Lido Launches GG Vault for One-Click DeFi Yield Access

The Lido Ecosystem Foundation introduced GG Vault, a new product that automates allocation of ETH, WETH, stETH and wstETH deposits across multiple DeFi protocols. The Vault integrates Uniswap, Aave, Euler, Balancer and other platforms under a single interface. The launch aims to simplify yield generation and support validator diversity.

U.S. Bank Resumes Bitcoin Custody and Adds ETF Support

U.S. Bank restarted institutional bitcoin custody services after a pause in 2022, now offering support for spot bitcoin ETFs. NYDIG will act as sub-custodian for digital assets under the bank’s Global Fund Services. The relaunch follows enhanced regulatory clarity and demand from fund managers.

Stellar Protocol 23 Upgrade Triggers Exchange Trading Pauses

Major exchanges including Upbit suspended XLM trading ahead of the Stellar Protocol 23 network upgrade to ensure stability during the transition. XLM price action consolidated between $0.36 and $0.37, with resistance at $0.37 and support at $0.36. Participants await post-upgrade price levels and network performance.

U.S. CFTC Grants No-Action Letter to Polymarket’s QCX Acquisition

The U.S. Commodity Futures Trading Commission issued a no-action letter for QCX, the recently acquired platform by Polymarket, waiving certain disclosure and data requirements. The decision applies at the staff level and permits QCX to offer event contracts under defined conditions. The move reflects a more permissive regulatory stance toward prediction markets in the United States.

Crypto Memes — 2025-09-04

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-04. 🚀

Crypto Digest — 04 September 2025

📢 Read the daily digest for 2025-09-04: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Stellar’s Protocol 23 Upgrade Prompts Trading Pauses on Upbit

Upbit suspended XLM trading ahead of Stellar’s Protocol 23 upgrade to safeguard network stability. XLM price consolidated between $0.36 and $0.37, with traders eyeing key resistance at $0.45 and support near $0.30 post-upgrade.

CFTC Issues No-Action Letter for Polymarket’s QCX Unit

The U.S. Commodity Futures Trading Commission granted a no-action letter to QCX, Polymarket’s recently acquired prediction-market platform, easing certain disclosure and recordkeeping requirements. The decision reflects a more permissive regulatory stance toward event contracts.

Kevin O’Leary Labels NFTs a Fad During $13M Card Purchase

Investor Kevin O’Leary described nonfungible tokens as a passing trend after acquiring a $13 million collectible card. The purchase underscores ongoing speculation in high-end digital and physical collectibles amid waning interest in NFT markets.

🔎 Coin Research — Portal to Bitcoin (PTB) — 04 September 2025

New weekly coin research for Portal to Bitcoin (PTB). — Score: 8.00/10 TL;DR: Trust-minimized atomic swaps protocol enabling native Bitcoin interoperability

CLARITY Act’s Definition of 'Mature' Blockchains Faces Critique

A recent analysis of the CLARITY Act’s criterion for defining mature blockchains highlights gaps in its approach, particularly in areas of decentralization, security and governance. Experts argue the measure oversimplifies network maturity and omits key technical benchmarks.

Solana Surges 33% Since August, Analyst Sees More Upside

Solana has outperformed major cryptocurrencies with a 33% gain since early August, driven by fund inflows and rotation from BTC and ETH. Up to $2.6 billion in treasury and ETF demand could fuel further upside. Retail and institutional flows underpin bullish patterns.

Ondo Finance Unveils Tokenized U.S. Stocks and ETFs on Ethereum

Ondo Finance launched Ondo Global Markets on Sept. 3, offering tokenized shares of over 100 U.S. stocks and ETFs on Ethereum. Backed by U.S.-registered broker-dealers, the tokens grant on-chain transferability while preserving full equity rights. The platform targets non-U.S. investors and plans expansion to Solana and BNB Chain.

Utila Secures $22M to Expand Stablecoin Infrastructure Platform

Utila closed a $22 million extension of its March Series A round, tripling its valuation in six months. The firm offers enterprise stablecoin operations, handling payments, treasury and trading for clients like neobanks and payment providers, and plans expansion into Latin America, Africa and Asia-Pacific.

Crypto Markets Today: Bitcoin Languishes as Altcoins Outperform

Bitcoin traded near $112,470 on Sept. 3, underperforming major altcoins such as Ether and Solana. Open interest climbed to $114 billion, with liquidation clusters signaling key resistance at $112,200 and support near $110,000. Market breadth favored smaller tokens amid muted volatility.

Bitcoin Treads Water Ahead of U.S. Jobs Report

Bitcoin traded in a narrow range on Sept. 3 as investors awaited the U.S. Bureau of Labor Statistics jobs data. A softer jobs figure could spur rate-cut expectations and boost crypto markets, while stronger data might weigh on risk assets amid Fed tightening concerns.

