Bank of America expands crypto access for wealth management clients

Bank of America will enable wealth advisers at its private bank and Merrill platforms to recommend crypto exchange-traded products to qualifying clients without asset thresholds, starting January. The shift marks a major step in institutional adoption of digital assets.

Spot crypto products to begin trading on CFTC-registered exchanges

CFTC announced spot crypto asset contracts will begin trading on registered futures exchanges, marking the first regulated listing of such products in the U.S. The move aims to enhance market safety and provide robust oversight amid offshore exchange failures.

Bitcoin Surges 11% on Fed’s $38B Liquidity Injection

Bitcoin rallied 11% from $83,823 to over $93,000 after the Federal Reserve ended quantitative tightening and injected $38.5 billion via repo operations. Vanguard’s opening to crypto ETFs added demand, and CME FedWatch odds for a December rate cut rose above 80%.

🔎 Coin Research — Bittensor (TAO) — 04 December 2025

New weekly coin research for Bittensor (TAO). — Score: 8.00/10 TL;DR: A decentralized blockchain-based AI network incentivizing machine intelligence contributions via TAO tokens

Anthropic AI Agents Expose Smart Contract Security Flaws

Anthropic’s AI agents autonomously reconstructed 19 of 34 real smart contract exploits, extracting $4.6 million in simulated value at $1.22 per contract. Exploit automation now rivals traditional audits, necessitating continuous AI-driven adversarial testing in CI/CD pipelines.

Strategy’s Yield Hunt Boosts Short-Seller Opportunities

Strategy’s exploration of crypto lending exposes its 650,000 BTC reserve to re-hypothecation and funds short-seller inventory. Market makers and hedge funds may exploit lower borrowing costs, increasing counterparty risk and compressing Strategy’s stock premium.

UK takes ‘massive step forward,’ passing property laws for crypto

The UK granted royal assent to the Property (Digital Assets etc) Act, legally recognizing cryptocurrencies and stablecoins as personal property. The law codifies Law Commission recommendations, clarifying ownership rights, asset recovery and insolvency processes for digital assets.

Crypto Digest — 03 December 2025

📢 Read the daily digest for 2025-12-03: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — AR.IO Network (ARIO) — 03 December 2025

New weekly coin research for AR.IO Network (ARIO). — Score: 7.00/10 TL;DR: Decentralized permanent cloud network enabling immutable data storage, querying, and domain management on Arweave

Bitcoin battles $50K price target as Fed adds $13.5B overnight liquidity

Federal Reserve halted quantitative tightening with a $13.5 billion repo injection, marking second-largest overnight liquidity boost since 2020. Bitcoin price briefly tested the $50,000 level amid renewed macro bull signals.

Swiss and German authorities shut down cryptomixer.io in money laundering crackdown

Swiss and German law enforcement seized servers and domains of cryptomixer.io, confiscating over €25 million in bitcoin and 12 TB of data. The operation targeted one of the largest crypto tumblers used for illicit transfers.

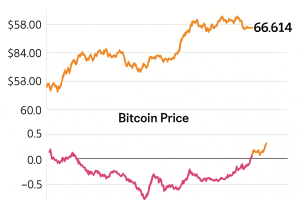

Bitcoin falls again after weak November as bearish sentiment goes on

Bitcoin slumped 6% to $85,788 following its largest monthly drop since mid-2021. Record $18,000 November decline and rising crypto liquidations totalling nearly $1 billion reinforced bearish sentiment. Strategy cut its earnings forecast.

Crypto Digest — 02 December 2025

📢 Read the daily digest for 2025-12-02: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Momentum (MMT) — 02 December 2025

New weekly coin research for Momentum (MMT). — Score: 7.00/10 TL;DR: A concentrated liquidity DEX and composable liquidity layer built on the Sui blockchain, leveraging Move language and ve(3,3) governance to provide capital-effi

European Cops Shut Down Cryptomixer Laundering Service

A coalition of law enforcement agencies coordinated by Europol seized the Cryptomixer platform and infrastructure, alleging it laundered over €1.3 billion in bitcoin since 2016. Authorities confiscated three servers, the domain cryptomixer.io and €25 million in bitcoin. The operation targeted ransomware and darknet operators using the service to obfuscate illicit funds.

