustained volatility.

‘Bitcoin Jesus’ Roger Ver Nears U.S. Tax Fraud Settlement

Early Bitcoin investor and advocate Roger Ver is reportedly close to settling U.S. tax fraud charges, according to the New York Times. Under the proposed agreement, Ver would pay approximately $48 million for unreported capital gains. The settlement remains subject to judicial review and is scheduled for a hearing in December.

🔎 Coin Research — Everlyn AI (LYN) — 10 October 2025

New weekly coin research for Everlyn AI (LYN). — Score: 7.00/10 TL;DR: Everlyn AI is a Web3-native platform providing on-chain autonomous video generation powered by an autoregressive foundational model, enabling real-time, verifia

Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Infrastructure Fintech BVNK

Coinbase and Mastercard have held advanced discussions to acquire London-based BVNK, a fintech building stablecoin payment rails. Sources indicate valuations between $1.5 billion and $2.5 billion, with Coinbase reportedly leading bids. Completion would mark the largest stablecoin-related acquisition to date and signal intensifying competition in digital payments infrastructure.

Senate Democrats’ DeFi Regulation Proposal Sparks Industry Outcry

A draft proposal circulated among Senate Democrats would require anyone profiting from a DeFi front-end to register as a broker with the SEC or CFTC, industry leaders warn. Observers say language could effectively ban most DeFi platforms in the US by imposing unworkable compliance burdens. The Blockchain Association and legal experts call for revisions to avoid driving innovation overseas.

North Dakota plans U.S. dollar stablecoin launch with Fiserv partnership

The Bank of North Dakota will issue a state-backed U.S. dollar stablecoin built on Fiserv’s digital asset platform, targeting roll-out in 2026. Dubbed Roughrider Coin, the token aims to streamline interbank transfers and merchant payments. State participation follows the GENIUS Act and Wyoming’s Frontier Stable Token test phase.

BNB Chain memecoins mint new millionaires in wild trading week

Onchain data reveals traders on BNB Chain generated gains of up to $7.9 million using small-cap memecoins. One investor achieved a 2,260-fold return, while multiple wallets turned modest investments into multi-million dollar profits. Activity reflects renewed speculative capital flow across DeFi ecosystems.

Fireblocks partners with Galaxy and Bakkt to enhance institutional custody

Fireblocks Trust Company formed partnerships with Galaxy, Bakkt, FalconX and Castle Island under NYDFS oversight to expand regulated custody services. The initiative targets token launches, digital asset treasuries and ETF infrastructure. Regulatory compliance and security are emphasized as catalysts for institutional adoption.

🔎 Coin Research — DoubleZero (2Z) — 09 October 2025

New weekly coin research for DoubleZero (2Z). — Score: 8.00/10 TL;DR: DoubleZero is a decentralized global fiber network infrastructure layer (DePIN) providing low-latency, high-performance connectivity for blockchains and distrib

Bitcoin rebounds toward range highs as liquidity data emerges

Bitcoin held above $120,000 after a correction from recent highs, with onchain and market data indicating controlled profit taking and renewed buying momentum. Net taker volume shifted to neutral levels, supporting confidence in sustained demand. Market metrics point to balanced conditions for further upside.

Coinbase enables staking for New York residents after state approval

New York residents gained access to crypto staking for assets including Ether and Solana after state regulator approval. Staking services had been paused in multiple states amid legal challenges. Expansion aims to broaden access and reward opportunities nationwide.

GraniteShares files leveraged XRP ETF offering 3x long and short exposure

GraniteShares submitted a filing for a new XRP ETF providing 3x long and 3x short leveraged exposure to XRP. The product parallels existing leveraged Bitcoin, Ethereum and Solana ETFs, broadening trading options for aggressive and hedging strategies. Institutional interest in leveraged crypto ETFs continues to expand.

PancakeSwap Chinese X account hack fails to dent CAKE gains, token jumps 16%

PancakeSwap’s Chinese-language X account was compromised, with attackers promoting a fake “Mr. Pancake” token amid a meme coin frenzy. Despite the breach, CAKE surged 16% to $4.52, reflecting strong trading momentum on BSC. The incident highlights escalating phishing threats across Binance Smart Chain channels.

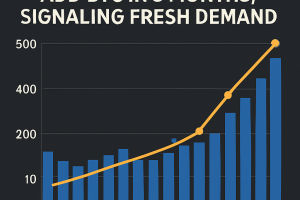

Short-term holders add 559,000 BTC in three months, signaling fresh demand

Short-term Bitcoin holders increased supply by 559,000 BTC over the past quarter, rising from 4.38 million to 4.94 million BTC, indicating new investor participation. On-chain data show the Fund Flow Ratio falling to its lowest level since July 2023. Reduced exchange activity suggests accumulation over selling amid near-peak prices.

Bitcoin loses $5K and Ethereum falls below $4,500 in 24-hour correction

Bitcoin declined by $5,000 within 24 hours, briefly dipping under $121,000 before recovering slightly. Ethereum fell over 5%, slipping below $4,500 alongside broader altcoin losses. The total crypto market capitalization decreased by approximately 2% to around $4.27 trillion.

Crypto race to tokenize stocks raises investor protection flags

A race by crypto firms to launch tokenized stock products has prompted warnings over insufficient investor rights and market fragmentation. Traditional financial institutions and regulatory experts caution that these tokens lack standard equity protections. Critics argue inconsistent disclosures and derivative-like structures could undermine market stability.