U.S. SEC, CFTC Jointly Endorse Spot Crypto Trading for Registered Platforms

The SEC and CFTC issued a joint statement clarifying that registered national securities exchanges and derivative platforms may facilitate certain spot crypto asset trading. The agencies invited inquiries on compliance processes ahead of pending Congressional market structure legislation.

Strategy Raises Dividend on STRC Offering to Attract Yield-Seeking Investors

Strategy (MSTR) increased the annual dividend on its STRC preferred stock to 10% from 9% to drive the price toward the $100 par target. The September payout was set at $0.8333 per share. Dividends for STRF, STRK and STRD were also declared, reflecting broader distribution of yield across preferred offerings.

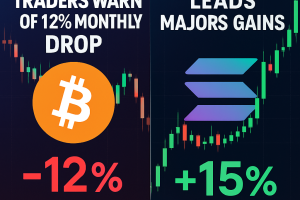

Bitcoin Traders Warn of 12% Monthly Drop as Solana Leads Majors Gains

Seasonal precedent and fragile sentiment warn of further bitcoin weakness in September after historical average losses of 12%. Crypto market cap slid to a three-week low of $3.74 trillion as Solana outperformed with 4% gains. Traders cite macro uncertainty, thin volumes and lack of catalysts as drivers of caution.

Winklevoss Twins Back $147M Raise for Treasury’s Landmark European Bitcoin Listing

Winklevoss Capital and Nakamoto Holdings led a €126 million ($147 million) funding round for Netherlands-based Treasury BV to acquire over 1 000 BTC. The investment supports a reverse merger listing on Euronext Amsterdam and acquisition of Bitcoin Amsterdam conference, aiming to position Treasury as Europe’s leading public bitcoin treasury.

Venus Protocol Restores Services, Recovers Stolen Funds After $27M Exploit

Venus Protocol on BNB Chain fully restored withdrawals and liquidations after a malicious contract update drained an estimated $27 million. Security teams verified front-end integrity and confirmed recovery of all siphoned funds. Native token XVS remained down around 2.69% despite assurances of fund safety.

Crypto Exchange OKX Fined $2.6M in Netherlands for Failing to Register With Dutch National Bank

The Dutch National Bank imposed a €2.25 million fine on Aux Cayes Fintech Co. (OKX) for operating without mandatory registration from July 2023 to August 2024. The penalty was reduced in recognition of remediation efforts and migration of Dutch users to a fully MiCA-licensed entity. The action underscores stricter enforcement ahead of full MiCA enforcement.

Crypto.com CEO Foresees Q4 Rally on Fed Rate Cut

Crypto.com CEO Kris Marszalek predicts that a Fed rate cut at the Sept. 17 meeting will drive a strong fourth-quarter for digital assets. With a 91.7% probability priced into CME futures, Marszalek expects improved revenue and plans to explore prediction market and IPO opportunities under easing policy.

XRP Trading Idea: Triangle Setup Eyes $3.30 Rally

XRP traded between $2.76 and $2.86 amid geopolitical and Fed rate-cut uncertainties, with whale accumulation of 340 million tokens over two weeks. A symmetrical triangle pattern supports a breakout toward $3.30 if key resistance levels at $2.86 and $3.00 are cleared.

DOGE/BTC Breakout Signals Upside if $0.22 Clears

Dogecoin reversed midday pressure with a 4% intraday swing and closed up 1% at $0.213 on 21% above-average volume. A descending triangle pattern on DOGE/BTC pairs has broken upward, suggesting a continuation toward $0.25 if the $0.22 level holds.

Figure Technologies Files for $4.13B Nasdaq IPO

Figure Technologies, the blockchain lender founded by Mike Cagney, plans to raise up to $526 million in a Nasdaq IPO at a valuation of $4.13 billion. The firm has originated over $16 billion in home equity lines of credit via its Provenance blockchain and merged with Figure Markets earlier this year.

Asia Morning Briefing: Stablecoins Link Crypto Liquidity to Fed Policy

Stablecoin market has almost doubled to $280 billion in a year, tying crypto liquidity directly to Federal Reserve policy. Analysts forecast growth to $1.2 trillion by 2028 and debate potential stability risks akin to a 2008-style liquidity crunch. Experts call for unified market structures to deliver efficiency and resilience.

Crypto Memes — 2025-09-03

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-03. 🚀

Crypto Digest — 03 September 2025

📢 Read the daily digest for 2025-09-03: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Investors Eye Volatility Risks as September Market Reset Arrives

Wall Street reopened from Labor Day with heightened uncertainty. Investors are bracing for volatility spikes as seasonal factors, tariff policy outlook and economic data releases converge this week.

