🔎 Coin Research — Pieverse (PIEVERSE) — 20 November 2025

New weekly coin research for Pieverse (PIEVERSE). — Score: 7.00/10 TL;DR: Pieverse is a Web3 payment compliance infrastructure that enables gasless, on-chain timestamping of invoices and receipts for legally recognized, auditable paym

Senator Tim Scott pushes for December vote on crypto market bill

Senate Banking Chair Tim Scott announced plans to mark up a crypto market structure bill in December, aiming for Senate passage and Presidential signature in early 2026. The bill would align with the CLARITY Act and provide clear regulatory authority for digital assets.

Crypto exchange Kraken submits confidential US IPO filing

Kraken confidentially filed a draft Form S-1 registration statement with the SEC to pursue a US IPO. The filing follows its recent $20 billion valuation and similar moves by Grayscale. The IPO remains subject to SEC review.

Kraken Scores $800M Raise Backed by $200M Citadel Securities Investment

Kraken raised $800 million in a two-part funding round led by major institutional investors and a $200 million follow-on from Citadel Securities at a $20 billion valuation. Proceeds will fuel global expansion and development of new trading tools, payments and tokenized asset offerings.

Crypto Digest — 19 November 2025

📢 Read the daily digest for 2025-11-19: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Datagram Network (DGRAM) — 19 November 2025

New weekly coin research for Datagram Network (DGRAM). — Score: 7.00/10 TL;DR: An AI-driven, blockchain-agnostic Hyper-Fabric Layer-1 network powering and deploying scalable DePIN infrastructures

🔎 Coin Research — Bittensor (TAO) — 18 November 2025

New weekly coin research for Bittensor (TAO). — Score: 8.00/10 TL;DR: Bittensor is a decentralized AI compute network that incentivizes machine learning contributions with the TAO token, creating a peer-to-peer intelligence market

Bitcoin Slips Below $93K as Crypto Weakness Worsens, Local Bottom Could Be Near

Bitcoin fell to a fresh six-month low below $93,000, erasing year-to-date gains amid deteriorating market sentiment. Strong U.S. economic data reduced expectations for near-term Federal Reserve rate cuts. Bitfinex analysts noted that capitulation by short-term holders may signal a local bottom soon.

Singapore Exchange to launch bitcoin and ether perpetual futures

SGX’s derivatives arm will launch bitcoin and ether perpetual futures on November 24, offering 24/7 trading without expiry exclusively for accredited and institutional investors. The move seeks to meet demand for hedging and speculative instruments amid growing crypto market momentum.

1inch Unveils Protocol Letting Multiple DeFi Strategies Share the Same Capital

1inch launched Aqua, a liquidity protocol enabling a single wallet to support multiple DeFi strategies simultaneously without locking funds on any platform. Aqua taps assets on demand to boost capital efficiency and a developer SDK is now available. Full front-end release is expected in early 2026.

ICIJ Investigation Reveals Crypto’s Criminal ‘Coin Laundry’ Financial Network

The ICIJ investigation uncovered extensive crypto-backed money laundering networks operating through major exchanges such as Binance, Coinbase and Kraken. The probe involved over 100 journalists from 35 countries exposing flows tied to drug cartels, people trafficking and sanctioned entities. The series highlighted gaps in compliance and called for stronger cross-border regulatory cooperation.

Crypto Digest — 17 November 2025

📢 Read the daily digest for 2025-11-17: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Caldera (ERA) — 17 November 2025

New weekly coin research for Caldera (ERA). — Score: 7.00/10 TL;DR: Caldera is a Rollups-as-a-Service platform and interoperability layer (Metalayer) allowing developers to deploy customizable rollups on Ethereum with unified cr

SEC Outlines Token Taxonomy to Exempt Commodities and Collectibles

SEC Chairman Paul Atkins unveiled a token taxonomy under ‘Project Crypto’, clarifying that digital commodities, collectibles, and utility tokens fall outside securities regulation. Investment contract tokens remain regulated until managerial efforts end. The framework aims to support innovation by defining clear categories and coordination with CFTC and banking regulators.

