Analyst Predicts ‘Uptober’ Rally for Bitcoin Regardless of Fed’s FOMC Decision

Two crypto analysts highlight bitcoin’s seasonal strength ahead of October, noting bitcoin’s relative underperformance versus gold and the S&P 500 since the post-election rally. Analysis of past September FOMC meetings suggests a tendency for bitcoin gains in the period, reinforcing the “Uptober” trend. The report finds bitcoin trading near key support while markets await the Fed announcement.

Crypto Memes — 2025-09-18

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-18. 🚀

Crypto Digest — 18 September 2025

📢 Read the daily digest for 2025-09-18: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Solayer (LAYER) — 18 September 2025

New weekly coin research for Solayer (LAYER). — Score: 7.00/10 TL;DR: Solayer is a hardware-accelerated Layer 2 protocol with a modular AI engine integrated on Base, offering 1M+ TPS and near-zero latency via InfiniSVM architectur

India Maintains Cautious Stance on Crypto Amid Regulatory Ambiguity

India’s regulators continue to view cryptocurrencies with ambivalence, neither fully embracing nor banning them. The Reserve Bank emphasizes risks and household protection, while SEBI signals openness to regulation. The government’s strategy keeps crypto off formal markets but may hinder innovation.

New York Governor Enacts Moratorium on Crypto Mining Permits

New York’s governor signed legislation imposing a two-year moratorium on new and renewed air permits for fossil fuel power plants used for proof-of-work cryptocurrency mining. The law mandates environmental reviews and aims to address climate concerns while balancing financial innovation.

SEC, Winklevoss Twins Resolve Lawsuit Over Gemini Earn Program

The U.S. Securities and Exchange Commission agreed to settle charges that Gemini failed to register its Earn crypto lending program before offering it to retail investors. The settlement, subject to SEC approval, will resolve the lawsuit and pauses further court deadlines, following Gemini’s recent $425 million IPO.

US Targets Iran Military Financing in New Crypto Sanctions

The U.S. Treasury imposed fresh sanctions on individuals and entities accused of using cryptocurrency and front companies to finance Iran’s Islamic Revolutionary Guard Corps and Defense Ministry, including transfers from oil sales. The measures bar U.S. entities from dealings with sanctioned parties and aim to disrupt illicit financing networks.

Swiss Banks Complete First Binding Payment on Public Blockchain

Three Swiss banks executed the first legally binding interbank payment using tokenized deposits on a public blockchain in a feasibility study. The pilot confirmed immediate settlement and potential integration into automated business processes, underscoring blockchain’s efficiency for cross-institutional transactions.

Crypto Memes — 2025-09-17

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-17. 🚀

Crypto Digest — 17 September 2025

📢 Read the daily digest for 2025-09-17: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Virtuals Protocol (VIRTUAL) — 17 September 2025

New weekly coin research for Virtuals Protocol (VIRTUAL). — Score: 7.00/10 TL;DR: Virtuals Protocol is a decentralized platform that tokenizes autonomous AI agents as co-owned, revenue-sharing assets, using the native VIRTUAL token for govern

Malta regulator opposes centralisation of EU crypto supervision

Malta's financial watchdog opposed calls by France, Italy and Austria to give ESMA direct oversight of major crypto firms, arguing centralisation would add bureaucracy and reduce efficiency. The MFSA supports supervisory convergence but warns against added layers amid a push to boost EU competitiveness.

Swiss banks claim first binding payment using public blockchain

Three Swiss banks executed the first binding interbank payment using tokenized deposits on a public blockchain as part of a joint feasibility study. The study demonstrated immediate and definitive settlement across institutions and highlighted potential integration into automated processes. The results suggest blockchain-based payments could serve as an alternative to stablecoins.

RI Mining Launches Low-Threshold BTC and XRP Cloud Mining

RI Mining introduced cloud mining services for Bitcoin and XRP with low entry requirements and enterprise-grade security. Offering flexible subscription tiers, the platform delivers detailed monitoring, cold wallet custody, and automated payout schedules.