Grayscale to launch first US spot Chainlink ETF this week

Grayscale plans to convert its Chainlink Trust into the first US spot Chainlink ETF, expected to begin trading on December 2. The fund will track LINK’s spot price and include staking returns, representing a significant step in altcoin institutional access.

Yearn Finance DeFi hack exploits yETH vulnerability draining $9M

A vulnerability in Yearn Finance’s legacy yETH token contract enabled an attacker to mint trillions of tokens and drain approximately $9 million from stableswap pools on November 30. The stolen ETH was laundered via Tornado Cash, while V2 and V3 Vaults remained unaffected.

Bitcoin drops over 5% amid renewed risk aversion

Bitcoin fell more than 5% to $86,461 on Monday, marking its steepest daily decline in a month as renewed risk aversion weighed on investors. Record outflows from US spot Bitcoin ETFs and Tether’s downgrade added further pressure.

Crypto Digest — 01 December 2025

📢 Read the daily digest for 2025-12-01: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — AI Rig Complex (ARC) — 01 December 2025

New weekly coin research for AI Rig Complex (ARC). — Score: 6.00/10 TL;DR: A decentralized framework of modular AI agents on Solana enabling on-chain analytics, automation and DeFi composability.

Ethereum Developers Prep for Fusaka, Second Upgrade of 2025

Ethereum developers are preparing for Fusaka, the network’s second major upgrade of 2025, scheduled for mainnet activation. Fusaka combines consensus- and execution-layer improvements via 12 EIPs, including PeerDAS for partial blob verification, to enhance scalability and reduce layer-2 transaction costs.

'We Wear Your Loathing With Pride': Tether's Downgrade at S&P Sparks Online Battle

S&P Global downgraded Tether’s USDT stablecoin rating to its weakest level, citing concerns over reserve transparency and increased bitcoin backing. The move reignited debates over audit practices and collateral composition as industry figures criticized S&P’s methodology and called for independent audits.

Crypto Digest — 30 November 2025

📢 Read the daily digest for 2025-11-30: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — GaiAI (GAIX) — 30 November 2025

New weekly coin research for GaiAI (GAIX). — Score: 7.00/10 TL;DR: GaiAI is a decentralized creative AI protocol and on-chain creative asset DAO enabling creators to generate, own, and monetize AI-generated visual content as ve

Bitcoin ETFs Become Top Revenue Source for BlackRock

BlackRock’s US-listed spot bitcoin ETF reached $70 billion in net assets 341 days after launch and has generated an estimated $245 million in annual fees. Allocations have approached $100 billion in assets under management and now represent over 3% of total bitcoin supply.

Senate, IRS, and SEC Unveil Key Cryptocurrency Regulatory Proposals

The U.S. Senate Agriculture Committee released a draft digital asset market structure bill, the IRS issued staking safe-harbor guidance, and the SEC introduced its 'Project Crypto' token taxonomy. These federal initiatives aim to clarify trading rules, tax treatment, and token classifications.

Bitcoin’s Coinbase Premium Index Turns Positive After Weeks

The Coinbase Premium Index, measuring the price spread between U.S. and global bitcoin markets, flipped positive for the first time in nearly a month as BTC traded near $91,000. Record stablecoin balances on Binance suggest potential inflows awaiting deployment.

Crypto Digest — 29 November 2025

📢 Read the daily digest for 2025-11-29: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — World Mobile Token (WMTX) — 29 November 2025

New weekly coin research for World Mobile Token (WMTX). — Score: 7.00/10 TL;DR: World Mobile Token powers a decentralized mobile network enabling node operators and users to connect underserved regions via blockchain-based telecom infrastru

Solana traders targeted by covert browser extension siphoning swap fees

A malicious Chrome extension named Crypto Copilot siphoned fees from Raydium swaps by appending hidden transfer instructions to transactions since June, remaining undetected until flagged by cybersecurity firm Socket.

South Korea suspects North Korea behind Upbit hack

South Korean authorities suspect North Korean Lazarus Group orchestrated an unauthorized withdrawal of 44.5 billion won from Upbit, triggering system inspections and forensic analysis linking the breach to a 2019 heist.

