Bitcoin Hovers Around $107K as Weakest Month Begins

Bitcoin opened September near $107,000 after slipping below key supports, marking the historically weakest month with average declines of around 6% over the past 12 years. Market sentiment is clouded by seasonal pressure, ETF outflows and doubts over corporate treasury models. Focus shifts to potential Fed rate cuts and ETF flows as drivers of near-term price action.

Crypto Memes — 2025-09-01

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-01. 🚀

Joe Lubin Predicts 100x Ether Surge as Wall Street Adopts DeFi Rails

Consensys founder Joseph Lubin forecasted that massive Wall Street adoption of Ethereum staking and DeFi infrastructure will drive Ether to surge 100x, potentially flipping it as a base monetary asset ahead of Bitcoin.

BTC Whale Now Holds $3.8B in ETH, Signaling Market Maturity

An OG Bitcoin whale rotated $435 million of BTC into 96,859 Ether over a weekend, raising ETH holdings to $3.8 billion. Analysts view the move as a sign of market diversification and maturation amid positive US regulations.

Bitcoin Risks Labor Day Crash to $105K Amid Whale Selling

Closed US markets for Labor Day and possible selling by an OG Bitcoin whale have created bearish pressure, risking a drop to $105,000. Sellers dominate futures and spot markets despite dip-buying activity.

Binance First Exchange to List Trump-Linked WLFI Token

World Liberty Financial (WLFI) token, linked to the Trump family, gained tradable status with spot pairs against USDT and USDC on Binance. Deposits are live and withdrawals will begin Tuesday. Quizzes are required before trading.

Red September: Bitcoin Risks Sliding to $100K After Monthly Drop

Bitcoin breached key support levels, indicated by Ichimoku cloud and moving average breakdowns, signaling bearish momentum. A 6.5% August drop ended a four-month rally amid $751 million ETF outflows. Seasonal trends point to risk toward $100,000.

Crypto Digest — 01 September 2025

📢 Read the daily digest for 2025-09-01: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — CeluvPlay (CELB) — 01 September 2025

New weekly coin research for CeluvPlay (CELB). — Score: 6.00/10 TL;DR: AI-powered Web3 entertainment ecosystem combining gaming, streaming, NFTs, and AI-generated IPs in a unified DApp

Here’s what happened in crypto today

Daily crypto trends highlight a forecast that AI-driven innovation will drive investors to Bitcoin as a safe-haven asset, while California’s governor teases a ‘Trump Corruption Coin’ in political jab. A surge in ‘buy the dip’ calls may paradoxically signal further market downside.

Bitcoin bull market will be 'over' if $100K BTC price is lost

Bitcoin faces a critical support retest at $100,000, which a popular trader warns will end the current bull market if breached. RSI divergences are clashing, with bearish signals dominating, though some analysts see buying opportunities near six-figure levels.

ETH Transactions Hit Year High as $2.7B BTC Whale Meltdown Sparks Crash

August chart data show 1.8 million daily Ethereum transactions—the highest in a year—and $2.7 billion in bitcoin sold by a single whale causing a flash crash. DeFi exploits netted $53 million, while crypto ATMs face increased regulation across 13 US states.

Bitcoin Faces Fee Crisis That Threatens Network Security: Can BTCfi Help?

Bitcoin transaction fees have dropped over 80% since April 2024, pressuring miner incentives and risking network security as block rewards halve. BTCfi—onchain DeFi on Bitcoin—could restore fee revenue by driving sustained onchain activity.

Bitcoin’s Rough August Wiped Out Summer Rally; September May Bring More Pain

Bitcoin fell 8% in August, erasing gains from its summer rally and closing below Memorial Day levels. Ether outperformed with a 14% gain, driven by treasury and ETF inflows. Historical seasonality suggests September is often bearish for bitcoin.

Major Bitcoin Breakout Brewing as Retail and Institutions Stack ‘Relentlessly’

Data indicates retail and institutional bitcoin accumulation reached the highest levels since April, absorbing over 140,000 BTC in July–August. Institutional demand in 2025 has outpaced new bitcoin supply by more than 6×, suggesting a potential breakout while price remains near $109,000.

Bitcoin vs Gold: Evaluating Hedge Asset Roles in 2025

Analysis from Bitwise highlights that gold remains the preferred hedge during equity market downturns, while bitcoin offers stronger protection against bond market stress. Year-to-date, gold has rallied over 30%, bitcoin about 16%, reflecting diverging responses to equity volatility and rate pressures.

Will Bitcoin Price Drop in September?

September has historically been a weak month for Bitcoin, with 8 of the past 12 Septembers closing lower, averaging −3.8% returns. However, green Septembers often follow painful August drawdowns. Technical patterns show hidden bullish divergence and key support at $105k-$110k, suggesting potential for a rebound toward $124,500 within 4-6 weeks.