OPTO Miner Unveils Zero-Threshold BTC and ETH Mining App

OPTO Miner launched a new mobile and desktop application enabling users to mine Bitcoin and Ethereum with no minimum deposit requirement. App features include real-time performance dashboards, automated pool selection, and integrated wallet support.

Crypto Market Extends Pullback as Bitcoin Holds $115K

Market continued two-day correction as GameFi sector led losses with a 4.41% decline. Bitcoin remained near $115,000, while Ethereum fell by 1.93% and major meme tokens dropped over 4%.

Crypto Memes — 2025-09-16

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-16. 🚀

Crypto Digest — 16 September 2025

📢 Read the daily digest for 2025-09-16: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Holoworld AI (HOLO) — 16 September 2025

New weekly coin research for Holoworld AI (HOLO). — Score: 7.00/10 TL;DR: Decentralized app store for AI agents enabling no-code creation, ownership, and monetization of virtual beings

Crypto taxes in India explained: key points for 2025

Indian law treats cryptocurrencies and NFTs as virtual digital assets under the Income Tax Act, 1961. A 30% flat tax on gains and 1% TDS on transfers apply without deductions. Mandatory reporting via Schedule VDA and strict record-keeping rules ensure compliance.

Monero sustains 7% rally despite 18-block chain reorg

Monero’s XMR token rallied over 7% after an 18-block reorg reversed approximately 117 transactions. Attack attributed to Qubic, which controls over 51% of network hash rate. Community explores DNS checkpoints and consensus changes to prevent future reorganizations.

London Stock Exchange unveils blockchain platform for private funds

LSEG and Microsoft launched the Digital Markets Infrastructure on Azure, enabling issuance, tokenization and post-trade settlement of private fund assets. MembersCap and Archax executed the inaugural transaction. Additional asset classes planned.

Bitcoin whale resumes dumping amid flat $116K price

A major long-term Bitcoin holder deposited 1,176 BTC, valued at over $136 million, into the Hyperliquid exchange and initiated sell-off. Whale had previously swapped over 35,900 BTC for Ether in late August. Whale movements may signal shifting market sentiment.

SEC chair signals preliminary notices before crypto enforcement actions

SEC Chair Paul Atkins announces shift from enforcement-first approach by promising preliminary notices for technical violations ahead of enforcement actions. Most tokens deemed non-securities and tokenized assets treated like traditional securities. Policy change aims to increase regulatory predictability.

Crypto Memes — 2025-09-15

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-15. 🚀

Crypto Digest — 15 September 2025

📢 Read the daily digest for 2025-09-15: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — OpenVPP (OVPP) — 15 September 2025

New weekly coin research for OpenVPP (OVPP). — Score: 7.00/10 TL;DR: OpenVPP provides a decentralized payment and tokenization layer tailored for the $10 trillion global electric utility industry, enabling seamless micropayments

HKMA Proposes Capital Rule Easing to Attract Crypto Business

The Hong Kong Monetary Authority released a draft proposal to reduce capital requirements for banks holding crypto assets, aligning with Singapore’s stablecoin and licensing frameworks. The plan maintains risk controls while lowering entry barriers and aims to position Hong Kong as a leading APAC digital asset hub.

Bitcoin Hyper Presale Raises $200,000 in 24 Hours

Bitcoin Hyper presale attracted $200,000 in its first 24 hours and has now surpassed $15 million in total fundraising. The wrapped token aims to bridge Bitcoin liquidity into a PayFi-compatible layer-2 environment, enabling rapid settlement and DeFi integration. Investors remain focused on security audits and tokenomics amid broader market volatility.

Crypto Memes — 2025-09-14

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-14. 🚀

Crypto Digest — 14 September 2025

📢 Read the daily digest for 2025-09-14: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

How High Can Bitcoin Price Go?

Bitcoin rallied over 10% since June 5 to reach $110,000, driven by strong market-wide momentum. Analysts project further gains toward $120,000–$150,000, while some forecast a long-term target of $1 million based on institutional interest and macro tailwinds.

Can XRP Outperform Bitcoin Further This Bull Cycle?