Bitcoin Nears 2025 Break-Even as Price Falls Below $95K

Bitcoin plunged below $95,000, erasing 2025 gains as investors withdrew $900 million from funds amid risk aversion. The largest cryptocurrency dropped 4.7% to $94,147 following deep liquidations and ETF outflows totaling $870 million. Market sentiment nears ‘extreme fear’ as liquidity thins and macro uncertainty intensifies.

Crypto Digest — 16 November 2025

📢 Read the daily digest for 2025-11-16: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Allora (ALLO) — 16 November 2025

New weekly coin research for Allora (ALLO). — Score: 7.00/10 TL;DR: Allora is a decentralized Model Coordination Network (MCN) that aggregates, evaluates, and continually improves machine learning models on-chain via a self-impr

ZEC up +43.96%, BTC -1.23%, Zcash is The Coin of The Day

Total cryptocurrency market capitalization fell by 1.56% to $3.23 trillion over 24 hours, with trading volume down by 25.58%. Bitcoin price declined 0.15% to $95,693, while Bitcoin dominance edged down to 58.92%. Zcash led gainers with a 43.96% advance.

Crypto Digest — 15 November 2025

📢 Read the daily digest for 2025-11-15: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Forge3 (FORGE) — 15 November 2025

New weekly coin research for Forge3 (FORGE). — Score: 7.00/10 TL;DR: Forge3 is a Solana-based platform enabling users to create and deploy AI trading agents that compete in on-chain tournaments, with transparent, smart-contract–v

Crypto Markets Today: Bitcoin Breaches $98K as Liquidations Top $1.1B

A sharp liquidity crunch triggered over $1.1 billion in crypto derivatives liquidations, pushing bitcoin below $98,000. Roughly half of the liquidations involved BTC positions, while ether and altcoins also suffered double-digit losses. Market response remained measured.

Crypto Digest — 14 November 2025

📢 Read the daily digest for 2025-11-14: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Bitcoin Crumbles Below $100K as Liquidity Crunch Hits

BTC fell below $100K during U.S. trading, reversing overnight gains above $104K. Market equities including miners dropped sharply amid easing rate-cut expectations. Government shutdown-related liquidity drain weighed on risk assets but fiscal flows may soon reverse.

🔎 Coin Research — Folks Finance (FOLKS) — 14 November 2025

New weekly coin research for Folks Finance (FOLKS). — Score: 8.00/10 TL;DR: Folks Finance is a crosschain lending protocol that unifies liquidity across EVM and non-EVM chains with a hub-and-spoke architecture

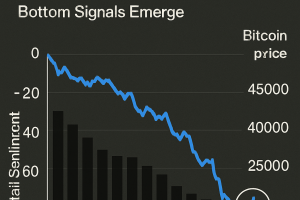

Retail Mood Sours Amid Crypto Selloff, Bottom Signals Emerge

Social sentiment around major tokens turned negative as prices declined, yet on-chain metrics hint at short-term bottom formation. Bitcoin’s Net Unrealized Profit ratio reached levels historically preceding rebounds. Institutions plan increased exposure ahead of regulatory changes.

Solana Slides 5% to $145 After Key Support Breach

SOL slid from $153 to $145 over 24 hours after breaking below $150 support. Trading volume jumped 13% above weekly averages as institutional sellers dominated. Spot Solana ETFs maintained inflows despite price pressures.

Suspected $30M Manipulation Causes $4.9M Loss on Hyperliquid

A suspected $30 million market manipulation on Hyperliquid triggered $4.9 million in losses after a trader used $3 million USDC to create a fake buy wall, causing forced liquidations. The exchange paused its Arbitrum bridge to stabilize liquidity.

Crypto Digest — 13 November 2025

📢 Read the daily digest for 2025-11-13: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Allora (ALLO) — 13 November 2025

New weekly coin research for Allora (ALLO). — Score: 7.00/10 TL;DR: Self-improving decentralized AI network that aggregates and refines thousands of ML models into adaptive, on-chain intelligence for DeFi and enterprise applicat

Major Ethereum Holders Withdraw Over $1.4B from Binance

Data from CryptoOnchain reveals top 10 transactions included 413,000 ETH withdrawals by major holders, totaling over $1.4 billion. Net outflows reached 106,000 ETH as institutional investors moved assets to private wallets. Analysts interpret the shift as a sign of long-term confidence and potential supply squeeze, though derivatives volumes and open interest remain elevated, indicating ongoing speculative activity.