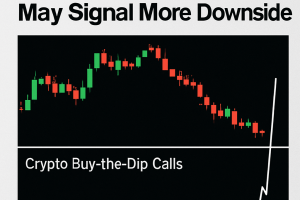

Crypto ‘Buy the Dip’ Calls Are Spiking, Which May Signal More Downside

Social media mentions of “buy the dip” have surged following Bitcoin’s 5% decline over the past week, according to Santiment. Historically, peak ‘buy the dip’ chatter can precede further market weakness, as real bottoms form in fear-driven environments. Crypto Fear & Greed Index remains in Neutral as traders eye altcoin season ahead.

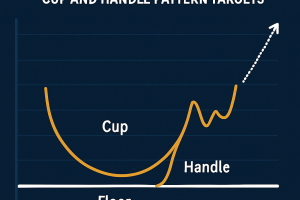

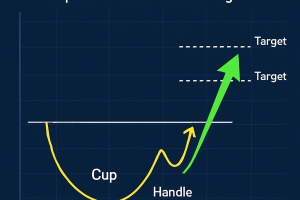

XRP Bullish Patterns Point to $5 as Korean Buyers Start to Accumulate

XRP fell 4.3% in 24 hours to $2.89 on above-average volumes before recovering toward $2.83-$2.89 support. Korean exchanges absorbed 16 million XRP, indicating institutional demand. Technical indicators show RSI recovery from oversold territory and a potential cup-and-handle pattern targeting $5 if key resistance at $3.02 breaks.

DOGE Rebounds From $0.21 Floor, Cup-and-Handle Pattern Targets $0.30

Dogecoin slipped 5% over the prior 24 hours amid broader risk-asset weakness and a whale transfer of 900 million DOGE to Binance. On-chain data show 680 million DOGE accumulated in August, underscoring institutional participation. Technical analysis highlights $0.21 as key support and $0.23 resistance, with a cup-and-handle pattern pointing to potential upside toward $0.30.

Given Trump’s Pro-Crypto Stance, Is It Time to Fully Ditch Gold in Favor of Bitcoin?

Bitwise research shows gold remains a stronger hedge during equity sell-offs, while bitcoin offers more resilience under bond market stress. In 2025 gold is up over 30% and bitcoin up about 15%, illustrating their distinct roles. The heuristic suggests using both assets for portfolio diversification rather than replacing one with the other.

Given Trump’s Pro-Crypto Stance, Is It Time to Fully Ditch Gold for Bitcoin

Bitwise’s André Dragosch argues that gold hedges equity risk while Bitcoin offers resilience against bond stress. Historical data show gold outperforms during stock declines and Bitcoin during Treasury sell-offs. Year-to-date, gold rose 30% and Bitcoin 15% as investors weigh macro risks.

XRP Bullish Patterns Point to $5 as Korean Buyers Start to Accumulate

XRP fell 4.3% in 24 hours before recovering toward $2.85–$2.86 support, with Korean exchanges absorbing 16 million XRP. Technical indicators suggest potential upside toward $3.02 resistance, while on-chain and regional institutional flows underpin a floor ahead of September’s event calendar.

DOGE Rebounds From $0.21 Floor, Cup-and-Handle Pattern Targets $0.30

Dogecoin fell 5% in 24 hours amid broader risk-asset weakness and whale activity before stabilizing at $0.21. On-chain data shows continued institutional accumulation of 680 million DOGE in August, underpinning support above the $0.21 floor.

Crypto Memes — 2025-08-31

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-08-31. 🚀

Crypto Digest — 31 August 2025

📢 Read the daily digest for 2025-08-31: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Bitcoin tumbles below $116K in market plunge for leveraged longs

A sudden market downturn liquidated over $585 million in leveraged crypto longs as Bitcoin fell below $116 000. CoinGlass data shows more than 213 000 positions were closed, with Ether and Dogecoin also suffering significant losses.

DeFi will outlast government and corporate walled garden efforts, says Fold CEO

Fold CEO Will Reeves argued that decentralized finance protocols will endure attempts to impose traditional financial controls, predicting that permissionless networks will ultimately prevail despite identity and custody regulations.

Crypto treasury firms draw comparisons to 2008 CDO risks, warns exec

Crypto treasury firms are introducing layered risks akin to 2008’s collateralized debt obligations, according to industry executives. These structures may reintroduce counterparty and systemic vulnerabilities into digital asset portfolios.