XRP/BTC has gained around 300% since November, fueled by Ripple’s SEC settlement and ETF speculation. A classic bullish reversal pattern against bitcoin signals a 100–250% upside potential for XRP/BTC in the current bull cycle if momentum sustains.

Dogecoin Targets $0.60 After 40% Weekly Rally

Dogecoin broke out of a symmetrical triangle on weekly charts with trading volumes tripling during the breakout. The technical setup and on-chain momentum suggest a potential rally of up to 95%, targeting a $0.60 price level in the coming weeks.

🔎 Coin Research — Avantis (AVNT) — 14 September 2025

New weekly coin research for Avantis (AVNT). — Score: 7.00/10 TL;DR: Avantis is a zero-fee perpetuals DEX on Base enabling permissionless high-leverage trading across crypto and real-world assets.

Fed’s Sept.17 Rate Cut Could Spark Jitters and Long-Term Upside

Markets widely expect a 25 basis-point Fed rate cut on September 17 despite August inflation ticking up to 2.9%. Short-term volatility is possible, but easing policy may support bitcoin, gold and equities over the longer term.

Bitcoin Climbs as Economy Cracks — Bullish or Bearish

CPI increased 0.4% MoM vs 0.3% forecast while U.S. job data revisions showed the largest downward adjustment in history. Bitcoin topped $116,000, maintained higher lows near the $117,300 CME gap, and held its 200-day moving average, signaling resilience.

CleanCore Solutions' DOGE Holdings Top 500M; Shares Rise 13%

CleanCore Solutions doubled its Dogecoin holdings to over 500 million tokens via a $175 million private placement backed by Pantera, GSR, and FalconX. The acquisition boosted the company’s DOGE treasury to approximately $130 million at current prices, driving its shares up 13% in premarket trading.

Spot BTC ETFs attract $642M, ETH adds $406M amid ‘rising confidence’

Spot Bitcoin ETFs attracted $642 million and Ether ETFs $406 million on Friday amid rising institutional demand. Fidelity’s FBTC and BlackRock’s IBIT led Bitcoin inflows; BlackRock’s ETHA and Fidelity’s FETH drove Ether inflows. The flows reflect renewed confidence and align with BlackRock’s exploration of blockchain-based tokenized ETFs.

‘Strong chance’ US will form Strategic Bitcoin Reserve this year: Alex Thorn

Galaxy Digital research head Alex Thorn asserted that the U.S. is likely to form a Strategic Bitcoin Reserve by year-end, citing the March executive order and recent congressional bills. The proposal would add government-owned Bitcoin to national reserves, though some industry figures view the timing as optimistic.

BONE Price Surges 40% After Shibarium Flash Loan Exploit

Shibarium, Shiba Inu’s layer-2 network, was hit by a flash loan exploit allowing an attacker to acquire 4.6 million BONE tokens, seize validator power, and drain bridge assets. The breach paused staking operations, secured remaining funds in multisig hardware wallets, and involved security firms and law enforcement amid estimated losses near $3 million.

‘Crypto’s Time Has Come’: SEC Chair Outlines Vision for On-Chain Markets and Agentic Finance

SEC Chair Paul Atkins outlined Project Crypto at an OECD forum, pledging clear, unified rules for token issuance, custody, trading, and staking, with bright-line asset classifications and frameworks for tokenized securities to modernize securities laws and support on-chain markets.

Bitcoin ETFs Record Fourth Consecutive Day of Inflows, Adding $550M

U.S. spot Bitcoin ETFs recorded a fourth consecutive day of inflows, adding $552.78 million on Thursday. Spot Ether ETFs logged a third straight day of inflows. Net ETF flows reached the highest level since mid-July, reflecting growing institutional interest.

Three Risks That Could Spoil Bitcoin Rally to $120K

Bitcoin’s breakout case faces three key headwinds: a bull fatigue zone near the 50-day SMA, possible dollar index overpricing of Fed cut expectations, and constrained downside in 10-year Treasury yields. Caution advised despite inverse head-and-shoulders breakout potential.