Crypto Digest — 12 November 2025

📢 Read the daily digest for 2025-11-12: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Brazil Central Bank Implements Crypto Regulations and $7M Capital Bar for Firms

Brazil’s central bank issued comprehensive crypto regulations requiring service providers to obtain licenses, adhere to foreign exchange and capital market rules, and report cross-border transactions. Firms must meet capital thresholds up to 37.2 million reais and have nine months to comply. Foreign entities must establish local operations or face prohibition.

🔎 Coin Research — Aria Protocol (ARIAIP) — 12 November 2025

New weekly coin research for Aria Protocol (ARIAIP). — Score: 7.00/10 TL;DR: Aria Protocol enables tokenization of iconic intellectual property real-world assets (initially music) on the Story blockchain, bringing traditionally illiquid

ClearToken Wins UK Regulator Approval for Digital Asset Settlement Service

ClearToken has secured authorization from the U.K. Financial Conduct Authority to launch CT Settle, a delivery-versus-payment settlement platform for crypto, stablecoins and fiat transfers. The service eliminates pre-funding requirements, enabling simultaneous asset and payment exchanges and freeing up institutional liquidity. Its design mirrors established settlement infrastructure like forex CLS.

Ethereum Positioned as Infrastructure for Wall Street, Says Ex-BlackRock Executive

Former BlackRock executive Joseph Chalom asserts that Ethereum’s trust, security, and liquidity make it the preferred blockchain for institutional finance. He highlights staking yield and restaking strategies as essential to delivering productive, on-balance-sheet returns for asset managers. His outlook frames Ethereum as the foundational layer for digitized global finance.

China Alleges U.S. Seizure of 127K BTC in 2020 Mining Pool Hack

China’s National Computer Virus Emergency Response Center (CVERC) claims that U.S. authorities seized 127,000 BTC stolen in a 2020 hack of a Chinese mining pool. The U.S. government disputes the accusation, maintaining that the action targeted criminal proceeds under law enforcement protocols.

Bitdeer Shares Fall 20% on Deeper-Than-Expected Q3 Loss and ASIC Chip Delay

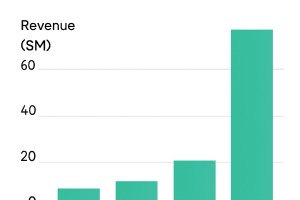

Bitcoin miner Bitdeer reported a net loss widening to $266.7 million, or $1.28 per share, in Q3 despite revenue doubling to $169.7 million. A delay on the SEAL04 ASIC chip was announced amid AI infrastructure expansion plans, prompting a 20% share drop.

Crypto Digest — 11 November 2025

📢 Read the daily digest for 2025-11-11: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Uniswap Proposes Sweeping ‘UNIfication’ With UNI Burn and Protocol Fee Overhaul

Proposal unites Uniswap Labs and Uniswap Foundation under a single governance plan. Plan would activate protocol fees, burn millions of UNI tokens and consolidate ecosystem teams. New fee mechanisms aim to align incentives and enhance protocol growth.

🔎 Coin Research — Janction (JCT) — 11 November 2025

New weekly coin research for Janction (JCT). — Score: 7.00/10 TL;DR: Janction is a Layer2 network and decentralized AI compute pool leveraging a Proof of Contribution consensus to provide scalable, verifiable GPU-based AI service

U.S. Clears Way for Crypto ETPs to Get Into Yield Without Triggering Tax Problems

IRS issued guidance allowing crypto ETPs to stake digital assets without jeopardizing tax status. Industry insiders view the safe harbor as removing a major barrier for fund sponsors. Treasury leaders called the move a boost for innovation and investor benefits.

Bitcoin Holds Above $105K as Traders Eye Shutdown Deal, Liquidity Boost

Bitcoin price recovered above $105,000 after an early session drop, sustaining near $106,000 into late afternoon. Traders anticipate a $150 billion Treasury liquidity injection following potential U.S. shutdown resolution. Altcoin performance varied amid ETF and policy developments.

Bank of England softens stablecoin stance with new proposals

Bank of England proposals would allow stablecoin issuers to invest up to 60 percent of reserves in short-term government debt while retaining caps on holdings. Temporary regime for FCA-regulated tokens would permit up to 95 percent allocation in debt instruments. Central bank liquidity facilities under consideration to backstop systemic tokens during market stress.