🔎 Coin Research — OpenVPP (OVPP) — 31 August 2025

New weekly coin research for OpenVPP (OVPP). — Score: 7.00/10 TL;DR: Decentralized virtual power plant enabling tokenized peer-to-peer energy trading via blockchain

No question Bitcoin will hit $1M, says Eric Trump at BTC Asia 2025

Eric Trump stated at the BTC Asia 2025 conference that Bitcoin will reach $1 million in the next several years, citing widespread institutional and nation-state adoption. He noted current market participants remain early adopters.

Crypto Daily Recap: EU explores digital euro on public blockchains, YZY wallets profit, State Street joins tokenized debt

EU officials are evaluating using public blockchains Ethereum and Solana for the digital euro pilot. Data shows top YZY wallets profited nearly $25 million trading the token. State Street became the first custodian on JPMorgan’s tokenized debt platform.

XRP Ledger Records New $131.6 Million All-Time High In This Major Market

The XRP Ledger closed Q2 2025 with a record $131.6 million market cap for real-world assets, driven by new issuances and platform integrations. Messari’s report credits a wave of RWA launches, including tokenized treasuries and commercial paper, for sustained network growth.

Supreme Court opened crypto wallets to surveillance; privacy must go onchain

The US Supreme Court’s refusal to review a case involving IRS summonses for crypto records upholds the third-party doctrine for blockchain data. This decision permits warrant-free analysis of onchain transactions, prompting calls for default privacy tools to protect users.

Has El Salvador Made Its Bitcoin Holdings Quantum-Proof?

El Salvador has moved its entire national bitcoin reserve out of a single address into multiple wallets capped at 500 BTC to reduce exposure and prepare for future quantum threats. The change aligns with industry best practices but offers limited immediate quantum protection.

Crypto ETF Surge Could Reshape Market, but Many Products May Fail

Over 90 crypto ETF applications are awaiting approval by U.S. regulators, potentially transforming institutional and retail access to digital assets. Analysts predict most filings will be greenlit but warn of inevitable closures among niche altcoin products. Investor demand is expected to determine the winners in this crowded field.

US and Dutch Authorities Take Down Crypto-Fueled Fake ID Marketplace

Law enforcement agencies in the US and the Netherlands have dismantled an online marketplace facilitating the sale of forged identification documents in exchange for cryptocurrency. Investigators seized servers, arrested key operators and traced transactions to multiple jurisdictions. Authorities warn such platforms exploit crypto’s pseudonymity and vow to expand cooperation.

El Salvador Redistributes Bitcoin Reserves into 14 Wallets

El Salvador has moved its 6,274 BTC reserve from a single address into 14 new wallets to mitigate quantum-computing security risks. Each new address will hold ~500 BTC and sync with a public dashboard for transparency. Experts note the measure as a precautionary safeguard against future cryptographic threats.

Block (BLOCK) Token to List on Gate.io Today

The Block (BLOCK) token will list on Gate.io on Aug 30, expanding its exchange availability. Gate.io is known for high trading volumes and global reach. This listing may enhance liquidity and trading volumes for BLOCK amid broader market weakness.

Binance Integrates Mitosis (MITO) Across Trading Platforms

Binance has launched the Mitosis (MITO) Layer 1 token across its Earn, spot, and futures platforms. Deposits opened on Aug 29 and trading commenced at 15:30 UTC with pairs USDT, USDC, BNB, FDUSD, and TRY, plus up to 50x leverage on perpetual contracts. A 15 million MITO airdrop is set for BNB holders.

Spot BTC and ETH ETFs See Outflows as Inflation Surges

Spot Bitcoin and Ether ETFs experienced significant outflows on Friday after stronger-than-expected core PCE data signaled inflation pressures. Ether funds saw $164.6 million exit while Bitcoin ETFs shed $126.6 million, marking the first net outflows since Aug. 22. The data stoked concerns over Fed rate paths under rising import costs from tariffs.

Indian Court Sentences 14 to Life in Bitcoin Extortion Case

An anti-corruption court in Ahmedabad convicted 14 individuals, including 11 police officers and a former legislator, for the 2018 kidnapping and extortion of a businessman to seize over 750 BTC. The judgment held that officers used unlawful detention, assault and ransom demands to force the victim to hand over crypto and cash. Confiscation orders were issued for recovered assets and ongoing investigations were launched.

Amplify Files XRP Option Income ETF With $12B in AUM

Amplify Investments has filed with the SEC to launch an XRP Option Income ETF managing $12.6 billion in AUM. The fund will invest at least 80 % in XRP-related instruments, generate income via covered call strategies, and list on Cboe BZX in November.

Gryphon Digital Mining Merges with Trump Family-Linked American Bitcoin

Gryphon Digital Mining shareholders approved a merger with Trump-backed American Bitcoin to form a Nasdaq-listed entity under ticker ABTC. The deal includes a 5-for-1 reverse stock split and positions Eric and Donald Trump Jr. in executive roles.