Crypto Pundits Remain Bullish Despite Stagflation Risks

Despite early signs of U.S. stagflation with August CPI at 2.9% and unemployment claims surging, experts maintain a bullish outlook on Bitcoin and select altcoins. Anticipated Fed rate cuts on September 17 underpin market optimism, with resilience noted in MAG7 stocks and tokens like SOL and HYPE.

This Invisible ModStealer Targets Browser Crypto Wallets

Malware strain ModStealer uses obfuscated NodeJS scripts to evade antivirus detection and target 56 browser wallet extensions for private key theft. Distribution occurs via malicious recruiter ads across Windows, Linux, and macOS. Functionality includes data exfiltration, clipboard hijacking, and remote code execution.

World Liberty Financial Token Holds Steady as Community Backs Buyback-and-Burn Plan

World Liberty Financial token WLFI remains stable near $0.20 after community approved directing all protocol-owned liquidity fees toward a buyback-and-burn model. Market cap stands at $5.4 billion with daily trading volumes around $480 million. Vote passed with 99.48% support and will run until September 19.

Crypto Memes — 2025-09-12

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-12. 🚀

Crypto Digest — 12 September 2025

📢 Read the daily digest for 2025-09-12: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Linea (LINEA) — 12 September 2025

New weekly coin research for Linea (LINEA). — Score: 7.00/10 TL;DR: Linea is a developer-ready zkEVM Layer 2 scaling solution for Ethereum, built by Consensys and leveraging zero-knowledge proofs for security and EVM equivalence

Forward Industries Closes $1.65B Deal to Build Solana Treasury

Forward Industries secured a $1.65 billion PIPE transaction led by Galaxy Digital, Jump Crypto and Multicoin Capital to establish a Solana-focused corporate treasury. Board appointments include Kyle Samani as chairman and observers from Galaxy and Jump. Pre-market trading saw a 15 percent share price increase.

Scroll DAO to Pause Governance Structure Amid Leadership Shake-Up

Scroll DAO governance will be paused following leadership resignations and confusion over live proposals. Co-founders announced a redesign toward greater efficiency while existing proposals remain active but without execution timelines. Delegates with significant voting power continue to participate off-chain.

Avalanche Foundation Eyes $1B Raise to Fund Two Crypto Treasury Companies

The Avalanche Foundation plans to raise $1 billion via two separate vehicles to establish US-based crypto treasury firms holding millions of AVAX tokens. A $500 million private investment is led by Hivemind Capital in a Nasdaq-listed entity, while a second $500 million SPAC deal is backed by Dragonfly Capital.

Blockchain-Based Lender Figure Prices IPO at $25 Per Share

Figure Technologies priced its initial public offering at $25 per share, valuing the offering at $787.5 million on 31.5 million Class A shares. The tranche includes 23.5 million new shares and 8 million secondary shares from existing investors. Trading on Nasdaq under FIGR begins September 11.

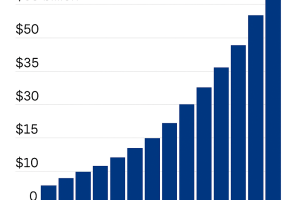

Stablecoin Reserves on Exchanges Soar to a Record $70 Billion

Exchange-based stablecoin reserves on Ethereum and Tron reached a record $70 billion, exceeding the 2021 high. On-chain data from CryptoQuant shows USDC balances nearly doubled in a month while USDT holdings held steady. Historical correlations suggest potential buying pressure for major cryptocurrencies.

Crypto Memes — 2025-09-11

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-11. 🚀

Crypto Digest — 11 September 2025

📢 Read the daily digest for 2025-09-11: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Binance partners with Franklin Templeton to push crypto products

Binance partnered with Franklin Templeton to co-develop institutional-grade crypto products, tapping the asset manager's $1.6 trillion portfolio and Binance's trading platform. The collaboration aims to launch new digital asset offerings upon regulatory approval.

Bitcoin giant Strategy dodges lawsuit alleging accounting wrongs

Digital asset treasury firm Strategy successfully had a lawsuit alleging accounting misstatements dismissed. The suit claimed the company failed to properly account for crypto holdings, but a court found no evidence of investor harm or regulatory breach.