Ether Machine Secures $654 M in Private ETH Funding

Ether Machine raised roughly 150,000 ETH (≈$654 million) in private financing ahead of its Nasdaq debut. The funding will support growth initiatives as the company prepares a public listing expected later this year.

🔎 Coin Research — Somnia (SOMI) — 03 September 2025

New weekly coin research for Somnia (SOMI). — Score: 8.00/10 TL;DR: Somnia is a high-performance EVM-compatible Layer 1 blockchain optimized for real-time mass-consumer applications such as gaming, offering over one million TPS,

Gemini Prepares $2.22B Valuation in U.S. IPO Filing

Gemini, the crypto exchange founded by the Winklevoss twins, filed for a U.S. IPO targeting up to $317 million at a valuation near $2.22 billion. The offering will list on Nasdaq under ticker GEMI with Goldman Sachs and Citi lead underwriters.

SEC and CFTC Launch Joint Spot Crypto Trading Initiative

The U.S. Securities and Exchange Commission and Commodity Futures Trading Commission announced a coordinated effort to allow registered trading venues to list and trade certain spot crypto products under existing frameworks.

Gemini Seeks Up to $317 Million in US IPO

Gemini, founded by the Winklevoss twins, plans to sell 16.67 million shares at $17–$19 each, aiming to raise up to $317 million. The IPO filing indicates a valuation range of $1.9–$2.22 billion based on diluted shares. Net proceeds will fund strategic investments and product expansion.

Trump-Linked World Liberty Team Floats Buyback-and-Burn Plan as WLFI Sinks

WLFI governance team has proposed a buyback-and-burn mechanism using protocol-owned liquidity fees to repurchase and destroy tokens, aiming to reduce supply and restore confidence as WLFI trades down 24% on debut and faces alternative community staking proposals.

Holders of Trump’s Crypto Token Targeted by Hackers in Phishing Exploit

Attackers exploited EIP-7702 phishing vulnerabilities after Ethereum’s Pectra upgrade to drain WLFI tokens, deploying malicious delegate contracts that redirected user deposits to hacker addresses, while victims reported limited recovery options and pervasive phishing links.

Bitcoin Long-Term Holders Spend 97K BTC in Largest One-Day Move of 2025

Long-term BTC holders offloaded 97,000 BTC in a single day, marking the largest patient-holder sell-off this year and triggering a 3.7% price drop to $108,000, while market trading held near $103,330 amid elevated 14-day average spending.

XRP Set for Higher Prices as MACD Nears Potential Bullish Crossover

XRP rose 3% over the past 24 hours as MACD histogram approached a bullish crossover, supported by whale buys of 340M tokens and institutional volumes nearly doubling average, amid lingering September seasonality and pending ETF rulings.

Japan Post Bank unveils DCJPY digital yen for depositors

Japan Post Bank announces launch of DCJPY, a fully fiat-backed digital yen token, by fiscal 2026. Developed in partnership with DeCurret DCP, DCJPY allows depositors to convert yen into a 1:1 blockchain-tokenised currency for instant settlement of digital assets and securities transactions, enhancing payment efficiency.

India SEBI issues new intraday position limits for equity derivatives

SEBI introduces net and gross intraday position caps for equity index derivatives effective October 1. Net intraday positions limited to ₹50 billion per entity; gross exposure capped at ₹100 billion separately for long and short. Exchanges must monitor positions via four random snapshots daily; breaches prompt review and penalties on expiry day.

EU watchdog warns of investor misunderstanding with tokenised stocks

ESMA executive director cautions that tokenised stocks may mislead investors by offering price exposure without shareholder rights. Synthetic token instruments enable fractional equity access but typically lack voting and dividend entitlements. EU regulators urge clear communication and investor protections.

Ethereum to sunset Holešky testnet post-Fusaka upgrade

Ethereum Foundation announces planned shutdown of the Holešky testnet after completion of the Fusaka fork, with migration to the Hoodi testnet. Holešky has served for over two years testing protocol upgrades including Dencun and Pectra. Migration will occur two weeks after Fusaka mainnet activation.

Crypto Memes — 2025-09-02

😂 Best crypto memes today — BTC swings, altcoin drama, and trader jokes. Laugh & share the top picks for 2025-09-02. 🚀

Crypto Digest — 02 September 2025

📢 Read the daily digest for 2025-09-02: 📰 top news, 📊 analytics and 🌍 events of the day in one place. Stay up to date with what s important!

Metaplanet’s Bitcoin Treasury Reaches 20 000 BTC After $112M Buy

Japanese investment firm Metaplanet acquired 1 009 BTC for $112 million, raising total reserves to 20 000 BTC. The purchase surpassed Riot Platforms and secured Metaplanet’s position as a top public corporate Bitcoin holder.