Strategy Bitcoin Lawsuit Dismissed as Investors Withdraw Claims

Investors have voluntarily dropped a class action lawsuit against corporate Bitcoin treasury firm Strategy, ending allegations of misleading profit projections. The dismissal with prejudice prevents refiling and clears Strategy’s $68.5 billion BTC holdings of legal risk.

Bitcoin Whale Moves $1B from Bitcoin to Ethereum

A $5 billion Bitcoin holder shifted $1 billion into Ethereum via Hyperliquid, extending a recent buying spree that saw $2.5 billion in ETH acquisitions. The whale’s actions have contributed to a 14 % rise in ETH price and highlight growing confidence in Ethereum.

BlackRock Overtakes Exchanges as Top Crypto Custodian

BlackRock’s iShares Bitcoin Trust holds 745,357 BTC, surpassing Coinbase and Binance as top custodian. US spot Bitcoin ETFs saw net outflows of $126.7 million on August 30, evidencing institutional preference for regulated ETF custody.

Crypto Memes — 2025-08-30

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-08-30. 🚀

Crypto Digest — 30 August 2025

📢 Read the daily digest for 2025-08-30: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

🔎 Coin Research — Mitosis (MITO) — 30 August 2025

New weekly coin research for Mitosis (MITO). — Score: 7.00/10 TL;DR: Mitosis is a programmable liquidity network enabling cross-chain tokenized liquidity positions through its Ecosystem-Owned Liquidity (EOL) and Matrix frameworks

Amdax backs $23m Bitcoin treasury bid, eyes 1% of global supply

Amdax has launched AMBTS, a standalone Bitcoin treasury company staffed with €20 million ($23.3 million) in initial funding and targeting a final close of €30 million by September 2025. The spin-off aims to accumulate 1% of Bitcoin’s total supply and pursue a Euronext Amsterdam listing for an equity-based Bitcoin vehicle.

Ethereum Foundation pauses open grant applications

Ethereum Foundation temporarily paused open grant applications for its Ecosystem Support Program to shift from a reactive to a proactive funding model. Support for existing grantees continues through Office Hours. New requests will resume under a revised process in Q4 2025.

Hong Kong Legislature Approves Stablecoin Licensing Ordinance

Hong Kong’s legislature enacted a stablecoin ordinance establishing licensing requirements, reserve management, redemption protocols, and risk controls for fiat-referenced stablecoin issuers. The new regime mandates authorization by the Hong Kong Monetary Authority to enhance investor safeguards and support market integrity.

Binance Restores All Futures Trading After Brief Suspension

Binance confirmed full restoration of futures trading on Aug 29 after resolving an issue affecting its Unified Margin engine. The service resumed at 07:10 UTC, resuming settlement of contracts in USDC and USDT with normal margin calculations and order execution capabilities.

Binance Futures Trading Temporarily Unavailable After System Issue

Binance halted all futures trading on Aug 29 due to a technical issue within the Unified Margin service, blocking opening, closing, and modification of positions settled in USDC and USDT. Engineers opened an incident review and engaged technical teams to diagnose and resolve root cause.

Eric Trump Predicts Bitcoin Will Reach $1 Million

Eric Trump forecast that bitcoin will hit $1 million within several years during a panel at the Bitcoin Asia conference in Hong Kong, highlighting surging institutional demand and limited supply. China’s efforts on yuan-backed stablecoins and Hong Kong’s stablecoin bill were also noted as key developments.

Seazen Group Launches Institute to Tokenize Real-World Assets

Seazen Group created Seazen Digital Assets Institute in Hong Kong to evaluate tokenization of intellectual property and asset income into blockchain-traded tokens. Plans include issuing tokenized private debt and NFTs of commercial properties before year end to enhance liquidity and reduce issuance costs.

92 crypto-related ETPs in the works: ‘Floodgates to open soon’

Ninety-two crypto exchange-traded products are awaiting US SEC approval, covering assets from Solana to Dogecoin. BlackRock leads with significant inflows into its Bitcoin and Ethereum ETFs, while pending filings include funds for altcoins, liquid staking and trust conversions.

Avalanche leads blockchain transaction growth amid US gov’t implementation

Avalanche transaction volume surged 66% over the past week, outpacing other networks amid growing US Department of Commerce adoption. Real GDP data will be posted on Avalanche and eight other blockchains, reinforcing government use of decentralized ledgers.

Bitcoin traders: BTC must close week above $114K to avoid ‘ugly’ correction

Traders warn that Bitcoin must close the week above $114,000 to prevent a deeper 6% correction toward $103,000. Technical analysis highlights failed support at $112,000 and a bear flag pattern signaling increased downside risk without recovery above key levels.