🔎 Coin Research — Linea (LINEA) — 28 November 2025

New weekly coin research for Linea (LINEA). — Score: 7.00/10 TL;DR: Linea is a fully Ethereum-equivalent zkEVM rollup offering seamless EVM compatibility, dual-token burn deflationary mechanics, and a major ecosystem fund manage

Balancer DAO Considers $8M Recovery Plan After $110M Exploit

Following a November 3 smart-contract exploit that drained $110 million from Balancer v2 vaults, Balancer DAO on November 27 began discussing a plan to distribute $8 million in recovered assets to affected liquidity providers. The proposal includes white-hat bounties and a pro-rata reimbursement mechanism.

Upbit Reports $36M Loss in Solana Hot-Wallet Breach

South Korea’s largest crypto exchange detected unauthorized transfers from its Solana hot wallet, resulting in a $36 million loss across multiple tokens. Remaining assets were moved to cold storage and on-chain freezes are in coordination. Upbit pledged full reimbursement from parent company funds to protect user balances.

Upbit Suspends Solana Token Withdrawals After $37M Irregular Activity

South Korea’s leading exchange halted deposits and withdrawals after detecting irregular Solana token transfers totaling about $37 million. The platform will cover all losses, froze assets worth roughly 12 billion won, and is collaborating with law enforcement. Withdrawal services will resume once security audits are complete.

Crypto Digest — 27 November 2025

📢 Read the daily digest for 2025-11-27: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Bio Protocol (BIO) — 27 November 2025

New weekly coin research for Bio Protocol (BIO). — Score: 7.00/10 TL;DR: Decentralized science platform enabling community-driven biotech funding through AI-native research agents and milestone-based token incentives.

Nevada Court Rules Prediction Markets Contracts Are Not Swaps Under CEA

A federal court in Nevada ruled that sports outcome contracts on a regulated exchange are not swaps under the Commodity Exchange Act. The decision exposes prediction markets like Kalshi to state gambling laws and may trigger a state-by-state regulatory battle.

🔎 Coin Research — Wayfinder (PROMPT) — 26 November 2025

New weekly coin research for Wayfinder (PROMPT). — Score: 7.00/10 TL;DR: AI-driven omnichain protocol enabling natural language blockchain interactions via autonomous AI agents

U.S. Bank Pilots Stablecoin Issuance on Stellar Blockchain

U.S. Bank commenced a pilot program to test issuance of custom stablecoins on the Stellar network in partnership with PwC and the Stellar Development Foundation. Features under evaluation include asset freezing and transaction reversal for compliance.

Dogecoin ETF Debut Flops with Zero Net Creations

Grayscale’s Dogecoin ETF (GDOG) launched on NYSE Arca on Nov. 24, 2025, recording zero net inflows on its first day despite $1.4 million in secondary trading volume. The absence of new creations contrasts with successful staking-yield ETFs, raising concerns about institutional appetite for single-token meme funds amid a pipeline of over 100 planned launches.

🔎 Coin Research — Monad (MON) — 25 November 2025

New weekly coin research for Monad (MON). — Score: 7.00/10 TL;DR: Monad is an EVM-compatible Layer-1 blockchain leveraging optimistic parallel execution and a custom database to achieve up to 10 000 TPS, near-zero gas fees, an

Crypto Market Mood Lifted as Amazon Pours $50B Into AI Infrastructure

Bitcoin rebounded above $87,000 and crypto mining stocks surged after Amazon announced a $50 billion investment in AI and high-performance computing infrastructure. Market sentiment improved as expectations rose for increased data-center demand.

Franklin Templeton Joins XRP ETF Race, Calling It ‘Foundational’ to Global Finance

Franklin Templeton launched its XRP-based exchange-traded fund (ETF) on NYSE Arca, emphasizing XRP’s potential in cross-border payments. The firm described the ETF as a ‘foundational infrastructure’ for integrating digital assets into traditional finance.

Bitcoin Extends Recovery on Fed Cut Hopes as Grayscale’s XRP and Dogecoin ETFs Debut

Bitcoin extended gains following comments from Federal Reserve officials hinting at potential rate cuts, rising above $86,700. Simultaneously, the NYSE approved Grayscale’s XRP and Dogecoin exchange-traded funds, marking their market debut and signaling growing institutional access to altcoin derivatives.