🔎 Coin Research — Boundless (ZKC) — 10 November 2025

New weekly coin research for Boundless (ZKC). — Score: 8.00/10 TL;DR: Universal ZK protocol enabling scalable, verifiable off-chain compute for any blockchain, decoupling execution from consensus.

Since Trump's election, crypto has experienced a wild year-long policy ride

Crypto industry saw a sweeping reversal from restrictive enforcement to pro-innovation rulemaking after the 2025 presidential election. Executive orders fast-tracked stablecoin regulation and a bitcoin reserve, while legislative efforts stalled amid a record government shutdown. The sector gained significant policy wins under an administration reshaping U.S. digital asset strategy.

Crypto Digest — 09 November 2025

📢 Read the daily digest for 2025-11-09: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Kite (KITE) — 09 November 2025

New weekly coin research for Kite (KITE). — Score: 8.00/10 TL;DR: Kite is the first layer-1 blockchain built for autonomous AI agents, enabling programmable governance and native stablecoin payments with sub–cent transaction f

XRP Outperforms Bitcoin as ETF Filings Near Final Window

XRP surged above resistance as ETF momentum and network growth drove renewed institutional interest. Volume spiked nearly double the daily average during the breakout, lifting XRP to its strongest close in over a week. New wallet creations also rose significantly.

Crypto Digest — 08 November 2025

📢 Read the daily digest for 2025-11-08: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — DeAgentAI (AIA) — 08 November 2025

New weekly coin research for DeAgentAI (AIA). — Score: 7.00/10 TL;DR: DeAgentAI is a decentralized multi-agent AI infrastructure integrating LLMs and on-chain consensus to enable autonomous intelligent agents across multiple block

U.S. Fed's Miran Says Policy Needs to Adjust to Stablecoin Boom That Could Reach $3T

Federal Reserve Governor Stephen Miran warned that stablecoin adoption could drive $1–3 trillion in Treasury demand by decade end, potentially influencing monetary policy. Regulatory frameworks under the GENIUS Act may not permit yield, shifting global dollar flows via stablecoins.

$120M Balancer hack exploited rounding bug across chains

A rounding-error vulnerability in Balancer’s batch-swap logic was leveraged to siphon over $120 million, exploiting mismatches between token decimal handling. Affected chains froze funds and emergency hard forks were deployed to safeguard users.

Irish regulator fines Coinbase Europe €21.5M over AML failures

Ireland’s central bank imposed a €21.5 million penalty on Coinbase Europe for misconfiguring its anti-money laundering systems, which left over 30 million transactions unmonitored for a year. The oversight delayed reporting of 2,708 suspicious transfers linked to serious crimes.

Crypto Digest — 07 November 2025

📢 Read the daily digest for 2025-11-07: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — UnifAI Network (UAI) — 07 November 2025

New weekly coin research for UnifAI Network (UAI). — Score: 7.00/10 TL;DR: AI-native infrastructure enabling autonomous DeFi strategy execution via on-chain AI agents

Trump Says He Wants U.S. to Be ‘The Bitcoin Superpower,’ Cites Competition From China

In Miami, the U.S. president declared intent to transform the country into a leading bitcoin and crypto hub, claiming executive orders ended a federal “war on crypto.” Remarks included support for dollar strength and warnings of rival advances if U.S. policy missteps occur.

Crypto Digest — 06 November 2025

📢 Read the daily digest for 2025-11-06: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Intuition (TRUST) — 06 November 2025

New weekly coin research for Intuition (TRUST). — Score: 7.00/10 TL;DR: Intuition is a Layer-3 rollup-based protocol providing a decentralized knowledge graph and trust layer for AI and Web3, enabling verifiable data curation and mo

Robinhood’s Crypto Trading Revenue Soared 339% in Q3

Crypto trading revenue jumped 339% year-over-year to $268 million in Q3 on record $80 billion trading volume. Adjusted EPS reached $0.61 versus $0.53 estimates and total net revenue hit $1.27 billion. Shares dipped 2% after hours despite strong growth.

Crypto Digest — 05 November 2025

📢 Read the daily digest for 2025-11-05: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!