Ripple vs. SEC Lawsuit Strengthens XRP’s Market Position

Analysis shows that the prolonged SEC lawsuit has bolstered XRP’s narrative as a decentralized asset. Community engagement and network activity have surged following favorable legal developments, contributing to renewed market confidence.

Bitcoin’s BRC20 Token Standard Launches ‘BRC2.0’ Smart Contracts

The new BRC2.0 standard extends Bitcoin’s Ordinals protocol, enabling EVM-style smart contracts on the Bitcoin blockchain. Developers can now issue fungible tokens and deploy programmable logic directly on Bitcoin, broadening on-chain capabilities.

🔎 Coin Research — Body Scan AI (SCANAI) — 02 September 2025

New weekly coin research for Body Scan AI (SCANAI). — Score: 6.00/10 TL;DR: An AI-powered body scanning platform that rewards users with tokens for wellness insights and real-world health services

Bitcoin Clings To $109K As Whales Rotate Into Ethereum

Bitcoin hovered near $109 000 as large holders shifted significant capital into Ether and UK government bonds. Rising bond yields and looming US jobs data weighed on Bitcoin’s near-term outlook, while further rotations raised market uncertainty.

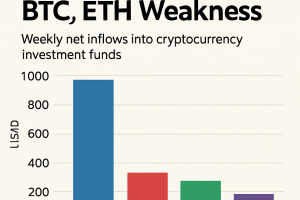

Crypto ETPs Attract $2.48B Inflows Despite BTC, ETH Weakness

Crypto exchange-traded products recorded $2.48 billion of net inflows last week, led by $1.4 billion into Ether products. Bitcoin ETPs saw smaller inflows amid broad market pressure, reflecting continued investor interest in crypto vehicles despite price declines.

Polygon Leads Crypto Gains With 16% Weekend Surge as CoinDesk 20 Index Holds Steady

Polygon’s POL token surged 16% over the weekend, topping $0.29 after integration announcements and U.S. government blockchain initiatives. The CoinDesk 20 Index remained largely unchanged amid modest bitcoin and ether movements.

BNB Slips Below $860 as Traders Brace for U.S. Jobs Data

BNB traded between $849.88 and $868.76 in a 24-hour window, failing to hold above key resistance near $868. Chain activity doubled with daily active addresses rising to 2.5 million, while volume declined. Focus shifted to upcoming U.S. payroll figures that could influence rate cut expectations.

XLM Plunges 5% in Wild Trading Session Before Staging Sharp Recovery

Stellar’s XLM token experienced a 5% intraday decline from $0.36 to $0.34 amid heavy institutional selling and network upgrade disruptions, then recovered to $0.36. Volume spikes above 70 million units accompanied both the selloff and rebound, indicating active whale participation.

European regulator says tokenised stocks risk 'investor misunderstanding'

The EU securities watchdog ESMA warned that tokenised stocks could lead to investor misunderstanding because they do not confer shareholder rights despite being linked to equity prices. Concerns highlighted the need for clear communication and safeguards as product offerings expand.

Trump's World Liberty Financial tokens begin trading

Some digital tokens backing the Trump family’s World Liberty Financial venture began trading on Monday after a vote by early investors allowed up to 20% of holdings to become tradable. Listings launched on Binance, OKX and Bybit following secondary market preparations.

WLFI Token Launches on Binance

World Liberty Financial (WLFI) token listed on Binance on September 1 at 13:00 UTC, with WLFI/USDT, WLFI/USDC and WLFI/TRY spot pairs. Binance applied a seed tag for risk control. Derivative open interest neared $1 billion ahead of a 5% unlock, while trading volume surged over 535%.

Binance Unlocks 5x Leverage with LINEAUSDT Perpetual Contract

Binance Futures launched a perpetual LINEA/USDT contract offering up to 5x leverage on September 1, enabling long and short positions without expiration. The contract supports multiple order types amid growing demand for high-potential tokens. Analysts caution leveraged risks and recommend risk management measures.

Asia Morning Briefing: August ETF Flows Show Massive BTC to ETH Rotation

U.S. Bitcoin ETFs saw $751 million in net outflows in August as Ethereum spot funds attracted $3.9 billion. On-chain data reveals Bitcoin holders under water, risking further declines toward $93,000–$95,000. Ethereum’s steady inflows delivered 25% gains over 30 days, indicating institutional rotation.

XRP Breaks $2.80 as Bearish September Begins

XRP declined 4% to $2.75 in the Aug. 31–Sept. 1 session amid $1.9 billion in institutional liquidations since July, even as whales added 340 million tokens. On-chain metrics reveal symmetrical triangle formations and liquidity pockets up to $4.00. Technicals suggest oversold conditions and potential recovery if key resistance breaks.