Crypto Digest — 24 November 2025

📢 Read the daily digest for 2025-11-24: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — PayAI Network (PAYAI) — 24 November 2025

New weekly coin research for PayAI Network (PAYAI). — Score: 7.00/10 TL;DR: PayAI is a decentralized AI Agent marketplace and payment facilitator built on Solana enabling autonomous agent micropayments via the x402 protocol.

Cardano Network Experiences Temporary Chain Split After AI-Script Exploit

A malformed transaction caused a brief divergence in the Cardano blockchain, as newer node versions accepted the malformed data while older nodes rejected it. The incident prompted an emergency patch and network-wide upgrade. Cardano’s co-founder described the event as a targeted attack by a disgruntled stake-pool operator.

ETF Outflows and Stablecoin Declines Signal Capital Flight in Crypto Market

Spot Bitcoin ETFs have recorded persistent outflows totaling $3.55 billion in November, marking the highest monthly withdrawal since launch. Stablecoin supply has contracted for the first time in months as algorithmic tokens lose nearly half their circulating supply. Corporate digital asset treasuries have reversed share premiums into discounts, indicating reduced demand for crypto assets.

🔎 Coin Research — Anoma (XAN) — 23 November 2025

New weekly coin research for Anoma (XAN). — Score: 8.00/10 TL;DR: Anoma is a novel intent-centric operating system that unifies multiple blockchains into one developer-friendly environment, enabling privacy-preserving, multi-p

Aerodrome Finance Suffers Front-End DNS Hijacking, Users Warned of Phishing Risk

Aerodrome Finance on Coinbase’s Base network was targeted by a front-end DNS hijack, redirecting users to phishing domains. Smart contracts remained secure; users urged to revoke approvals and use ENS mirrors to interact safely.

Bitcoin ETFs Smash Trading Volume Records During BTC’s Wild Friday Swings

US spot Bitcoin ETFs traded a combined $11.5 billion on Friday, marking a new single-day volume high. BlackRock’s IBIT accounted for $8 billion but saw $122 million in net outflows. ETFs still net positive by $238.4 million overall.

🔎 Coin Research — Intuition (TRUST) — 22 November 2025

New weekly coin research for Intuition (TRUST). — Score: 7.00/10 TL;DR: Intuition is the first blockchain and protocol purpose-built for Information Finance, enabling a decentralized token-curated knowledge graph and an L3 trust lay

Grayscale's DOGE, XRP ETFs to go live on NYSE Monday

Grayscale’s new Dogecoin (GDOG) and XRP (GXRP) spot ETFs will commence trading on NYSE Arca on Monday, providing regulated market access to these altcoins for U.S. investors. The GDOG and GXRP funds each hold respective underlying assets, joining a broader wave of altcoin ETF launches by major asset managers. Growing institutional demand for non-Bitcoin crypto exposure underpins the recent surge in altcoin ETP filings.

Cryptocurrencies Whipped by Flight from Risk

Bitcoin and ether fell over 2% to multi-month lows as investors fled risk assets, with bitcoin sliding to $85,350.75 and ether to $2,777.39 amid tech stock declines. Both tokens faced weekly losses around 8%, marking a broader shift in market sentiment and erasing roughly $1.2 trillion from crypto market value over six weeks.

Bitcoin ETFs Have Bled a Record $3.79B in November

U.S.-listed spot BTC ETFs recorded record outflows of $3.79 billion in November, exceeding the prior peak of $3.56 billion. BlackRock's IBIT fund saw over $2 billion redeemed, while ether ETFs lost $1.79 billion. Solana and XRP ETFs saw net inflows amid the sell-off.

Crypto Digest — 21 November 2025

📢 Read the daily digest for 2025-11-21: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Sei (SEI) — 21 November 2025

New weekly coin research for Sei (SEI). — Score: 7.00/10 TL;DR: A sector-specific Layer 1 blockchain optimized for high-speed, low-latency trading and DEX activity via parallelized EVM execution.

BlackRock Takes First Step Toward a Staked Ether ETF

BlackRock registered a preliminary filing for the iShares Staked Ethereum Trust ETF in Delaware, signaling intent to offer a yield-bearing ether product pending SEC clarity on staking inclusion. The move follows VanEck’s similar filing and prepares for the next phase of competition.

Crypto Digest — 20 November 2025

📢 Read the daily digest for 2025-11-20: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!